Last Update04 Oct 25Fair value Increased 27%

Analysts have raised their price targets for New Gold, citing revised fair value estimates and stronger revenue growth forecasts. The targets now reach up to C$9.50 and $6.25, reflecting increased optimism for the company's outlook.

Analyst Commentary

Recent analyst activity has highlighted growing confidence in New Gold's performance and outlook, with rising price targets and affirmations of positive ratings. The following key takeaways summarize analyst perspectives:

Bullish Takeaways- Bullish analysts have revised their price targets upward, reflecting higher fair value estimates based on improved company fundamentals.

- Optimism centers on strong revenue growth forecasts, suggesting continued positive momentum for New Gold's core operations.

- Outperform ratings indicate analyst conviction in the company’s ability to execute effectively and capture additional market value.

- The new price targets suggest potential for meaningful share price appreciation if management meets growth and operational benchmarks.

- Despite higher price targets, analysts remain attentive to execution risk if projected growth rates are not achieved.

- Persistent market volatility could challenge the company’s ability to sustain momentum and reach revised targets.

- Cautious analysts note that valuation is more demanding at these new target levels, which increases pressure on future performance.

What's in the News

- New Gold announced significant expansion at its New Afton mine. Exploration drilling more than doubled the size of the K-Zone mineralized system and resulted in the discovery of new copper-gold porphyry mineralization to the east and at depth (Key Developments).

- The company plans to increase New Afton's 2025 exploration budget by $5 million, bringing it to $22 million and targeting a maiden mineral resource for K-Zone in the 2025 year-end estimates (Key Developments).

- Recent quarterly operating results showed gold production of 78,595 ounces in Q2 2025, up from 68,598 ounces a year earlier. Copper production remained steady at 13.5 million pounds (Key Developments).

- Six-month gold production for 2025 stands at 130,781 ounces, slightly down from the prior year. Copper production totaled 27.1 million pounds, up marginally year over year (Key Developments).

Valuation Changes

- Fair Value Estimate has risen from CA$9.13 to CA$11.60, reflecting a higher assessment of New Gold's intrinsic worth.

- Discount Rate increased slightly from 6.77% to 6.80%, which indicates a modest adjustment to required returns.

- Revenue Growth Forecast moved up from 21.47% to 25.43%, which signals greater anticipated expansion in top-line results.

- Net Profit Margin improved from 39.09% to 42.22%, which points to expectations for stronger profitability.

- Future Price-to-Earnings (P/E) ratio decreased from 12.21x to 9.36x, suggesting shares may be valued more attractively based on future earnings.

Key Takeaways

- Increased production efficiency, resource expansion, and copper exposure are driving higher margins, revenue diversification, and long-term growth potential.

- Ongoing cost reductions and disciplined capital management are strengthening financial flexibility and positioning the company for improved shareholder returns.

- Heavy dependence on maturing assets, high costs, significant capital demands, and execution risks threaten long-term production stability, earnings sustainability, and financial flexibility.

Catalysts

About New Gold- An intermediate gold mining company, engages in the development and operation of mineral properties in Canada.

- Ramp-up of higher-grade ore production at both Rainy River (open pit and underground) and New Afton (C-Zone block cave), supported by strong operational execution and milestones achieved, is expected to drive increased gold and copper output at lower unit costs, directly improving revenue and net margins over the next 2–3 years.

- Ongoing advancement and investment in exploration and resource expansion at both sites (especially the K-Zone at New Afton and Northwest trend at Rainy River) position the company for resource conversion and future reserve replacement, supporting sustained long-term production growth and earnings.

- Successful consolidation of 100% interest in New Afton, combined with higher copper exposure and the broader global push towards electrification, increases participation in a commodity with structurally rising demand, enhancing revenue diversification and supporting higher cash flows.

- Consistent progress on cost-reduction and operational efficiency initiatives, evidenced by declining all-in sustaining costs and record free cash flow, are boosting overall operational margins and positioning the company to benefit disproportionately from persistent high gold prices due to heightened geopolitical tensions and inflationary pressures.

- Execution of a disciplined capital allocation strategy-including significant debt reduction, careful management of expansion capital, and a shift towards potential shareholder returns as free cash flow inflects-will increase financial flexibility, reduce interest expense, and improve both earnings and the company's valuation multiples.

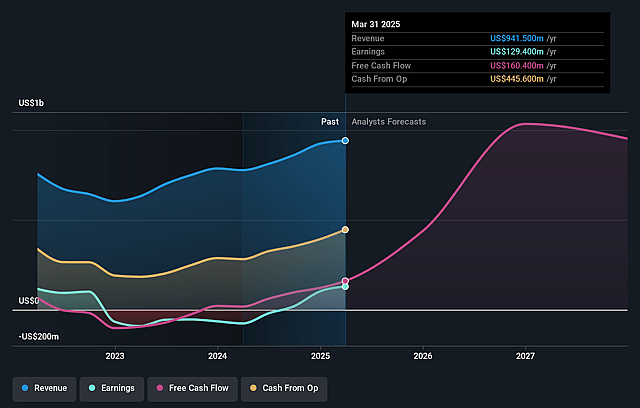

New Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming New Gold's revenue will grow by 33.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.0% today to 45.1% in 3 years time.

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $0.84) by about September 2028, up from $144.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.5x on those 2028 earnings, down from 33.6x today. This future PE is lower than the current PE for the US Metals and Mining industry at 18.0x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.67%, as per the Simply Wall St company report.

New Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing reliance on Rainy River and New Afton as core assets-with Rainy River expected not to fully replace all mined reserves and New Afton's C-Zone starting with lower-than-average grades-raises long-term risks of declining production volumes and resource depletion if exploration does not yield significant new discoveries, potentially impacting future revenue and earnings.

- Sustained high all-in sustaining costs at Rainy River ($1,696/oz in Q2 2025) and overall costs that, while improving, remain vulnerable to even modest gold price declines or inflationary pressures, may erode net margins if commodity prices weaken or operational efficiency initiatives stall, impacting net income and financial flexibility.

- Significant capital expenditures for growth (e.g., C-Zone development, ongoing underground expansion at Rainy River, and $30 million in exploration spend for 2025) combined with a need to pay down drawn credit facilities and gold prepayment obligations may constrain free cash flow and limit the company's ability to return capital to shareholders or invest in new opportunities, negatively affecting net earnings and liquidity.

- Execution risk remains elevated around the ramp-up of New Afton's C-Zone and the underground expansion at Rainy River, where any project delays, cost overruns, or technical challenges in mine development could disrupt planned production increases and delay cash flow inflection points, thus impacting revenue and earnings reliability.

- Despite strong exploration activity, any failure to materially expand reserves (especially at Rainy River, where full reserve replacement in 2025 is not expected) would heighten long-term exposure to industry-wide challenges of reserve depletion, higher exploration costs, and declining ore grades-ultimately pressuring future revenues and the sustainability of earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$8.782 for New Gold based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.5 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 5.5x, assuming you use a discount rate of 6.7%.

- Given the current share price of CA$8.49, the analyst price target of CA$8.78 is 3.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.