🏦 Room to Run: A Look at Where the Financial Sector Could Go

Reviewed by Michael Paige, Bailey Pemberton

Quote of the week: "It's a business that can be a very good business, when run right. There's no magic to it. You just have to stay away from doing something foolish. It's a little like investing. You don't have to do anything very smart. You just have to avoid doing things that are ungodly dumb." Warren Buffett

The AI capex boom is getting all of the attention, but behind that flurry of spending is an entire corner of the market that many are overlooking: Financials .

Three key factors underpin the sector’s medium-term potential: a steepening yield curve, heightened IPO activity, and surging business spending together could boost financial stocks and ETFs higher.

Of course, these conditions could change, but for now, the market appears distracted from the powerful fundamentals developing in the Financial sector.

This week, we’ll:

- Explore the reasons why Financials could be a good trade into year-end.

- Weigh the risks inherent in the sector.

- Identify if these supportive factors are secular or cyclical.

What Happened in Markets This Week?

- 📈 Nvidia crosses $5 trillion as BATMMAAN stocks dominate the market ( Sherwood )

- Nvidia just crossed the $5 trillion market cap after CEO Jensen Huang teased $500 billion in AI chip orders and rolled out new partnerships with Palantir , Uber , and CrowdStrike .

- With Nvidia, Broadcom , and the rest of the BATMMAAN gang now owning 40% of the S&P 500’s market cap, buying an index fund like SPY is basically a bet on AI.

- Nvidia’s gravity-defying rally shows how concentrated the AI trade has become. Broadcom has even outpaced it YTD, up 64%, proving this isn't just a one-chip wonder.

- Microsoft and Meta dipped post-earnings despite solid growth, as Azure’s outage and Meta’s expense warning spooked investors. Alphabet jumped 8% after a $100B revenue quarter and strong AI-fueled cloud growth.

- If you're indexing, you're betting on AI whether you like it or not.

- ✂️ Fed cuts rates again, but Powell raises doubts about easing at next meeting ( CNBC )

- The Fed cut rates to 3.75-4% and announced an end to Quantitative Tightening (QT), but Powell’s “ not a foregone conclusion ” comment on any December rate cut spooked markets.

- Diverging votes show growing tension inside the Fed, with Trump’s appointee pushing for faster cuts while others want a pause.

- The cut comes as the Fed flies blind on key data, with most economic reports frozen by the government shutdown.

- Markets pared gains as traders slashed odds of a December cut from 90% to 67%. Still, looser policy and QT’s end are tailwinds for equities and credit.

- The rate cut is in, but Powell’s tone hit pause on the “cut” party. Keep an eye on the data, that is, if it ever comes back.

- 🤝 Trump, Xi Set to Formalize Trade Truce After Months of Chaos ( Bloomberg )

- Trump and Xi are expected to ink a short-term truce that rolls back some tariffs, reopens trade on key goods like soybeans, and delays China’s rare-earth restrictions.

- Markets like hearing the possible easing of hostility, but the deal is more ceasefire than a surrender. Deeper issues like tech decoupling, Nvidia export limits, and TikTok’s fate are far from resolved.

- Relief for semis, shippers, and agriculture stocks is likely in the near-term, but national security hawks will be watching closely for any US concessions, especially on AI chips.

- China looks increasingly confident in its tech self-sufficiency, which could limit future US leverage in negotiations.

- This truce may soothe markets for now, but investors betting on a full trade reset are getting ahead of the story.

- 🇰🇷 South Korean markets smash records as investors bet on AI and corporate governance reforms ( CNBC )

- South Korea’s Kospi index has surged past 4,000, up 72% YTD, driven by a combo of AI-fueled chip optimism and long-awaited corporate governance reforms.

- SK Hynix and Samsung have led the charge, with Hynix tripling this year on booming AI memory demand, and both stocks are still trading below global semiconductor valuation multiples.

- The government’s “Value-Up” program is helping chip away at the Korea discount, and domestic buyers are now taking the lead as foreign inflows cool.

- Risks remain though, from geopolitics to frothy earnings expectations. But, for now, Korea looks like the AI growth story with value still on the table.

- Korea’s AI + reform combo is powering its local market. Its moderate valuations, on a relative basis, suggest there could still be room to run, especially if the government sticks to the script.

