💵 Hedging Your Bets on The Debasement Trade

Reviewed by Bailey Pemberton, Michael Paige

Quote of the week: “Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair. “ Sam Ewing

The ‘debasement trade’ has been gathering momentum all year, but it's really gathered momentum in the financial media lately. And then just to keep everyone on their toes, the gold price took a tumble on Tuesday.

So what is the debasement trade? Is it real, and should you be following it?

In this piece, we’ll unpack what debasement really means, why it’s driving markets today, and how to think about real assets, stocks, and strategies that can protect your portfolio when the value of the denominator itself starts to come into question.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🚗 Tesla posts best quarterly revenue ever in last quarter with EV tax credit ( Sherwood )

- Tesla hit record quarterly revenue thanks to a final EV tax credit rush and aggressive discounting, but profits didn’t follow. Gross margins came in light at 15.4%, and earnings missed despite the sales spike.

- Regulatory credits for Q3 were $417m, down from $739m a year ago, and will likely only continue to decline from here since there isn’t really a credit market in the US anymore.

- Musk pitched big AI and robotaxi dreams to distract from shrinking automotive profits, but investors aren’t biting without clearer timelines or revenue.

- With the tax credit now gone, demand could soften, and Tesla’s new lower-trim models may boost volume but squeeze margins further.

- Tesla’s top line may look shiny, but the margin erosion is hard to ignore. Investors want profits, not promises.

-

🛢️ Oil jumps 5% after Trump administration sanctions big Russian oil companies ( CNBC )

- Oil spiked over 5% after the US slapped fresh sanctions on Russia’s top oil firms, Rosneft and Lukoil, aiming to choke off Kremlin war funding.

- The rally offers a reprieve for a market down double digits YTD, but if supply disruptions escalate, it could reignite inflation concerns and complicate central bank rate plans.

- Energy equities, especially US shale names and refiners, could see near-term upside. Watch also for pressure on India if Russian crude supply tightens further.

-

✂️ Meta lays off 600 from ‘bloated’ AI unit as Wang cements leadership ( CNBC )

- Meta just cut 600 AI staffers, mostly from legacy units, as new AI chief Alexandr Wang consolidates power and trims redundancy in the $14B department.

- The layoffs show Zuckerberg’s bet on flashy new hires over internal veterans, and a pivot toward leaner, more centralized AI execution via Superintelligence Labs.

- With AI spending still set to grow into 2026, the cuts are more about resource reallocation than cost-saving. Look for Meta to double down on infrastructure and core models, not flashy AI demos.

-

☠️ AWS services recover after daylong outage hits major sites ( CNBC )

- AWS suffered a major outage, taking down everything from Disney+ to Amazon’s own warehouses. The root cause was a DNS mess in its US-East-1 region, not a hack, just a bad day for cloud plumbing.

- The 5-hour disruption underscores how exposed the digital economy is to a few cloud giants. This could push enterprise clients to diversify across providers or demand stronger uptime. 99.99% uptime still means a few hours down each year.

- Cloud-dependent names like Canva, Coinbase, and Reddit got hit hard, reminding investors that digital resilience is now a risk factor. Keep an eye on SaaS and cloud infra stocks for volatility after incidents like this.

- When AWS hiccups, the internet gets whiplash. Diversified cloud exposure just got a little more attractive.

-

💵 Why credit risks are jarring Wall Street ( Axios )

- Credit jitters are resurfacing after the collapses of First Brands and Tricolor, with investors spooked by hidden debt and weak due diligence. The fear is that more landmines are lurking in portfolios.

- Institutional money is in “risk discovery” mode, digging into exposures they’d previously glossed over in a looser credit environment. Retail investors aren’t waiting around either, yanking cash from high-yield and leveraged loan funds.

- If trade credit risks and off-balance-sheet financing blow up elsewhere, liquidity could dry up fast for corporate borrowers, especially in junk-rated sectors.

- The market’s shrugging now, but another shock could flip the switch from credit cycle to credit crunch.

