The Divergence Between Gold and Gold Miners

Reviewed by Michael Paige, Bailey Pemberton

Quote of the Week: "Gold will be around, gold will be money when the dollar and the euro and the yuan and the ringgit are mere memories." - Richard Russell

Like many asset classes in 2024, gold has had a stellar performance so far.

It’s trading near record levels, which is somewhat unusual when equity indices are also close to record highs. So what’s driving these gains?

Well, several factors can increase the demand for gold, including inflation expectations, a weaker USD, and financial and geopolitical uncertainty or crises.

But more recently, two additional factors have led to higher demand than usual.

That’s why this week, we’re diving into them, plus why gold miner performance can diverge from the price of gold, and how to get exposure, if you’re interested in gold, through a method that suits you.

Let’s dive in!

What Happened In The Markets This Week?

Here’s a quick summary of what’s been going on:

- 🪴 Marijuana Gets Medical Use Classification, Almost ( Axios )

- Our Take: The new rule has to be approved by the White House Office of Management and Budget first but would be a huge help to the marijuana industry. Profit margins in these U.S. marijuana businesses are low because they can’t deduct business expenses on their federal taxes. If the rule takes effect, it should help improve the profitability of these businesses thanks to the federal tax break, which is why many cannabis stocks rallied on the news.

- ✂️ Tesla Is Being Hardcore About Cost Reductions ( Business Insider )

- Our take: Part of the budget cuts involved laying off almost all of the 500-strong Supercharger team. This could hurt global EV adoption considering these chargers can be used by almost all new EVs. Plus, the Supercharger network was also considered a competitive advantage for Tesla, so while it will still have some network, this may reduce the scale of its advantage over others.

- 🤝 Hong Kong Bitcoin ETFs Allow In-Kind Redemption ( Axios )

- Our Take: While the 3 recently approved Hong Kong Bitcoin ETFs are similar in most respects to their 11 U.S. counterparts, they differ in regards to fees and redemptions. These Hong Kong ETFs management fees are much higher and range from 0.3% to 0.99% due to lower competition currently in the region. As for redemptions, the Hong Kong-based ETFs allow “in-kind” redemptions, which the U.S. ETFs currently don’t. Essentially, you’ll be able to buy or sell Hong Kong ETF units for the underlying asset, i.e. Bitcoin, rather than cash, which appeals to those who want to deposit or withdraw their Bitcoin from the ETF.

- 🍔 Consumer Pullback Finally Hits Restaurants ( CNBC )

- Our Take: McDonald’s, Starbucks and KFC all reported a decline in same-store sales. Consumers have become pickier in where they dine out since prices have increased. According to the Bureau of Labor Statistics, prices at limited-service restaurants rose 5% in March compared with the same period 1 year ago, while prices for groceries haven’t risen as quickly. However, the likes of Chipotle Mexican Grill , Wingstop and Popeyes (owned by Restaurant Brands International ) bucked the trend with strong increases in same-store sales. While arguably all these companies mentioned have strong competitive brands, when push comes to shove, some brands appear stronger than others.

As for macroeconomic data, here’s what came out:

- 🇺🇸 Fed Funds Rate kept on hold at 5.5%

- This was in line with expectations, and the market liked hearing that the next move was unlikely to be a rate hike (keep in mind, that can change of course).

- 🇺🇸 JOLTs job openings came in at 8.49m in March

- This was below the 8.7m expected, and indicates that the labour market and economy are slightly weaker than expected.

- 🇯🇵 Japan’s consumer confidence came in lower at 38.3

- Expectations were for 39.6, and this indicates that Japanese consumers are less optimistic than expected, which could lead to lower spending.

- 🇦🇺 Australia’s Balance of Trade hit a 3-year low at AU$5.0bn

- While Australia was still exporting more than it imported, it wasn’t as high as the AU$7.0bn that investors had expected for the month of March. Continued weakness in exports and a spike in imports both contributed to the decline.

Now, let’s dive into the main piece!

🏦 Central Banks Are Stacking The Shiny Stuff

What’s the first reason demand for gold is higher than usual?

