Last Update26 Sep 25Fair value Increased 5.60%

TeraWulf’s price target has been raised to $12.86 as analysts cite transformative strategic agreements—including new long-term leases with Fluidstack and Google’s substantial investment—which strengthen its credit, growth outlook, and market positioning in AI/HPC infrastructure.

Analyst Commentary

- Bullish analysts highlight new long-term colocation agreements with Fluidstack, which diversify TeraWulf's customer base and add significant, contracted critical IT load (CITL), enhancing growth prospects.

- Google's $1.8B lease backstop and equity investment in conjunction with Fluidstack deals are viewed as transformative, materially boosting TeraWulf's credit profile, financing visibility, and reputation within the AI/high performance computing ecosystem.

- Analysts raise EBITDA and revenue expectations, citing expanding contracted capacity—such as the 200+ MW Fluidstack deal and 422MW signed leases—along with an 80-year ground lease at a key site, all of which improve long-term cash flow and site utilization.

- Convertible notes offerings and exercised capacity options are factored positively, as analysts believe they enable further portfolio expansion and additional site development, widening the company's addressable market.

- Upside risks cited include potential for additional tenant wins, further site additions, and industry leadership in hyperscale AI/HPC infrastructure, offset by watch items around execution and funding.

What's in the News

- TeraWulf (WULF) is among the publicly traded companies positioned to benefit from a proposed White House order allowing alternative investments, including crypto, in 401(k) retirement portfolios, though this introduces new risks for investors (Reuters, Aug 10).

- The White House is set to release a comprehensive crypto policy report that may shape industry regulations, directly impacting companies like TeraWulf engaged in digital asset activities (Reuters, Jul 30).

- President Trump plans to sign an executive order to open U.S. retirement markets to crypto, gold, and private equity, potentially expanding the accessible investor base for TeraWulf and peers (Financial Times, Jul 18).

- Progress on landmark crypto regulation bills in the House has been tumultuous; despite lengthy debate and opposition, the bills have advanced, impacting the regulatory landscape for TeraWulf (CNBC, Jul 17).

- Bitcoin’s surge past $120,000, credited to robust institutional buying, could positively influence crypto mining companies like TeraWulf, with further gains expected despite broader market uncertainties (CNBC, Jul 14).

Valuation Changes

Summary of Valuation Changes for TeraWulf

- The Consensus Analyst Price Target has risen from $12.18 to $12.86.

- The Future P/E for TeraWulf has risen from 42.41x to 46.60x.

- The Net Profit Margin for TeraWulf has fallen from 17.15% to 15.95%.

Key Takeaways

- Transition to diversified digital infrastructure with major institutional backing reduces reliance on bitcoin price, boosting revenue stability and supporting margin growth.

- Expansion of sustainable, regulatory-compliant infrastructure positions the company to meet rising enterprise demand, drive new revenue streams, and achieve operational efficiency.

- Aggressive diversification into AI and HPC hosting exposes TeraWulf to rising costs, tenant risks, and operational challenges that threaten margin stability and long-term financial health.

Catalysts

About TeraWulf- Operates as a digital asset technology company in the United States.

- TeraWulf's recent multi-billion-dollar, multi-year hyperscale hosting agreements (e.g., with Fluidstack and Google), mark a significant shift from a pure bitcoin mining model toward diversified, contracted revenue streams in high-demand digital infrastructure-this underpins higher revenue visibility and insulates earnings from bitcoin price volatility.

- Long-term partnerships and investments from marquee players (Google's $1.8B lease backstop and equity stake) signal institutional validation, enhance creditworthiness, and are likely to lower WULF's future cost of capital, directly supporting margin expansion and accelerated infrastructure growth.

- Rapid expansion of zero-carbon, high-capacity digital infrastructure (Lake Mariner and Cayuga) positions TeraWulf to capture rising enterprise demand for sustainable, regulatory-compliant compute, supporting long-term revenue and improved net margins as regulatory and ESG pressures rise globally.

- Proven operational track record (on-time, on-budget delivery, experienced team, long-standing contractor relationships) de-risks future capacity scale-up and enables disciplined cost management, supporting sustained margin improvement and higher EBITDA.

