Last Update 11 Dec 25

Fair value Decreased 0.45%AKRBP: Future Returns Will Depend On Execution And Disciplined Capital Allocation

Analysts have slightly trimmed their fair value estimate for Aker BP from NOK 262.00 to about NOK 260.82 per share, reflecting a marginally lower discount rate and refined earnings growth assumptions, while maintaining broadly stable long term profitability and valuation multiples.

Analyst Commentary

Recent commentary on sector peers underscores a growing emphasis on disciplined capital allocation and prioritizing companies with outsized earnings growth, themes that are directly relevant to Aker BP’s investment case.

Bullish Takeaways

- Bullish analysts highlight that Aker BP’s focused asset base and relatively visible production profile position it well to deliver steady earnings growth, which supports the modest adjustment rather than a wholesale reset of fair value.

- The refined discount rate is seen as consistent with a lower perceived risk profile compared to more leveraged or diversified peers, underpinning confidence in cash flow durability and dividend capacity.

- Stricter market preference for growth is viewed as a tailwind for Aker BP if it can continue to execute on its project pipeline and enhance recovery rates, potentially justifying valuation multiples in line with quality upstream names.

- Analysts also see room for upside if Aker BP can demonstrate better than expected cost control and capital discipline, which would translate into higher free cash flow yields relative to current market expectations.

Bearish Takeaways

- Bearish analysts caution that in an environment where investors are gravitating to names with outsized earnings acceleration, Aker BP’s growth profile may appear more incremental, limiting multiple expansion despite solid fundamentals.

- There is concern that any execution slippage on key projects or delays in bringing new barrels online could quickly erode the narrow buffer embedded in current valuation assumptions.

- Some analysts flag the risk that if commodity prices soften or sector sentiment rotates further toward higher growth energy transition plays, Aker BP could face relative de rating even if it meets its operational targets.

- Bearish views also note that with the valuation now close to refined fair value estimates, the margin of safety for new investors is thinner, making the stock more sensitive to negative surprises on costs, capex, or regulatory developments.

What's in the News

- Aker BP and Equinor reported a major gas and condensate discovery in the Lofn and Langemann wells in the North Sea, with gross recoverable volumes estimated at 30 to 110 mmboe, and are evaluating low emission, infrastructure led development options (Key Developments).

- Aker BP’s Omega Alfa exploration campaign in the Norwegian North Sea delivered one of Norway’s largest oil discoveries in a decade, with recoverable volumes estimated at 96 to 134 mmboe, supporting its goal of producing more than one billion barrels from the Yggdrasil area (Key Developments).

- The company strengthened its position in the Alvheim and Kjottkake areas through asset swap agreements with DNO, gaining operatorship of the Kjottkake discovery and additional stakes in producing and exploration assets, subject to regulatory approvals (Key Developments).

- Aker BP raised its full year 2025 production guidance to 410 to 425 mboepd from 400 to 410 mboepd, citing improved operational outlook (Key Developments).

- Third quarter 2025 production came in at 414 mboepd with 396.1 mboepd sold, while goodwill impairment charges were reduced to $172.5 million from $303.5 million a year earlier (Key Developments).

Valuation Changes

- Fair Value: trimmed slightly from NOK 262.00 to NOK 260.82 per share, reflecting only a marginal adjustment to the valuation model.

- Discount Rate: reduced modestly from 6.54 percent to 6.53 percent, indicating a slightly lower perceived risk profile.

- Revenue Growth: effectively unchanged at around 1.95 percent, signaling no material revision to top line growth expectations.

- Net Profit Margin: maintained at roughly 12.84 percent, with only immaterial rounding differences in the updated estimate.

- Future P/E: nudged higher from 12.47x to 12.49x, implying a marginally richer multiple on forward earnings assumptions.

Key Takeaways

- Advances in digitalization and low-emission technologies aim to optimize operations, reduce costs, and improve net margins, enhancing long-term profitability.

- Strategic financial management and targeted exploration strategies boost financial stability, enabling growth investments and potentially enriching future revenue streams.

- Increasing emissions costs and reliance on key assets may expose Aker BP to operational risks, impacting margins and revenue stability amidst evolving energy policies.

Catalysts

About Aker BP- Explores for, develops, and produces oil and gas on the Norwegian Continental Shelf.