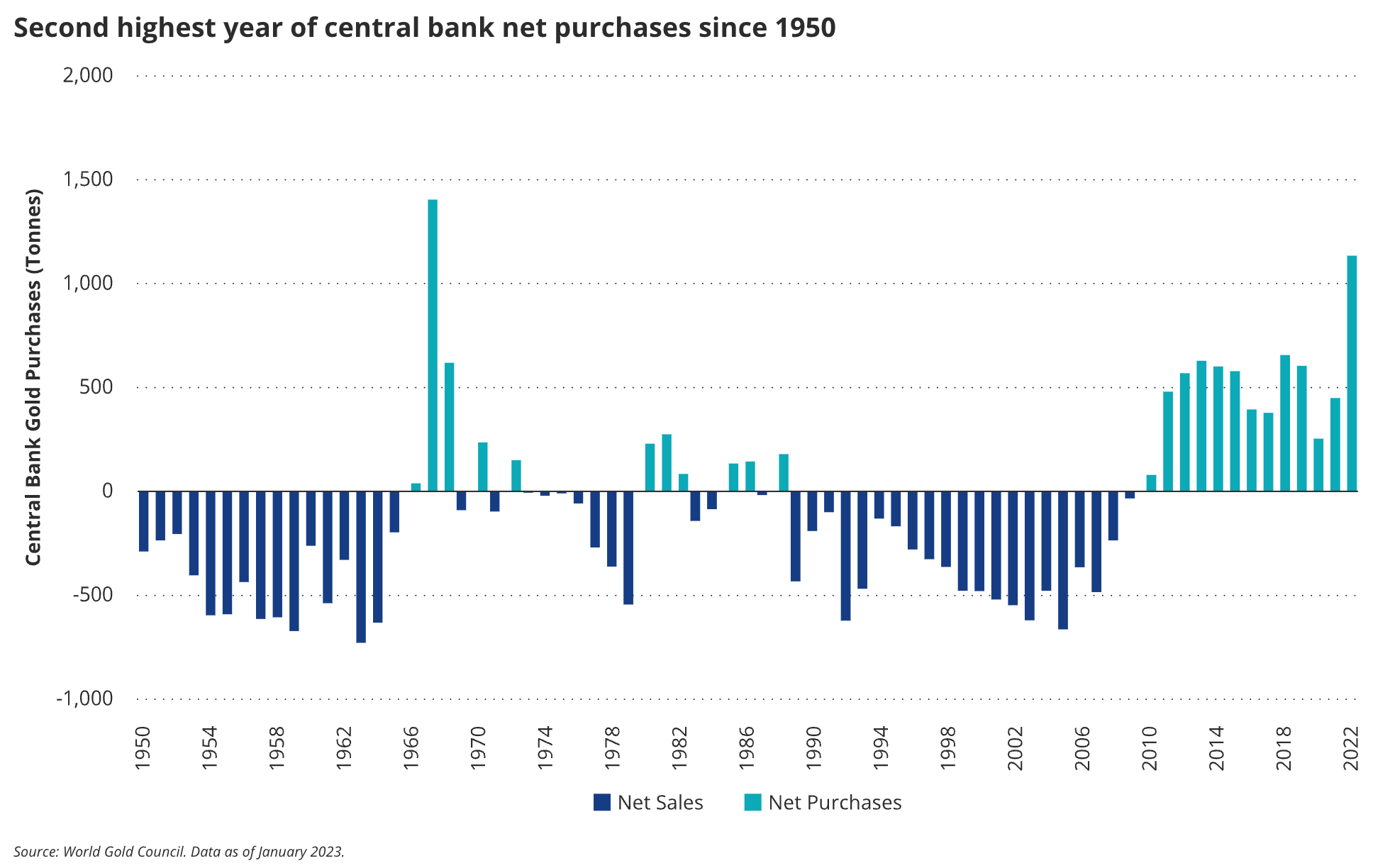

Well, central banks have been buying gold at record levels since 2021. Central banks were net sellers of gold during the 1990s and 2000s, but became net buyers again after the global financial crisis.

Central bank buying accelerated in 2022 when purchases hit a record at 1,082 tonnes in 2022, followed by 1,037 tonnes in 2023.

The rationale for central banks buying gold typically revolves around diversifying their reserves from being overly concentrated in USD, shoring up their balance sheets and owning an asset with no credit risk.

