Last Update 22 Oct 25

Fair value Increased 1.80%Analysts Weigh In as Wärtsilä Oyj Abp Price Target and Growth Estimates Edge Higher

Analysts have modestly increased their price target for Wärtsilä Oyj Abp from €21.06 to €21.44, citing improved revenue growth projections and recent upward adjustments in research valuations.

Analyst Commentary

Recent market research indicates that opinions on Wärtsilä Oyj Abp are divided, with both bullish and bearish analysts weighing in following the company’s share rally and adjusted financial forecasts.

Bullish Takeaways

- Bullish analysts have raised their price targets, reflecting increased confidence in the company’s growth trajectory and revenue prospects.

- Improved earnings estimates signal optimism around Wärtsilä’s execution and ability to capitalize on favorable market conditions.

- Some analysts believe current valuations remain attractive despite the recent share price rally. They note underlying business momentum and resilient demand in key segments.

- Upward price target revisions suggest expectations for continued outperformance relative to previous assumptions.

Bearish Takeaways

- Bearish analysts caution that shares may be "priced for perfection" after a strong year-to-date rally. They raise concerns about limited further upside.

- There is some apprehension about whether top-line growth will be sufficient to justify the higher valuations now assigned to the company.

- Some note that despite price target increases, cautious ratings persist due to potential execution risks in realizing growth forecasts.

- Ongoing valuation adjustments are seen as prudent, but some analysts maintain conservative recommendations due to broader market uncertainties.

Valuation Changes

- Consensus Analyst Price Target has risen slightly from €21.06 to €21.44.

- Discount Rate has increased marginally from 6.83% to 6.85%.

- Revenue Growth projections have improved, moving up from 4.99% to 5.49%.

- Net Profit Margin estimate has declined modestly from 8.77% to 8.67%.

- Future P/E ratio has increased from 21.64x to 21.97x.

Key Takeaways

- Heavy reliance on traditional engine technologies exposes Wärtsilä to risks from shifting regulations and customer preferences toward cleaner alternatives.

- Lagging adaptation to new clean technologies and global disruptions may erode market share, increase costs, and pressure long-term profitability.

- Demand for decarbonization, renewable energy, and digitalized solutions drives robust equipment orders, recurring revenue, and strong margin expansion for Wärtsilä.

Catalysts

About Wärtsilä Oyj Abp- Offers technologies and lifecycle solutions for the marine and energy markets worldwide.

- Investors may be overestimating Wärtsilä's exposure to long-term demand growth from global decarbonization and stricter emissions regulations, as a significant portion of the company's portfolio still relies on traditional engine technologies; this creates the risk of customer transitions away from fossil-fuel-based solutions, potentially resulting in slower revenue growth and pressure on earnings as regulations tighten further.

- Continued acceleration of the energy transition toward renewables and intermittent power sources may reduce the long-term demand for Wärtsilä's core engine power plants, as future investments shift more heavily toward pure renewables and battery storage, limiting the expansion of high-margin service contracts and thus net margin stability.

- Heightened geopolitical uncertainty, de-globalization, and global trade tensions could disrupt Wärtsilä's supply chains and project pipelines, introducing operational inefficiencies and increased costs that may negatively impact operating margins and future earnings.

- Slower adaptation compared to competitors in next-generation clean technologies (such as hydrogen or full electrification) exposes Wärtsilä to the risk of losing market share, resulting in lower-than-expected top-line revenue growth if the market pivots faster toward new solutions.

- Rapid increase in industry-wide R&D requirements for decarbonization and digitalization may force Wärtsilä to allocate more capital expenditure than anticipated, threatening to dilute returns on invested capital and suppress long-term net profit growth.

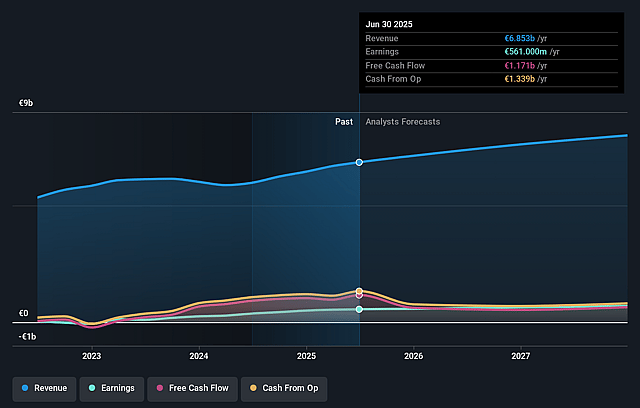

Wärtsilä Oyj Abp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Wärtsilä Oyj Abp's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.2% today to 8.8% in 3 years time.

- Analysts expect earnings to reach €700.3 million (and earnings per share of €1.18) by about September 2028, up from €561.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €815 million in earnings, and the most bearish expecting €599.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.7x on those 2028 earnings, down from 25.8x today. This future PE is greater than the current PE for the GB Machinery industry at 20.1x.

- Analysts expect the number of shares outstanding to decline by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.71%, as per the Simply Wall St company report.

Wärtsilä Oyj Abp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global drive toward decarbonization and stricter emissions regulations supports strong, long-term demand for Wärtsilä's alternative fuel-capable engines, hybrid systems, and marine carbon capture solutions-securing increased equipment orders and a robust pipeline, which should favorably impact order intake and revenue over the coming years.

- Sustained investment in renewable energy, balancing power, and data centers drives expanding opportunities for Engine Power Plants and related service contracts, with recent record-high energy order intake and a growing backlog underpinning future net sales and recurring service revenue growth.

- Rapid growth in Wärtsilä's service agreements-evidenced by a 48% YoY order intake increase and over 30% of the installed base under agreement, with high renewal rates-provides increasing, high-margin recurring earnings and margin stability through economic cycles.

- Wärtsilä's strong innovation in lifecycle digitalization, predictive maintenance, and value-added "Smart Marine" and "Smart Energy" solutions enhances its competitive advantage and enables margin expansion, supporting both top-line and bottom-line growth.

- The company's ability to pass through risks such as tariffs and its significant investments in manufacturing and R&D position it to capitalize on positive secular trends (e.g., global fleet renewal, energy transition, data center expansion), supporting sustained improvement in operating margins and long-term earnings visibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €20.393 for Wärtsilä Oyj Abp based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €26.0, and the most bearish reporting a price target of just €13.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €8.0 billion, earnings will come to €700.3 million, and it would be trading on a PE ratio of 20.7x, assuming you use a discount rate of 6.7%.

- Given the current share price of €24.55, the analyst price target of €20.39 is 20.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.