Last Update08 Oct 25Fair value Increased 7.51%

Analysts have raised their price target for Paladin Energy from A$8.03 to A$8.64, noting the company's improving profit margins and valuation, which is now seen as fairly reflecting its growth prospects.

Analyst Commentary

Recent research has highlighted both opportunities and risks regarding Paladin Energy's outlook following the latest target price adjustments.

Bullish Takeaways

- Bullish analysts note that Paladin Energy continues to demonstrate strong growth potential within the sector, which supports a higher valuation.

- Rising profit margins have improved the company’s financial profile and signal effective operational execution.

- The upward revision in price targets reflects confidence in management’s ability to capitalize on market demand.

- Valuation is now seen as appropriately reflecting the company's positive future prospects.

Bearish Takeaways

- Some analysts caution that much of Paladin Energy's growth is already priced into the stock, making further upside more challenging.

- With the current share price approaching fair value, the risk-reward profile appears less compelling than in earlier periods.

- There is concern that any execution missteps or market fluctuations could impact performance, given the reduced margin for error in the valuation.

What's in the News

- Completion of a follow-on equity offering raised AUD 261.4 million through the issuance of over 36 million new ordinary shares at prices ranging from AUD 6.66 to AUD 7.25 per share (Key Developments).

- The company entered into a private placement agreement with Canaccord Genuity Corp., securing CAD 30 million for 4,504,505 shares at CAD 6.66 per share, offered in Canada and internationally, with closing expected on September 23, 2025 (Key Developments).

- Filing of an additional follow-on equity offering totaled AUD 20 million, issuing 2,758,621 ordinary shares at AUD 7.25 per share (Key Developments).

- An update on the Patterson Lake South (PLS) uranium project confirmed unchanged production targets, updated capital and operating cost estimates, and a revised schedule targeting first uranium production in 2031 (Key Developments).

Valuation Changes

- Fair Value has increased from A$8.03 to A$8.64. This reflects an improved assessment of the company’s worth.

- The Discount Rate has fallen slightly from 6.73% to 6.48%, indicating a modest reduction in perceived risk.

- Revenue Growth estimates remain nearly unchanged, moving marginally from 42.99% to 42.97%.

- Net Profit Margin has risen modestly from 31.88% to 32.61%, signaling stronger expected profitability.

- The Future P/E ratio has dropped significantly from 23.53x to 16.12x, suggesting higher expected earnings relative to the share price.

Key Takeaways

- Growing Western demand, successful asset acquisitions, and operational ramp-up position Paladin for higher sales, improved margins, and expansion in revenue and cash flow.

- Strategic new projects and exploration activities support long-term production growth, increased asset value, and stronger shareholder returns.

- Regulatory delays, rising project costs, operational risks, and uncertain funding could significantly constrain Paladin Energy's long-term profitability and shareholder value.

Catalysts

About Paladin Energy- Engages in the development, exploration, evaluation, and operation of uranium mines in Australia, Canada, and Namibia.

- Paladin is set to benefit from sustained, increasing global demand for non-Russian, non-Chinese uranium supply, as evidenced by utility contracting trends, growing Western interest, and the company's advances in securing agreements and permits for Canadian assets; this should improve future sales volumes and pricing power, positively impacting revenue growth and gross margins.

- Completion of the ramp-up at the Langer Heinrich mine and transition to full operational capacity by FY 2027, combined with the asset's low cost structure, positions Paladin for significant production and cash flow growth, increasing EBITDA and net margin expansion.

- The addition of the high-quality Patterson Lake South (PLS) project-targeted for first production in 2031 and benefiting from compelling project economics and a globally strategic location-provides Paladin with a clear pathway to long-term production growth, contributing to both asset value and future top-line expansion.

- Ongoing and planned exploration drilling at Saloon East and PLS is expected to unlock further resource upside, providing optionality for reserve and production growth and creating potential for future strategic partnerships, thereby supporting long-term shareholder returns and balance sheet strength.

