Last Update 26 Oct 25

Fair value Increased 4.17%Narrative Update on Scatec

Analysts have raised Scatec's price target from NOK 116 to NOK 120.83, citing improved profit margin forecasts and a recent upgrade to Buy as key factors supporting this higher valuation.

Analyst Commentary

Bullish Takeaways

- Bullish analysts cite the recent upgrade to Buy as a reflection of confidence in Scatec's strategic direction and improved outlook.

- The increased price target signals optimism over anticipated profit margin expansion driven by operational efficiencies.

- Strong execution on key projects is seen as a catalyst for sustained growth and potential upside to current valuations.

- Near-term momentum is supported by positive forecasts, indicating that Scatec may outperform previous expectations if market conditions remain favorable.

Bearish Takeaways

- Some analysts remain cautious about Scatec’s ability to consistently deliver margin improvements in light of fluctuating market conditions.

- Execution risks and external macroeconomic factors could pose challenges to realizing the newly set price targets.

- Uncertainty in project pipelines and regulatory environments might limit upside potential despite recent positive sentiment.

What's in the News

- Scatec has signed new lease agreements totaling 64 MW of solar power and 10 MWh of battery storage in Liberia and Sierra Leone. These projects are supported by USD 100 million in loans and USD 65 million in guarantees from the World Bank's IFC. They mark the debut of Release's in-house solar panel mounting structure and will help deliver affordable, clean power to African utilities. (Key Developments)

- Scatec ASA entered a 15-year Power Purchase Agreement covering about 85% of production from a 130 MW solar plant in Nariño, Colombia. This marks its first project in the country, with construction expected to start in 2025. The project will involve non-recourse financing and a minority equity partnership with Norway. (Key Developments)

- The company completed a share buyback of 68,533 shares for NOK 6.49 million as announced between June 27 and June 30, 2025, fulfilling its latest program. (Key Developments)

- For 2025, Scatec has issued earnings guidance of 4,000 to 4,300 GWh power production, slightly lower than previous estimates due to curtailments in Brazil and Ukraine. However, EBITDA impact is expected to be marginal as most curtailments are refundable. (Key Developments)

- In the Philippines, Scatec's joint venture with Aboitiz Power (SNAP) secured regulatory approval for an increased contract rate under contingency reserve ancillary services. This results in retroactive revenues of approximately NOK 231 million to be recognized in Q2 2025, with payments phased over the next year. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target has increased from NOK 116 to NOK 120.83, reflecting a modest rise in fair value estimates.

- Discount Rate has risen slightly from 9.35% to 9.46%, indicating a marginally higher required rate of return.

- Revenue Growth projections have edged up from 35.99% to 36.06%, suggesting expectations for stable or slightly improved top-line performance.

- Net Profit Margin has improved from 8.80% to 10.80%, representing a notable gain in projected profitability.

- Future P/E ratio has fallen from 27.32x to 23.21x, which indicates a lower expected price relative to earnings and potentially enhanced value for investors.

Key Takeaways

- Expansion into emerging markets offers growth but brings significant geopolitical, currency, and regulatory risks that could impact cash flow stability and earnings.

- Market optimism on rapid margin and revenue growth may be misplaced due to potential technology price stabilization, supply disruptions, and financing cost challenges.

- Strong financial discipline, diverse growth portfolio, and early adoption of batteries position Scatec for resilient earnings, reduced risk, and sustained margin expansion across global markets.

Catalysts

About Scatec- Provides renewable energy solutions worldwide.

- Investor optimism appears high regarding Scatec's expansion into emerging markets like Egypt and South Africa, where the company has secured record project backlogs and near-term growth, but this strategy exposes the company to heightened geopolitical and currency risks, potentially increasing future cash flow volatility and impacting earnings and net margins.

- The market may be overvaluing Scatec due to the expectation that falling renewable technology and battery costs will continually translate into higher margins and rapid capacity additions; however, if technology prices stabilize or supply chain disruptions return, future margin improvement and revenue growth could fall short of expectations.

- Overreliance on government contracts, PPAs, and regulatory approvals-especially in developing countries-means that any shifts in policy support, fiscal tightening, or payment delays could risk lower-than-anticipated revenue visibility and introduce downward pressure on future earnings.

