Key Takeaways

- Accenture's strategic focus on Generative AI and substantial AI investments indicate a strong push towards leading in AI-driven market transformations.

- The firm's continuous acquisitions and emphasis on industry-specific partnerships suggest a strategy to enhance its market presence and diversify revenue sources.

- Reliance on acquisitions, challenging macroeconomics, competition in digital/AI, execution risks in new areas, and geographic concentration risks could impact growth and earnings.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Accenture's aggressive investment in strategic areas like Generative AI and acquisitions across geographic markets indicates a focus on driving future growth, which could positively impact revenue and earnings as these investments mature.

- The company's commitment to business optimization actions aimed at reducing structural costs could improve operational efficiency, leading to expanded net margins over time.

- With a significant amount of bookings ($18.4 billion), indicating trust from large clients, there's potential for future revenue growth as these projects are executed.

- Accenture's continuous focus on cloud capabilities through acquisitions and expansion into new growth areas, like capital projects and digital marketing in the healthcare industry, suggests a diversification of revenue sources that could drive long-term growth.

- The firm's investments in learning and development, ensuring an average of 12 hours of training per person in the quarter, aims to enhance employee skills, especially in emerging technologies like GenAI, which could lead to innovative solutions, driving growth and maintaining a competitive edge in consulting and technology services.

Assumptions

How have these above catalysts been quantified?

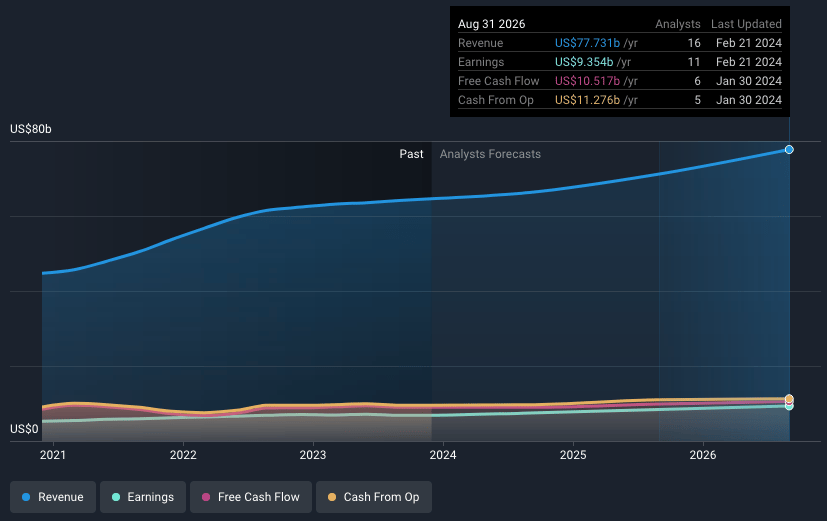

- Analysts are assuming Accenture's revenue will grow by 7.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.7% today to 12.0% in 3 years time.

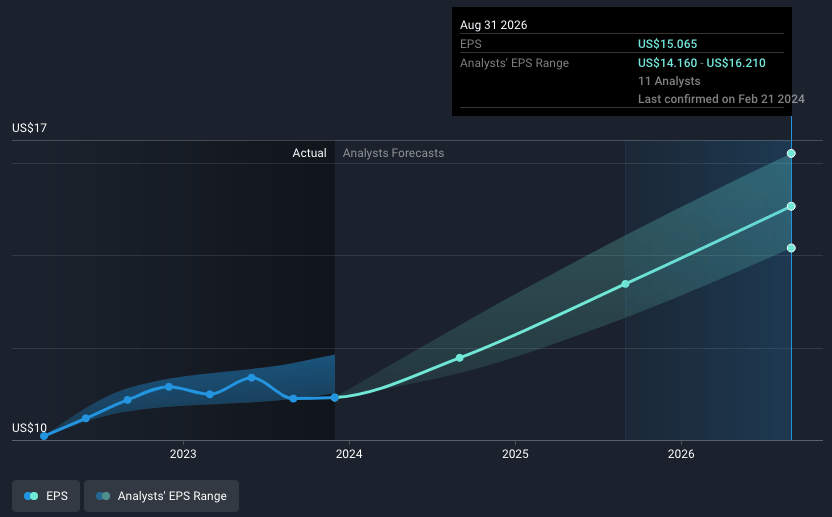

- Analysts expect EPS to reach $15.67 ($9.7 billion in earnings) by about February 2027, up from $10.97 today.

Risks

What could happen that would invalidate this narrative?

- The reliance on reprioritizing budgets to accommodate growing interest in Generative AI and other strategic investments might result in reduced funding for other critical projects, potentially impacting revenue growth.

- Increased competition for large transformative deals, as indicated by the continued pursuit of clients for bookings over $100 million, could pressure margins if Accenture needs to offer more competitive pricing or terms to secure contracts.

- The acceleration in acquisitions to enter new strategic areas or to scale quickly in compelling sectors, such as capital projects and digital healthcare, might lead to integration risks and affect net margins if synergy targets are not met or costs exceed expectations.

- The challenging macro environment, especially in regions like the UK where the market has been slower to recover, could lead to lower-than-expected discretionary spending by clients, impacting revenue and earnings.

- A deceleration in headcount growth, as the company matches hiring with demand expectations, might limit Accenture's capacity to scale rapidly and take full advantage of market recovery, thereby affecting revenue growth potential.

How well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Bailey has no position in any company mentioned. Simply Wall St has no position in the company(s) mentioned. This narrative is general in nature and explores scenarios and estimates created by the author. These scenarios are not indicative of the company’s future performance and are exploratory in the ideas they cover. The fair value estimate’s are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.