Last Update10 Oct 25Fair value Increased 2.34%

Nordic Semiconductor’s analyst price target has been raised from NOK 142.41 to NOK 145.74. Analysts cite improved valuation forecasts and steady growth expectations for the company in their recent updates.

Analyst Commentary

Recent analyst updates on Nordic Semiconductor reflect a mix of optimism and caution regarding the company's future performance. The following summarizes the main bullish and bearish takeaways from the latest street research reports.

Bullish Takeaways- Bullish analysts have raised their price targets for Nordic Semiconductor. Several institutions now forecast prices between NOK 130 and NOK 180, indicating heightened confidence in the company's valuation potential.

- Updated estimates reflect sustained growth for the company. Positive momentum has been noted following recent quarterly results described as "trending in the right direction."

- Some market watchers see long-term valuation support, especially when factoring in projections based on 2027 earnings estimates, suggesting a favorable outlook for patient investors.

- Continued strength in artificial intelligence-related sectors is seen as a supportive trend, even if the direct benefit to Nordic Semiconductor’s group is currently limited.

- Bearish analysts caution there is downside risk to 2026 performance estimates. Some suggest the company’s recent tailwinds may fade due to cyclical and customer-specific challenges.

- Certain research notes highlight a cautious stance toward European technology hardware as a sector. Ongoing uncertainty is emphasized heading into the third quarter.

- Despite some target increases, a number of analysts maintain Hold or Neutral ratings, reflecting reservations about valuation and near-term execution risks.

- Several institutions remain wary, suggesting that while current valuations appear supported by long-term prospects, significant upside may be constrained by broader sector headwinds.

What's in the News

- Nordic Semiconductor ASA has completed a follow-on equity offering, raising NOK 1.05 billion through the sale of 7,000,000 ordinary shares at NOK 150 each, in a subsequent direct listing (Key Developments).

- The company recently filed for a follow-on equity offering involving ordinary shares as part of its ongoing capital strategies (Key Developments).

- Nordic Semiconductor provided third quarter 2025 revenue guidance, projecting between USD 165 million and USD 185 million based on current customer orders and business forecasts (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly, increasing from NOK 142.41 to NOK 145.74.

- Discount Rate has increased modestly from 9.25% to 9.38%, which indicates a slightly higher required return by analysts.

- Revenue Growth projections are nearly unchanged, moving from 13.60% to 13.61% for the forecast period.

- Net Profit Margin estimate has fallen marginally, shifting from 10.86% to 10.68%.

- Future P/E ratio has fallen significantly from 347.3x to 35.91x, suggesting a much lower valuation multiple is expected going forward.

Key Takeaways

- Market optimism may be overestimating sustainable revenue growth, as cyclical benefits and external risks could limit long-term sales and profitability.

- High valuation is tied to growth in green technology and IoT, but rising costs, regulatory pressures, integration challenges, and increased competition threaten margins and earnings.

- Strong innovation, broadening market reach, and a strategic solutions shift position Nordic Semiconductor for sustained growth, margin resilience, and long-term competitive differentiation.

Catalysts

About Nordic Semiconductor- A fabless semiconductor company, develops and sells integrated circuits for use in short- and long- range wireless applications in Europe, the Americas, and the Asia Pacific.

- Investors may be overestimating Nordic Semiconductor's ability to sustain current high revenue growth rates as the company is currently benefitting from a cyclical rebound, inventory normalization, and restocking, while long-term consumer and industrial customer demand could slow due to macroeconomic volatility or shifts in global buying patterns; this could impact future revenue growth sustainability.

- Optimism about the company's exposure to green technology and sustainability trends could be inflating valuation, but tightening regulatory requirements and European climate policies may increase compliance costs and CapEx, potentially leading to downward pressure on net margins and earnings over time.

- The move toward a solution-oriented, chip-to-cloud provider and recent M&A (Newton AI, Memfault) are seen as strong long-term growth catalysts, but integration risks and consistently high R&D and OpEx requirements, especially for high-salary software talent, could weigh on profitability and net margins in the near term.

- Current multiples may reflect investor confidence that the ongoing proliferation of IoT, smart city, and digitalization trends will continue to drive above-market revenue and market share gains; if adoption rates plateau or competition intensifies (especially from low-cost or Asian providers), revenue growth and gross margins could disappoint relative to expectations.