-

🇺🇸US races to secure critical minerals amid supply chain challenges ( S&P Global )

- The US is doubling down on friendly sourcing for critical minerals as China clamps down on rare earth exports. A $450 million financing deal with Australia’s RZ Resources signals Washington’s intent to bypass China and tighten ties with mineral-rich allies.

- Keep an eye on Aussie mining plays and US-exposed firms in defense, aerospace, and EVs. The spotlight is on copper, lithium, and rare earths, especially as AI drives up grid demand.

- Copper supply shocks and a 25% price rally YTD suggest tight conditions could linger. If copper remains elevated into 2026, expect margin pressures for manufacturers and windfalls for miners.

- US-Australia mineral pacts and a potential copper crunch might make it worth revisiting your critical metals exposure.

💸 The Great Debasement

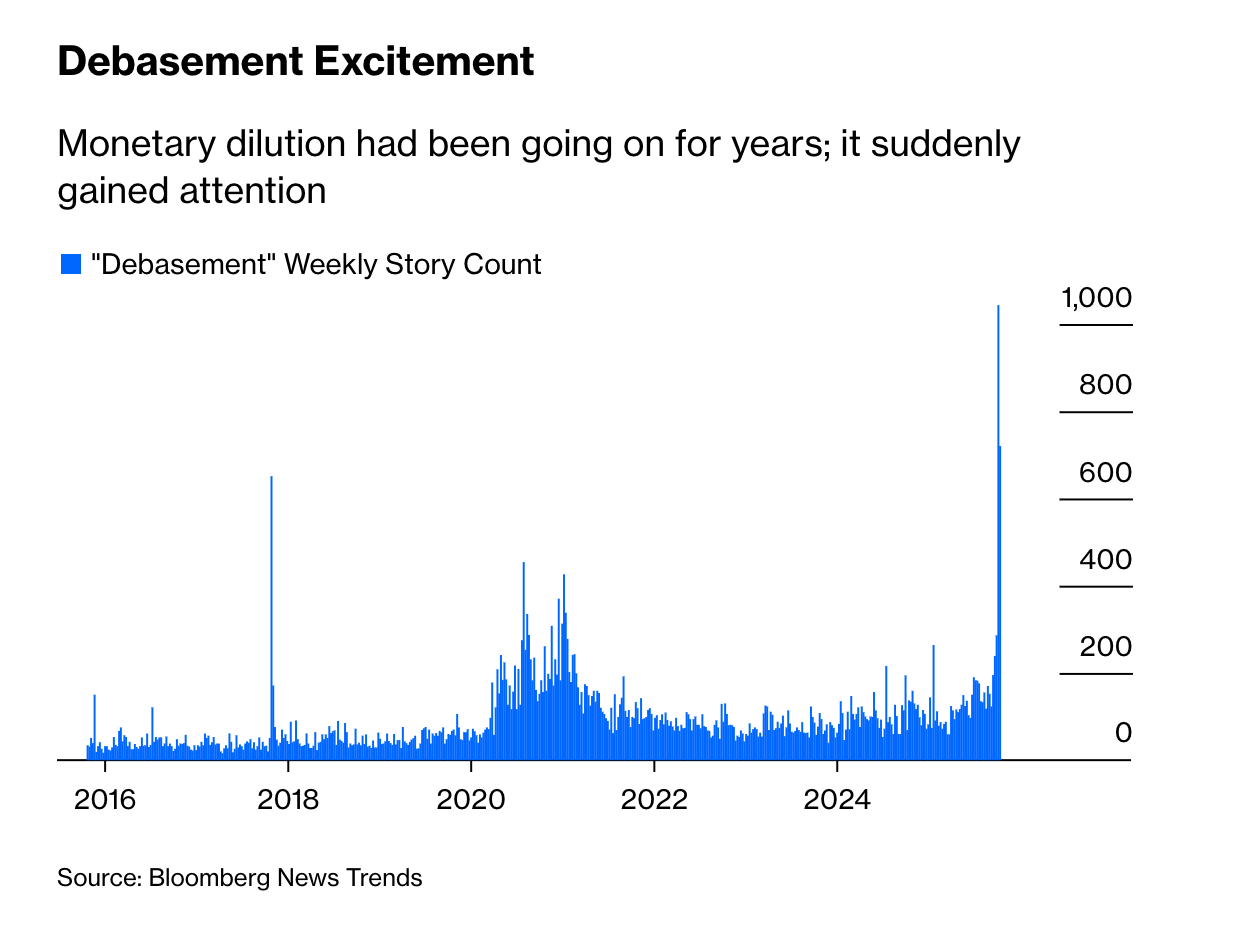

The term ‘debasement trade’ isn’t entirely new, but based on the number of stories mentioning the term, it’s been getting a lot more airtime and interest lately.

Source: Bloomberg Opinion Newsletter

Google search results display a similar trend. It isn’t a coincidence that mentions are closely correlated with the price of gold, silver, and bitcoin.

So, is everyone talking about the debasement trade because the gold price is flying? Or , is the gold price on fire because everyone’s banging on about debasement?

🤔 What on Earth is "Debasement"?

Let’s break it down.

Currency debasement refers to the devaluation of a currency . Yes, effectively the same as inflation, but debasement can be more deliberate.