- Growing momentum for institutional and enterprise digital asset adoption, coupled with TeraWulf's expansion into grid-interactive, renewable-powered data centers, positions the company to benefit from both higher transaction volumes and new ancillary revenue streams, enhancing long-term earnings stability and upside.

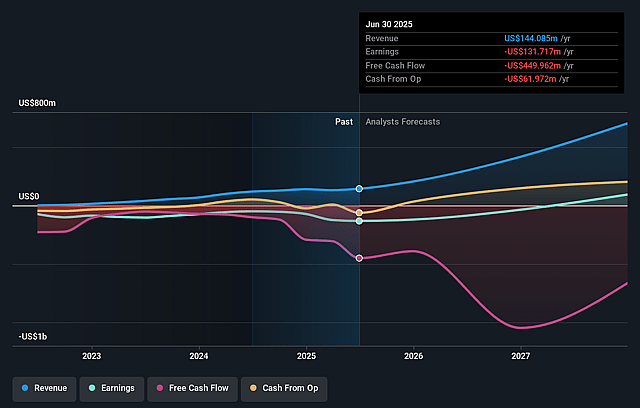

TeraWulf Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TeraWulf's revenue will grow by 85.6% annually over the next 3 years.

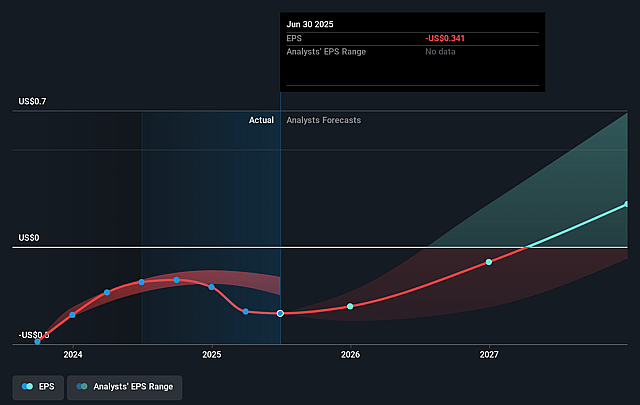

- Analysts assume that profit margins will increase from -91.4% today to 17.1% in 3 years time.

- Analysts expect earnings to reach $157.9 million (and earnings per share of $0.33) by about September 2028, up from $-131.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $405.2 million in earnings, and the most bearish expecting $-45.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.4x on those 2028 earnings, up from -27.8x today. This future PE is greater than the current PE for the US Software industry at 36.6x.

- Analysts expect the number of shares outstanding to grow by 1.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.78%, as per the Simply Wall St company report.

TeraWulf Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- TeraWulf's aggressive expansion into High Performance Computing (HPC) and AI data center hosting (e.g., the Fluidstack deal and Cayuga site development) requires substantial capital expenditures and increases debt exposure, introducing long-term risks to free cash flow, net margins, and balance sheet stability-especially if demand or execution timelines falter.

- The company's revenue stream is rapidly diversifying away from its legacy crypto mining business, but longer-term returns are highly dependent on maintaining "transformative" leases with newer tenants (e.g., Fluidstack) whose own financial stability, customer base, and AI sector demand are not fully transparent, creating potential risks to recurring revenue and earnings should counterparties struggle or market conditions shift.

- Although Google's backstop reduces near-term counterparty risk, its credit support for the Fluidstack lease declines over time and is tied to equity dilution, potentially impacting future shareholder value and exposing TeraWulf to ongoing concentration risks if similar structures are used in future expansions.

- TeraWulf faces escalating operational costs (e.g., labor, custom buildouts, supply chain constraints) as evidenced by higher CapEx on Fluidstack versus Core42 and increasing SG&A guidance, posing a risk to gross and net margins unless efficiencies scale materially or future contracts continue to deliver very high site-level net operating income.

- The company's long-term growth relies on sustained strong demand in both the AI infrastructure and crypto mining sectors, both of which could be adversely affected by regulatory changes (e.g., U.S. energy/environmental policy, digital asset legislation) or technology disruptions, leading to potential declines in revenue, EBITDA, or asset utilization if sectoral sentiment or policy support weakens.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.182 for TeraWulf based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $6.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $920.8 million, earnings will come to $157.9 million, and it would be trading on a PE ratio of 42.4x, assuming you use a discount rate of 8.8%.

- Given the current share price of $8.98, the analyst price target of $12.18 is 26.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.