Last Update 11 Dec 25

Fair value Decreased 1.00%SAN: Future Returns Will Depend On Execution Of Late-Stage Pipeline

Analysts have nudged their fair value estimate for Sanofi slightly lower from EUR 106.26 to about EUR 105.20, citing marginally softer revenue growth assumptions, partially offset by a modestly stronger profit margin outlook and a slightly reduced forward P E multiple.

Analyst Commentary

Analyst sentiment on Sanofi remains broadly constructive, with recent fair value adjustments reflecting a more nuanced balance between growth ambitions and execution risks.

Bullish Takeaways

- Bullish analysts highlight that, despite the slight trim in fair value, Sanofi still screens as modestly undervalued on a forward earnings basis relative to large cap European pharma peers, supported by a resilient core portfolio.

- Improving margin expectations are viewed as a key support for the investment case, with ongoing cost discipline and mix shift toward higher value therapeutics helping to cushion softer top line assumptions.

- Analysts with a more optimistic stance see continued pipeline progress and selective business development as potential catalysts for re rating, particularly if late stage assets deliver against current timelines.

- The more constructive camp believes that balance sheet strength and consistent cash generation provide flexibility for shareholder returns, which could underpin the valuation even if revenue growth moderates.

Bearish Takeaways

- Bearish analysts point to the reduced revenue growth outlook as evidence that Sanofi may struggle to accelerate beyond low to mid single digit expansion, which could limit upside to earnings and the multiple.

- There is concern that any further delays or setbacks in key pipeline programs could undermine confidence in medium term growth and prompt additional downward pressure on valuation assumptions.

- Cautious voices argue that competitive dynamics in several core franchises, along with pricing headwinds in major markets, could erode top line momentum faster than efficiency gains can offset.

- Some see the slightly lower fair value estimate as a signal that the risk reward profile is becoming more balanced, with less room for execution missteps before the shares move closer to intrinsic value.

What's in the News

- Sanofi and LabGenius Therapeutics entered a second AI enabled collaboration to co optimize Nanobody molecules for new inflammation targets, extending their earlier successful partnership in antibody engineering.

- The European Commission approved Dupixent for chronic spontaneous urticaria in patients 12 and older with inadequate response to antihistamines, opening a new first line targeted option in a large under treated population.

- The EMA committee issued a negative opinion on Rezurock for third line chronic graft versus host disease in Europe, with Sanofi planning a re examination after citing supportive long term efficacy and safety data.

- The EMA committee recommended EU approval of Wayrilz for immune thrombocytopenia in adults refractory to other treatments, based on positive phase 3 results showing sustained platelet responses and reduced bleeding.

- Sanofi completed a major share buyback tranche, repurchasing 48,653,745 shares for about EUR 4.3 billion, equal to roughly 3.9% of its share capital.

Valuation Changes

- The fair value estimate has fallen slightly from €106.26 to €105.20, reflecting modestly softer growth assumptions.

- The discount rate is effectively unchanged, holding steady at about 6.18 percent and implying a stable risk assessment.

- Revenue growth has eased marginally from approximately 4.09 percent to 4.00 percent, indicating a slightly more conservative top-line outlook.

- The net profit margin has risen slightly from about 19.88 percent to 20.03 percent, pointing to improved profitability expectations.

- The future P/E has edged down from roughly 13.80x to 13.59x, suggesting a modestly lower valuation multiple on forward earnings.

Key Takeaways

- Continued investment in innovative products, strategic acquisitions, and portfolio streamlining is positioning Sanofi for long-term growth in high-value therapeutic areas.

- Leadership in biologics and vaccines, alongside regulatory opportunities, supports revenue stability and operating efficiency amid evolving market dynamics.

- Prolonged pricing pressures, R&D setbacks, and rising costs from acquisitions and regulations threaten Sanofi's margins and future growth amid increasing post-patent competition.

Catalysts

About Sanofi- A healthcare company, engages in the research, development, manufacture, and marketing of therapeutic solutions in the United States, Europe, and internationally.

- Sanofi's ongoing focus on innovative product launches and its strong R&D pipeline-highlighted by accelerating investments, multiple Phase III readouts through 2026, and continued expansion of biologics (e.g., Dupixent, amlitelimab)-position the company to capture higher demand for chronic disease treatments in a world with an aging population, supporting robust long-term sales growth and EPS upside. (Revenue, EPS)

- Strategic expansion into rare disease and immunology through targeted acquisitions (e.g., Blueprint Medicines with Ayvakit, Vigil Neuroscience, Vicebio) will expand Sanofi's presence in high-growth, premium-priced therapeutic areas, broadening its addressable patient base as global healthcare access increases, and driving net margin and revenue improvement over time. (Revenue, Net Margins)

