Last Update 05 Nov 25

Fair value Decreased 0.83%FUR: Cost Cuts And Sales Growth Will Drive Potential Share Upside

Fugro's analyst price target has been revised downward from €10.08 to €10.00, as analysts cite tempered growth expectations and a more cautious outlook on future profitability.

Analyst Commentary

Recent street research highlights differing perspectives on Fugro's outlook, resulting in a mixed but cautious sentiment around the company's valuation and growth trajectory.

Bullish Takeaways

- Bullish analysts note that cost-cutting measures are expected to support profit margins and drive operational efficiency.

- Continued sales growth is seen as a catalyst for the stock’s potential re-rating in the future.

- Some analysts predict that if performance targets are met, there is room for further upward momentum in Fugro’s share price beyond current levels.

Bearish Takeaways

- Bearish analysts express caution regarding the achievability of Fugro’s medium-term profitability targets, particularly in the second half of 2025.

- There are concerns that recent growth expectations may be overly optimistic, which has led to more tempered price targets.

- A more risk-averse view reflects uncertainty about whether the company can maintain its recent pace of growth in a changing market environment.

- Some believe valuation may be stretched if operational targets are not fully delivered within the anticipated timeline.

What's in the News

- Jefferies downgraded Fugro to Underperform from Hold and reduced its price target to EUR 10, citing "relatively optimistic" profitability targets for the second half of 2025 (Jefferies).

- Fugro N.V. withdrew its financial guidance for the full year 2025, citing significant recent market changes, and no longer anticipates meeting previously stated revenue and EBIT margin targets (Key Developments).

- Fugro N.V. was removed from the Euronext 150 Index (Key Developments).

Valuation Changes

- Consensus Analyst Price Target: Reduced marginally from €10.08 to €10.00, reflecting more conservative expectations.

- Discount Rate: Increased from 7.59% to 7.77%, signaling higher perceived risk in Fugro's future cash flows.

- Revenue Growth: Lowered from -1.12% to -1.45%, indicating slightly deeper declines anticipated in top-line performance.

- Net Profit Margin: Edged up from 7.40% to 7.42%, showing a minor improvement in expected profitability.

- Future P/E: Increased slightly from 9.24x to 9.28x, suggesting a modest uplift in future valuation multiples.

Key Takeaways

- Accelerating demand for renewable energy, climate services, and expanded project backlog is driving recurring revenue and improving resilience against sector volatility.

- Adoption of autonomous technologies and disciplined cost controls are set to enhance operational efficiency, drive margin expansion, and support strategic growth flexibility.

- Weakness in renewables, volatile infrastructure demand, heavy investment costs, restructuring risks, and a shift to lower-margin projects threaten Fugro's growth, margins, and earnings stability.

Catalysts

About Fugro- Provides geo-data services for the infrastructure, energy, and water industries in Europe, Africa, the Americas, the Asia Pacific, the Middle East, and India.

- The accelerated build-out of renewable energy and offshore wind globally continues to expand Fugro's long-term addressable market, even as the sector recalibrates in the near term; as projects delayed in H1 are now being mobilized and activity recovers, this is expected to drive higher revenue growth and strengthen order backlog in the coming years.

- Heightened need for coastline monitoring, climate risk mitigation, and subsea infrastructure security (spurred by rising climate risks and regulatory pressures) is establishing recurring, mission-critical project demand for Fugro's geospatial and geotechnical services, supporting both revenue resilience and longer-term earnings visibility.

- Fugro's rapid adoption and rollout of autonomous and remote survey technologies (such as USVs and advanced seabed drills) is poised to structurally improve operational efficiency and vessel utilization rates; this, combined with a comprehensive cost reduction program, should lift net margins and boost earnings as asset downtime decreases and more high-value, lower-cost services are delivered.

- Ongoing expansion and diversification of the order backlog-with a shift from volatile wind to include large, multi-year projects in oil & gas, infrastructure, and defense-reduces revenue cyclicality and provides enhanced earnings predictability, supporting a quicker recovery from recent revenue shortfalls.

