Last Update19 Sep 25Fair value Decreased 1.52%

Glencore’s consensus price target has edged lower to £3.66 as analysts react to near-term free cash flow pressure from coal price weakness and commodity market volatility, though confidence in the company’s diversified assets and long-term positioning has limited the downward revision.

Analyst Commentary

- Analysts cite near-term pressure on Glencore's free cash flow due to weakness in coal prices, leading to more cautious stances.

- Several bearish analysts have trimmed their price targets following recent commodity price volatility and increased uncertainty in the coal market outlook.

- Bullish analysts have offset some of the negative sentiment with upward adjustments, driven by expectations of recovery in commodity demand and Glencore's diversified asset base.

- Major banks like JPMorgan and Barclays remain constructive, highlighting the company's strong positioning in essential metals tied to energy transition themes.

- There is a general consensus to retain positive or neutral ratings despite target reductions, reflecting confidence in Glencore's long-term strategic execution and resilience.

What's in the News

- Glencore and Vitol are expected to submit bids for Chevron's 50% stake in Singapore's second-largest refinery, estimated at a total value of around $1 billion, with final bids due in October (Reuters).

- Glencore initiated a $1 billion share buyback program following the sale of its agricultural business to Bunge, with the buyback scheduled to run until February 2026 (Company announcements, July 2025).

- The company updated its 2025 production guidance, narrowing copper production guidance to 850-890 kt (previously 850-910 kt), slightly increasing energy coal guidance, while mostly maintaining targets for cobalt, zinc, nickel, and steelmaking coal (Company guidance, July 2025).

- For H1 2025, Glencore reported lower copper and nickel output year-over-year but higher cobalt, zinc, and coal production, with total copper equivalent production reaching 1,485 kt compared to 1,409 kt last year (Operating results, July 2025).

- Shareholders approved an aggregate distribution of $0.10 per share for FY24, payable in two tranches, with related administrative restrictions for South African shareholders during late August 2025 (Dividend announcement, August 2025).

Valuation Changes

Summary of Valuation Changes for Glencore

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from £3.71 to £3.66.

- The Future P/E for Glencore has significantly fallen from 13.56x to 9.88x.

- The Consensus Revenue Growth forecasts for Glencore has risen from 1.7% per annum to 1.8% per annum.

Key Takeaways

- Rising copper production, new projects, and disciplined supply management position Glencore for sustained revenue and earnings growth amid strong electrification and EV demand.

- Ongoing efficiency initiatives and portfolio optimizations enhance margins, bolster cash flow resilience, and provide capital flexibility despite inflationary and geopolitical pressures.

- Decarbonization, regulatory and legal risks, volatile marketing returns, and ESG pressures threaten Glencore's earnings stability, project execution, and access to capital.

Catalysts

About Glencore- Engages in the production, refinement, processing, storage, transport, and marketing of metals and minerals, and energy products in the Americas, Europe, Asia, Africa, and Oceania.

- A significant uplift in copper production volumes is expected in the second half of 2025 and beyond, as operational bottlenecks and mine sequencing normalize across key sites, with a clear pathway to 1 million tonnes of annual copper by 2028 and new low-capex, high-return brown/greenfield projects in Argentina (MARA, El Pachón) progressing-supporting sustained, long-term revenue and EBITDA growth in alignment with continued global electrification and EV adoption.

- Structural cost savings of ~$1 billion annually by 2026 are being delivered through over 300 efficiency and organizational optimization initiatives across Glencore's industrial portfolio, with more than half expected to be banked in H2 2025 and the remainder by 2026. This recurring benefit should materially improve net margins and operating leverage, offsetting inflationary pressures relative to peers.

- The upgraded marketing EBIT range (from $2.3–3.5bn, midpoint +16%) reflects robust performance in metals trading, particularly copper, and Glencore's ability to capitalize on persistent supply chain dislocations, trade realignments, and arbitrage opportunities amid tighter global supply and rising geopolitical focus on critical minerals-driving cash flow resilience and margin expansion over the cycle.

- Recent portfolio enhancements, including the integration of Tier 1, long-life, low-cost assets such as EVR and stakes in profitable industrials (e.g., Alunorte, Century), are poised to deliver incremental earnings and cash flows, with further monetization potential from Bunge shareholding and potential infrastructure asset sales, providing both downside protection and future capital return flexibility.