- High expectations are likely being placed on Scatec's ability to efficiently execute its large pipeline and ramp up its operating portfolio, but persistent industry issues like grid constraints, project delays, and curtailments (as already hinted in Brazil and Ukraine) may disrupt revenue timing and compress overall returns.

- Assumptions of easy capital access and continuous deleveraging may be optimistic given the potential for persistently high global interest rates, which could increase project financing costs and reduce net margins if debt servicing becomes more expensive than currently projected.

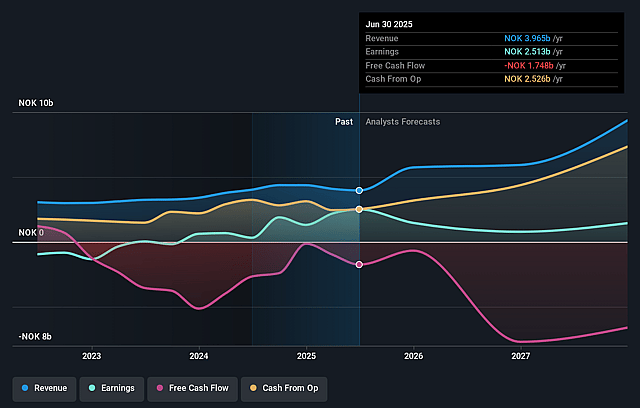

Scatec Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Scatec's revenue will grow by 36.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 63.4% today to 8.8% in 3 years time.

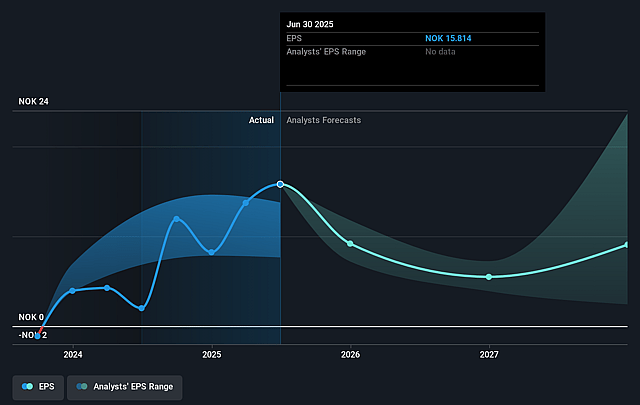

- Analysts expect earnings to reach NOK 877.1 million (and earnings per share of NOK 9.52) by about August 2028, down from NOK 2.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting NOK3.8 billion in earnings, and the most bearish expecting NOK387.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.3x on those 2028 earnings, up from 6.8x today. This future PE is greater than the current PE for the GB Renewable Energy industry at 6.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.35%, as per the Simply Wall St company report.

Scatec Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Scatec's strong financial performance, exemplified by significant year-on-year growth in revenue and EBITDA, robust OpEx control, and high gross margins from both power production and development/construction activities, indicates healthy and resilient earnings potential that could support share price appreciation.

- The company's rapidly expanding growth portfolio-including a record-high backlog of 3.2 GW, an additional 2 GW under construction, and a pipeline of 7.7 GW of mature projects across multiple technologies and geographies-signals the potential for continued top-line growth and a doubling of installed capacity over the next two years, which would positively impact future revenues.

- Continued reduction in corporate debt and strengthening of the balance sheet, with a clear deleveraging strategy, enhanced capital efficiency, and improved financial flexibility, lowers financial risk and creates capacity for self-funded growth, supporting strong net margins and earnings stability.

- Accelerating adoption of battery storage and hybrid solutions, particularly the unexpected earnings upside from batteries in the Philippines, positions Scatec to capitalize on long-term trends in grid flexibility and reserves markets, potentially increasing recurring revenues and improving profit margins as these technologies scale.

- Scatec's diversified global footprint (notably in South Africa, Egypt, the Philippines, and new markets) and active asset rotation strategy provide resilience against regional risks and generate recurring proceeds from divestments, which together underpin consistent cash flows, margin expansion, and share price support through business cycles.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK116.0 for Scatec based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK135.0, and the most bearish reporting a price target of just NOK105.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK10.0 billion, earnings will come to NOK877.1 million, and it would be trading on a PE ratio of 27.3x, assuming you use a discount rate of 9.4%.

- Given the current share price of NOK106.8, the analyst price target of NOK116.0 is 7.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.