Last Update21 Aug 25Fair value Increased 9.94%

Scatec’s fair value estimate has been revised upward primarily due to significantly higher consensus revenue growth forecasts, despite a lower net profit margin, resulting in the analyst price target increasing from NOK105.51 to NOK114.67.

What's in the News

- Scatec provided FY2025 power production guidance of 4,000–4,300 GWh, slightly reduced due to curtailments in Brazil and Ukraine, with marginal EBITDA impact as most curtailments are refundable.

- Joint venture with Aboitiz Power in the Philippines received regulatory approval for a higher ancillary services contract rate, leading to a NOK 231 million retroactive revenue impact to be recognized in Q2 2025.

- Awarded preferred bidder status for an 846 MW solar cluster (Kroonstad PV) under South Africa’s REIPPPP, with total project cost of ZAR 13 billion and up to 90% non-recourse project debt financing.

- Signed a 25-year USD-denominated PPA with Egypt’s EETC for a 900 MW wind project at Ras Shukeir, with wind measurements to be completed before advancing to financial close.

- Secured preferred bidder status for the 123 MW/492 MWh Haru BESS battery storage project in South Africa with a 15-year agreement; project capex is ZAR 2.2 billion, 90% financed with non-recourse project debt.

Valuation Changes

Summary of Valuation Changes for Scatec

- The Consensus Analyst Price Target has risen from NOK105.51 to NOK114.67.

- The Consensus Revenue Growth forecasts for Scatec has significantly risen from 14.8% per annum to 21.5% per annum.

- The Net Profit Margin for Scatec has significantly fallen from 9.84% to 8.52%.

Key Takeaways

- Expansion into emerging markets offers growth but brings significant geopolitical, currency, and regulatory risks that could impact cash flow stability and earnings.

- Market optimism on rapid margin and revenue growth may be misplaced due to potential technology price stabilization, supply disruptions, and financing cost challenges.

- Strong financial discipline, diverse growth portfolio, and early adoption of batteries position Scatec for resilient earnings, reduced risk, and sustained margin expansion across global markets.

Catalysts

About Scatec- Provides renewable energy solutions worldwide.

- Investor optimism appears high regarding Scatec's expansion into emerging markets like Egypt and South Africa, where the company has secured record project backlogs and near-term growth, but this strategy exposes the company to heightened geopolitical and currency risks, potentially increasing future cash flow volatility and impacting earnings and net margins.

- The market may be overvaluing Scatec due to the expectation that falling renewable technology and battery costs will continually translate into higher margins and rapid capacity additions; however, if technology prices stabilize or supply chain disruptions return, future margin improvement and revenue growth could fall short of expectations.

- Overreliance on government contracts, PPAs, and regulatory approvals-especially in developing countries-means that any shifts in policy support, fiscal tightening, or payment delays could risk lower-than-anticipated revenue visibility and introduce downward pressure on future earnings.

- High expectations are likely being placed on Scatec's ability to efficiently execute its large pipeline and ramp up its operating portfolio, but persistent industry issues like grid constraints, project delays, and curtailments (as already hinted in Brazil and Ukraine) may disrupt revenue timing and compress overall returns.

- Assumptions of easy capital access and continuous deleveraging may be optimistic given the potential for persistently high global interest rates, which could increase project financing costs and reduce net margins if debt servicing becomes more expensive than currently projected.

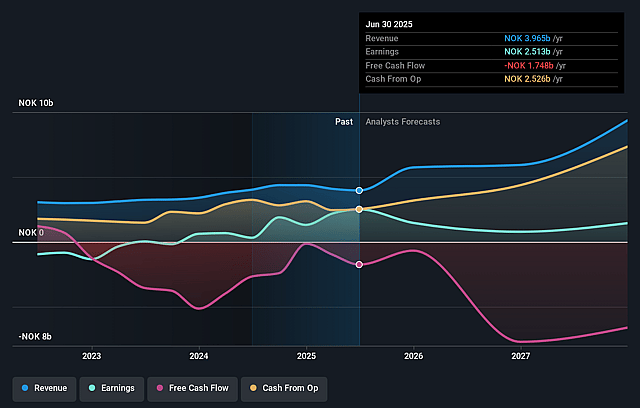

Scatec Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Scatec's revenue will grow by 36.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 63.4% today to 8.8% in 3 years time.

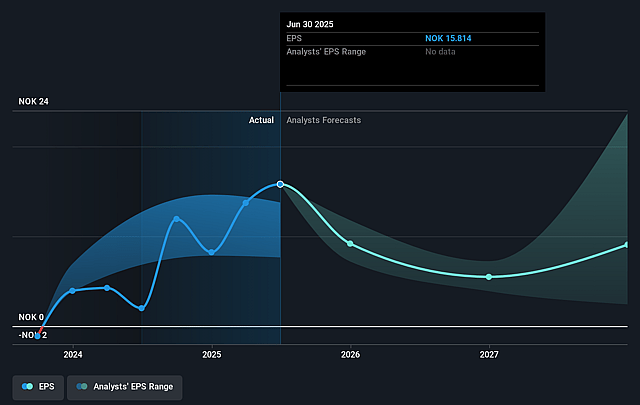

- Analysts expect earnings to reach NOK 877.1 million (and earnings per share of NOK 9.52) by about August 2028, down from NOK 2.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting NOK3.8 billion in earnings, and the most bearish expecting NOK387.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.3x on those 2028 earnings, up from 6.8x today. This future PE is greater than the current PE for the GB Renewable Energy industry at 6.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.35%, as per the Simply Wall St company report.

Scatec Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Scatec's strong financial performance, exemplified by significant year-on-year growth in revenue and EBITDA, robust OpEx control, and high gross margins from both power production and development/construction activities, indicates healthy and resilient earnings potential that could support share price appreciation.

- The company's rapidly expanding growth portfolio-including a record-high backlog of 3.2 GW, an additional 2 GW under construction, and a pipeline of 7.7 GW of mature projects across multiple technologies and geographies-signals the potential for continued top-line growth and a doubling of installed capacity over the next two years, which would positively impact future revenues.

- Continued reduction in corporate debt and strengthening of the balance sheet, with a clear deleveraging strategy, enhanced capital efficiency, and improved financial flexibility, lowers financial risk and creates capacity for self-funded growth, supporting strong net margins and earnings stability.

- Accelerating adoption of battery storage and hybrid solutions, particularly the unexpected earnings upside from batteries in the Philippines, positions Scatec to capitalize on long-term trends in grid flexibility and reserves markets, potentially increasing recurring revenues and improving profit margins as these technologies scale.

- Scatec's diversified global footprint (notably in South Africa, Egypt, the Philippines, and new markets) and active asset rotation strategy provide resilience against regional risks and generate recurring proceeds from divestments, which together underpin consistent cash flows, margin expansion, and share price support through business cycles.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK116.0 for Scatec based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK135.0, and the most bearish reporting a price target of just NOK105.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK10.0 billion, earnings will come to NOK877.1 million, and it would be trading on a PE ratio of 27.3x, assuming you use a discount rate of 9.4%.

- Given the current share price of NOK106.8, the analyst price target of NOK116.0 is 7.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.