Last Update24 Oct 25Fair value Increased 6.55%

Narrative Update: Kitron Analyst Price Target Revision

Analysts have raised their fair value estimate for Kitron from NOK 65 to approximately NOK 69.26, citing expectations for stronger revenue growth and profitability improvements.

What's in the News

- Kitron ASA revised its 2025 earnings guidance and now expects revenue between EUR 700 and 740 million as well as operating profit (EBIT) between EUR 59 and 66 million. This adjustment reflects increased demand in the Defence/Aerospace sector (Key Developments).

- Kitron secured a EUR 100 million order from a customer in the Defence/Aerospace market sector, with deliveries planned for 2025 and 2026 (Key Developments).

- The company commenced a share repurchase program in September 2025. It is authorized to buy back up to 10% of its share capital with potential uses including cancellation, board remuneration, incentive schemes, and acquisitions (Key Developments).

Valuation Changes

- Consensus Analyst Price Target: Increased from NOK 65 to NOK 69.26. This reflects a modest upward revision in perceived fair value.

- Discount Rate: Increased slightly from 7.71% to 7.78%.

- Revenue Growth: Projected rate increased from 16.54% to 17.53%.

- Net Profit Margin: Remained largely unchanged, moving marginally from 7.02% to 7.03%.

- Future P/E: Decreased significantly from 18.36x to 14.35x, indicating lower anticipated valuation multiples.

Key Takeaways

- Strong order backlog and innovation in Defense & Aerospace forecast future revenue growth and earnings increases.

- M&A efforts, expanded production, and tariff adjustments support market leadership and enhance revenue and net margins.

- Tariffs and regional demand declines, along with high material costs and dependence on low-margin defense contracts, threaten Kitron's revenue growth and profitability.

Catalysts

About Kitron- Operates as an electronics manufacturing services provider in Norway, Sweden, Denmark, Lithuania, Germany, Poland, the Czech Republic, India, China, Malaysia, and the United States.

- The strong order backlog growth of 11% sequentially, particularly with significant new orders in Defense & Aerospace, indicates future revenue growth as these orders are fulfilled.

- Expansion and ramp-up of production facilities in Norway and Sweden, with the ability to triple production capacity in the EU and U.S., suggest an increase in future revenue and potential for improved net margins through economies of scale.

- Strategic M&A efforts are on track, which are expected to expand capabilities and solidify market leadership, potentially translating into higher future earnings as these acquisitions begin to contribute to the bottom line.

- The company's adjustments to tariffs and ability to pass through tariff costs help maintain price competitiveness in the U.S. market, which should aid in protecting net margins and maintaining stable revenue streams.

- Projected sector growth, particularly in Defense & Aerospace driven by innovation and rising NATO budgets, is expected to drive long-term growth, positively impacting future revenue and earnings.

Kitron Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kitron's revenue will grow by 16.5% annually over the next 3 years.

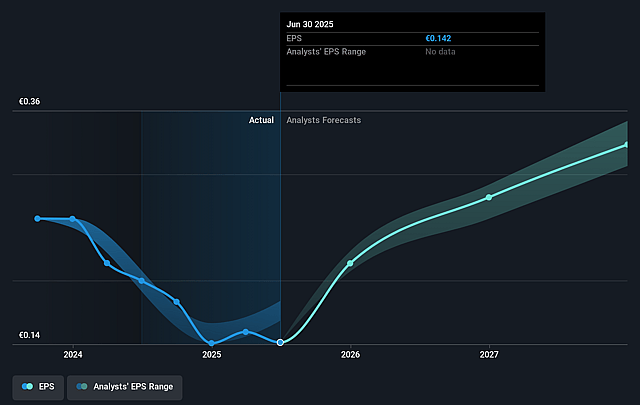

- Analysts assume that profit margins will increase from 4.5% today to 7.0% in 3 years time.

- Analysts expect earnings to reach €71.4 million (and earnings per share of €0.36) by about September 2028, up from €28.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.4x on those 2028 earnings, down from 33.5x today. This future PE is lower than the current PE for the GB Electronic industry at 34.0x.

- Analysts expect the number of shares outstanding to decline by 1.64% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.71%, as per the Simply Wall St company report.

Kitron Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tariffs remain a challenge, particularly for sales in the U.S., which could impact revenue and profit margins due to higher costs and potential reduction in demand for U.S. sales.

- The decline in Asia demands and reduced volumes at CEE sites may impact overall revenue growth and highlight regional vulnerabilities in sales performance.

- Operational challenges related to capacity utilization and the need for efficient production line management could lead to increased costs and lower EBIT margins if not adequately addressed.

- The medical devices sector experienced a decline, which may affect overall revenue and margin mix if not countered by growth in other sectors.

- There's pressure on gross margins due to high material costs and dependency on defense contracts, which have lower margins, affecting overall profitability and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK65.0 for Kitron based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.0 billion, earnings will come to €71.4 million, and it would be trading on a PE ratio of 18.4x, assuming you use a discount rate of 7.7%.

- Given the current share price of NOK56.55, the analyst price target of NOK65.0 is 13.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.