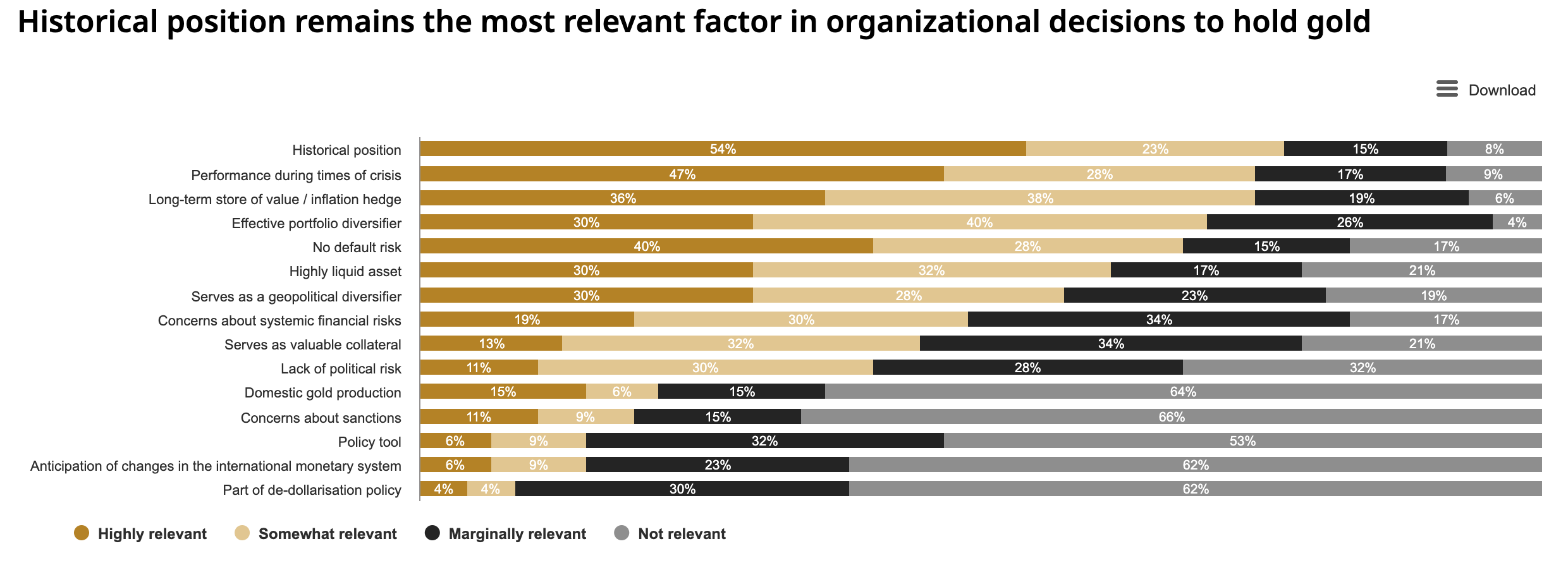

A survey last year from the World Gold Council found that central banks find gold’s historical position, store of value, and performance during crises as appealing reasons to add it to their reserves. Here’s the list of full reasons for buying and what percentage of central banks voted for that answer as either highly relevant, somewhat relevant, marginally relevant or not relevant in their decision.

Outside of the central banks, the likes of Nick Colas at DataTrek Research believe that the increased demand from central banks appears to be a result of the US’s weaponization of the USD.

The USD is still the preferred reserve currency, but US sanctions against Russia, following its invasion of Ukraine, showed that dollar accounts can be frozen.

✨ Typically, foreign central banks' US dollars can only be held in a US bank, which means the US effectively has a level of control over USD reserves held by other central banks. By swapping their dollars for gold, central banks can have physical custody of an asset that is denominated in USD.

For any country that may find itself at odds with the US in the future, switching USD reserves to gold makes sense. As long as the current polarization of the world continues, this is likely to drive demand for gold.

The same survey by the World Gold Council above indicated as much, with 7 out of 10 central banks indicating that they expected to increase their gold reserves over the next 12 months (taken from May 2023).