Back in the old days, ruling monarchs would literally debase gold and silver coins by adding cheaper metals during minting. Or by simply minting smaller coins. The Roman Empire did “ coin clipping ”.

This allowed them to repay their debts “in full” - but not really. Adam Smith called it a ‘pretend payment’ in ‘The Wealth of Nations’ , published in 1776.

Modern debasement is the same idea, just with printers. It happens through:

- 💰 Massive money printing (think, quantitative easing).

- 💳 Persistent spending that outpaces revenue (deficit spending).

- 🏛️ Central banks keep interest rates low to help governments manage their debt load, even if it means letting inflation run a little hot.

The combination of deficit spending and inflation leads to an increase in nominal GDP (not real GDP). That means the debt to GDP ratio falls (or stays flat) - but what’s really happening is that the value of the debt is falling in real terms.

✨ In other words, the government repays the $100 you lent them, but you discover it doesn’t buy what it did when you first lent it to them.

With global debt at eye-watering levels (the U.S. is near 120% of GDP, Japan is over 260%), there’s an incentive to adopt this approach. The alternatives involve cutting costs or raising taxes, both of which are politically unpopular.

Donald Trump’s commitment to the Big Beautiful Bill and potentially inflationary policies has reinforced the view that this is where things are headed.

💵 Debasement… or de-dollarization?

