Last Update 15 Oct 25

Fair value Decreased 1.02%Paris Airport Modernization And Air France Collaboration Will Fuel Progress

Analysts have slightly reduced their price target for Aéroports de Paris to €122.73 from €124, citing modest changes in financial assumptions and a recently lowered benchmark from sector research.

Analyst Commentary

Bullish Takeaways- Bullish analysts continue to see potential for long-term growth, supported by stable traffic and gradual recovery in international travel.

- Operational efficiencies and cost management are expected to bolster profitability margins over the next several quarters.

- The company's diversified revenue streams, including retail and real estate, provide a buffer during periods of aviation market volatility.

- Analysts note that valuation remains attractive for investors seeking exposure to the European infrastructure sector.

- Bearish analysts highlight recent downward adjustments to price targets, reflecting more cautious assumptions on passenger growth and recovery pace.

- Execution risks remain, particularly around the ability to maintain cost discipline in a challenging macroeconomic environment.

- Competitive pressures and regulatory uncertainties could weigh on mid-term revenue expansion.

- There is concern that further benchmark reductions in the sector could lead to a more conservative stance on future growth projections.

What's in the News

- Aéroports de Paris reported group traffic of 37,207,212 passengers in August 2025, marking a 3.0% year-over-year increase (Key Developments).

- Year-to-date passenger traffic as of August 2025 reached 252,593,844, up 4.2% from the previous year (Key Developments).

- In July 2025, group traffic was 36,301,056 passengers, a 1.4% rise compared to July the prior year (Key Developments).

- Year-to-date as of July 2025, total group traffic climbed by 4.5% to 215,387,450 passengers (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has declined moderately, moving from €124 to €122.73.

- Discount Rate has decreased slightly, changing from 9.67% to 9.44%.

- Revenue Growth forecasts have risen marginally, increasing from 4.37% to 4.47%.

- Net Profit Margin projections have edged down, shifting from 11.97% to 11.88%.

- Future P/E ratio is fractionally lower, moving from 18.30x to 18.10x.

Key Takeaways

- Expansion, modernization, and regulation at Paris airports are set to increase efficiency, revenue predictability, and long-term growth through capacity and sustainable infrastructure investments.

- Diversification into non-aeronautical businesses and global airport partnerships should reduce earnings volatility and drive sustained margin growth.

- Rising costs, regulatory uncertainty, volatile non-operational items, heavy debt reliance, and sluggish high-margin passenger recovery threaten margins, earnings growth, and financial stability.

Catalysts

About Aeroports de Paris- Operates and designs airports in France, Turkey, Kazakhstan, Jordan, Georgia, and internationally.

- The upcoming long-term Economic Regulation Agreement with the French state, in conjunction with large-scale expansion and modernization projects at Charles de Gaulle, will boost capacity and efficiency while providing revenue visibility through regulated tariffs, supporting long-term revenue growth and predictability.

- Collaboration with Air France and a strategic focus on multimodality, modular development, and low-carbon energy at Paris airports position Aeroports de Paris to benefit from future government funding and incentives for sustainable infrastructure, which should drive higher earnings and improve net margins.

- Recovery and robust growth in international passenger traffic (notably on North America, Africa, and Asia Pacific routes), combined with structural expansion in global air travel demand, lay the groundwork for sustained top-line growth and higher spend-per-passenger, supporting both revenue and earnings.

- Ongoing diversification into non-aeronautical revenue streams (retail, real estate, hospitality, and digital services), and optimization of commercial assets via digitalization and brand partnerships (such as Extime), are expected to reduce volatility tied to airline cycles and drive margin expansion over time.

- Equity stakes and management contracts in high-growth international airports (especially through TAV and GMR Airports) enable group-level earnings and revenue diversification, and as these foreign entities begin or increase dividend payments (notably GMR in 2028), they should materially bolster consolidated cash flow and net income.

Aeroports de Paris Future Earnings and Revenue Growth

Assumptions

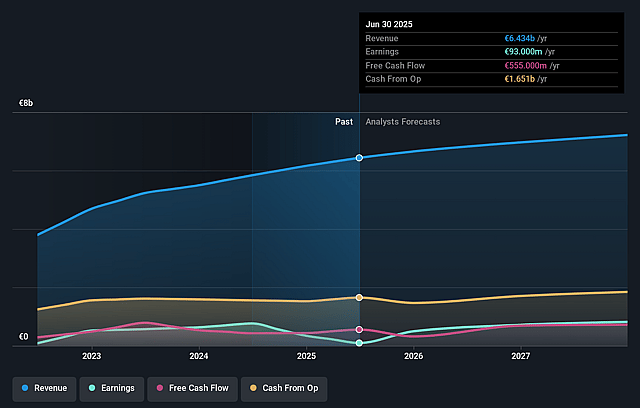

How have these above catalysts been quantified?- Analysts are assuming Aeroports de Paris's revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.4% today to 12.0% in 3 years time.

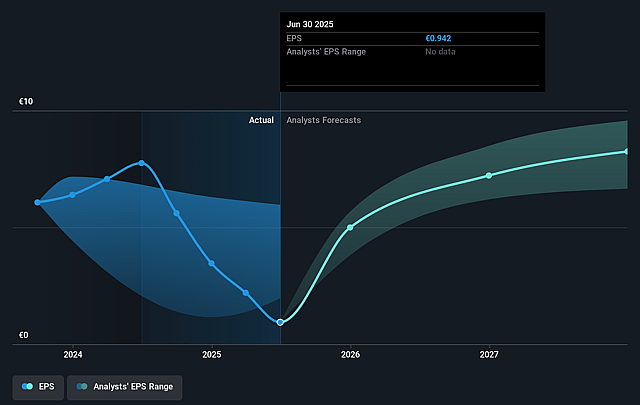

- Analysts expect earnings to reach €875.8 million (and earnings per share of €8.85) by about September 2028, up from €93.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €659.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.3x on those 2028 earnings, down from 117.6x today. This future PE is lower than the current PE for the GB Infrastructure industry at 33.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.67%, as per the Simply Wall St company report.

Aeroports de Paris Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Structural increases in operating costs, including rising staff expenses (baseline 2.5% per annum), higher external services costs, and increased property taxes, may erode margins and limit future earnings growth, especially as CapEx ramps up for major infrastructure projects.

- Heightened volatility in non-operational items (notably FX impacts and fluctuating taxation, such as the exceptional surplus corporate tax in France) has already led to sharp declines in net income, potentially undermining profit predictability and future dividend stability.

- Heavy reliance on debt-financed expansion, as evidenced by a net debt to recurring EBITDA ratio of 4x and recent large bond issuances, could strain financial flexibility and increase financial risk if anticipated traffic growth or expected returns from CapEx fail to materialize, impacting net margins and long-term earnings.

- Slower recovery in key high-spend passenger segments-particularly Asian travelers (with Asia traffic still at 91% of pre-COVID levels) and recent signs of slowdown in luxury retail-coupled with adverse FX movements, may constrain growth in high-margin non-aeronautical revenue, limiting earnings upside.

- The upcoming Economic Regulation Agreement introduces regulatory uncertainty; delays, an unfavorable tariff or WACC regime, or capex remuneration below expectations could cap allowable returns or slow investment recoupment, directly constraining revenue growth, profitability, and long-term value creation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €124.0 for Aeroports de Paris based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €144.0, and the most bearish reporting a price target of just €109.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €7.3 billion, earnings will come to €875.8 million, and it would be trading on a PE ratio of 18.3x, assuming you use a discount rate of 9.7%.

- Given the current share price of €110.8, the analyst price target of €124.0 is 10.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.