💸 Retail Investors In China And Other Emerging Markets

In China, real estate has been the preferred asset class for many investors for many years until recently. Additionally, China’s stock market has always been viewed as volatile and risky, and it's been even more out of favor over the last two years.

So now Chinese investors are generally avoiding real estate and the stock market due to the ongoing crisis, and looking for other places to deploy their capital. This has made gold one of the preferred investment assets for the average investor in China.

Gold bars, coins and jewellery are also a favoured store of value in other countries, particularly India, Middle Eastern countries and some other emerging economies. India’s strong economic growth has also resulted in increased gold demand, particularly during the wedding season.

So with all these tailwinds and demand for gold, surely gold miners have been going well too?

Why Aren’t Gold Stocks Matching Gold’s Performance?

The usual promise of gold stocks is that they offer leveraged exposure to the gold price.

If it costs a producer $1500 to mine an ounce of gold and the price rises from $2000 to $2100, their profit jumps from $500 to $600 an ounce. In this case, a 5% increase in the price of gold should lead to a 20% jump in profits. Happy days, right?

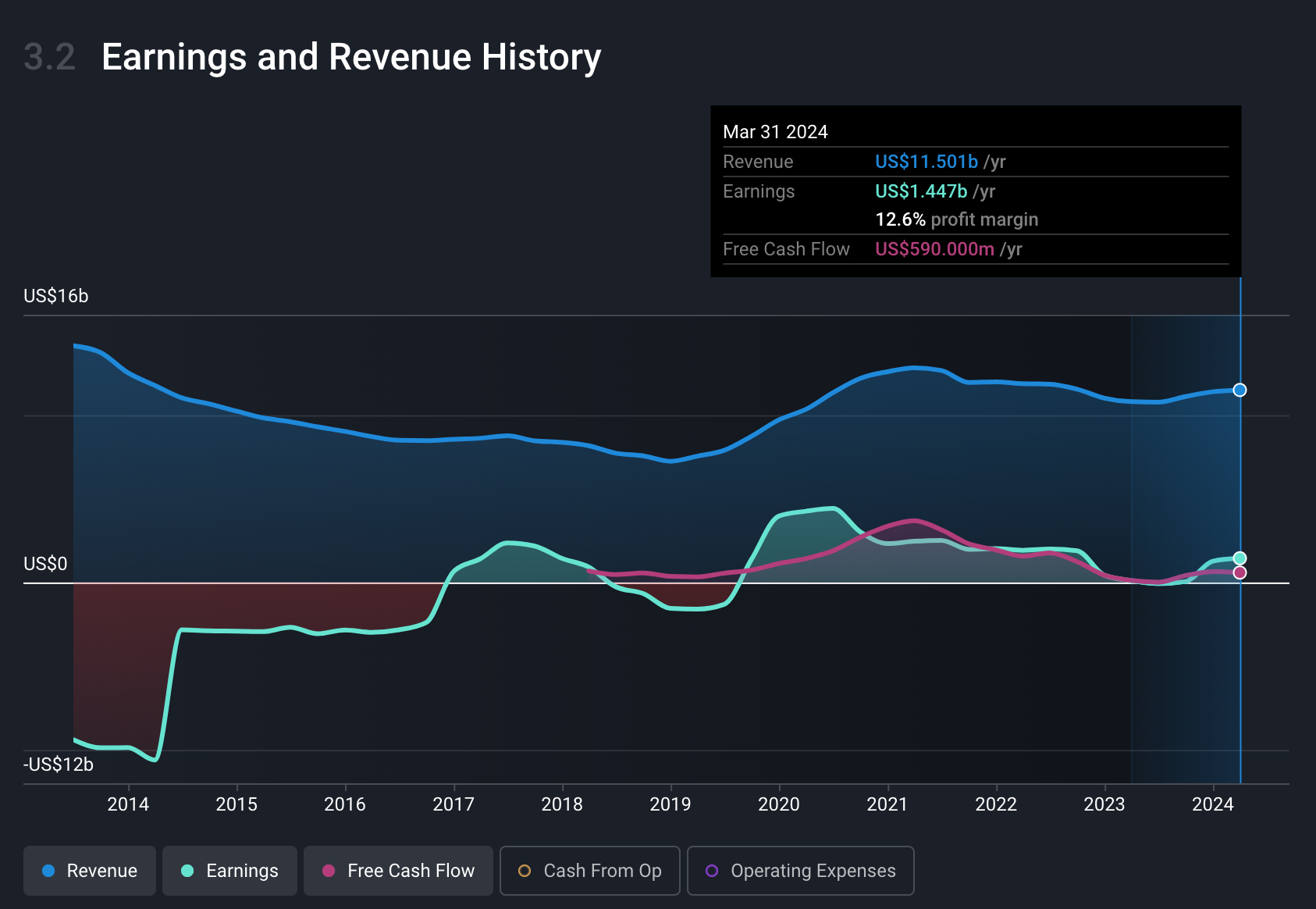

However, the reality is that gold miners have been struggling to grow earnings at the same rate that the gold price has increased, let alone at higher growth rates. You can see below how Barrick Gold, one of the world’s largest gold producers, has struggled to turn a profit over the last 10 years, while the gold price increased by around 80%.