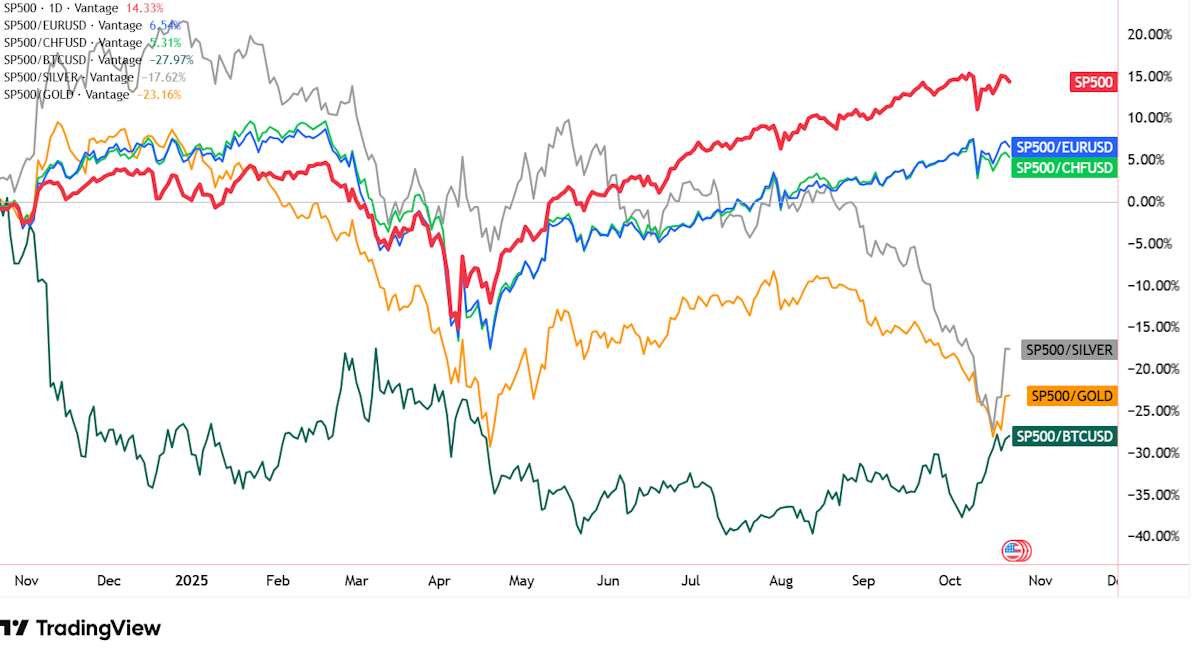

The S&P 500 index is up about 15% over the last year, which isn’t a bad return.

The thing is, though, if you measure that return in another currency , like the Euro or Swiss Franc, it’s only up about 5% .

Change your denominator to Gold, Silver or Bitcoin, and it’s actually down ~20%.

And, while the index is making new record highs ( in USD terms ), it’s still below the 2024 peak when measured by those other currencies and assets.

S&P 500 Index - TradingView

The jury is still out on whether the market is actually positioning for:

- 💵 A USD-specific debasement,

- 💱 A more widespread debasement of fiat currencies, or

- 🤔 Something else is going on….

Keep in mind, the USD weakness has also been a result of global investors diversifying their equity portfolios , and expectations for rates to fall faster in the US than elsewhere.

The strength in Gold and Bitcoin is also at least partially due to specific catalysts, but more on those later.

🤷 The Market's Mixed Signals: Who to Believe?

Opinions about the future of fiat currencies compared to assets like Gold, Silver, and Bitcoin are widely divided. So here’s each side:

📈 The “Pro-Debasement” Arguments

- Government debt around the world continues to rise, and few policymakers are making any attempt to do anything about it.

- Fiscal dominance incentivizes deficit spending and looser monetary policy.

- Unless real GDP accelerates, interest payments will swamp budgets. That makes debt even less sustainable.

- 🚀Gold, silver, etc, are outperforming, which is the market telling you what it thinks.

- Stocks are up despite high valuations, implying that they are pricing in weaker currencies too.

📉 The “Skeptical” Arguments

- The US Dollar has been fairly stable since April.

- Long-term bond yields aren’t spiraling, though the gap between 10 and 30-year US Treasury yields has widened.

