Key Takeaways

- ServiceNow's strategic investment in AI and early successes in gen AI position it well to leverage the expanding AI market for enhanced earnings.

- Expansion into new workflow categories and strategic alliances with entities like Visa and AWS indicate a broadening market presence and potential for increased revenue and customer base growth.

- Aggressive investment in generative AI and new products, along with strategic expansions and high renewal rate reliance, pose operational and financial risks if projections aren't met.

Catalysts

What are the underlying business or industry changes driving this perspective?

- The company's growth in subscription revenue and large new logo count, including a notable $10 million deal with a global financial services firm, suggests a solid foundation for future revenue expansions.

- ServiceNow's strategic focus on AI, as highlighted by their significant investment and the introduction of products with early success in gen AI, positions the company to capitalize on the burgeoning AI market, potentially enhancing earnings as these technologies gain traction.

- The expansion into new workflow categories generating over $1 billion in ACV indicates a diversified and growing product portfolio, likely to drive broader market penetration and improve revenue streams.

- Strategic alliances with global entities like Visa and AWS and the inclusion of ServiceNow as a SaaS offering in the AWS marketplace, suggest an expansion in reach and market presence, which could positively impact future revenues and customer base growth.

- ServiceNow's increasing emphasis on the public sector, evidenced by key wins with significant entities such as the U.S. Army and Australian Department of Defense, reveals a growing and potentially lucrative market segment for its offerings, which may contribute to future revenue growth and stability.

Assumptions

How have these above catalysts been quantified?

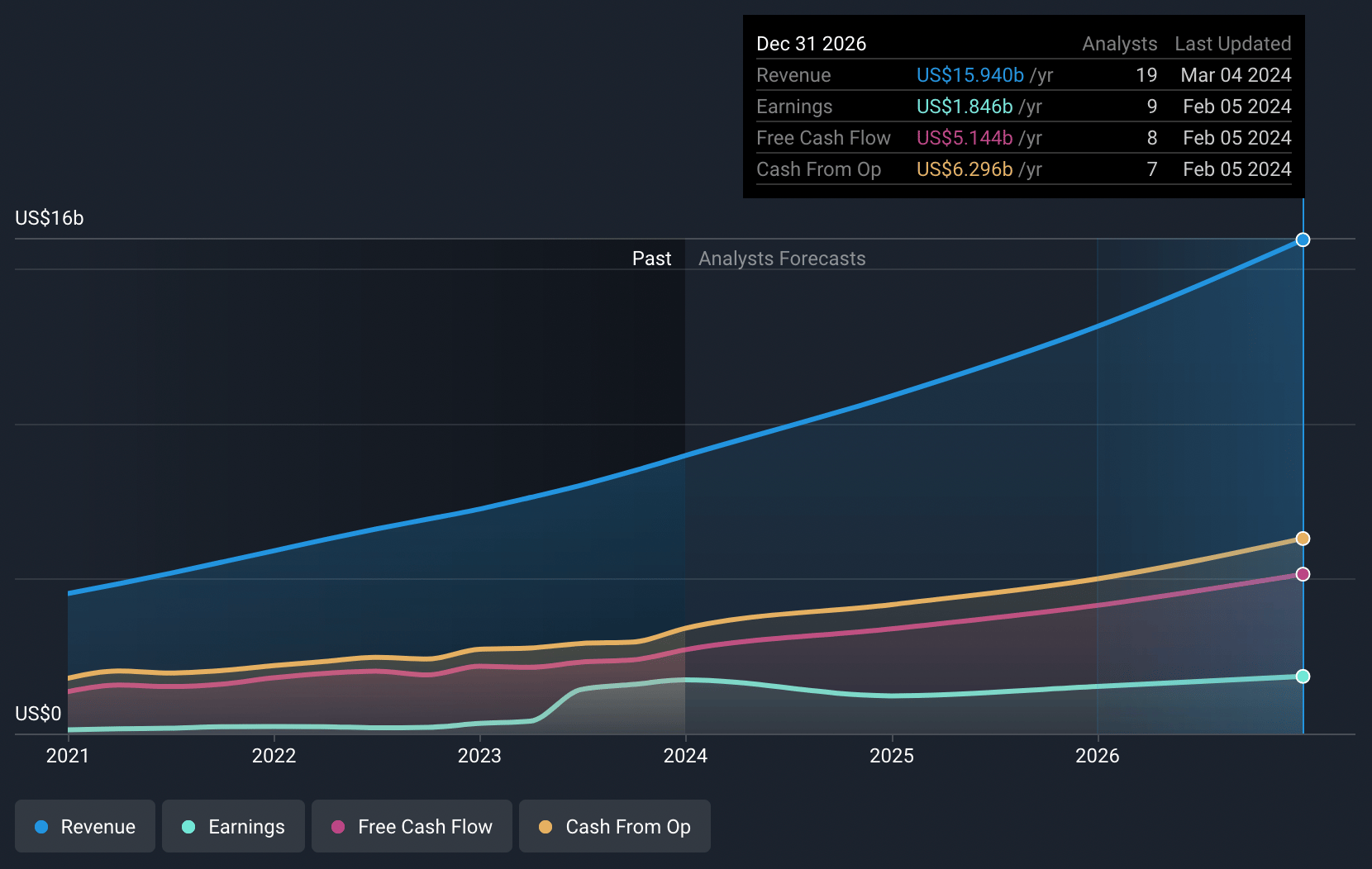

- Analysts are assuming ServiceNow's revenue will grow by 21.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 19.3% today to 11.6% in 3 years time.

