Key Takeaways

- Acquisitions and divestments have improved financial flexibility, enhancing investment capacity in strategic areas and debt reduction, potentially improving earnings.

- Strong performance indicated by record net revenues and a focus on mortgage technology suggest future revenue growth and new revenue streams.

- Technical and adoption challenges with integrating datasets, aggressive debt reduction limiting capital return, investment risks in technology, reliance on volatile transaction revenues, and market resistance to fee increases could impact financial health.

Catalysts

What are the underlying business or industry changes driving this perspective?

- The acquisition of Black Knight and subsequent divestment of stakes in Dun & Bradstreet have improved financial flexibility, enhancing the company's ability to invest in strategic areas and reduce debt, which can lead to improved earnings and debt metrics.

- Record net revenues in both the fourth quarter and the full year, driven by increases in transaction revenues across interest rate and energy businesses, indicate a strong performance foundation that is likely to enhance future revenue growth.

- Significant reduction in adjusted operating expenses below guidance ranges due to lower compensation expenses and accelerated expense synergies suggests an improvement in net margins going forward.

- The company's expansion into mortgage technology through the acquisition of Black Knight, combined with strong demand for innovative solutions in the mortgage industry, points to new revenue streams that can contribute to future growth.

- Forward-looking investments in technology and growth initiatives, offset by anticipated expense synergies, position Intercontinental Exchange to capitalize on future opportunities across its business segments, potentially driving earnings growth.

Assumptions

How have these above catalysts been quantified?

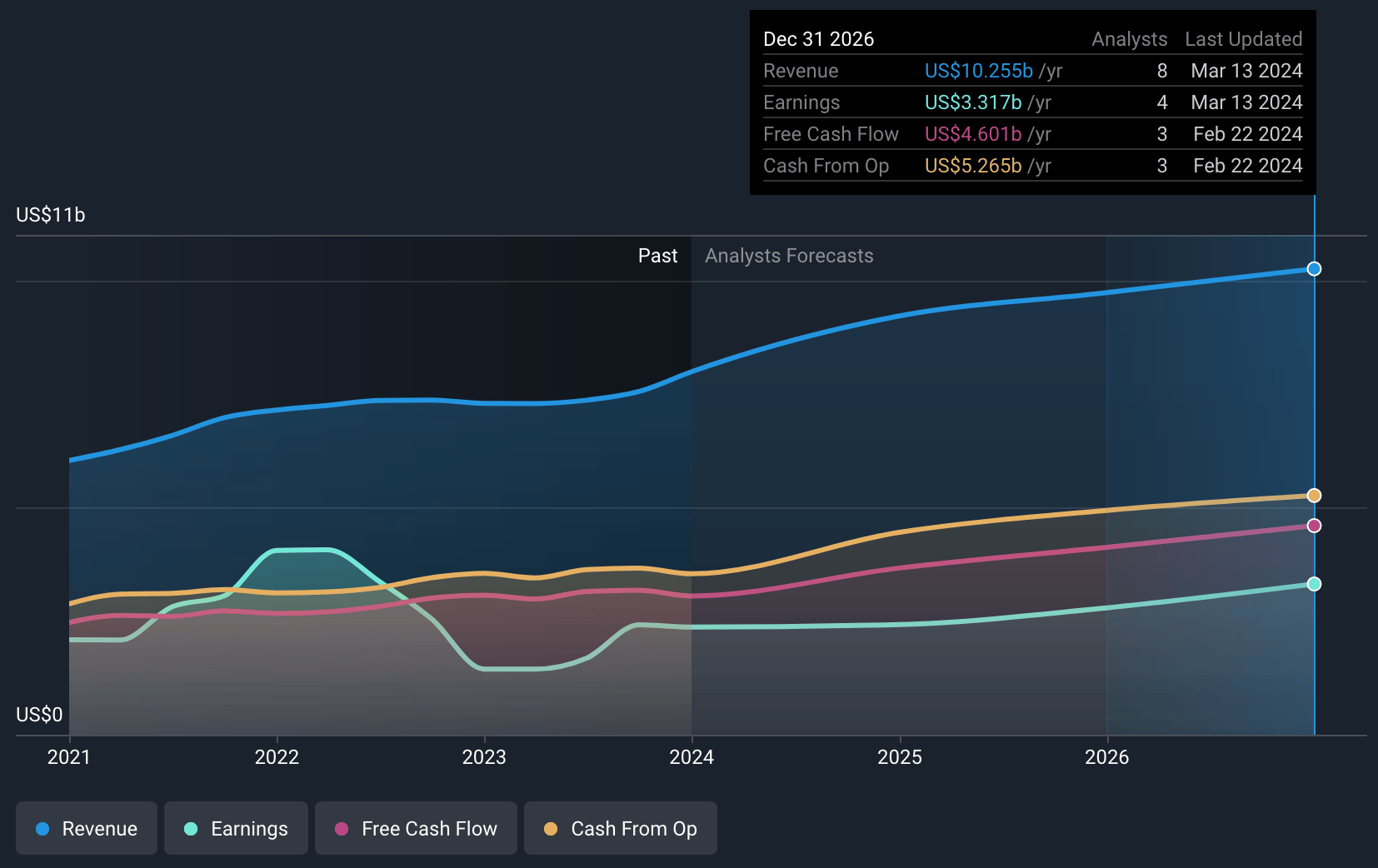

- Analysts are assuming Intercontinental Exchange's revenue will grow by 8.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 29.6% today to 32.3% in 3 years time.

