Key Takeaways

- I'm bullish on Microsoft as a business, its most profitable days ahead

- Growth avenue: revamp current products with AI, increase offers on Azure cloud

- Not leader in cloud infrastructure, but dominant in SaaS productivity suite

- Highest potential growth industries: CRM & ERP, gaming, healthcare

- Teams: Microsoft's true super app, pushing to make it as prevalent as Office 365

Catalysts

Business Catalysts

Enhancing the family of apps with AI.

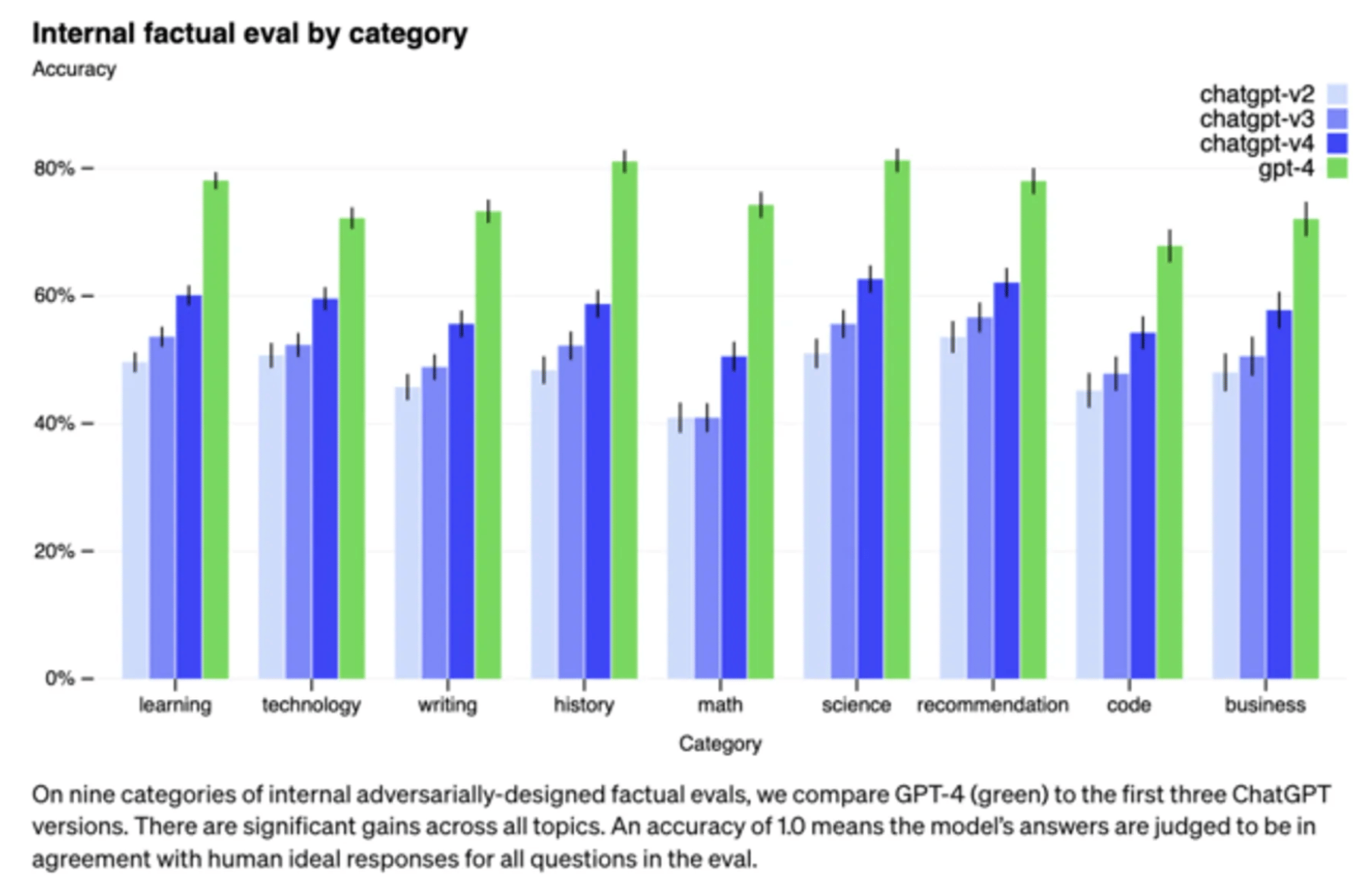

By now, most of the investing world regards Microsoft as a leader in AI. The company is expected to grow its AI revenue by $10B as well as utilize its cloud and existing apps as a platform to enhance its AI offering. Specifically, I believe that Microsoft 365 and Microsoft Azure will be a key driver of this AI-driven growth because the benefits it provides to enterprise businesses outweigh the costs of implementation. The practical effects from AI are related to productivity, which translates to the ability to cut headcount and operational complexity in companies - hence the appeal. While doing more with less is great as can be the case with an AI-powered Microsoft 365, reducing organizational complexity with Dynamics and Azure while retaining output is the key driver and will allow AI products to be monetized even if highly priced. Microsoft’s advantage in AI also comes from being able to utilize large proprietary data to improve the product. Which is why smaller peers will not be able to catch up with cloud giants that have years of data history. This is why I think that Microsoft will retain its leadership position in AI, even as smaller competitors gain the technology to train their own models.

ChatGPT Improving Model Quality: Internal Factual Evaluations per Category

Appeal Of Their Productivity Suite Keeps Growing

Microsoft 365 is a key player in the business ecosystem, with their productivity and CRM (Customer Relationship Management) apps having great integration and familiarity with large enterprise customers. The power of Microsoft apps comes from their combined use, which makes them competitive and difficult to replace. In the FY2023 Q3 quarterly report we saw a sustained growth for productivity suite (Office) by 14% YoY, as well as 17% for Dynamics - the CRM & ERP (Enterprise Resource Planning) software. On a user count level, Office 365 reached 65.4M subscribers in Q3 2023.

Large portion of Knowledge Workers Will Use Teams

Teams is Microsoft’s true super app. As the technology expands, Teams may become a widespread app, with internal communication and networking. In 2022 Teams had 270 million monthly users, now 300M (1), with a yearly $25.19 revenue per user. The company targets 1B monthly active users by 2030 for Teams. To put that into perspective, reports estimate that there are between 1B and 1.3B knowledge workers in the world (1, 2, 3), and capturing 1B would mean that most of them use Teams. Even with an expectation of 1.5B knowledge workers by 2028, I find it difficult to estimate a market share larger than 50% for the app. My estimate therefore is that Teams onboards 750 million monthly active users at an increased monetization of $30 per user, yielding $22.5B of revenue in 2028.

As with most Microsoft products, Teams will have a harder time growing via acquisitions as the company is seen as a monopolistic threat, and may have to rely on organic growth with internal development in order to reach their targets. This may prove difficult if competitors develop technology that is patent protected.

