Last Update 07 Dec 25

SPSN: Defensive Rentals And Leadership Change Will Shape Earnings Profile

Analysts have raised their price target for Swiss Prime Site to CHF 118 from CHF 102, citing the defensiveness of Swiss real estate and expectations for superior earnings growth and higher profit margins, even as they apply a slightly higher discount rate and more conservative revenue growth assumptions that still support a modestly lower future P E multiple.

Analyst Commentary

Recent Street research reflects a notably more constructive stance on Swiss Prime Site, with bullish analysts highlighting both the robustness of the Swiss real estate backdrop and company specific drivers that could support the upgraded valuation framework.

Bullish Takeaways

- Bullish analysts argue that the perceived defensiveness of Swiss real estate provides a resilient earnings base, which they see as justifying a higher target price despite a more demanding macro environment.

- Superior earnings growth expectations relative to peers are seen as a key support for the revised valuation, with scope for operating leverage to lift profit margins over time.

- The move to a higher price target is presented as consistent with stronger execution on the existing portfolio and development pipeline, which in turn narrows the gap between intrinsic value and the current share price.

- Even with a slightly higher discount rate applied in models, bullish analysts state that cash flow visibility and stable rental income streams underpin an attractive risk reward profile.

Bearish Takeaways

- More cautious analysts point out that using a higher discount rate and more conservative revenue growth assumptions naturally caps upside and implies less room for valuation multiple expansion.

- There is concern that any slowdown in leasing momentum or delays in project delivery could pressure the anticipated margin improvements that underpin the new price target.

- Some view the modestly lower future P E multiple embedded in forecasts as an indication that expectations for structural growth should remain measured rather than aggressive.

- Uncertainty around the broader interest rate path and transaction volumes in the property market is seen as a residual risk to both valuation and near term execution.

What's in the News

- The Board of Directors appoints current CFO Marcel Kucher as Chief Executive Officer, effective 16 September 2025, succeeding René Zahnd after nearly a decade of leadership (Key Developments).

- The leadership transition is framed as a planned succession as Zahnd approaches his 10 year tenure, which signals continuity rather than an abrupt strategic shift (Key Developments).

- Kucher brings prior experience from Peach Property Group as CFO and COO, and the Board emphasizes his strategic, acquisition, and corporate finance track record as key factors behind the unanimous appointment (Key Developments).

- Swiss Prime Site launches a search for a new CFO and is considering both internal and external candidates to fill the role vacated by Kucher (Key Developments).

Valuation Changes

- Fair Value: Maintained at approximately CHF 118.8 per share, indicating no change in the headline valuation target.

- Discount Rate: Risen slightly from about 7.13 percent to 7.20 percent, reflecting a modestly more conservative risk assessment.

- Revenue Growth: Reduced moderately from around 1.92 percent to 1.64 percent, indicating slightly lower expectations for top line growth.

- Net Profit Margin: Increased meaningfully from roughly 65.0 percent to 70.1 percent, signaling stronger anticipated profitability.

- Future P/E: Lowered from about 30.1x to 28.1x, implying a modestly reduced valuation multiple applied to forward earnings.

Key Takeaways

- Strategic portfolio shifts toward prime urban assets and major redevelopment projects position the company for stronger rental growth and reduced vacancy risk.

- Growth in sustainable property initiatives and fee-based management income underpins higher occupancy, stable margins, and long-term earnings resilience.

- Exposure to challenged office and retail sectors, refurbishment costs, reliance on transaction activity, rising ESG compliance expenses, and tenant concentration pose major risks to long-term growth.

Catalysts

About Swiss Prime Site- Through its subsidiaries, operates as a real estate company in Switzerland.

- The company's active portfolio optimization-disposing of noncore assets in secondary locations and buying prime assets in urban centers like Geneva, Lausanne, and Bern-positions it to benefit from ongoing urbanization and increasing demand for high-quality office and mixed-use space, supporting future rental growth and reducing vacancy risk, which should drive higher rental income and asset valuations.

- Strong momentum in sustainability initiatives (net zero by 2040, circular economy focus, and ESG upgrades in redevelopment projects) enhances the attractiveness of Swiss Prime Site's properties to top-tier tenants seeking sustainable solutions, likely enabling higher occupancy rates and premium rents, which should support net margin improvement over time.

- Rapid growth in the asset and property management division, evidenced by a 41% jump in recurring fees and synergistic acquisition of Fundamenta, is creating a stable, high-margin, fee-based income stream that is less sensitive to cyclical swings in property leasing, underpinning long-term earnings and margin expansion.

