Last Update27 Aug 25Fair value Increased 4.89%

BOC Aviation’s analyst price target has been raised to HK$80.82, primarily reflecting sharply higher future P/E and upgraded revenue growth forecasts.

What's in the News

- Announced an interim dividend of USD 0.1476 per share for H1 2025.

- Board meeting held to discuss H1 2025 unaudited results and interim dividend.

- Entered into an agreement with Airbus and secured long-term leases with Gulf Air, expanding its aircraft leasing activities.

- Approved a final dividend of USD 0.2670 per share for FY2024.

- Appointed Ernst & Young LLP as auditor for FY2025.

Valuation Changes

Summary of Valuation Changes for BOC Aviation

- The Consensus Analyst Price Target has risen slightly from HK$77.42 to HK$80.82.

- The Future P/E for BOC Aviation has significantly risen from 11.76x to 90.75x.

- The Consensus Revenue Growth forecasts for BOC Aviation has significantly risen from 8.4% per annum to 10.2% per annum.

Key Takeaways

- Expanding air travel and airlines' shift to leasing support strong, recurring revenue growth and greater earnings stability for BOC Aviation.

- Fleet modernization and industry supply constraints create pricing power, driving higher lease rates and improved margins.

- Rising committed capital, high leverage, environmental regulations, and shifting market dynamics increase BOC Aviation's exposure to demand, interest rate, asset impairment, credit, and competition risks.

Catalysts

About BOC Aviation- Operates as an aircraft operating leasing company in Mainland China, Hong Kong, Macau, Taiwan, rest of the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

- Strong anticipated growth in global air travel, especially in Asia-Pacific and emerging markets, is expected to sustain high demand for leased aircraft, supporting stable or rising utilization rates and driving future revenue growth.

- Airlines are increasingly adopting asset-light strategies, favoring operating leases over ownership, which should expand BOC Aviation's customer base and underpin longer-term lease demand-positively impacting recurring revenues and enhancing earnings predictability.

- Ongoing fleet modernization, with a record orderbook heavily weighted to new, fuel-efficient aircraft, positions BOC Aviation to benefit from replacement cycles and environmental compliance trends, supporting higher lease rates and improving net margins.

- Continued stability and gradual rebound in aircraft manufacturer deliveries, combined with a multi-year industry-wide supply shortfall, is creating pricing power and lease rate uplift, translating into higher lease yields and margin expansion for the company going forward.

- Declining airline credit risk, evidenced by improved collection rates and strong customer profitability, enhances cash flow stability, reduces the need for bad debt provisions, and provides greater visibility over future earnings.

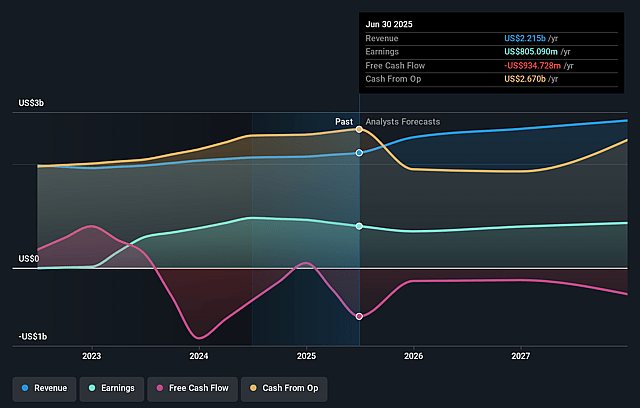

BOC Aviation Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BOC Aviation's revenue will grow by 10.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 36.3% today to 28.8% in 3 years time.

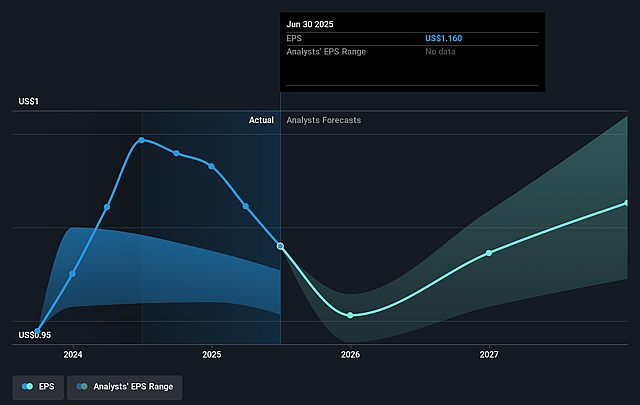

- Analysts expect earnings to reach $866.5 million (and earnings per share of $1.25) by about September 2028, up from $805.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $998.5 million in earnings, and the most bearish expecting $763 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.4x on those 2028 earnings, up from 7.7x today. This future PE is greater than the current PE for the HK Trade Distributors industry at 10.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.11%, as per the Simply Wall St company report.

BOC Aviation Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- BOC Aviation's significant increase in committed capital expenditure and record orderbook (~$20 billion through 2030) exposes the company to risk if airline demand growth falters due to global economic downturns, unexpected disruptions from geopolitical tensions, or sustained weakness in regions like APAC, potentially resulting in excess capacity, lower fleet utilization, and suppressed lease revenues.

- The company's high and stable leverage (gross debt-to-equity ratio at 2.6x) leaves its earnings vulnerable to a prolonged high-interest-rate environment or tightening credit conditions, which could materially increase refinancing costs and compress net interest margins, pressuring overall net income and debt servicing capacity.

- Although BOC Aviation boasts a young and fuel-efficient fleet, the rapid acceleration of environmental regulation and potential advancements in decarbonization technologies (electric/hydrogen aircraft) may shorten the economic useful lives of existing assets, introducing impairment risk and higher depreciation expenses, adversely impacting net margins over the medium-to-long term.

- Despite strong collection rates and declining receivables, BOC Aviation is increasingly placing orderbook capacity several years forward with specific airlines-raising exposure to future counterparty credit risks, especially if weaker airlines in emerging or cyclical markets default or restructure, leading to elevated bad debt provisioning and revenue losses.

- The trend towards manufacturers (OEMs) increasing production and supply chain normalization could saturate the aircraft leasing market over time, especially if airlines revert to direct purchases or alternative sale-and-leaseback models, increasing competition and potentially compressing lease yields, which would limit future revenue growth and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$81.207 for BOC Aviation based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$86.28, and the most bearish reporting a price target of just HK$72.22.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.0 billion, earnings will come to $866.5 million, and it would be trading on a PE ratio of 11.4x, assuming you use a discount rate of 11.1%.

- Given the current share price of HK$69.45, the analyst price target of HK$81.21 is 14.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.