- 💰 OpenAI lays groundwork for $1 trillion IPO valuation ( Reuters )

- OpenAI is quietly prepping for a potential late-2026 or 2027 IPO that could value it as high as $1 trillion, putting it in the same league as Apple , Microsoft , and Nvidia .

- The move follows a restructuring that reduces Microsoft’s control and boosts flexibility to raise capital or make major acquisitions with public stock.

- A public listing would give OpenAI a war chest to fund Sam Altman’s trillion-dollar infrastructure ambitions, but it also exposes the company to the scrutiny and short-termism of public markets.

- With $20B in projected annualized revenue and rising losses, OpenAI will need to show it’s more than just the poster child of the AI boom.

- If OpenAI goes public, it could allow a more direct way to invest in the LLM layer, but valuation hype alone won’t cut it once the quarterly numbers start rolling in.

🏦 Why Financials are Banking on Growth

Financial institutions are the pipes and valves beneath today’s once-in-a-generation AI buildout . At the same time, accommodative monetary policy and increased dealmaking are letting money flow freely.

Here’s a rundown of how these three factors could push Financials higher in the coming months.

📈 1. A Steepening Yield Curve is Good for Financials

Fed rate cuts have started . Since September, the Federal Open Market Committee (FOMC) has now cut the federal funds rate by 25 basis points twice , bringing it to 3.75% – 4.00%.

The FedWatch tool from CME now assigns a probability of 75% that the Fed will cut an additional 25 bps in December . That’s down from 91% odds prior to the Fed’s FOMC meeting on Wednesday.

Source: CME Group - FedWatch Tool

So, why does all of this matter?

The answer: These cuts could be the catalyst needed to reset the financial sector’s multiple to a higher number . The cuts, if they happen as expected, could steepen the yield curve, which is typically a good environment for Financials.

Here’s why:

- The anticipation of rate cuts stokes fears of rising inflation.

- As a result, investors demand higher yields on longer-dated bonds .

- Because banks borrow money at short-term rates and lend at long-term rates, a higher long-term rate means that banks see their net interest margin increase , which earns them more money.

- Simply put, they earn more on the loans they issue and pay less on deposits.

This dynamic could be just the thing to juice the Financial sector. Research from FactSet shows that the sector has “recorded an increase in (expected) dollar-level earnings due to upward revisions to earnings estimates.”

✨ This increase matters because this rise in earnings estimates could spark a significant upward movement in the Financial sector’s forward PE multiple.

That could change in the coming months.

Other sectors that have experienced an upward change in forward earnings expectations ( Communications , Technology , Industrials , and Utilities ) have all seen their forward PE multiple rise and their share price surge.

Financials are poised to follow. The fuse is burning.

Steepening Yield Curve YTD – YCharts

💸 2. IPO Activity is Back

As the Global Co-Head of Equity Capital Markets at Morgan Stanley remarked , " From a sentiment standpoint, we're back .”

After a multi-year lull, the IPO market is firing on all cylinders.

In Q3 of this year, the number of global IPO deals surged 19% year-over-year, leading to an 89% spike in proceeds. Previously, high interest rates and tariff concerns kept many potential deals on the sidelines. Today, rates are falling, and many have moved on from, or absorbed, any lingering tariff worries.

The investment bank Renaissance Capital recently explained , " We haven't seen this type of energy in the IPO market for a long time. "

This turnaround might explain why the Renaissance IPO Index (IPOUSA) has posted a year-to-date return of about 16.4%, outpacing even the S&P 500 over the same period.

Research by PwC

✨ Every step of the IPO process requires the services of investment banks that are part of the Financials sector.

Stages like pre-IPO planning, due diligence, pricing and valuation, marketing, and launching IPOs all require investment bank professionals.

🏦 3. The Capex Boom is Accelerating the Demand for Financial Services

Citigroup forecasts that AI capex among hyperscalers will climb to $490 billion by the end of next year, and that spending on AI-related infrastructure is likely to pass the $2.8 trillion mark through 2029 . This sustained activity requires the financing, insurance, and investment services found within the Financials sector.

Many of these companies will require external financing through the issuance of corporate loans, bonds, and equities. The Financial sector touches all three.

✨ Some have raised concerns that the record levels of capex spending within tech are unsustainable; however, this spending is not confined to just one industry.

Research from Morgan Stanley forecasts that the average capex spend across all industries will grow by 8% in 2025, with many of those industries surpassing that amount.

