Key Takeaways

- Asset-light, tech-focused strategy and proprietary AI tools are driving higher margins, steady cash generation, and expanding the recurring revenue base.

- Broadening demand for advanced geoscience data and innovative solutions is increasing addressable markets and supporting sustained, resilient long-term growth.

- Heavy reliance on cyclical oil & gas, rising competition, and high debt leave Viridien vulnerable to volatile demand, financial strain, and limited diversification prospects.

Catalysts

About Viridien Société anonyme- Provides data, products, services, and solutions in Earth science, data science, sensing, and monitoring in North America, Latin America, the Central and South Americas, Europe, Africa, the Middle East, and the Asia Pacific.

- Viridien's ongoing transition to an asset-light, technology-driven model and its focus on high-value geoscience and digital data services (including AI-powered subsurface imaging and cloud-based platforms) is expanding margins and driving more consistent cash generation, which is likely to support sustained improvements in both net margins and free cash flow.

- Persistent global demand for advanced geoscience data from both traditional oil & gas (due to falling reserve life and the need for replacement) and growing markets such as offshore wind, carbon capture, and wider energy infrastructure is broadening Viridien's addressable market and underpins long-term revenue growth.

- The company's leadership in proprietary algorithms, high-performance computing, and AI-enabled interpretation is driving strong recurring order intake from technically sophisticated clients (NOCs and IOCs), enhancing earnings stability and supporting gradual ARR expansion as clients increasingly outsource subsurface analytics.

- Strategic risk-sharing partnerships and disciplined portfolio management in multi-client data are optimizing CapEx investment and exposure, positioning the company to benefit from both cyclical upswings and secular growth in new frontier basins-thus improving ROIC and supporting net margin resilience.

- Ongoing innovations such as the Accel drop-only land node (which significantly lowers client operating costs and increases efficiency) are expected to preserve high margins and grow the installed base, supporting future revenue and margin growth as the market migrates away from legacy cable systems to advanced node solutions.

Viridien Société anonyme Future Earnings and Revenue Growth

Assumptions

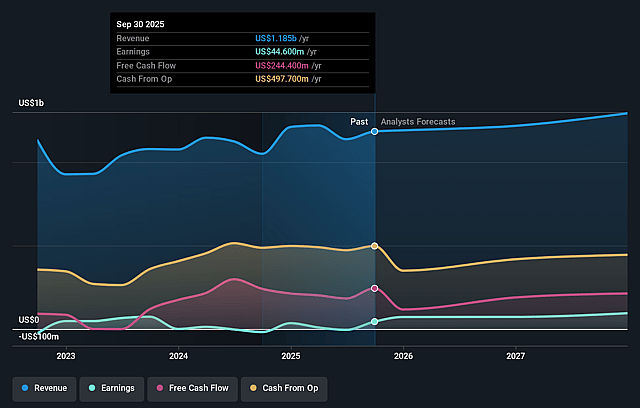

How have these above catalysts been quantified?- Analysts are assuming Viridien Société anonyme's revenue will grow by 6.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.4% today to 6.6% in 3 years time.

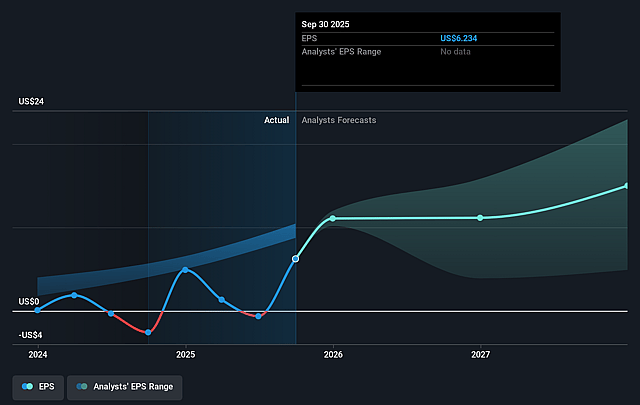

- Analysts expect earnings to reach $89.4 million (and earnings per share of $10.98) by about October 2028, up from $-4.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $164 million in earnings, and the most bearish expecting $35 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.0x on those 2028 earnings, up from -124.1x today. This future PE is greater than the current PE for the US Energy Services industry at 11.2x.

- Analysts expect the number of shares outstanding to grow by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.38%, as per the Simply Wall St company report.

Viridien Société anonyme Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The multi-client Earth Data business remains highly cyclical and volatile, with Q2 2025 revenue down 8% year-on-year and a flat performance over H1, indicating ongoing risk of inconsistent project flow and revenue declines if industry demand for seismic data wanes or exploration budgets are cut-negatively impacting recurring revenues and earnings.

- Viridien's continued strong orientation toward oil & gas, combined with management's own admission that oil company reserve lives are declining and E&P capex decisions are highly sensitive to oil price levels, leaves the company exposed to energy transition risks and secular declines in hydrocarbon investment that could erode long-term topline growth.

- Despite technological differentiation and a high-performance computing advantage, rising client capabilities in in-house data analytics and proprietary modeling tools, along with the ongoing shift toward AI-driven industrial automation, increase the risk of service commoditization and pricing pressure, potentially compressing gross and net margins over time.

- The company's substantial net debt ($997 million as of June 2025) and high refinancing costs-compounded by negative currency effects and reliance on timely receivables collection (e.g., $50 million overdue from Pemex)-heighten financial risk and reduce flexibility, directly threatening net income and free cash flow in the event of further capex cuts or payment delays from key customers.

- Management notes a recent slowdown in carbon capture and storage (CCUS) projects, with oil & gas clients reallocating budgets away from energy transition initiatives, suggesting that Viridien's diversification into new markets (such as CCUS or low-carbon solutions) could face structural headwinds and slow adoption, limiting future addressable market expansion and long-term revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €94.655 for Viridien Société anonyme based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €119.51, and the most bearish reporting a price target of just €68.39.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $89.4 million, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 11.4%.

- Given the current share price of €68.1, the analyst price target of €94.66 is 28.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.