Tailwinds and Headwinds In The Wind Industry

Reviewed by Michael Paige, Bailey Pemberton

Quote of the Week: “Of all the forces of nature, I should think the wind contains the largest amount of motive power” - Abraham Lincoln

Last week we had a look at the solar industry, and this week we are following up with wind power.

2023 was a terrible year for wind energy stocks….heaps of headwinds….

But expectations and valuations are now much lower than in prior years, which could mean there are bargains amongst the wreckage. So let’s have a look!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🏦 US investment banking showing signs of life ( AP )

- Our take : First quarter results from banks were mixed. Revenue from asset management, trading and M&A recovered at most banks, but net interest margins were squeezed once again. Guidance suggested the outlook is very uncertain for banks. Trading and M&A profits can be lucrative at times, but they aren’t as sustainable as lending and asset management. Asset management might keep delivering, but lending is likely to be tricky until rates fall again.

-

🖥️ Semi stocks sink as ASML reports a 22% drop in revenue ( CNBC )

- Our take : ASML sells equipment used to fabricate semiconductor chips - so its sales could be regarded as a leading indicator for the industry. But the machines that ASML sells go for hundreds of millions, which means revenue tends to be lumpy. If just one order gets pushed into the next quarter, revenue could be way below estimates. Nevertheless, last year’s 34% jump in sales was always going to be a high bar to beat.

-

🇪🇺 ECB wants to cut rates soon ( CNBC )

- Our take: European policymakers are more optimistic about inflation than their US counterparts. This makes sense as weaker economies have less inflationary pressure. If rates do fall sooner or faster in Europe, the USD is likely to remain stronger (it’s been rising all year) which will be good news for European exporters, and bad news for importers.

And some of the key economic data released recently:

- 🇨🇳 China’s economy grew by 5.3% in the first quarter, which was higher than just about every economist’s forecast.

- Setting aside the fact that a lot of analysts don’t believe China’s data, the growth rate was boosted by manufacturing and capital investment. Consumer demand and property investment remained weak in the first quarter.

- 🇺🇸 US retail sales rose 4% in the year to March, well above the 2.5% expected by analysts.

- Consumer confidence is clearly holding up despite rate cuts being pushed further into the future.

- 🇺🇸 US housing data was weaker than expected across the board,

- This suggests higher mortgage rates are still weighing on the industry.

- 🇬🇧 UK unemployment rose to 4.2% from the prior level of 4%,

- While inflation fell to 3.2%, it was still slightly higher than expected.

- 🇨🇦 Canada’s inflation rate followed the US trend, rising from 2.8% to 2.9% compared to estimates of a slight decrease.

🌬️ Are. Favourable Winds Coming?

Much like the solar industry, the wind energy industry has been on the wrong side of just about every trend over the last two years.

In fact, in many ways, it’s been worse for the wind power industry.

- ⛓️ Supply chain disruptions and inflation resulted in higher costs, which squeezed profits.

- 💲 At the same time, rising interest rates meant the cost of capital rose.

- 💸 The large wind farm owners are utilities, and like most utilities they offer dividend yields that look attractive until bonds start yielding 4% plus.

All of this resulted in numerous projects being canceled in 2023 - particularly in the US, where large offshore wind farms are planned on the East coast.

On top of the current fundamentals, the US election could throw another spanner in the works.

Wind vs Solar

The cost of producing solar and wind energy have both fallen in the last 15 years, and are actually quite similar. But there are some major differences in terms of capital requirements.

A solar installation can be as small as 10 panels providing power to a household, or as big as the Bhadla Solar Park in India, which covers 14,000 acres. Commercial installations are also viable and allow companies to generate their own electricity.

Wind projects are usually only viable at utility scale. Turbines cost at least $2 million each, and 10 turbines would be considered a very small wind farm.

✨ All of this means wind farms require larger capital commitments. But wind power projects often involve local government support, which can provide stability for investors.