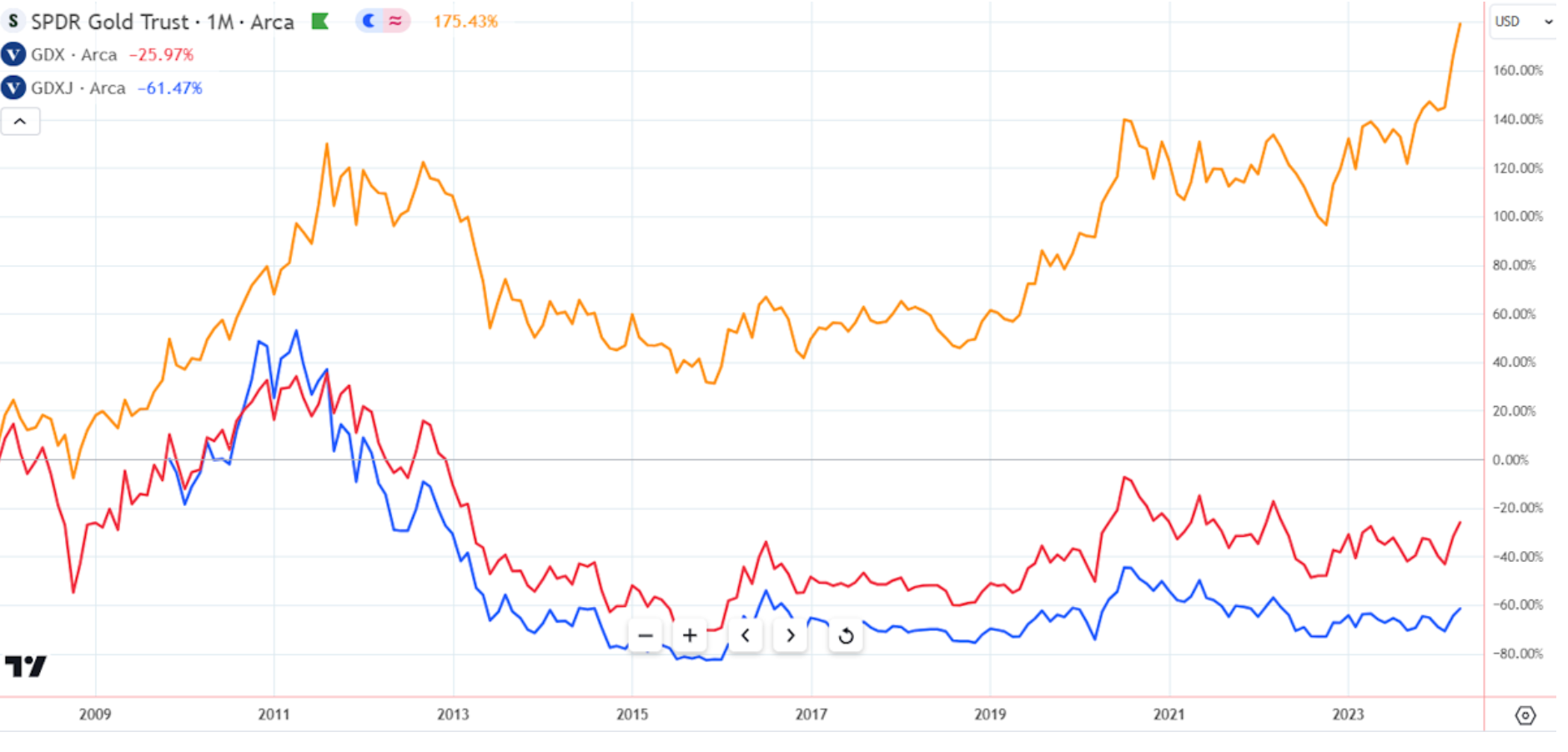

Share prices have reflected these difficulties too. The VanEck Gold Miners ETF (in red) and the VanEck Junior Gold Miners ETF (in blue) have underperformed the SPDR Gold trust (in orange) by nearly 200% since 2008.

Several factors have eroded profits for gold producers:

- ⛏️ The easy-to-reach, high-grade deposits have already been mined

- Whether producers extract gold from lower-grade deposits, or go deeper, it’s a more expensive process. AngloGold Ashanti’s Mponeng gold mine in South Africa is nearly 4 km deep. Either way, the cost of accessing gold increases and margins decrease.

- 📈 Most of the input costs for gold miners have increased

- The likes of labour, energy and transportation have all been subject to higher-than-average inflation. Gold miners in certain jurisdictions are subject to a royalty payment on a percentage of revenue earned, and royalty payments globally also seem to be trending upwards, particularly in less economically stable countries.

- ⛑️ Safety is taken far more seriously than it used to

- This is a good thing of course - but simply means that it’s more expensive to mine safely.

- 🌍 The environmental impact of mining is also taken more seriously

- This has raised costs that are associated with minimizing environmental impact and operating sustainable practices.

Historically, miners often lost out on potential profits by hedging and forward selling their production. However, most producers have stopped or reduced hedging in the last decade.

Since 2013, gold producers have reported All-In Sustaining Costs (AISC), rather than cash costs, with their financials. Previously, only the current cost of actually extracting, processing and delivering gold was considered, which doesn’t show you the whole story. AISC includes the costs over the life of a mine, including explorations and capital expenditure, so it provides way more clarity.

As you might expect, AISC gives investors a more realistic picture of a mine’s profitability - and it turns out it wasn’t as rosy as it previously appeared. This has resulted in the market losing interest in the whole sector, which might be overdone.

💡 The Insight: Consider The Cyclical Nature Of Gold Stocks

The fact that the market has lost interest in gold stocks doesn’t mean it’ll always be that way.

Gold producers are like any business - if they can sell a product for more than they pay for it, they will make a profit. The fact that there’s little investor interest, could mean current share prices are an opportunity if investor sentiment is overly bearish.

As Buffett says: “Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can’t buy what is popular and do well.”

Just like it was unpopular to own energy stocks in 2020 and 2021 as they were out of favour, those who did likely had a pretty lucrative 2022. However, if then you invested in energy stocks when they were all the rage in 2022, you would’ve likely lost money in 2023 since you bought when they were all anyone was talking about.

✨ It all depends on your view on the gold price. Costs are likely to keep rising, but if the gold price rises faster, producers will be able to generate returns for shareholders.

Considering there are plenty of macroeconomic factors that seem to be indicating a higher gold price is likely (some analysts even think that prices over $3,000 per ounce are possible by the end of next year), some gold miners may be well positioned to benefit from that more than others.

