Last Update21 Oct 25Fair value Increased 3.05%

Analysts have raised their price target for Construction Partners from $120 to $124 per share, citing growing confidence in recent higher-margin acquisitions as well as the expectation of new long-term financial targets driving potential upside.

Analyst Commentary

Recent research has highlighted both strengths and areas for caution regarding Construction Partners' outlook following notable upgrades and increased price targets.

Bullish Takeaways- Bullish analysts are increasingly optimistic about the company’s recent acquisitions in Texas and Tennessee, viewing them as delivering higher profit margins than initially forecast.

- Materially increased earnings estimates suggest that the stock remains attractively valued at current levels.

- The anticipated announcement of new long-term financial targets is seen as a potential catalyst for additional share price upside.

- Strong acquisition integration and execution are expected to drive robust growth and improve overall profitability.

- Some analysts remain watchful regarding the company’s ability to consistently deliver higher margins from new acquisitions over the long run.

- Caution persists over integration risk associated with rapid expansion into new regions, which could impact operational efficiencies.

- There is uncertainty surrounding the exact timing and impact of the upcoming long-term financial targets. This could create volatility if expectations are not met.

What's in the News

- Acquired eight hot-mix asphalt plants, crews, and equipment in the Houston, Texas metro area from Vulcan Materials Company. This expands operations as part of Durwood Greene Construction Co. (Key Developments)

- Announced the continuation of buyback activity, repurchasing 7,393 shares for $0.67 million in Q2 2025. This brings the total to 293,111 shares and $18.52 million under the current program. (Key Developments)

- Maintained fiscal year 2025 earnings guidance, with projected revenue between $2.77 billion and $2.83 billion and net income between $106 million and $117 million. (Key Developments)

- Held an Analyst/Investor Day focused on strategic initiatives, growth priorities, organizational achievements, and the business outlook. (Key Developments)

- Continues to pursue strategic acquisitions, with management signaling an emphasis on both organic growth and expansion into new markets. (Key Developments)

Valuation Changes

- Consensus Fair Value has risen slightly from $120.17 to $123.83 per share. This reflects increased optimism about company prospects.

- Discount Rate has increased marginally from 8.65% to 8.74%. This suggests a modest reassessment of risk or cost of capital.

- Revenue Growth projection has decreased slightly, moving from 18.26% to 18.00% year-over-year.

- Net Profit Margin is now expected to improve modestly, increasing from 7.06% to 7.15%.

- Future P/E ratio estimate has gone up from 30.14x to 30.95x. This indicates expectations for higher earnings multiples.

Key Takeaways

- Increasing infrastructure funding and focus on Sunbelt regions position the company for outsized growth, with acquisitions driving expanded market share and contract awards.

- Vertical integration and ongoing strategic acquisitions enhance operational efficiency, earnings resilience, and support sustained long-term revenue and margin growth.

- Heavy dependence on public funding, regional concentration, labor shortages, rising costs, and sustainability demands threaten long-term revenue stability, profitability, and competitive positioning.

Catalysts

About Construction Partners- A civil infrastructure company, constructs and maintains roadways in Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Texas.

- Construction Partners is set to benefit from sustained increases in federal, state, and local infrastructure funding-supported by the Infrastructure Investment and Jobs Act (IIJA) and robust state programs-leading to multi-year growth in backlog and long-term visibility on revenue.

- The company's concentration in high-growth Sunbelt regions, particularly with recent transformative acquisitions like Lone Star in Texas and Durwood Greene in Houston, aligns with continued migration and urbanization trends that will drive outsized growth in contract awards, organic revenue, and market share.

- Ongoing vertical integration-through investment in owned asphalt plants and material sourcing-combined with increasing scale, is already enhancing operational efficiencies and margin expansion, as shown by record adjusted EBITDA margins despite weather disruptions; this should drive higher net margins and improved earnings resilience going forward.

- Active pursuit of strategic acquisitions in growing, demographically advantaged markets is likely to continue compounding top-line growth and expanding geographic reach, while post-acquisition synergies and bolt-on opportunities further increase revenue and margin potential in both public and private segments.

- Strong backlog coverage (80–85% of next 12 months' revenue) and recurring state/city DOT contracts, underpinned by secular demand for maintenance and expansion of aging U.S. road infrastructure, provide visibility and stability for future cash flows and support sustainable long-term earnings growth.

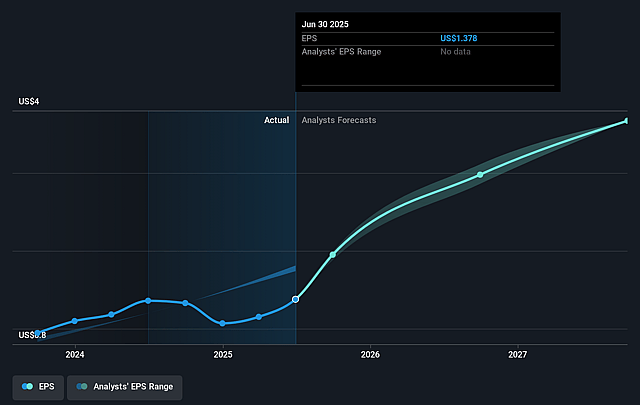

Construction Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Construction Partners's revenue will grow by 18.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.0% today to 7.1% in 3 years time.

- Analysts expect earnings to reach $286.4 million (and earnings per share of $4.99) by about September 2028, up from $74.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.1x on those 2028 earnings, down from 90.9x today. This future PE is lower than the current PE for the US Construction industry at 34.7x.

- Analysts expect the number of shares outstanding to grow by 0.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.65%, as per the Simply Wall St company report.

Construction Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Construction Partners' heavy reliance on public infrastructure funding exposes it to the risk of government budget changes, political shifts, or fiscal tightening, which could result in significant revenue volatility and contraction in future earnings if public spending slows.

- The company's geographic concentration in the Southeast and Sunbelt states increases sensitivity to region-specific economic downturns, policy changes, and weather events (such as the weather-related delays highlighted this quarter), which could negatively impact both revenues and margins over the long term.

- Long-term labor force pressures, including an aging workforce and industry-wide talent shortages, could create higher recruitment, retention, and compensation costs, potentially compressing net margins and limiting the company's ability to execute on its backlog.

- Sustained increases in raw material (bitumen, aggregates) and energy costs, or heightened competition that limits pricing power-combined with the company's relatively low differentiation in a fragmented market-may put downward pressure on gross margins and net earnings.

- Rising expectations and regulatory demands for sustainable construction and greener paving solutions could necessitate higher capital expenditures and operational changes; failure to keep pace may result in lost contracts or market share, diminishing future revenue growth and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $120.167 for Construction Partners based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.1 billion, earnings will come to $286.4 million, and it would be trading on a PE ratio of 30.1x, assuming you use a discount rate of 8.7%.

- Given the current share price of $120.81, the analyst price target of $120.17 is 0.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.