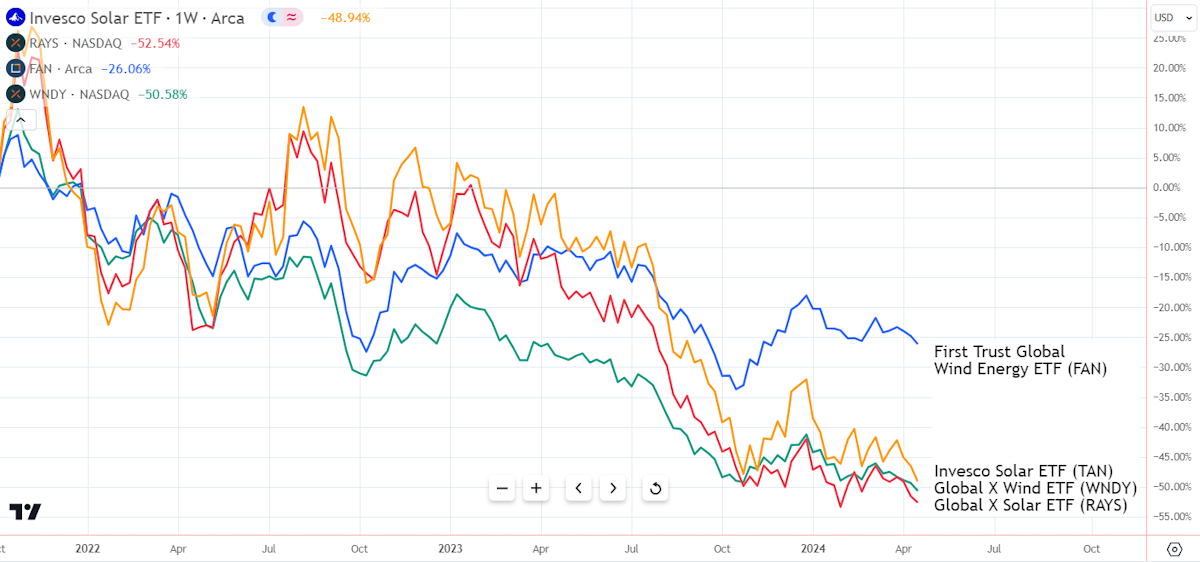

The chart below shows the performance of the largest solar and wind ETFs. Something that stands out here is that stock prices are highly correlated across the two industries. The outperformance of the First Trust Wind ETF is due to lower exposure to China’s wind energy stocks.

It’s unlikely that earnings potential is as correlated as the chart suggests. This means there may well be bargains lurking within both industries.