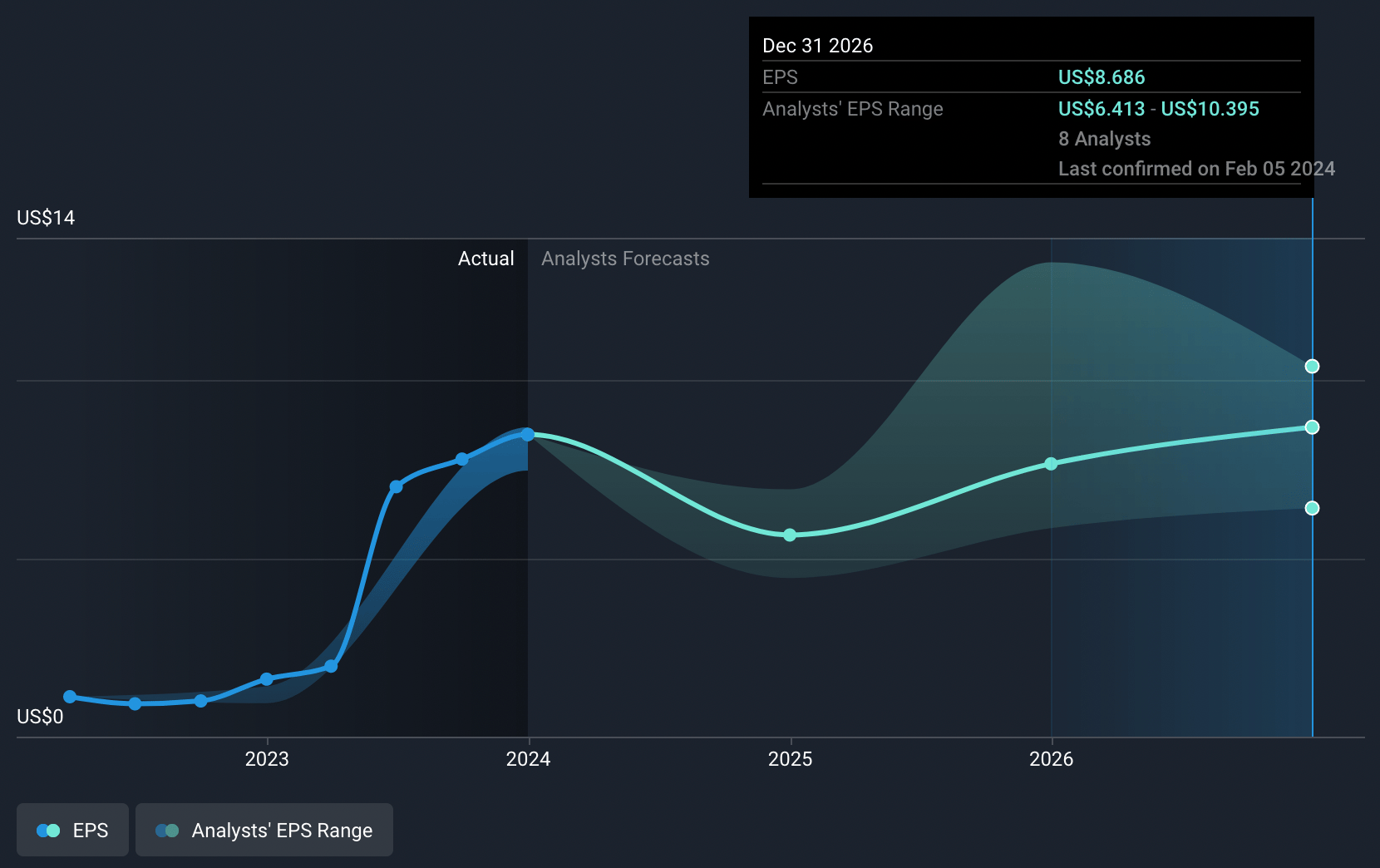

- Analysts expect earnings to reach $1.8 billion (and earnings per share of $8.69) by about March 2027, up from $1.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 109.5x on those 2027 earnings, up from 92.3x today.

- To value all of this in today’s dollars, we will use a discount rate of 6.91%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Increased anticipation of rising interest in generative AI and its applications in enterprise software could inflate expectations, potentially affecting the company's stock if these expectations are not met, impacting investor sentiment and share price.

- The company's aggressive pursuit and significant investment in generative AI and new product lines heighten operational risks, potentially affecting net margins if returns do not align with projections.

- ServiceNow's expansion into large new logos and strategic areas, including public sector engagements, could face execution risks, influencing revenue growth if expansion efforts face unforeseen challenges or delays.

- The reliance on maintaining high renewal rates (noted as 99% in the call) is critical for sustained revenue growth; any significant dip in renewal rates could adversely affect recurring revenue streams.

- The strategic focus on industry-specific solutions and partnerships for driving new ACV growth, such as with Visa and AWS, introduces risks associated with the scalability of these solutions and partnerships, affecting potential earnings if these efforts underperform expectations.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $832.11 for ServiceNow based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $15.9 billion, earnings will come to $1.8 billion, and it would be trading on a PE ratio of 109.5x, assuming you use a discount rate of 6.9%.

- Given the current share price of $779.49, the analyst's price target of $832.11 is 6.3% higher. The relatively low difference between the current share price and the analyst target indicates that they believe the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.