Last Update 09 Feb 26

Fair value Increased 2.10%8411: Buyback And Dividend Support Will Likely Fail To Offset Valuation Risk

Analysts have lifted their price target for Mizuho Financial Group from ¥6,335 to about ¥6,468, citing updated assumptions that combine a slightly lower discount rate, a higher profit margin of about 36.8%, and a modestly lower future P/E estimate of around 12.2.

What's in the News

- Mizuho Financial Group extended its existing share buyback plan to March 31, 2026, keeping the program in place longer than originally scheduled (company announcement, February 2, 2026).

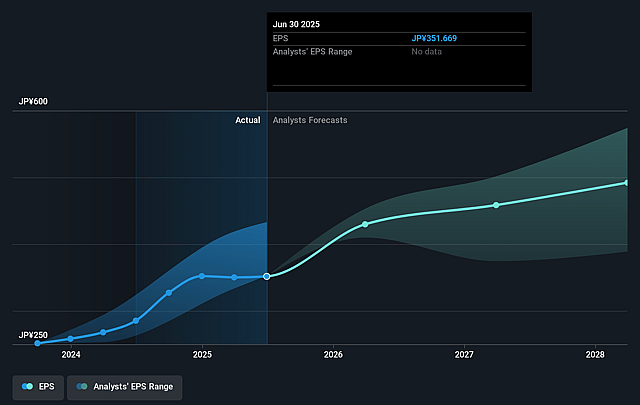

- The company issued earnings guidance for the fiscal year ending March 31, 2026, with profit attributable to owners of parent projected at ¥1,130,000 million and earnings per share of ¥454.39 (corporate guidance, February 2, 2026).

- Between November 14, 2025 and December 31, 2025, Mizuho repurchased 15,329,000 shares, or 0.62% of its shares, for ¥84,485.11 million, completing the tranche under the buyback announced on November 14, 2025 (buyback tranche update).

- The Board of Directors approved a share repurchase program on November 14, 2025, authorizing up to 60,000,000 shares, or 2.41% of issued share capital, for ¥200,000 million, with all repurchased shares to be cancelled and the program scheduled to run until February 28, 2026. On February 2, 2026, this authorization was adjusted to up to 65,000,000 shares, or 2.6% of issued share capital, for ¥300,000 million (buyback transaction announcements).

- For the second quarter ended September 30, 2025, the company announced a dividend of ¥72.50 per share, compared with ¥65.00 per share a year earlier, with payment scheduled to commence on December 5, 2025. At the same time, guidance for profit attributable to owners of parent for the year ending March 31, 2026 was set at ¥1,130,000 million and earnings per share at ¥453.49 (dividend announcement and revised corporate guidance).

Valuation Changes

- The fair value estimate was raised slightly from ¥6,335 to about ¥6,468 per share.

- The discount rate was trimmed slightly from 6.15% to about 6.04%.

- The revenue growth assumption shifted from about 21.19% growth to an 18.08% decline.

- The net profit margin increased from about 34.99% to roughly 36.79%.

- The future P/E eased from about 13.0x to around 12.2x.

Key Takeaways

- Strategic acquisitions, partnerships, and cost-cutting initiatives aim to enhance competitive edge, improve efficiency, and expand revenue streams for Mizuho Financial Group.

- Diversifying revenue sources and enhancing shareholder returns through investments and buybacks could stabilize growth and elevate stock valuation.

- Operational costs and governance expenses could rise, while integration risks and domestic transaction dependence may affect revenue stability and net margins.

Catalysts

About Mizuho Financial Group- Engages in banking, trust, securities, and other businesses related to financial services in Japan, the Americas, Europe, Asia/Oceania, and internationally.

- Mizuho Financial Group is focused on growing its assets under management (AUM) and expanding product lines, which should enhance their revenue streams from wealth management and consulting services, potentially boosting future revenues.

- The strategic acquisitions and collaborations, such as those with Greenhill and Rakuten Securities, are expected to create new synergies and enhance the Group's competitive edge, leading to increased revenues and improved earnings.

- Cost reduction initiatives, alongside the transition to a new HR framework, are intended to improve operational efficiency and net margins, allowing for potential margin expansion as expenses are controlled.

- The diversification of revenue sources beyond traditional banking operations to include sales and trading, alongside developments in the overseas market, is intended to stabilize and grow revenues, reducing dependency on interest income and improving earnings predictability.

- Mizuho's strategy of enhancing shareholder returns through disciplined growth investments and share buybacks aims to improve earnings per share (EPS) and potentially elevate the stock's valuation relative to book value.

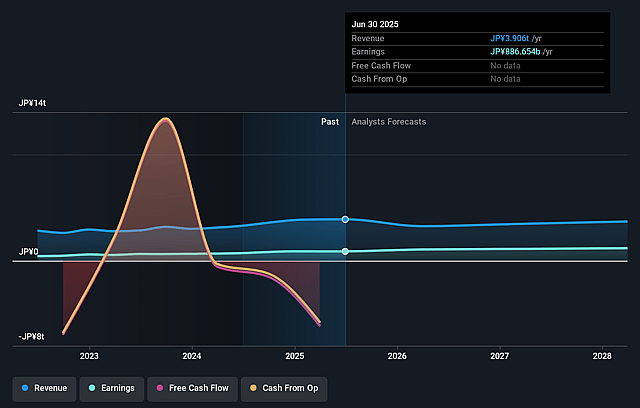

Mizuho Financial Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mizuho Financial Group's revenue will decrease by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 22.7% today to 32.4% in 3 years time.

- Analysts expect earnings to reach ¥1201.2 billion (and earnings per share of ¥505.66) by about September 2028, up from ¥886.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥1343.7 billion in earnings, and the most bearish expecting ¥946.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.8x on those 2028 earnings, down from 13.1x today. This future PE is greater than the current PE for the US Banks industry at 11.1x.

- Analysts expect the number of shares outstanding to decline by 1.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.28%, as per the Simply Wall St company report.

Mizuho Financial Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The environment surrounding the company is described as difficult, requiring significant infrastructure strengthening and efficiency improvements, which may increase operational costs and impact net margins.

- Rising expenses related to governance, infrastructure updates, and necessary investments in human capital due to increasing wages are highlighted, potentially affecting earnings and profitability.

- Integration and collaboration with entities such as Rakuten and Greenhill present potential execution risks, and challenges in aligning cultures or operational systems could disrupt revenue stability and growth.

- The dependence on large transactions in the domestic market implies potential volatility in revenue during economic downturns or changes in client needs, affecting net business profits.

- There is mention of many challenges in the asset and wealth management sector, suggesting potential shortfalls in consulting capabilities or competitive positioning, which could negatively impact revenue from these services.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥4971.818 for Mizuho Financial Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥6070.0, and the most bearish reporting a price target of just ¥3800.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥3704.3 billion, earnings will come to ¥1201.2 billion, and it would be trading on a PE ratio of 11.8x, assuming you use a discount rate of 6.3%.

- Given the current share price of ¥4672.0, the analyst price target of ¥4971.82 is 6.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Mizuho Financial Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.