- A disciplined capital expenditure program, vessel investment now largely complete, and ongoing balance sheet strengthening position Fugro to capitalize on industry upturns and pursue strategic growth opportunities without overleveraging; this improved financial flexibility is a catalyst for future net earnings expansion as markets recover.

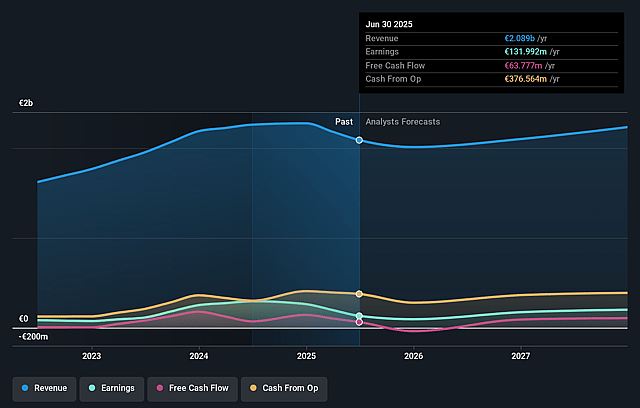

Fugro Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Fugro's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.3% today to 8.7% in 3 years time.

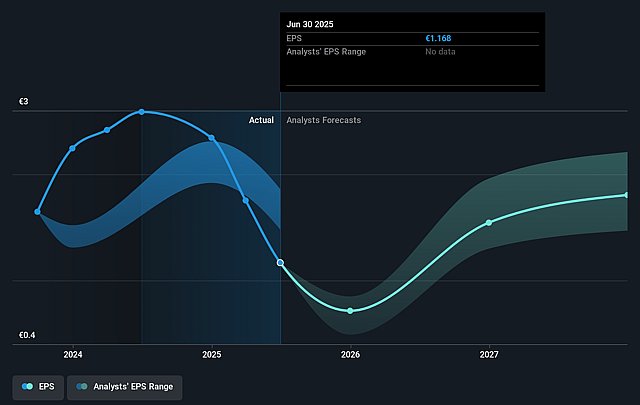

- Analysts expect earnings to reach €198.1 million (and earnings per share of €1.79) by about September 2028, up from €132.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €241.1 million in earnings, and the most bearish expecting €136 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.9x on those 2028 earnings, down from 9.6x today. This future PE is lower than the current PE for the GB Construction industry at 13.4x.

- Analysts expect the number of shares outstanding to decline by 1.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.27%, as per the Simply Wall St company report.

Fugro Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged weakness and recalibration in the offshore wind market, with significant drops in renewables backlog and ongoing uncertainties from changing regulations, high interest rates, and grid connection complexities in key regions like Europe and the U.S., continue to reduce revenue visibility and growth prospects in one of Fugro's largest addressable markets.

- Persistent macroeconomic instability, high inflation, and slow infrastructure activity across regions (notably the Middle East, Hong Kong, and Europe-Africa), combined with seasonality, are already causing delays and scope reductions in both land and marine revenues, making earnings and future revenue streams more volatile.

- Heavy capital expenditures on vessel conversion and USV fleet expansion, following a front-loaded capex profile and rising net debt (from €96 million to €437 million), introduce financial risk-especially as returns from these investments depend on winning projects in increasingly competitive, and sometimes shrinking, markets, placing future net margins and free cash flow under pressure.

- Fugro's ongoing cost reduction program, including significant global layoffs (750 FTE) and renegotiations with suppliers, underscores structural cost and operational challenges, and while intended to stabilize margins, it risks negatively impacting execution capability, increasing restructuring charges, and limiting growth capacity during any market upturns.

- The replacement of higher-margin long-term wind contracts with a larger number of shorter-duration oil & gas and infrastructure projects increases risk, given the cyclical nature of oil & gas-and with limited near-term evidence of recovery in wind or sustained infrastructure growth, this shift may put pressure on margins and expose the company to sectoral downturns, reducing overall earnings resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €13.667 for Fugro based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €15.0, and the most bearish reporting a price target of just €10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €2.3 billion, earnings will come to €198.1 million, and it would be trading on a PE ratio of 8.9x, assuming you use a discount rate of 7.3%.

- Given the current share price of €11.49, the analyst price target of €13.67 is 15.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.