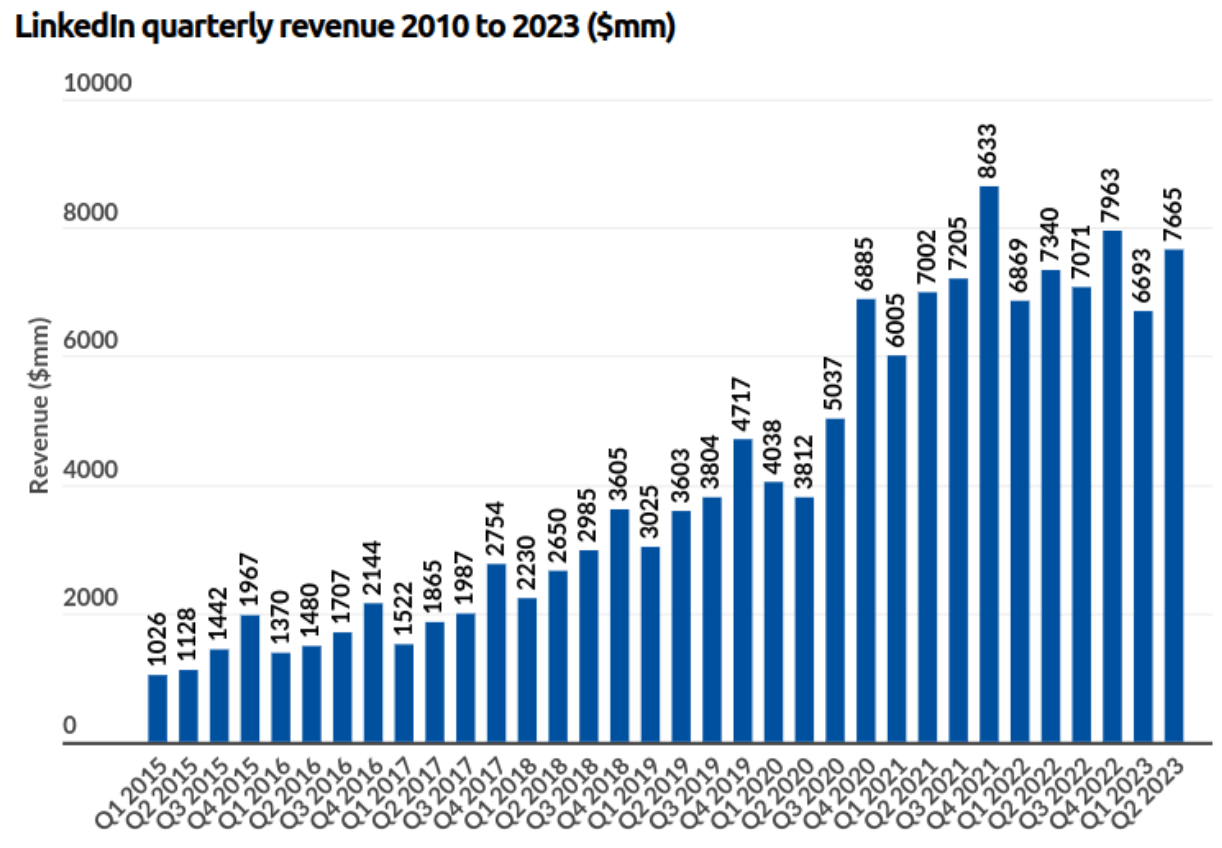

LinkedIn Will Pull Some Monetization Levers Due To Slowing Growth

LinkedIn (1, 2) is the world’s professional social network and is continuously introducing new business cases such as salary comparison and lead generation. LinkedIn’s growth has been decelerating from 35% in Q3 2022 to 10% in Q3 2023. We can see that the app is approaching its market saturation and may experience slowed growth in the future. However, sessions of existing users grew 15%, indicating that the company may be able to drive further monetization. The app’s most active user base is the population between 20 and 39 years old, of which there are 2.3 billion in the world. My estimate is that it can capture 50% of this demographic by 2028, with an average monetization of $20 per user. This yields an revenue expectation of around $23B for LinkedIn, which is an 84% total increase in revenue.

For reference, in 2022 LinkedIn had $14.5B in revenue, and 875M users, resulting in $16.7 per user.

BusinessofApps: LinkedIn Quarterly Revenue

Diverse Uses Cases For Cloud Will Drive Azure Growth