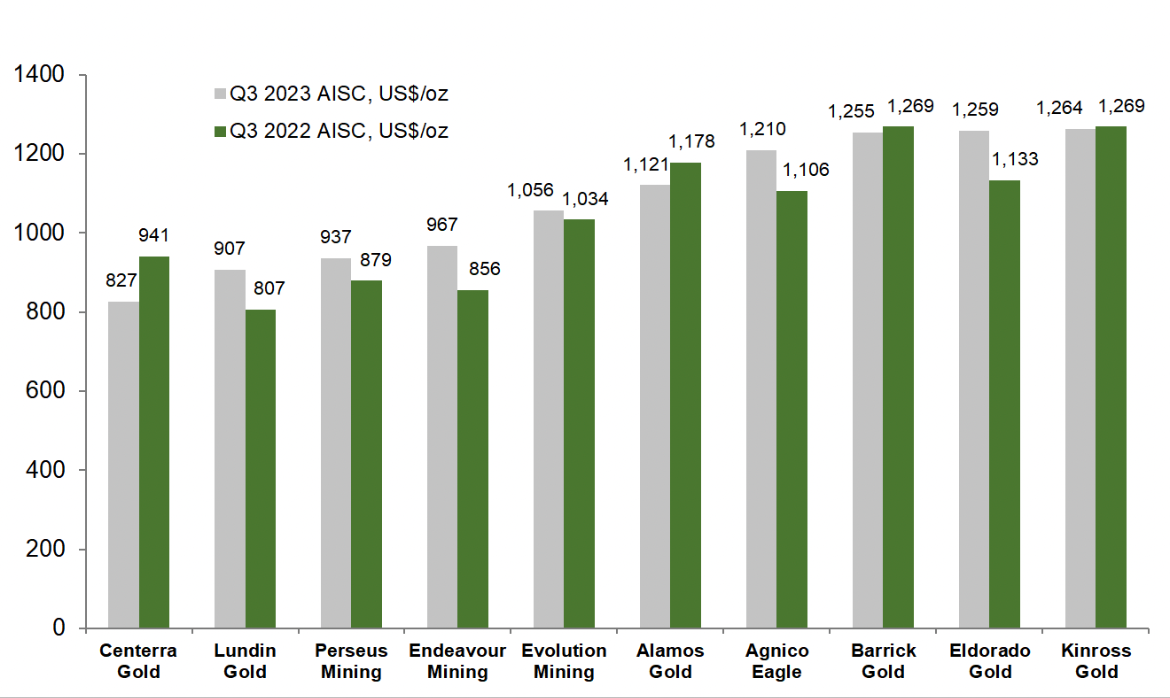

Here are some examples of how different Gold miners AISC costs have changed over 2022/2023.

For those interested in getting gold exposure, you’re spoilt for choice, but here are a few simple options:

- ⛏️ Gold Miners stocks

- If you want a more leveraged approach, you could go with the gold miners. As mentioned, they come with risks since you’re relying on the business being able handle the logistics of operating mines and other challenges they face. This option typically provides leveraged upside considering the multiplier effect of the price of gold on their revenues.

- 🥇 Physical Gold ETFs.

- 🛏️ Buy Physical Gold Yourself (and store it under your mattress).

- While this may give you more peace of mind because you can see the store of value in front of you, it does have less liquidity, divisibility and portability than the gold investment vehicles listed above.

So, depending on your financial goals and risk profile, you may choose one, or a combination of all 3!

For some individual names, here’s a list of U.S. Precious metals companies, with good future prospects and decent financial health. And here’s one of the latest investor narratives on Barrick Gold.

Key Events During The Next Week

Most of the big macro data releases are at the tail end of next week.

Tuesday

- 🇦🇺 Australia’s RBA rate decision is due, with investors expecting rates to stay at 4.35%.

- 🇩🇪 Germany's Balance of Trade data is due, with forecasts for a slight increase from €21.4bn last month to €23bn.

Thursday

- 🇨🇳 China's Balance of Trade is due, with forecasts expecting an increase from 58.55bn CNY to 62bn CNY.

- 🇬🇧 The minutes from the UK’s MPC (Monetary Policy Committee) meeting are due, and like FOMC minutes, investors will keep a close eye on what’s said for indications of future actions they may take.

- 🇬🇧 The UK Cash rate is due, with expectations for it to remain flat at 5.25%.

Friday

- 🇬🇧 The UK’s Preliminary GDP Growth rates for both Year-on-year and Month-on-month are due, with expectations that slight improvements will occur from -0.2% and -0.3% to 0.5% and 0.2%, respectively.

As for earnings season, it’s in full swing as we’ve got another busy week, here are some of the biggest names reporting:

- Vertex Pharmaceuticals

- Palantir

- Realty Income Corp

- Walt Disney

- Arista Networks

- Ferrari

- Occidental Petroleum

- Uber

- Airbnb

- Shopify

- Arm Holdings

- Roblox

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.