Last Update 08 Dec 25

Fair value Increased 0.37%UBSG: Medium-Term Earnings And Capital Returns Will Withstand Escalating Regulatory Pressures

The analyst price target for UBS Group has inched higher, with fair value moving from approximately CHF 33.77 to CHF 33.89, as analysts factor in slightly stronger revenue growth expectations despite modestly softer margin assumptions and a marginally higher future P/E multiple.

Analyst Commentary

Recent Street research on UBS Group highlights a broadly constructive stance on the bank's medium term earnings power, with several upward revisions to price targets reflecting improved confidence in execution and capital return, even as a few houses turn more cautious on near term upside.

Bullish Takeaways

- Multiple bullish analysts have raised their price targets into the low to high CHF 30s, signaling increased conviction that UBS can deliver on revenue growth and cost synergies already embedded in valuation models.

- The highest targets, including the CHF 38 level cited by JPMorgan, point to meaningful upside versus the current fair value estimate, implying that successful strategic execution could unlock further multiple expansion.

- Upward target revisions clustered over recent weeks suggest improving sentiment around UBS's ability to integrate past acquisitions efficiently and drive sustainable returns on equity.

- Supportive views on earnings momentum and capital strength underpin expectations for continued buybacks and dividends, which are seen as key drivers of total shareholder return.

Bearish Takeaways

- Bearish analysts have maintained Underweight stances even while nudging price targets higher, indicating that they see limited upside relative to current market levels and to sector peers.

- The recent downgrade to a Neutral stance, alongside a CHF 32 target, underscores concerns that a significant portion of the restructuring and earnings recovery story may already be priced in.

- Cautious voices remain focused on execution risk in realizing planned cost savings and on the possibility that revenue normalization could cap earnings growth, constraining further rerating.

- Some analysts highlight that UBS's valuation premium versus parts of the European banking sector leaves less room for error if macro conditions soften or fee based income underperforms expectations.

What's in the News

- Swiss populist leader Christoph Blocher has called for UBS to be split into a domestic Swiss bank and a separate U.S. focused unit, arguing the group is too large a risk for Switzerland to shoulder alone (Bloomberg).

- UBS chair Colm Kelleher has held discussions with U.S. Treasury secretary Scott Bessent on the potential relocation of UBS's headquarters to the U.S., with the Trump administration reportedly open to the idea (Financial Times).

- Swiss investors are pushing for a settlement over the SFr16.5B wipeout of Credit Suisse AT1 bonds, after a court ruled the 2023 rescue lacked a solid legal basis, a decision now being appealed by FINMA and UBS and headed to the Swiss Supreme Court (Financial Times).

- UBS is winding down an investment vehicle with significant exposure to bankrupt U.S. auto parts maker First Brands Group and closing several related invoice finance funds, with the bank facing over $500M in exposure (Financial Times).

- Chairman Colm Kelleher has warned of looming systemic risk in the U.S. insurance industry, citing weak and complex regulation and rising private debt allocations by life insurers, which he says could create vulnerabilities (Bloomberg).

Valuation Changes

- Fair Value has risen slightly, moving from around CHF 33.77 to CHF 33.89, reflecting a modestly higher implied upside.

- Discount Rate is unchanged at 8.91 percent, indicating no revision to the risk or cost of capital assumptions.

- Revenue Growth has increased marginally, with the long term growth assumption edging up from about 3.96 percent to 4.03 percent.

- Net Profit Margin has fallen slightly, easing from roughly 24.47 percent to 24.38 percent, suggesting a minor deterioration in expected profitability.

- Future P/E has risen modestly, with the forward multiple moving from about 12.38x to 12.50x, implying a small expansion in valuation expectations.

Key Takeaways

- Integration of Credit Suisse and investment in digital infrastructure are enhancing efficiency, scalability, and profitability, boosting margins and long-term earnings potential.

- Global wealth management leadership and growing demand for high-margin solutions position UBS for recurring revenue growth and diversified income streams amid favorable market trends.

- Rising regulatory burdens, capital requirements, margin compression, and challenging integration risks threaten UBS's profit growth and may limit capital deployment for expansion or shareholder returns.