Nuance is introducing AI in healthcare, in order to reduce the massive administrative burden of physicians and drive efficiency in the industry. Besides gaming, utilizing the cloud to expand into healthcare may be a large and viable growth avenue for Microsoft.

While there may be another cloud winner (1), it won’t take away most of the market share from other cloud players, and Microsoft Azure will settle on its own optimized customer segments. The main growth avenues and key customer segments for Microsoft Azure include:

- Gaming: cloud, mobile and desktop, along with Xbox account management and a possible mixed AR/VR wave.

- Government tech services and security: Microsoft is a close partner to the US government, and is expanding their offering across multiple services.

- Healthcare: Microsoft bought Nuance and is using it to offer AI powered administrative productivity tools to the healthcare industry in order to reduce complexity and improve healthcare services for patients.

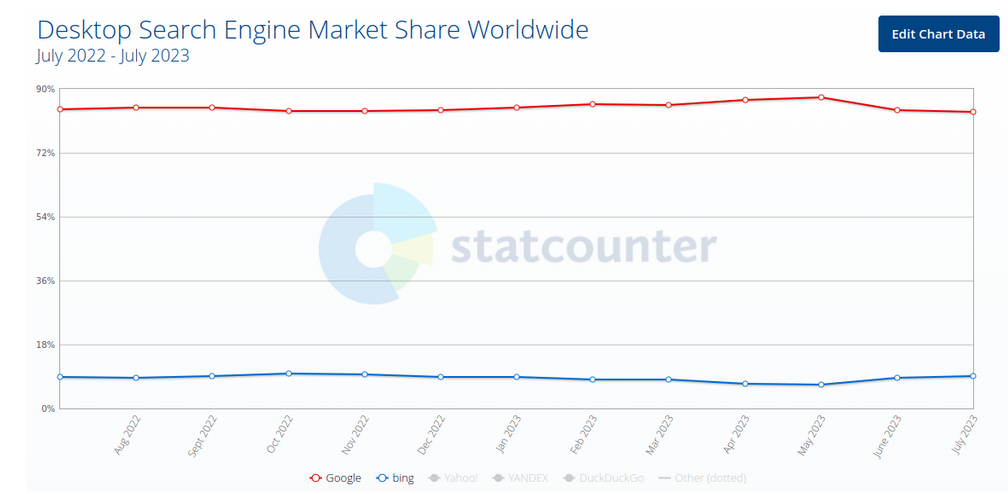

- Bing search and chat: Bing crossed 100 monthly active users, and one third of them are new to the service. It already has a 8.73% search market share, and may pose a threat to the google status quo.