- Tightening global uranium supplies-highlighted by recent announcements of production shortfalls by major producers and visible near-term utility procurement needs-suggest that spot and contract prices will remain elevated or increase, enhancing the company's future realized prices and free cash flow.

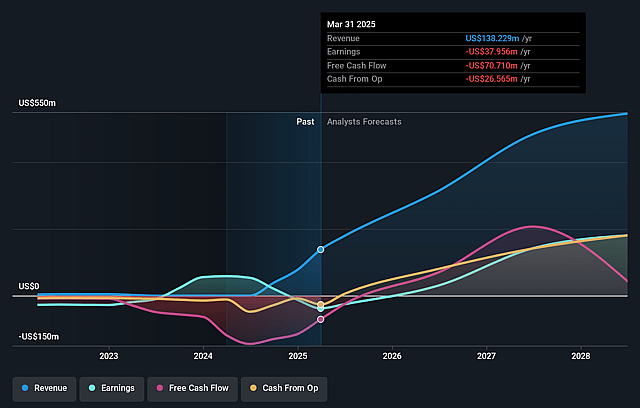

Paladin Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Paladin Energy's revenue will grow by 43.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -25.1% today to 33.7% in 3 years time.

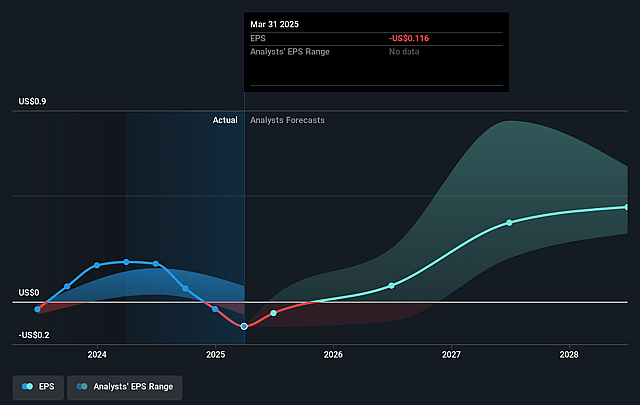

- Analysts expect earnings to reach $175.2 million (and earnings per share of $0.37) by about September 2028, up from $-44.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $251.0 million in earnings, and the most bearish expecting $99.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.2x on those 2028 earnings, up from -45.1x today. This future PE is greater than the current PE for the AU Oil and Gas industry at 14.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.57%, as per the Simply Wall St company report.

Paladin Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The PLS project has a lengthy development timeline, with first production not expected until 2031 due largely to a rigorous and potentially unpredictable Canadian regulatory process; delays or permitting challenges would postpone future revenue streams and impact long-term earnings projections.

- Recent increases in capital expenditures for PLS-driven by rising construction, labor, and infrastructure costs-raise the risk of further cost overruns, which could adversely impact Paladin's net margins and put pressure on future free cash flow, especially if uranium price assumptions prove optimistic.

- Paladin's future production and earnings are highly leveraged to the successful ramp-up and continued operation of the Langer Heinrich mine; any operational disruptions, reserve downgrades from declining ore grades, or lower-than-expected recovery could sharply reduce revenues and margins.

- Paladin's funding strategy for major developments like PLS remains uncertain, potentially requiring debt, equity issuance, or the sale of strategic project interests; reliance on capital markets or dilution from equity raises could negatively impact long-term earnings per share and shareholder value.

- Industry-wide risks-including the possibility of renewed uranium oversupply from ramped-up global projects or lower-than-expected utility contracting volumes-could limit uranium price growth, constraining Paladin's top-line potential and pressuring long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$8.449 for Paladin Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$13.06, and the most bearish reporting a price target of just A$5.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $519.5 million, earnings will come to $175.2 million, and it would be trading on a PE ratio of 15.2x, assuming you use a discount rate of 6.6%.

- Given the current share price of A$7.73, the analyst price target of A$8.45 is 8.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.