Catalysts

About UBS Group- Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

- The ongoing integration of Credit Suisse is progressing ahead of schedule, driving meaningful cost savings, increased scale, and improved operating efficiency; as these synergies are realized through further platform migration and operational streamlining, UBS's net margins and return on equity are likely to improve, supporting higher earnings growth.

- UBS's global leadership in wealth management and strong asset flows-especially in Asia-Pacific, EMEA, and the Americas-positions it to benefit from rising global wealth and high-net-worth client growth, which should drive topline revenue expansion and highly recurring fee income as intergenerational wealth transfer accelerates.

- Significant investment in digital infrastructure, AI-powered client solutions, and operational automation (e.g., the rollout of in-house AI assistant and expanded Microsoft Copilot access) is expected to increase differentiation, expand UBS's scalable client base, and lower expense ratios over time, further boosting operating margins and profitability.

- Heightened client demand for mandates, higher-margin discretionary solutions, and alternative investments-including robust growth in UBS's Unified Global Alternatives unit-supports recurring revenues and asset management fees, leveraging long-term shifts toward sustainable and diversified investing.

- Globalization of capital markets and UBS's expansive cross-border franchise are driving market share gains in trading, FX, and advisory revenues, providing diversified revenue streams that are positioned to benefit as client conviction and capital deployment accelerate, especially as macroeconomic uncertainty subsides.

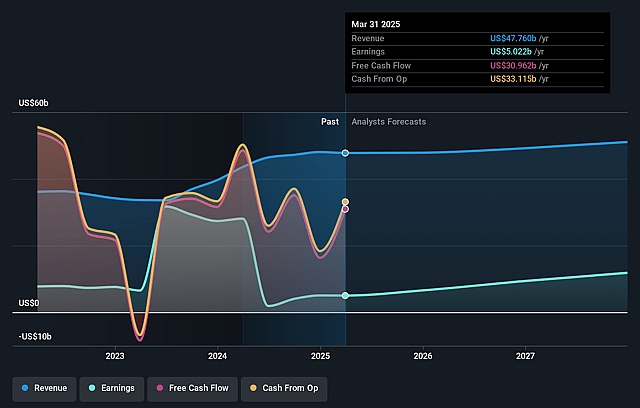

UBS Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming UBS Group's revenue will grow by 4.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.4% today to 24.3% in 3 years time.

- Analysts expect earnings to reach $12.8 billion (and earnings per share of $4.25) by about September 2028, up from $6.3 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $10.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.6x on those 2028 earnings, down from 20.0x today. This future PE is lower than the current PE for the GB Capital Markets industry at 16.3x.

- Analysts expect the number of shares outstanding to decline by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.87%, as per the Simply Wall St company report.

UBS Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The proposed changes to Switzerland's capital regime and early Basel III finalization would require UBS to hold $24–$42 billion in additional capital, significantly impacting return on tangible equity and potentially reducing the group's ability to deploy capital for growth, shareholder returns, or higher earnings.

- Rising global regulatory scrutiny and expected longer-term increases in compliance burdens (especially for cross-border banking, KYC, resolution planning, and ESG standards), are likely to drive structural increases in operational expenses and legal risk, eroding long-term net margins.

- Persistent margin compression in core businesses (particularly Asset Management, where clients continue rotating into lower-margin products, and Investment Banking as competition with passive investing and algorithmic trading intensifies) could limit UBS's ability to grow revenues and maintain current profit levels.

- Ongoing macroeconomic uncertainties in key markets (especially Switzerland and Europe), combined with prolonged low or negative interest rate environments, directly pressure net interest income and lending profitability-seen clearly in recent Swiss Personal & Corporate Banking performance, which may further constrain future earnings.

- The successful integration of Credit Suisse, though progressing, still carries multi-year execution risks-including restructuring costs, client attrition, IT decommissioning delays, and potential underperformance relative to targeted cost savings-which could weigh on net margins and overall group profitability longer than currently expected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF32.13 for UBS Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF39.5, and the most bearish reporting a price target of just CHF21.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $52.8 billion, earnings will come to $12.8 billion, and it would be trading on a PE ratio of 12.6x, assuming you use a discount rate of 8.9%.

- Given the current share price of CHF31.82, the analyst price target of CHF32.13 is 1.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on UBS Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.