Wind Power 2.0

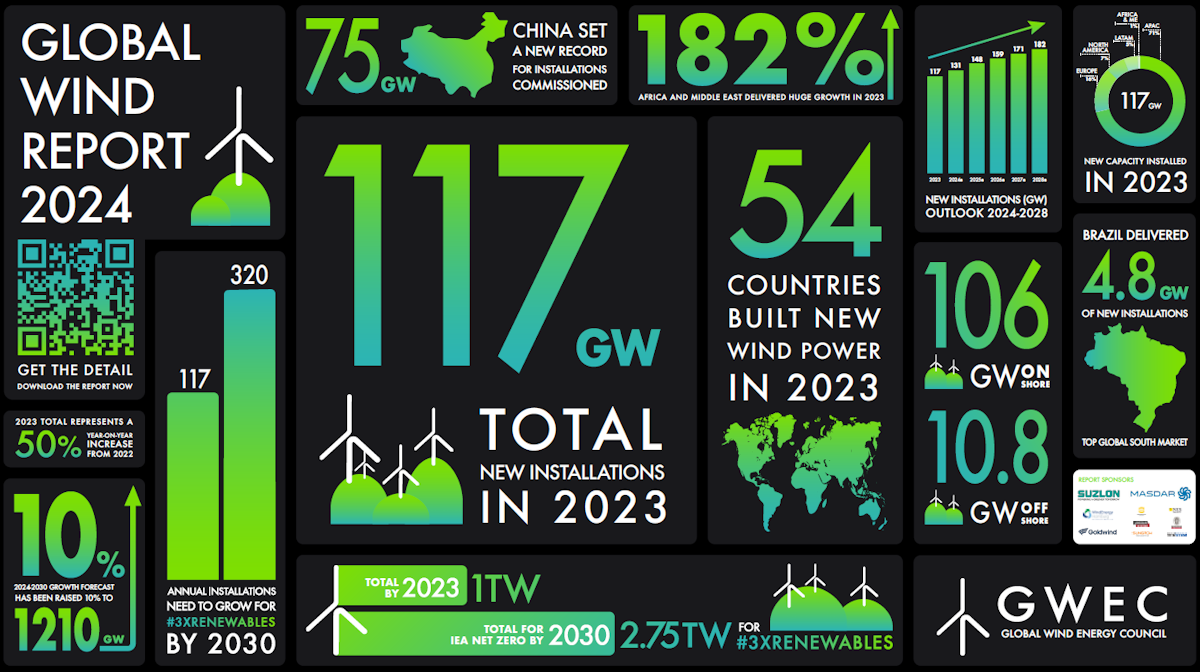

Share prices might suggest the industry is in disarray, but the reality is that the 117GW of wind generation capacity added in 2023 was a record, and up 50% from 2022. Policymakers around the world are still committed to COP28 targets, which will require annual capacity additions to triple by 2030.

Global Wind 2023 Capacity vs 2030 Targets - Global Wind Energy Council

✨ Unless the world completely abandons the current goals for net-zero emissions, a lot of new wind turbines will need to be installed. Yes, the US election in November could throw a spanner in the works, but the US goals are actually quite a small percentage of the global target.

Demand could also increase if advances are made in battery storage technology, hydrogen use, and if the lifespan of turbines increases. Turbines are currently expected to last about 20 years. If that increases to 25 or 30 years, the economics of each project improve considerably.

GE Vernova: A New Player In The Renewable Energy Space

General Electric recently completed its three-way split, when the energy business was spun off as GE Vernova. It’s not a new business, but it was previously buried within the larger GE.

Prior to the spin-off, the energy business accounted for around 50% of GE’s revenue, but contributed zero net income and only 15% of its market cap.