Research by Morgan Stanley

⚠️ Understanding the Risks within the Financial Sector

While the Financial sector is experiencing tailwinds, there are always risks inherent to this space. Investors should be aware of the major ones, which include:

-

📊 Interest Rate Risk

- If rates start to rise, which is unlikely at the moment, borrowing costs rise, which could dampen financial activity. Financial institutions are subject to a net interest margin, which can reduce their profitability. The most recent high-profile example of interest rate risk was Silicon Valley Bank (SVB). The bank held about 55% of its assets in fixed-income security investments. SVB had to sell these securities before they reached maturity; these sales led to losses because the market value of the securities was less than their face value.

-

🏛️ Regulatory Risk

- Regulations keep businesses and consumers safe, but they also impose considerable costs on financial firms. Many of the biggest reforms came post-2008 in response to the GFC. For example, the Basel III Endgame has increased capital requirements and liquidity standards for financial institutions. Similarly, the Dodd-Frank Act (2010) also introduced stricter capital and liquidity standards, which apply to Systemically Important Financial Institutions (SIFIs).

-

💰 Credit & Default Risk

- If borrowers, like corporations, fail to repay loans, financial institutions could suffer. J.P. Morgan CEO Jamie Dimon famously said that recessions are something “ that happens every seven to 10 years, ” during which borrowers are less able to meet their loan obligations, presenting risks to the lenders (we’ll discuss this next week, so stay tuned!).

📈 Is The Financial Sector Growth Cyclical or Secular?

The combination of a steepening yield curve, increasing IPO activity, and a rise in capex spending could all be good for the financial sector and those invested in this sector .

