Last Update 02 Nov 25

Fair value Increased 2.51%Analysts have raised their price target for Japan Tobacco from ¥4,974 to ¥5,099, citing slightly improved profit margin forecasts even though the outlook for revenue growth remains tempered.

What's in the News

- Japan Tobacco revised its year-end 2025 dividend guidance and increased the expected cash dividend to JPY 130.00 per share from the previously expected JPY 104.00 per share (Key Developments).

- The company provided consolidated earnings forecasts for the fiscal year ending December 31, 2025. It expects revenue of JPY 3,456,000 million, operating profit of JPY 845,000 million, profit attributable to owners of parents of JPY 562,000 million, and basic earnings per share of JPY 316.55 (Key Developments).

- On September 25, 2025, a board meeting was held to consider and resolve entering into an absorption-type split contract with Shionogi, and the contract was entered into on that day (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from ¥4,974 to ¥5,099.

- Discount Rate has increased marginally from 5.68% to 5.68%.

- Revenue Growth forecast has fallen from 4.61% to 3.62%.

- Net Profit Margin outlook has risen moderately from 17.14% to 17.96%.

- Future P/E Ratio estimate has declined from 16.01x to 15.46x.

Key Takeaways

- Expansion into reduced-risk products and premium offerings drives sustained margin improvement, while innovation investment secures future earnings growth.

- International acquisitions and market share gains offset declines in mature markets, diversifying revenue and strengthening global competitive positioning.

- Heavy reliance on declining domestic markets, unprofitable reduced-risk products, and global regulatory, economic, and foreign exchange risks threaten profitability and revenue stability.

Catalysts

About Japan Tobacco- A tobacco company, manufactures and sells tobacco products, pharmaceuticals, and processed foods in Japan and internationally.

- Expansion of harm-reduction products like Ploom AURA and EVO addresses evolving consumer preferences for reduced-risk options, with segment share gains and plans for accelerated international rollout supporting sustained future revenue growth and improved net margins over the medium term.

- Strategic acquisitions (notably Vector Group in the U.S.) and continued international market share gains, especially in emerging markets with rising disposable incomes and expanding middle classes, position Japan Tobacco to offset volume declines in mature geographies and drive long-term revenue and operating profit diversification.

- Robust pricing power and portfolio premiumization, evidenced by successful launches at higher price points (e.g., premium EVO sticks) and effective price increases in markets like the Philippines, Italy, and the UK, underpin resilience in core revenue and the potential for sustainable net margin expansion.

- Ongoing R&D investment and a targeted ¥650 billion global allocation for innovation in next-generation products and marketing are likely to future-proof earnings and accelerate the path to profitability in the company's Reduced-Risk Product segment, positively impacting margins and long-term earnings growth.

- Industry-wide consolidation and shifting regulatory landscape create barriers to entry and enable further scale efficiencies for large incumbents like Japan Tobacco, bolstering competitive positioning and enabling improved operating leverage and bottom-line growth in less-regulated, high-potential regions.

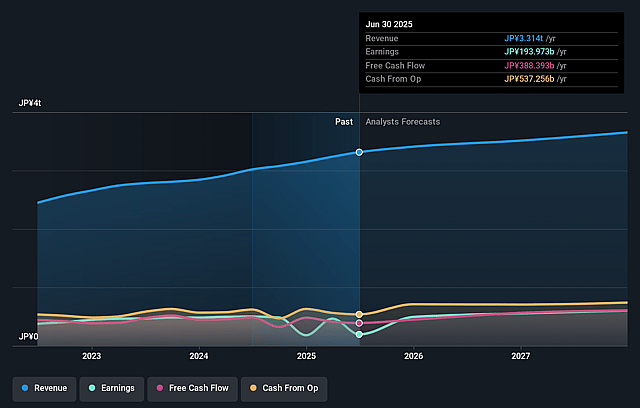

Japan Tobacco Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Japan Tobacco's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.9% today to 17.0% in 3 years time.

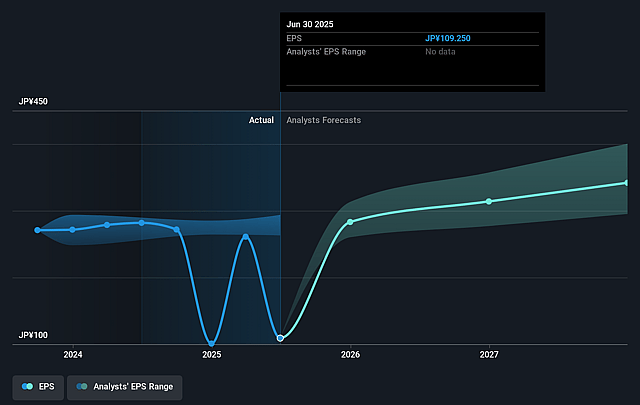

- Analysts expect earnings to reach ¥645.1 billion (and earnings per share of ¥367.81) by about September 2028, up from ¥194.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥710.6 billion in earnings, and the most bearish expecting ¥524.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.4x on those 2028 earnings, down from 42.8x today. This future PE is lower than the current PE for the JP Tobacco industry at 42.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.66%, as per the Simply Wall St company report.

Japan Tobacco Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is heavily reliant on the Japanese domestic tobacco market, which continues to experience year-on-year declines in combustibles industry volume and overall market contraction, directly threatening a core source of revenue and profits.

- There is ongoing evidence of down-trading in key Asian and emerging markets, including Japan and the Philippines, where consumers shift to lower-priced products in response to price increases and weaker economic sentiment, eroding revenue growth and net margin expansion.

- While reduced-risk products (RRPs) and heated-tobacco (HTS) devices are showing growth, management indicates the RRP segment as a whole remains unprofitable, requiring massive investment (¥650 billion over three years) and is only targeting breakeven by 2028, meaning RRPs are a drag on overall group earnings until then.

- Foreign exchange volatility remains a persistent risk, as significant overseas earnings (especially from emerging markets) are subject to yen strength, with negative FX impacts already weighing on AOP and reported earnings, contributing potential downside to net margins and profit growth.

- The industry continues to face global regulatory tightening, litigation costs (e.g., Canadian settlements), tax hikes, and possible new tariffs, all of which can compress profit margins, increase operating costs, and reduce legitimate demand-negatively impacting top-line revenue and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥4757.5 for Japan Tobacco based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥5400.0, and the most bearish reporting a price target of just ¥4250.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥3783.8 billion, earnings will come to ¥645.1 billion, and it would be trading on a PE ratio of 15.4x, assuming you use a discount rate of 5.7%.

- Given the current share price of ¥4676.0, the analyst price target of ¥4757.5 is 1.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.