- Aker BP aims to sustain production above 500,000 barrels per day beyond 2030, driven by their 2 billion barrel opportunity and projects like Yggdrasil and Johan Sverdrup. This supports long-term revenue growth through extended production capacities.

- The Yggdrasil project is designed to be technologically advanced and low-emission, powered by renewable electricity from shore, ensuring efficient and cost-effective operations that will likely improve net margins by reducing operational costs and environmental compliance expenses.

- Aker BP’s commitment to digitalization, including developments like Agile Asset Management and the ACE toolkit, aims to optimize operations and enhance efficiency, potentially leading to improved net margins and higher earnings through reduced downtime and streamlined processes.

- The company’s enhanced financial flexibility, including refinancing short-term maturities with long-term debt, strengthens its balance sheet, supporting financial stability and the capacity for strategic growth investments, which can bolster earnings and shareholder value.

- Aker BP’s exploration strategy and M&A considerations focus on maximizing near-field exploration tied to existing assets, potentially increasing reserves and production efficiency with lower upfront costs, which could enhance future revenue streams and profitability.

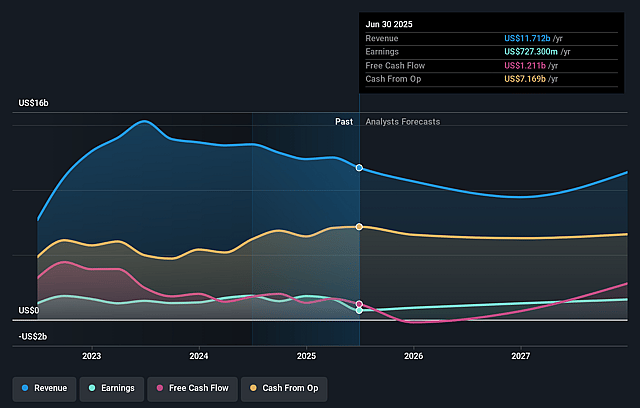

Aker BP Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aker BP's revenue will grow by 1.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.2% today to 13.6% in 3 years time.

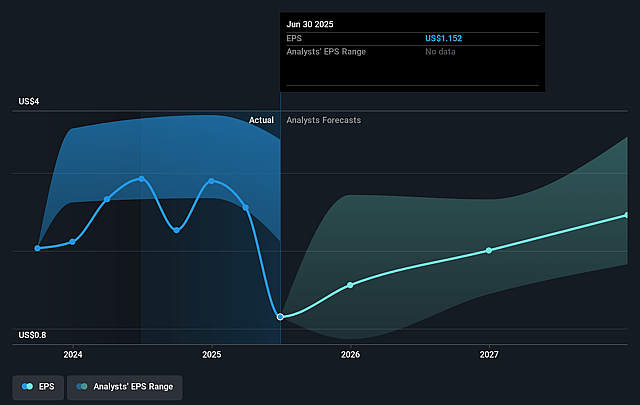

- Analysts expect earnings to reach $1.6 billion (and earnings per share of $2.59) by about September 2028, up from $727.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.9 billion in earnings, and the most bearish expecting $1.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, down from 21.5x today. This future PE is greater than the current PE for the GB Oil and Gas industry at 8.4x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.94%, as per the Simply Wall St company report.

Aker BP Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The possibility of emissions costs increasing could weigh on Aker BP's long-term financials by increasing operating expenses and potentially reducing net profit margins.

- Uncertainties around global energy transitions and the policy environment may pose risks to future oil and gas demand, impacting Aker BP's long-term revenue projections.

- Heavy reliance on a few key assets, such as Johan Sverdrup, for a substantial portion of the production could expose the company to significant operational risks, potentially impacting revenue stability.

- High exploration activities and potential delays or cost overruns in major projects like Wisting or Yggdrasil could strain cash flows and increase financial leverage beyond expectations.

- The emphasis on production growth through M&A or new projects may increase exposure to integration risks and execution challenges, potentially affecting future earning potential if synergies are not realized as planned.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK256.824 for Aker BP based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK300.0, and the most bearish reporting a price target of just NOK190.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $12.1 billion, earnings will come to $1.6 billion, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of NOK248.2, the analyst price target of NOK256.82 is 3.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Aker BP?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.