- Elevated valuation could also be supported by expectations that Nordic's expansion in power management ICs and advanced SoCs (nRF54 series) will lead to accelerated sales traction and attach rates; a slower ramp due to extended customer design cycles, certification lags, or delays in broad-based adoption could limit earnings and revenue upside versus optimistic assumptions.

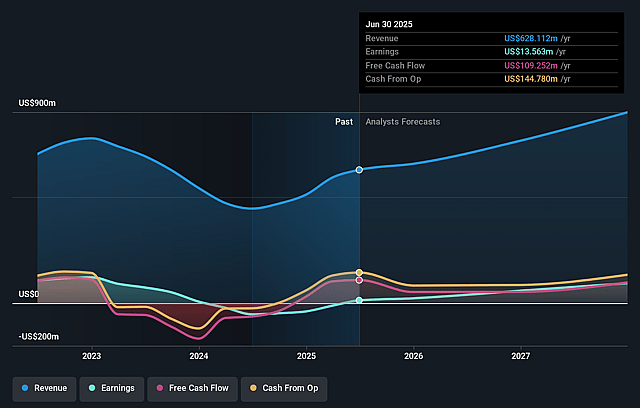

Nordic Semiconductor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nordic Semiconductor's revenue will grow by 13.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.2% today to 10.8% in 3 years time.

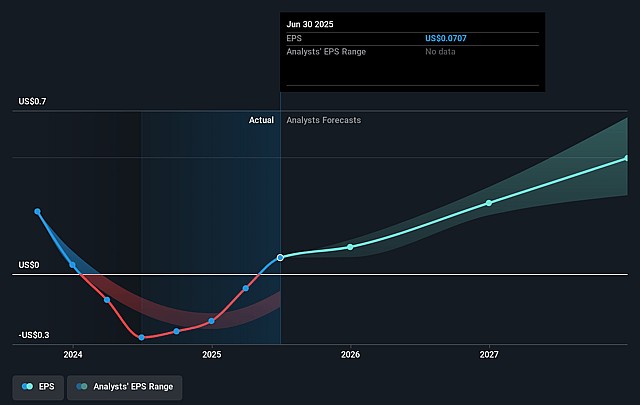

- Analysts expect earnings to reach $100.0 million (and earnings per share of $0.52) by about September 2028, up from $13.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $131.2 million in earnings, and the most bearish expecting $67.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.8x on those 2028 earnings, down from 218.8x today. This future PE is lower than the current PE for the GB Semiconductor industry at 218.8x.

- Analysts expect the number of shares outstanding to decline by 0.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.36%, as per the Simply Wall St company report.

Nordic Semiconductor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust year-on-year revenue growth and recovery across both short

- and long-range product segments, with sustained demand from key customers in industrial, healthcare, and consumer markets, indicates potential for continued top-line expansion in the medium to long term, supporting future revenue growth.

- Ongoing product innovation and expansion, including the launch of the nRF54 series, extended PMIC offerings, and acquisitions like Newton AI and Memfault (cloud life cycle management), position Nordic as a leader in low-power, integrated semiconductor solutions and differentiated full-stack offerings, potentially enabling margin resilience and defending against commoditization.

- High customer engagement and a strong design pipeline for recently launched and upcoming products, along with significant leadership in Bluetooth Low Energy design certifications, suggest long-term customer stickiness, broadening market reach, and higher chances of recurring revenues and design win-driven growth.

- Commitment to sustainability and recognition as one of Europe's and the world's most sustainable companies increases Nordic's appeal to eco-conscious customers and partners across geographies, opening pathways to large, sustainability-driven contracts and long-term competitive differentiation, potentially leading to higher sales or improved margins.

- Strategic shift toward becoming a solutions provider (hardware, software, and cloud) diversifies Nordic's revenue streams, increases customer lock-in, and reduces business risk associated with reliance on single markets or product lines, supporting more stable EBITDA and earnings growth over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK139.485 for Nordic Semiconductor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK190.0, and the most bearish reporting a price target of just NOK109.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $923.1 million, earnings will come to $100.0 million, and it would be trading on a PE ratio of 33.8x, assuming you use a discount rate of 9.4%.

- Given the current share price of NOK156.8, the analyst price target of NOK139.49 is 12.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.