Statcounter: Desktop Search Engine Market Share

- As more customers use AI services, the revenue of MS Azure will increase as Open-AI is run on Microsoft’s servers.

Industry Catalysts

Growing AI market

The global AI market is projected to grow 39% annually, and reach $357B in 2027 from the current value of $69B. This includes all first and second order revenue derived from adopting AI services, so we can’t expect companies to capture too much market share. Instead, leaders like Microsoft can be reasonably expected to benefit by including AI functionality across their portfolio of products. The two key beneficiaries of this growth are likely hardware manufacturers that are producing processing units tailored for AI applications; and software companies that will integrate AI functionality in their existing offering as well as develop innovative technology that relies on AI.

It is fair to consider large language models as the second coming of AI, as the older - machine learning driven AI race has been ongoing with underwhelming success. The fusion between the first and second wave of AI may be the key in delivering a result that can touch end customers, meaningfully reduce costs, and provide new tangible services.

In my view, Microsoft is well positioned to capture AI trends in search & advertising, software (office and CRM), cloud computing with Azure, gaming, and healthcare. This can revitalize growth and sustain it above 10% in the next few years.

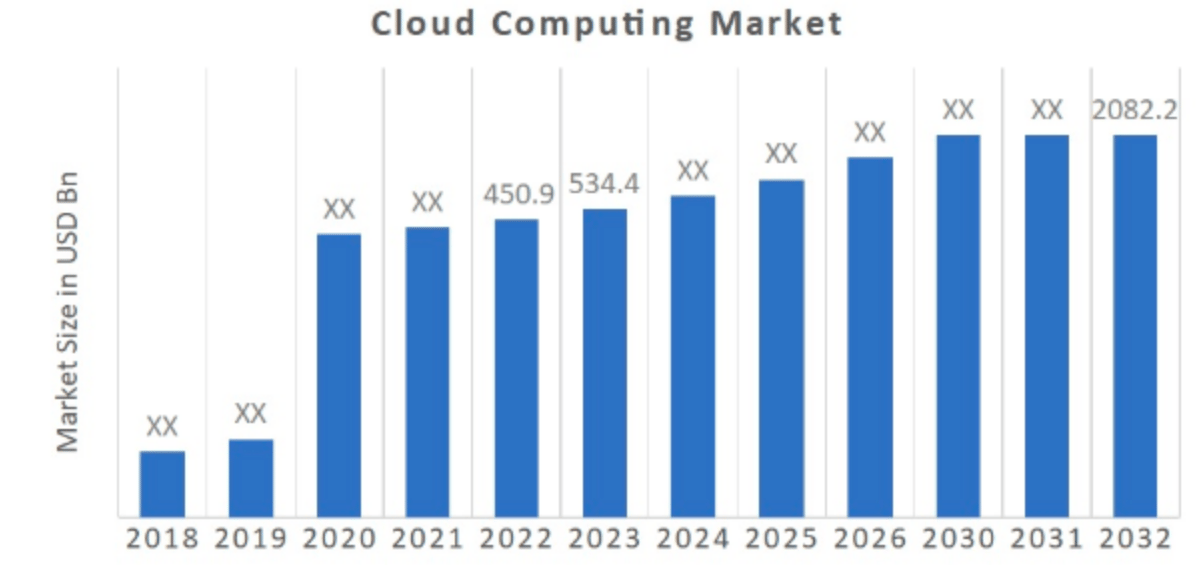

Cloud Computing Is Expected To Grow, But Not Without Difficulties

Cloud computing is estimated to grow around 18.5% annually in the next decade. The cloud market is currently valued at $450B and is expected to grow to about $2T around 2030. I disagree somewhat with this assessment, and would not place the cloud market above 1.2T in the next decade as I see a few possible headwinds to this trend:

- As software innovation continues, companies will be able to adopt key technology at a lower cost - which will lower their cloud spend.

- One of the key reasons why many large software and cloud companies were employing so many software engineers was to inflate the price of software development and make it feasible for companies to migrate to the cloud - instead of paying a software engineer to deploy services on premise. With the large-scale layoffs, this trend is reversing and software engineers are becoming affordable again. When managed properly, these employees will start pitching on-prem deployment in order to cut costs for companies and ensure their long-term employment. Sidenote: another reason why so many developers were employed was to keep talent away from the hands of peers and startups.