- Ongoing developments and refurbishments (including large projects like Jelmoli, Fraumünsterpost, and new builds in Schlieren and Bern), are expected to bring properties back online with higher rental rates in coming years, directly supporting higher revenues and enhancing like-for-like growth as redeveloped assets reach full occupancy.

- Access to significant capital and robust balance sheet management (LTV below 39%, strong liquidity reserves, and recently completed capital raises) gives Swiss Prime Site the resources to pursue further accretive acquisitions aligned with secular trends in urbanization and smart office demand, which should fuel future revenue growth and provide resilience in earnings.

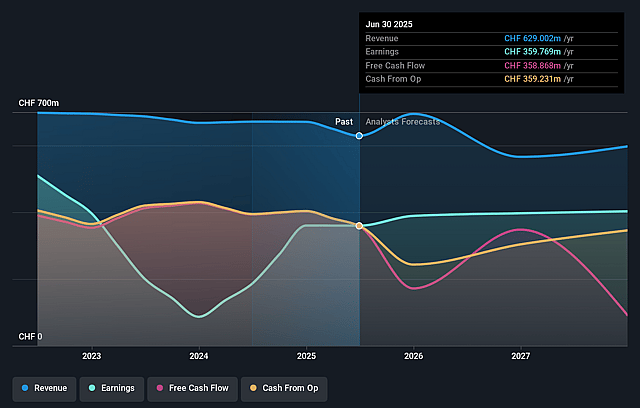

Swiss Prime Site Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Swiss Prime Site's revenue will grow by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 57.2% today to 62.7% in 3 years time.

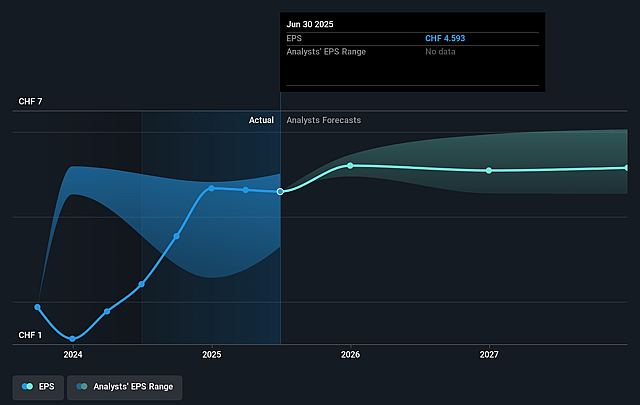

- Analysts expect earnings to reach CHF 416.1 million (and earnings per share of CHF 5.16) by about September 2028, up from CHF 359.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CHF485.4 million in earnings, and the most bearish expecting CHF364 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.0x on those 2028 earnings, up from 24.6x today. This future PE is greater than the current PE for the GB Real Estate industry at 15.0x.

- Analysts expect the number of shares outstanding to grow by 3.78% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.0%, as per the Simply Wall St company report.

Swiss Prime Site Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Swiss Prime Site's portfolio remains heavily concentrated in commercial office and retail properties, sectors that face structural challenges from long-term shifts to remote and flexible working models and e-commerce, which could result in rising vacancy rates, downward pressure on rents, and ultimately lower rental income and net margins.

- The company's ongoing redevelopment and refurbishment projects (e.g., Jelmoli, Fraumünsterpost, Talacker) have led to temporary declines in rental income and increases in capital expenditures; prolonged or costlier construction, as exemplified by Jelmoli's cost overrun from CHF 130 million to CHF 150 million due to unforeseen issues, could pressure cash flows and diminish return on investment.

- While recent asset management fee growth is strong, future performance depends on successfully scaling the platform and maintaining high transaction activity; any slowdown in Swiss real estate transactions or reduced demand for management services could curtail the expansion of fee-based recurring revenues, impacting long-term earnings growth.

- Increasing regulatory requirements for sustainable buildings (e.g., net zero targets by 2040, circular economy mandates) and the need for costly ESG upgrades present long-term risks of higher operating and capital expenses, potentially leading to reduced net margins if such costs escalate faster than rent growth can offset.

- High reliance on a few large tenants in prime locations (e.g., Globus, Google) raises tenant concentration risk; failures to extend major lease agreements or unexpected defaults could significantly reduce occupancy, increase vacancy rates, and impact top-line revenues and short-to-medium-term earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF114.417 for Swiss Prime Site based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF130.0, and the most bearish reporting a price target of just CHF102.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF664.0 million, earnings will come to CHF416.1 million, and it would be trading on a PE ratio of 30.0x, assuming you use a discount rate of 7.0%.

- Given the current share price of CHF110.1, the analyst price target of CHF114.42 is 3.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.