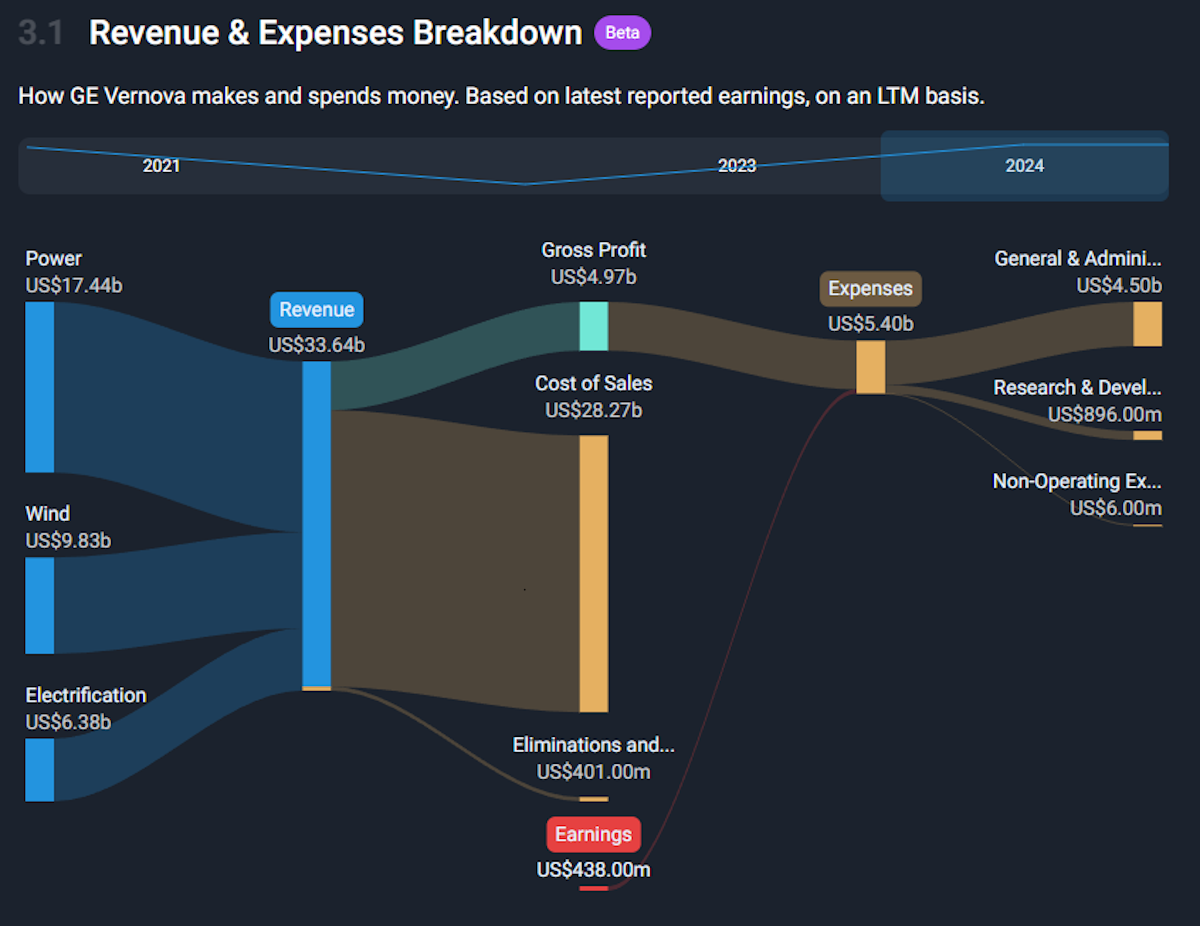

The new entity has three segments:

- ⚡ The power segment provides technology and services to natural gas, nuclear, and hydroelectric generation facilities.

- 🌬️ The wind segment manufactures wind turbine blades and provides services to onshore and offshore wind farms.

- 🔌 The electrification segment provides software and equipment used for grid management, transmission and storage.

Section 3.1 of each company report on the Simply Wall St platform provides a breakdown of the companies' revenue by source. This is how GE Vernova earned its $33 billion in revenue in 2023.

GE Vernova is interesting for a couple of reasons.

- Firstly, it operates across the entire power generation industry, including but not limited to wind.

- Secondly, it has a huge backlog of orders ($116 billion across all three segments), most of which is services revenue which isn’t as capital intensive as manufacturing. The company isn’t as well known either, which means it may be overlooked.

The issue then is how profitable it can be.

In 2023, it was just about profitable on a free cash flow basis, but reported negative earnings. First quarter results will be published on Thursday the 25th, so it may be worth checking them out. You can also find the investor day presentation here.

💡 The Insight: Don’t Forget The Rest Of The Electrification Ecosystem

When we think of wind energy stocks, it's usually the companies that own and operate wind farms or the ones that manufacture the turbines and blades. But there’s a whole ecosystem which includes companies that are sometimes overlooked.