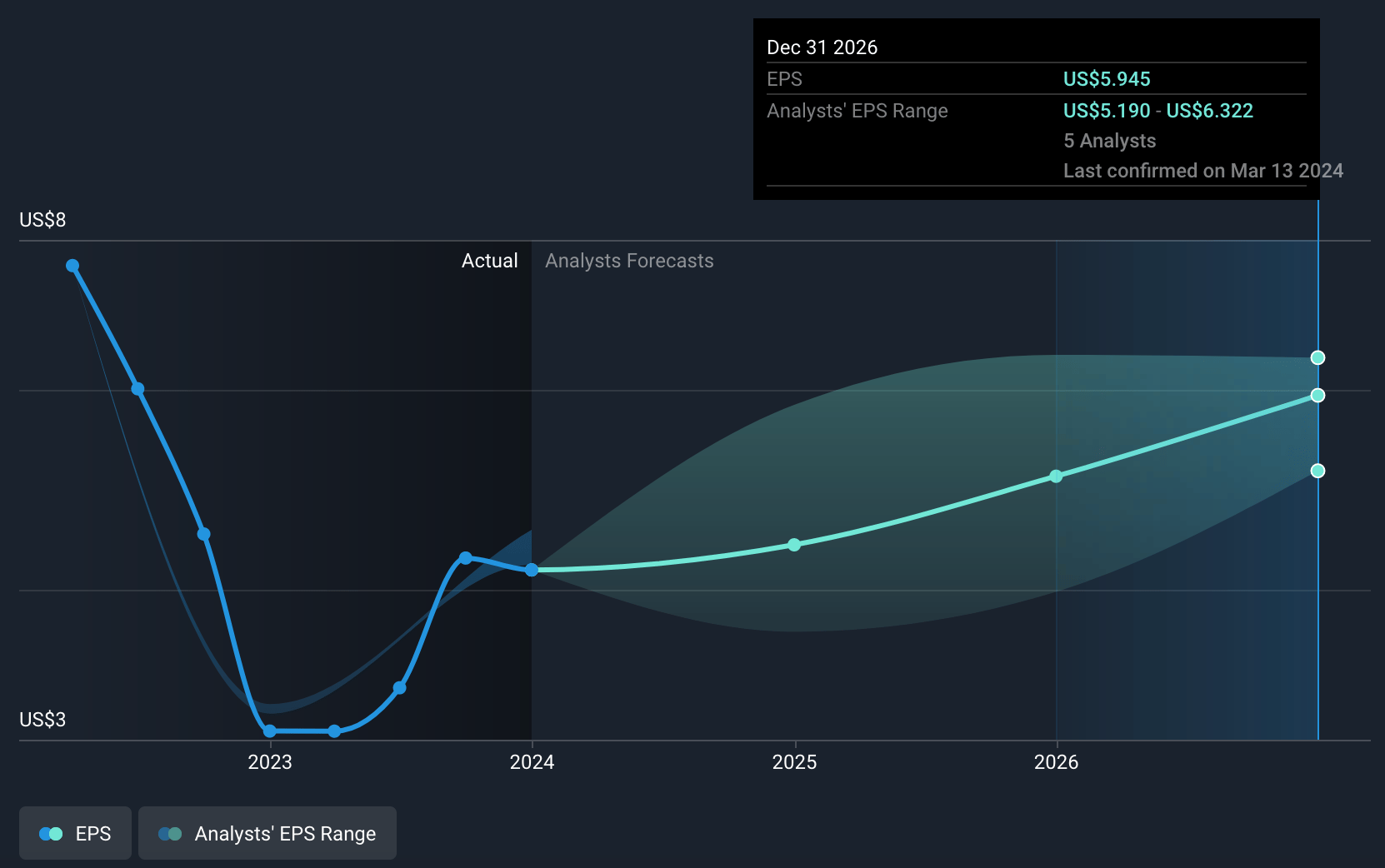

- Analysts expect earnings to reach $3.3 billion (and earnings per share of $5.95) by about March 2027, up from $2.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.4x on those 2027 earnings, down from 32.5x today.

- To value all of this in today’s dollars, we will use a discount rate of 7.44%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Integrating proprietary datasets like closing fees and valuation models into Intercontinental Exchange's platforms may face technical and adoption challenges, potentially impacting revenue growth in data services.

- Aggressive debt reduction efforts, while improving leverage metrics, might limit the company's ability to return capital to shareholders or invest in growth opportunities, thereby affecting net income and EPS.

- Increased investment in technology, including the enhancement of the MSP platform, carries execution risk. If these investments do not yield the expected efficiencies or if there are significant cost overruns, they could negatively impact operating margins.

- Reliance on transaction revenues in a volatile market environment, especially within the Mortgage Technology segment, could lead to revenue instability. Fluctuations in mortgage origination volumes may significantly impact transaction-related revenues and net margins.

- Announced fee increases within the futures' complex and other adjustments might not be well-received by the market, potentially affecting volume and revenue growth if customers reduce their transaction activities in response.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $151.25 for Intercontinental Exchange based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $10.3 billion, earnings will come to $3.3 billion, and it would be trading on a PE ratio of 29.4x, assuming you use a discount rate of 7.4%.

- Given the current share price of $134.4, the analyst's price target of $151.25 is 11.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.