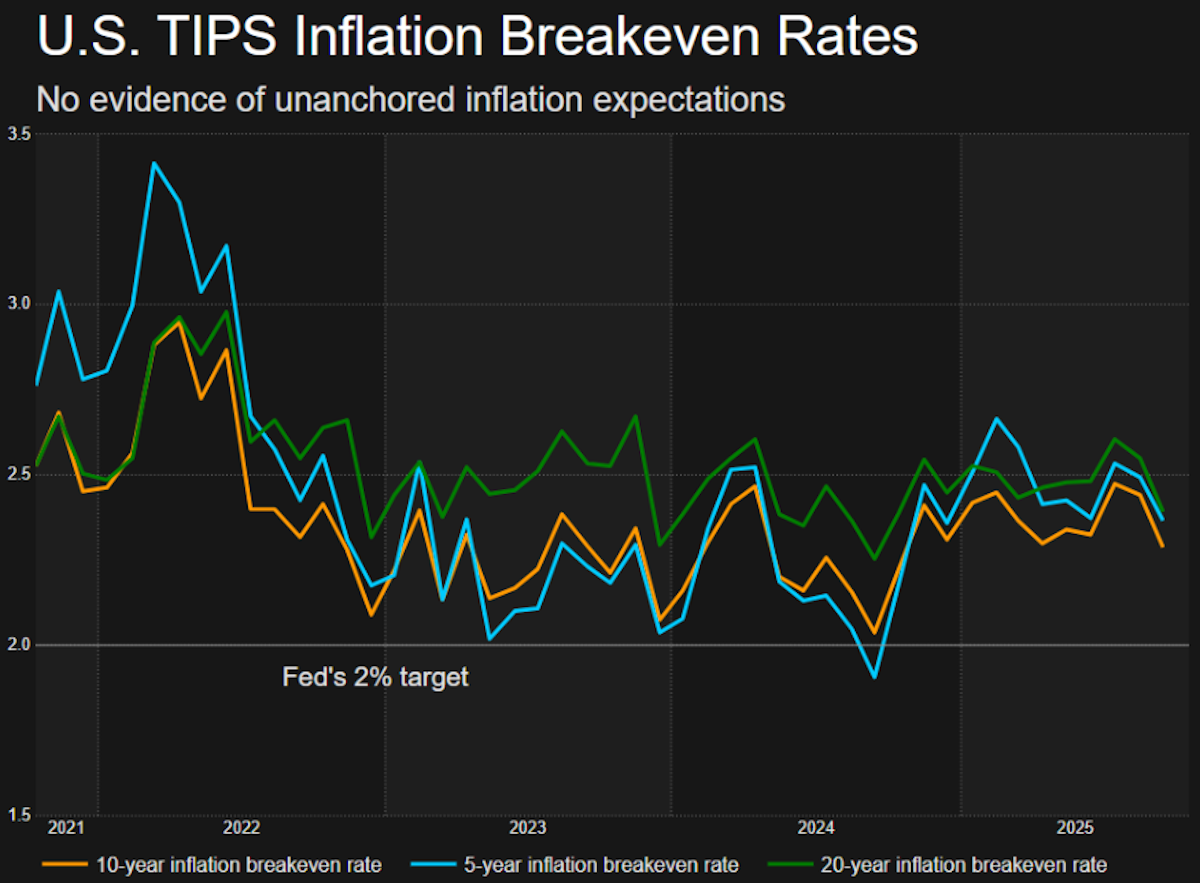

- Breakeven rates on TIPS (inflation-protected securities) are still low, even on the 30-year notes.

US TIPS Breakeven Rates - Reuters

Another argument in the skeptical column is that gold has become a momentum trade.

That’s probably true regardless of whether the debasement argument is valid. The higher an asset’s price rises, the more buyers arrive, often with leverage and short time horizons.

So… There are still conflicting signals. It’s a powerful story, but keep in mind that many of the pundits on either side of the argument have strong biases.

Investors like Ray Dalio, who try to build “All-weather” portfolios that benefit no matter the season, advocate for having as much as 15% of your portfolio in gold for these exact reasons.

⚖️ Real Assets vs Financial Assets

📄 Financial assets are assets that derive their value from claims on future cash flows.

- Typically, they are intangible and exist as some form of contract .

- Examples include stocks, bonds, and derivatives .

- But the cash flows used to value them are anchored to a currency.

🏗️ Real assets are physical, or tangible. Their value is derived from their utility and scarcity, rather than cash flows.

- If their utility and scarcity aren’t anchored to a currency , their value shouldn’t rely on a weakening currency to change.

- So a real asset’s price rises when the currency it’s being priced in weakens , and vice versa. Well, at least that’s the theory anyway!

Owning real assets in a portfolio is really a hedge against currency debasement, rather than an investment to generate wealth. But a growing number of investors view real assets as an alternative, or a compliment to bonds, as a stabilizing component of a portfolio.

Gold and Silver are still the go-to real assets, but what are the others?

-

🪙 Metals and energy commodities :

- Any long-lasting commodity is a real asset.

- Copper, iron ore, and oil are all real assets, but they do come with complications like storage, etc.

-

⛏️ Commodity producers:

- Shares in a commodity-producing company are financial assets, but they own real assets in the form of reserves and inventory . So they come with the pros and cons of both.

- But their cash flows are also linked to the price of the commodity.