- Dupixent's continued growth across multiple indications-including recent launches in COPD, CSU, and bullous pemphigoid-along with significant potential for geographic and indication expansion (notably in underpenetrated markets such as China), underpins a credible pathway to €22 billion in 2030 sales, supporting sustained top-line growth and improved operating leverage. (Revenue, Net Margins)

- Portfolio streamlining-such as the sale of Opella and Consumer Healthcare separation-combined with redeployment of capital into higher growth pharmaceuticals and vaccines, is driving greater operating efficiency, improved product mix, and tighter SG&A/G&A control, all likely to further support net margin and BOI (business operating income) expansion. (Net Margins, BOI)

- Sanofi's leadership in vaccines, development of combination and next-generation products (e.g., Beyfortus, flu/RSV combinations), and active pursuit of regulatory incentives (orphan/fast-track designations) position the company to capitalize on secular trends of rising non-communicable disease prevalence and industry shifts toward biologics, supporting baseline revenue resilience despite periodic pricing pressures in established markets. (Revenue)

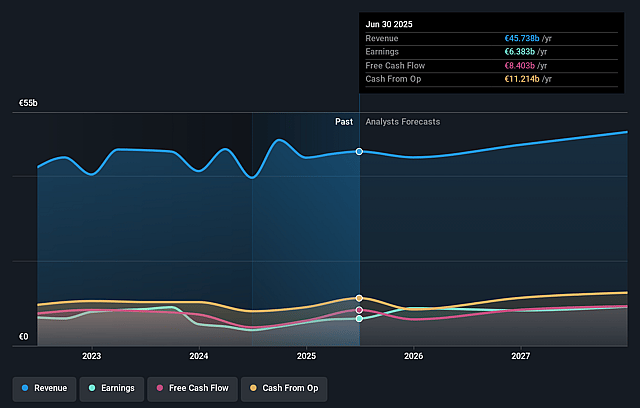

Sanofi Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sanofi's revenue will grow by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.0% today to 18.5% in 3 years time.

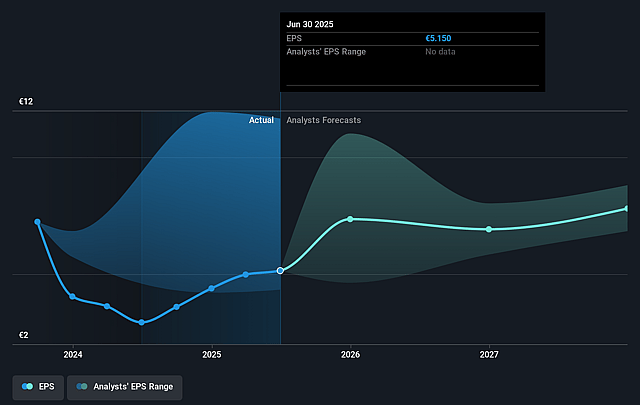

- Analysts expect earnings to reach €9.6 billion (and earnings per share of €8.23) by about September 2028, up from €6.4 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €8.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.2x on those 2028 earnings, down from 16.5x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 2.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.98%, as per the Simply Wall St company report.

Sanofi Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened pressure from competitive pricing, particularly in flu vaccines (expected mid-teens decline in 2025 sales from price competition in the U.S. and Germany), poses a structural risk to Sanofi's long-term vaccine franchise and could compress net margins as pricing headwinds persist beyond this year.

- Pipeline execution remains a key uncertainty: management and investors directly acknowledged that Sanofi's R&D transformation will take several years to play out, and that some high-profile late-stage assets have produced "mixed" results or outright Phase III failures (e.g., itepekimab in COPD), increasing the risk of slower revenue and earnings growth if pipeline assets don't materialize as expected.

- Sanofi's heavy investment in new launches and recent acquisitions (e.g., Blueprint, Vigil Neuroscience, Vicebio), while offering promising long-term growth avenues, has resulted in higher SG&A and R&D expenses; failure to generate expected returns from these investments or delayed integration could limit operating leverage and compress net margins in the coming years.

- The expiration of patent protection for key blockbuster drugs like Dupixent (U.S. 2031, EU 2033) and increasing biosimilar/generic competition industry-wide mean Sanofi faces the risk of accelerating revenue erosion post-exclusivity, particularly as payers, governments, and insurers globally push harder for drug price reductions and transparency.

- Intensified regulatory and geopolitical uncertainty-such as potential U.S. tariffs on EU pharmaceuticals, drug pricing reforms in both the U.S. and Europe, and lengthening approval timelines amid higher regulatory scrutiny-could drive higher operating costs, strain international sales, and directly impair net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €109.218 for Sanofi based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €124.8, and the most bearish reporting a price target of just €92.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €51.8 billion, earnings will come to €9.6 billion, and it would be trading on a PE ratio of 15.2x, assuming you use a discount rate of 6.0%.

- Given the current share price of €86.12, the analyst price target of €109.22 is 21.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Sanofi?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.