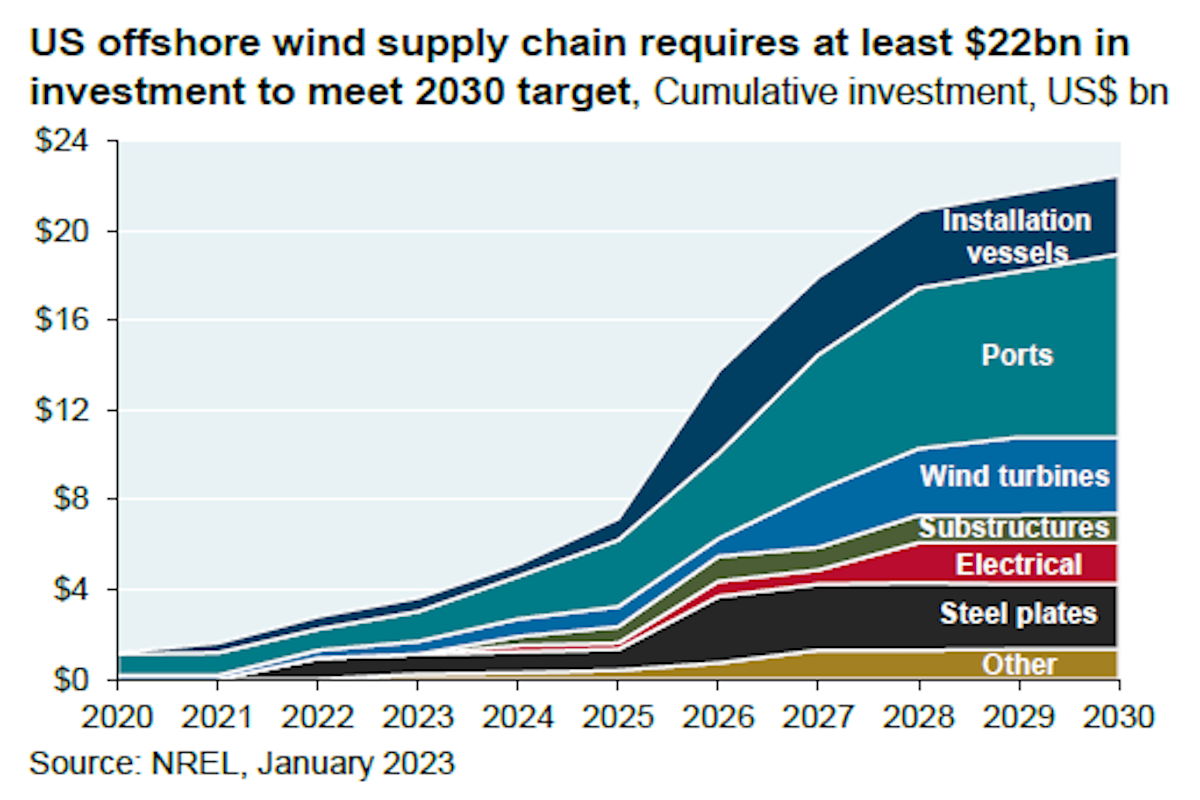

The chart below projects the investments that will need to be made for the US to achieve the Biden Administration’s offshore goal by 2030. Clearly there’s a lot more to it than turbines.

Previously, we mentioned the importance of the companies involved in connecting solar and wind installations to power grids, as well as expanding and managing grids. GE Vernova is one of these companies, but there are quite a few others including Quanta Services, Itron, NV5 Global, ABB (Switzerland), and Eaton. These companies stand to benefit as wind capacity increases, but they aren’t dependent on it.

For more ideas, check out the Wind Energy Stocks collection. As always, thematic ETFs are another way to find potential investments:

- Global X Wind Energy ETF (holdings here)

- First Trust Global Wind Energy ETF (holdings here)

✨ If you want diversified exposure, ETFs can help, but if you want to own specific names, you can look through those ETFs portfolios of holdings, and then assess each stock on their individual merits (future growth, past performance, financial health etc) on Simply Wall St to see how they stack up.

Key Events During The Next Week

It isn’t a big week for economic data, but it’s a very big week for quarterly results, as 5 of the Magnificent 7 reports.

Wednesday

- 🇦🇺 Australia’s inflation rate will be published and is forecast to fall from 4.1% to 3.4%.

- 🇺🇸 US durable good orders are expected to be 1.2% lower, after rising 1.4% in the prior period.

Thursday

- 🇺🇸 US GDP Growth Rate is expected to fall from 3.4% to 2.8%. This is the advance estimate and is likely to be revised in the coming weeks.

Friday

-

🇯🇵 The Bank of Japan will announce its interest rate decision, and is expected to keep rates steady at 0%.

-

🇺🇸 US personal consumption and expenditures (PCE) data will be published. The core PCE price index is expected to be 2.7% higher YoY, down slightly from 2.8%.

These are the largest companies reporting this week, but there are lots more. Check out the Nasdaq website for a comprehensive list.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.