Last Update 07 Nov 25

Fair value Decreased 1.92%MTCH: Improved Profit Margins And Operational Efficiencies Will Drive Stronger Performance

Match Group's analyst price target has been revised downward from $38.47 to $37.74, as analysts anticipate modestly stronger revenue growth and profit margins while applying a higher discount rate to reflect a slightly riskier outlook for the company.

Analyst Commentary

Analysts remain divided in their views of Match Group's prospects, reflecting both renewed optimism about growth and ongoing concerns tied to the company's execution and risk profile. The following key themes have emerged from recent analyst commentary:

Bullish Takeaways- Bullish analysts point to the potential for stronger revenue growth than previously expected, which could support higher long-term valuations.

- Improved profit margins are anticipated, with some expecting operational efficiencies to benefit the company in the coming quarters.

- There is confidence that Match Group can leverage its market position to navigate industry headwinds and capture growth as digital dating adoption expands globally.

- Bearish analysts are applying a higher discount rate to Match Group's valuation, reflecting a moderate increase in perceived risk around future earnings and execution.

- Some express caution regarding sustained margin improvements, noting that increased competition and potential regulatory changes could pressure profitability.

- Uncertainty related to broader macroeconomic headwinds and consumer spending trends is also cited as a factor that could adversely impact growth prospects.

What's in the News

- Match Group rolled out Face Check, a facial verification feature for Tinder users in the U.S. The new tool requires all new members in select markets to verify their identities through a video selfie, which has led to a reported 60% drop in exposure to bad actors and improved user trust (Company Announcement).

- The company's latest buyback tranche repurchased 6.7 million shares for $230 million. This brings the total buyback under the current program to 18.8 million shares, or 7.6% of shares outstanding, at a cost of $602.57 million (Company Filing).

- Match Group provided earnings guidance for Q4 2025, anticipating revenue between $865 million and $875 million, which would represent 1% to 2% year-over-year growth. Net income attributable to shareholders is projected to be between $159 million and $164 million (Company Guidance).

- The Trump administration added 407 derivative product codes to steel and aluminum import tariffs. This change may affect several industries and indirectly influence companies with global operations (Reuters).

- Canada is set to drop many retaliatory tariffs on U.S. products. However, it is likely to keep import taxes on U.S. steel, aluminum, and automotive imports, a development that could impact global supply chains (Bloomberg).

Valuation Changes

- Consensus Analyst Price Target has declined marginally from $38.47 to $37.74.

- Discount Rate has risen moderately to 9.68% from 8.94%. This indicates a higher perceived risk.

- Revenue Growth expectations have increased slightly, moving from 5.01% to 5.24%.

- Net Profit Margin projections have improved, edging up from 20.32% to 20.51%.

- Future P/E ratio has decreased from 12.93x to 11.77x. This suggests a lower valuation multiple on future earnings.

Key Takeaways

- AI-driven innovation, safety enhancements, and alternative payments are set to boost engagement, retention, and profitability across Match Group's brands.

- Focused global expansion and shifting cultural trends help diversify users and revenue sources while strengthening growth beyond mature core markets.

- Declining user metrics, overreliance on Tinder, increased competition, regulatory costs, and user trust concerns threaten Match Group's long-term revenue growth and profitability.

Catalysts

About Match Group- Engages in the provision of digital technologies.

- Accelerated product innovation-especially at Tinder and Hinge with new AI-powered features, personalization, trust/safety enhancements, and lower-pressure connection options for Gen Z-should revitalize user growth, increase engagement, and support higher payer conversion rates; this is likely to drive sustained top-line revenue and margin expansion as new features mature.

- Strong international expansion plans for Hinge and other brands, targeting markets like Europe, Mexico, Brazil, and broader Asia, position Match Group to capture growth from increasing smartphone and internet adoption worldwide-expanding the addressable user base and diversifying revenue beyond more saturated U.S. markets.

- Growing societal acceptance and normalization of online dating, reinforced by product improvements focused on safety and authenticity (e.g., face check and bot detection), should reduce friction to adoption, broaden the user demographic, and support elevated ARPU and payer conversion, positively impacting long-term revenue and earnings.

- Successful rollout and optimization of alternative payment options (particularly on iOS), building on early test results of >30% transaction shift to web and >10% net revenue uplift, offer substantial potential for margin improvement and higher adjusted operating income (AOI)/free cash flow, with an estimated $65M AOI saving opportunity in 2026.

- Data-driven organizational and cultural turnaround (with flattened teams, rapid product cycles, and cross-brand AI/model sharing) increases efficiency and positions Match Group to leverage its large data set to improve user retention and stickiness-contributing to higher lifetime value and healthier net margin trends over the medium to long term.

Match Group Future Earnings and Revenue Growth

Assumptions

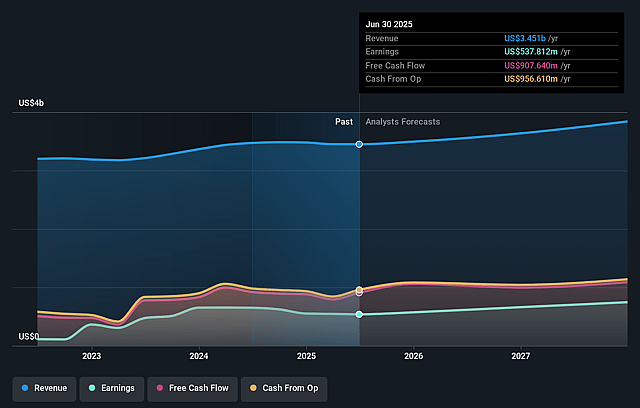

How have these above catalysts been quantified?- Analysts are assuming Match Group's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.6% today to 20.3% in 3 years time.

- Analysts expect earnings to reach $811.8 million (and earnings per share of $3.56) by about September 2028, up from $537.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.9x on those 2028 earnings, down from 17.1x today. This future PE is lower than the current PE for the US Interactive Media and Services industry at 17.0x.

- Analysts expect the number of shares outstanding to decline by 4.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.94%, as per the Simply Wall St company report.

Match Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent year-over-year declines in Match Group's core user metrics-such as new account registrations, monthly active users (MAU), and payers-highlight demographic headwinds, competition, and product fatigue, which, if not fully reversed, could pressure long-term revenue growth and earnings.

- Overdependence on Tinder as the primary revenue driver presents significant risk, as Tinder direct revenue declined 4% year-over-year (and payers are down 7%), indicating potential market share loss or saturation, which could undermine revenue and net margins if product turnarounds do not succeed.

- Intensifying competition, including proliferating free and AI-powered dating options, may erode Match Group's pricing power and user engagement, resulting in higher customer acquisition costs and downward pressure on both revenue per payer and profitability.

- Increased regulatory scrutiny, evidenced by penalties such as the $14 million FTC settlement and ongoing need for compliance with data privacy and digital payments regulations, may elevate costs and limit monetization strategies, compressing long-term net margins and earnings.

- Ongoing user concerns regarding trust, safety, and digital burnout-alongside Match Group's need to continually enhance moderation and safety features-could dampen user growth and engagement, leading to higher operating expenses or reduced monetization potential, ultimately impacting overall revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $38.474 for Match Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $49.0, and the most bearish reporting a price target of just $31.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.0 billion, earnings will come to $811.8 million, and it would be trading on a PE ratio of 12.9x, assuming you use a discount rate of 8.9%.

- Given the current share price of $38.21, the analyst price target of $38.47 is 0.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.