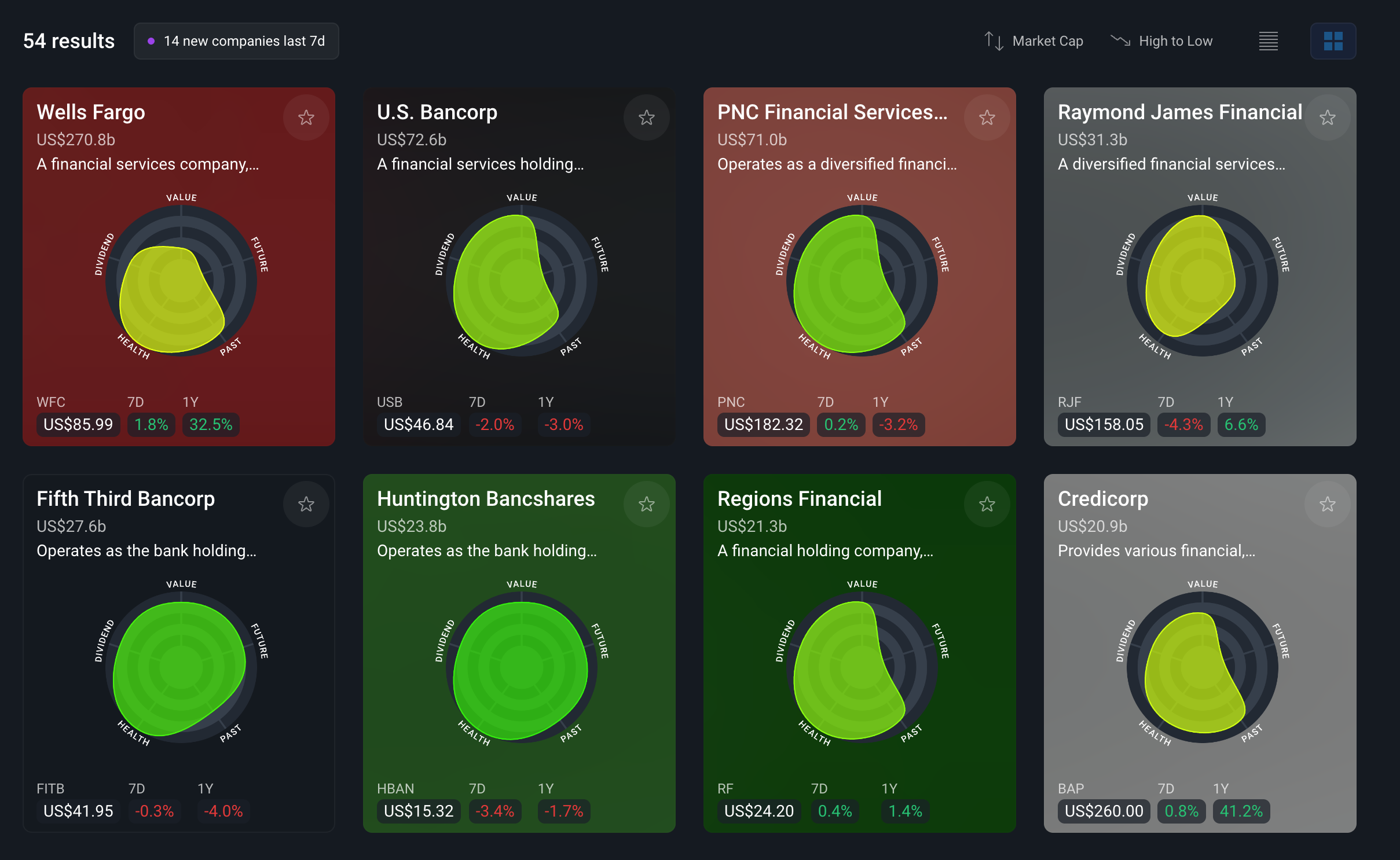

The names below from our Large US Financial Stocks Screener give you an idea of the biggest players in this sector and thus, those who are likely to benefit from these trends.

Simply Wall St - Large US Financial Stocks

But are these factors merely passing trends, making them cyclical , or are they in place for many years, making them secular ?

The question is important because cyclical stocks often sell off when the supporting growth slows. The answer is impossible to know for sure.

Still, some characteristics of today's setting suggest that we're in a secular environment that will buoy Financials for an extended period:

-

🔥 M&A Activity is Reigniting

- Technology, media, and telecommunications deal values have been steadily rising since H1 of 2023 and are expected to continue that trend.

-

📈 Private Credit Demand is Growing

- Morgan Stanley indicated that t he size of the market at the start of the year was about $3 trillion compared to $2 trillion five years ago. Their forecasts suggest that the market could reach $5 trillion by 2029.

-

🤖 AI-Enabled Efficiencies Create Savings for Financials

- AI solutions are helping financial institutions drive down costs. Consider that J.P. Morgan has applied AI-powered large language models for payment validation screening for over two years, leading to lower levels of fraud and a drop of 15-20% in account validation rejection rates.

💡 The Insight: Financials Provide The Fuel for the Engine of the 21 st Century

Financials are the quiet giant standing behind the flashy AI headlines.

Investors have an opportunity to benefit from potential multiple expansion as the flurry of economic activity among hyperscalers continues.

Meanwhile, supportive monetary policy and a resurging IPO market mean that the biggest names in finance will have plenty of demand. The result could translate into outperformance for forward-looking investors ready to increase their exposure to the sector.

If you’re looking for possible plays, check out the screener we’ve made to find High Quality Financial Stocks to help narrow down your search .

High Quality Financial Stocks - Simply Wall St

As with any investment decision, diversification matters.

Therefore, it’s important to remember that exposure to the financial sector should just be one part of a portfolio that represents a variety of sectors. Our portfolio tool gives you valuable insights on your position sizings and helps you make sure it’s aligned with your goals and risk profile.

Key Events Next Week

Tuesday

- 🇦🇺RBA Interest Rate decision

- ⏸️ Forecast: 3.6% Previous: 3.6%

- ▶️ Why it matters: No change keeps policy tight; wording on inflation/housing could move AUD and short-term yields.

Thursday

-

🇦🇺 Balance of Trade

- ⬆️Forecast: $6.2B Previous: $1.825B

- ▶️ Why it matters: A larger surplus signals stronger exports and can support the AUD and miners.

-

🇬🇧 BoE Interest Rate Decision

- ⏸️ Forecast: 4% Previous: 4%

- ▶️ Why it matters: The vote split and tone guide the path for cuts and can move GBP and gilt yields.

Friday

- 🇨🇳 Balance of Trade

- ⬆️Forecast: $97B Previous: $90.45B

- ▶️ Why it matters: A wider surplus points to firmer exports and commodity demand—important for EMs and metals.

- 🇨🇦 Unemployment Rate

- ⬇️Forecast: 7.1% Previous: 7.2%

- ▶️ Why it matters: A small drop suggests a firmer job market, which can reduce BoC cut odds and lift CAD and short-term yields.

Here are some of the biggest stocks reporting next week:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.