-

🧑🌾 Alternatives:

- Think farmland, timber, and infrastructure.

- These assets produce essential stuff (food, lumber) or have contracts linked to inflation.

- Generally, very illiquid, but there are some ETFs like RAAX that invest in these types of assets.

-

🏘️ Real Estate:

- Land and buildings are very much a real asset.

- But listed real estate (like REITs) is a little more complicated.

- REITs tend to be more sensitive to interest rates than property prices .

📉 The Gold and Silver Mini-Correction

Okay, back to the shiny stuff.

On Tuesday, the gold price fell 6%, its biggest daily decline in over a decade . Silver and other precious metals followed it lower.

The correction was attributed to all sorts of things, including a possible easing of US/China hostility . Markets in India were also closed for Diwali, meaning slightly less liquidity from a key market for physical gold.

After Gold’s 55% year-to-date rally, a bit of volatility shouldn’t really come as a surprise.

In April, we covered the bull case for gold in detail. So what’s changed since then?

- 📈 The price is up ~25%.

- 🌍 The geopolitical factors have moderated somewhat.

- 🏦 Central bank buying has continued, but at a slower rate.

One of the key catalysts, the weaponization of the US dollar, hasn’t gone away, though. Gold still gives central banks more autonomy than USD assets that can be frozen (like after Russia’s invasion of Ukraine).

✨ The fact that gold has now surpassed US Treasuries in terms of central bank reserves globally tells us that they are increasingly valuing durability and neutrality over yield.

Source: Financial Times (chart above only goes to June 30, 2025, when the gold price was $3,286 per ounce. At today’s prices, it now surpasses US Treasuries)

So, the bull case for gold isn’t over, but with more speculative ownership, more volatility could be in store.

💡 The Insight: Hedge Your Debasement Hedge

Gold, and at times, other real assets, can be an effective hedge against uncertainty, volatility, and inflation.

But when everyone’s talking about an asset, there’s every chance it’s owned by a lot of speculators via leveraged instruments . So, that’s probably not the best time to be piling in hand over fist.

If you think currency debasement is on the cards, dollar cost averaging , or accumulating on weakness , can be a good way to increase your exposure. But, there’s another way to hedge against inflation and currency debasement:

💪 Not all stocks are victims. Some are victors.

The key is pricing power : A company’s ability to raise prices without scaring away customers. This lets them pass on higher costs and protect their profits.

✨ Companies that provide essential goods and services, and have strong moats, can keep pace with inflation and compound their earnings over time.