- Security and data-protection trends indicate that countries will increase legislation that keeps data within countries where it originated, instead of allowing it to jump borders.

- Cloud software is a relatively new occurrence, and part of the projects that were envisioned but didn’t work will be cut and serve as examples of the limitations of the cloud.

Assumptions

Investors May Be A Little Overexcited About AI: Cash Flow To Come But Not Yet

I assume that the market is in an exuberance phase related to AI stocks including Microsoft. The bet that investors are making for the company is likely not wrong, but may be a few years early, and may have to hold out for some time in volatility before they reach a point where we see tangible, cash flow returns from AI projects.

Cloud Segment To Be Primary Driving Force Behind Company Revenues

I assume that Microsoft adds another $150B in revenue in the next 5 years, led by growth in the cloud segment. I expect the cloud to grow by 20% per year, from $63.4B in the last 12-months to $157.6B in 2028. I view both productivity and personal computing segments as experiencing lower growth, and expect them to grow at a more mature rate of 8%. This would increase the productivity segment from the current $75.3B to $110.6B in 2028. Conversely, I expect the “more personal computing” segment to grow from the current $59.7B to $87.7B in 2028 with the same 8% rate.

In total, this would yield revenues of $365.6B (along with the “other” segment) in 2028, up by 76% in 5 years, or 12% growth per year, which is a reasonable position for a maturing growth company like Microsoft.

Use Of AI And Further Monetization Sweeten Net Profit Margin

Microsoft has high and stable net profit margins of 33.25%. I expect the company to increase its monetization as it introduces more services to the ecosystem, and leverages proprietary data to facilitate the training of AI models. For this reason, I expect Microsoft to converge to a net profit margin of 38% in 5 years, incrementally adding 1% profitability every year.

Healthier Profit Margins And Stronger Revenues Boost Earnings Significantly

Given my current assumptions, a 38% profit margin on $365.6B in revenues results in $138.9B of earnings. Close to double from the $69B in the last 12 months. While this level of profitability is much harder to add from the large current basis position that Microsoft has, it is likely one of the few companies that has the setup and capacity to realize it.

Share Buybacks Increase Over The Next 5 Years

Microsoft had 7.44B outstanding shares in Q3 2023. The company has bought back an average of $28B worth of shares in the last 3 years, or 1.46% of its market cap every 12 months. This means that the company is reducing its share count by an average of 0.76% per year in the last 3 years. I assume that the company will increase its buyback program as it becomes more profitable and reduce its number of shares by 0.85% annually over the next 5 years, resulting in 7.13B shares outstanding, 4.18% less than today.

Assumptions Summary

In the next 5 years, I estimate that Microsoft reaches $365.8B revenues mostly driven by a 20% growth in the cloud segment. My expected average annual revenue growth is 12%. I expect they drive up profitability and reach 38% profit margins, resulting in $139B in earnings. Because of this, I expect buybacks to increase, resulting in a 4.2% reduction of shares outstanding by 2028.

Risks

- Failing to close the Activision Blizzard acquisition may set a precedent and change the monopoly status of Microsoft forcing them to concentrate on organic growth and development instead of hunting for acquisitions.

- Azure by itself appears weaker than anticipated as court documents show that it made $34B in revenue, well behind the $72B that AWS had for the same 12-month period ending in June 2022.

- The mega cap may face a lack of reinvestment opportunities needed to drive growth. It may have to look internally and target tail-end innovation in order to deliver double digit growth at the latter part of the next 10 years. AI could be one of those avenues, but may turn out less sticky as competitors jump in.

- Microsoft’s 365 apps may be impacted by AI solutions for productivity by Google as well as other peers such as CRM, Atlassian, Notion, Airtable. What these small peers are doing is taking a single product from Microsoft and making it much better for an underserved use case - Now, it is likely that they will be adding some AI functionality, even further increasing their appeal.

- Microsoft’s apps have a significant appeal to decision-makers in companies, as their ecosystem solves a lot of problems on the organizational level. However, they may be less favorable on the employee-level as they tend to be clunky and may exhibit a weaker employee experience when using. If UX doesn’t improve, we may see a stagnation of growth, as the company has already captured most of the large potential customers, while small and medium businesses may favor leaner solutions from competitors.

- Microsoft already has a large net profit base of $69B, and increasing it may paint a target on their back from antitrust commissions. Additionally, scaling from a large profit base may prove challenging for the company.

How well do narratives help inform your perspective?