- The trend of disciplined supply management (e.g., targeted curtailments in coal, ferrochrome, and smelting) positions Glencore to benefit from shrinking capacity and slowing project development industry-wide-likely resulting in persistent supply deficits and structurally higher realized prices for battery and base metals, supporting long-term revenue growth and EBITDA uplift.

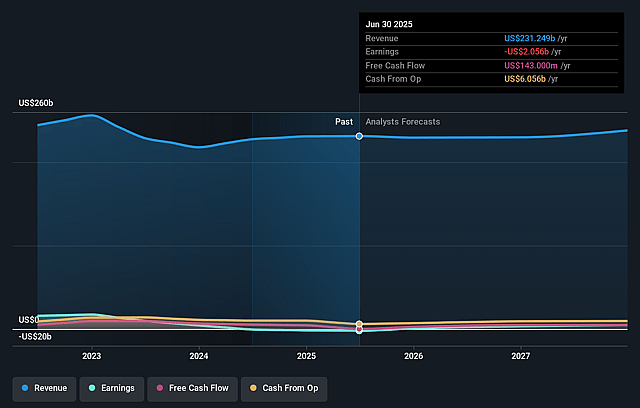

Glencore Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Glencore's revenue will grow by 1.7% annually over the next 3 years.

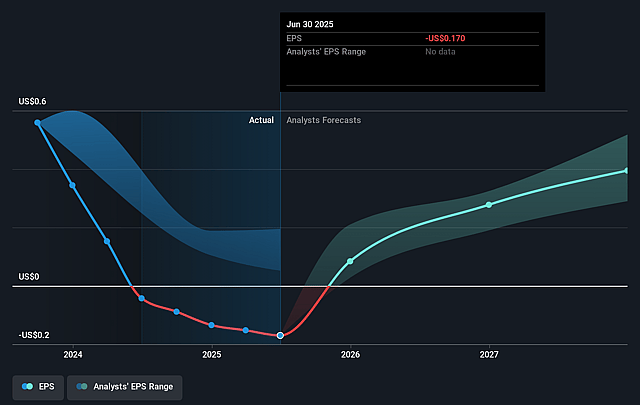

- Analysts assume that profit margins will increase from -0.9% today to 2.2% in 3 years time.

- Analysts expect earnings to reach $5.2 billion (and earnings per share of $0.43) by about September 2028, up from $-2.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $5.9 billion in earnings, and the most bearish expecting $4.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.6x on those 2028 earnings, up from -22.2x today. This future PE is greater than the current PE for the GB Metals and Mining industry at 11.7x.

- Analysts expect the number of shares outstanding to decline by 1.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.48%, as per the Simply Wall St company report.

Glencore Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Weakness in first-half commodity prices, particularly for coal and copper, led to a significant decrease in industrial EBITDA; if this persists due to long-term global decarbonization or accelerated renewables adoption (limiting fossil fuel demand), Glencore's revenues and earnings from coal could structurally decline.

- Ongoing geopolitical and regulatory risks-including cobalt export bans in the DRC, uncertain Argentine regulatory frameworks for major copper projects (MARA, El Pachón), and potential global resource nationalism-could delay project execution, increase costs, or impede access to strategic minerals, ultimately impacting revenue growth and profit margins.

- Exposure to legacy coal operations and related carbon-intensive assets raises the risk of stranded assets, negative ESG sentiment, and shrinking access to ESG-linked capital as global investors increasingly shun fossil-fuel companies, potentially leading to higher cost of capital and reduced net margins.

- Marketing business returns have become more volatile and are increasingly reliant on short-term arbitrage opportunities driven by tariff uncertainty and market dislocations; if global trade becomes more stable, or commodity market regulations tighten further, structural profitability of the marketing business may become less predictable, pressuring Glencore's earnings and cash flow stability.

- Legal and remediation liabilities, particularly regarding historical corruption/bribery investigations and rising costs for environmental reclamation, mine closure, and water management, present material risks; future fines, tightening environmental standards, or new compliance mandates could create unpredictable headwinds for net earnings and increase operational expenditures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £3.712 for Glencore based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.61, and the most bearish reporting a price target of just £3.09.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $243.3 billion, earnings will come to $5.2 billion, and it would be trading on a PE ratio of 13.6x, assuming you use a discount rate of 8.5%.

- Given the current share price of £2.87, the analyst price target of £3.71 is 22.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.