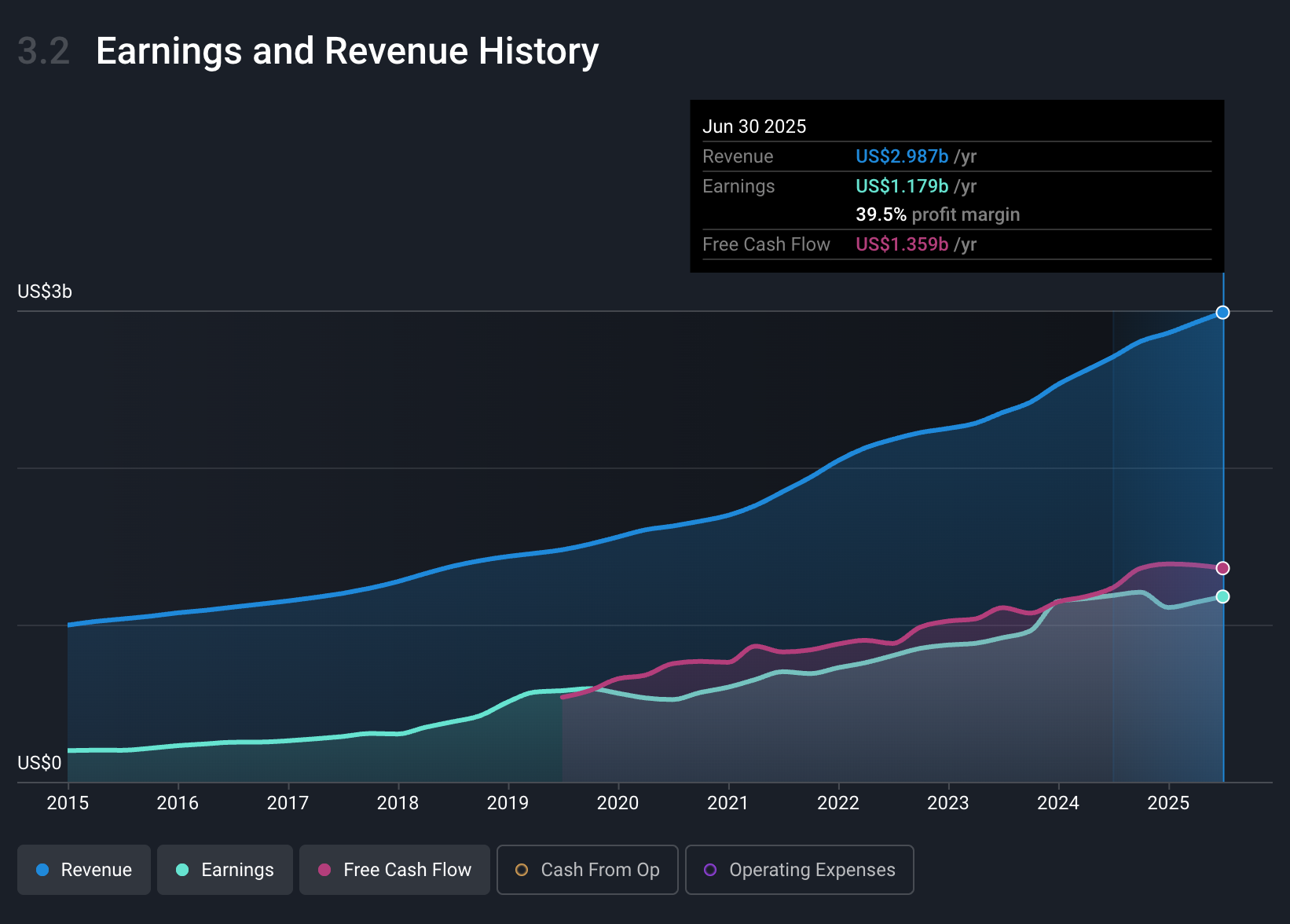

Look for leaders in growing industries (like MSCI below) that have monopoly-like positions.

MSCI Revenue, Earnings, and Cash Flow - Simply Wall St

Or in consumer-facing industries, companies that sell essential goods and services (eg, Procter and Gamble ). For consumer businesses, have a look at their margins in 2022 (when inflation spiked) and see if they managed to maintain their margins and whether revenue kept pace with inflation.

Seems like Proctor and Gamble was one of those businesses able to pull it off .

Key Events During the Next Week

It’s a big week for earnings and interest rates, with most of the action on Wednesday.

Wednesday

- 🇨🇦 BoC Interest Rate Decision

- 🔻 Forecast: 2.25%, Previous: 2.5%

- ➡️ Why it matters: A slight uptick in inflation isn’t enough to prevent the expected cut, but their commentary may reflect any change in forward expectations.

- 🇺🇸 Federal Funds Rate

- 🔻 Forecast: 4.0%, Previous: 4.25%

- ➡️ Why it matters: This is expected to be the first of two more 0.25% rate cuts before year's end.

Thursday

- 🇯🇵 BoJ Interest Rate Decision

- ⏸️ Forecast: 0.5%, Previous: 0.5%

- ➡️ Why it matters: No change is expected, but any change in policy going forward may be announced. New PM Takaichi Sanae took office on Monday.

- 🇪🇺 ECB Interest Rate Decision

- ▶️ Forecast: 2.15%, Previous: 2.15%

- ➡️ Why it matters: The ECB is in a holding pattern, but may indicate that further rate cuts are on the horizon.

Look out for earnings from 5 of the Mag7, and some of the mega-caps in the financial, pharma, and energy sectors:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.