Last Update 05 Dec 25

Fair value Increased 4.49%ROAD: Houston Expansion And Multi Year Backlog Will Drive Future Upside

The analyst price target for Construction Partners has increased modestly to $128.00 from $122.50, as analysts factor in slightly higher long term valuation multiples, despite more tempered revenue growth expectations and a marginally higher discount rate.

Analyst Commentary

Analysts remain broadly constructive on Construction Partners, balancing solid execution and encouraging long term guidance with a more measured view on near term upside and valuation.

Bullish Takeaways

- Bullish analysts highlight better than expected initial FY26 guidance as a sign that core demand and project visibility remain healthy, supporting sustained revenue growth.

- Improving long term outlook in key end markets is seen as a driver for maintaining premium valuation multiples relative to historical averages.

- Continued operational execution and margin discipline are viewed as catalysts that can unlock further earnings upside, even under more conservative top line assumptions.

- Incremental price target increases from some bullish analysts suggest confidence that the company can compound value as it delivers on its multi year backlog and disciplined capital deployment strategy.

Bearish Takeaways

- Bearish analysts are trimming price targets in recognition of a less favorable risk reward profile at current levels, reflecting both macro uncertainty and higher discount rates.

- There is heightened caution around activity levels in certain regional markets, which could introduce volatility to near term revenue growth and project timing.

- Some analysts see limited valuation headroom in the near term, arguing that the current share price already embeds much of the expected earnings improvement.

- Execution risk around converting guidance into consistent quarterly results, particularly in a potentially softer demand environment, remains a key factor tempering more aggressive target revisions.

What's in the News

- Reiterated fiscal 2026 guidance, projecting revenue of $3.4 billion to $3.5 billion and net income of $150 million to $155 million, which underscores confidence in multi year growth visibility (company guidance).

- Issued detailed outlook for fiscal 2025, targeting revenue of $2.80 billion to $2.82 billion and net income of $101.0 million to $101.8 million, indicating a significant step up from fiscal 2024 results (company guidance).

- Acquired eight hot mix asphalt plants, crews, and equipment across the Houston metro area from Vulcan Materials affiliates, expanding capacity and reinforcing its competitive position in a key Texas market (business expansion announcement).

- Completed an additional tranche of share repurchases, buying 25,729 shares for $2.74 million in the quarter and totaling 318,840 shares for $21.26 million under the current buyback program (buyback update).

Valuation Changes

- Fair Value: Increased modestly to $128.00 from $122.50, reflecting a slightly higher long term valuation assessment.

- Discount Rate: Risen slightly to 9.21% from 9.11%, indicating a marginally higher required return in the model.

- Revenue Growth: Reduced meaningfully to 16.53% from 20.17%, signaling more tempered long term top line expectations.

- Net Profit Margin: Edged down slightly to 5.10% from 5.14%, implying a relatively stable but marginally lower profitability outlook.

- Future P/E: Increased to 42.60x from 40.79x, suggesting a somewhat richer multiple applied to forward earnings.

Key Takeaways

- Increasing infrastructure funding and focus on Sunbelt regions position the company for outsized growth, with acquisitions driving expanded market share and contract awards.

- Vertical integration and ongoing strategic acquisitions enhance operational efficiency, earnings resilience, and support sustained long-term revenue and margin growth.

- Heavy dependence on public funding, regional concentration, labor shortages, rising costs, and sustainability demands threaten long-term revenue stability, profitability, and competitive positioning.

Catalysts

About Construction Partners- A civil infrastructure company, constructs and maintains roadways in Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, and Texas.

- Construction Partners is set to benefit from sustained increases in federal, state, and local infrastructure funding-supported by the Infrastructure Investment and Jobs Act (IIJA) and robust state programs-leading to multi-year growth in backlog and long-term visibility on revenue.

- The company's concentration in high-growth Sunbelt regions, particularly with recent transformative acquisitions like Lone Star in Texas and Durwood Greene in Houston, aligns with continued migration and urbanization trends that will drive outsized growth in contract awards, organic revenue, and market share.

- Ongoing vertical integration-through investment in owned asphalt plants and material sourcing-combined with increasing scale, is already enhancing operational efficiencies and margin expansion, as shown by record adjusted EBITDA margins despite weather disruptions; this should drive higher net margins and improved earnings resilience going forward.

- Active pursuit of strategic acquisitions in growing, demographically advantaged markets is likely to continue compounding top-line growth and expanding geographic reach, while post-acquisition synergies and bolt-on opportunities further increase revenue and margin potential in both public and private segments.

- Strong backlog coverage (80–85% of next 12 months' revenue) and recurring state/city DOT contracts, underpinned by secular demand for maintenance and expansion of aging U.S. road infrastructure, provide visibility and stability for future cash flows and support sustainable long-term earnings growth.

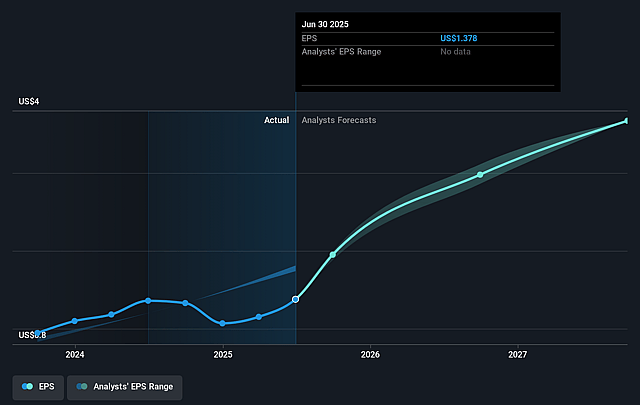

Construction Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Construction Partners's revenue will grow by 18.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.0% today to 7.1% in 3 years time.

- Analysts expect earnings to reach $286.4 million (and earnings per share of $4.99) by about September 2028, up from $74.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.1x on those 2028 earnings, down from 90.9x today. This future PE is lower than the current PE for the US Construction industry at 34.7x.

- Analysts expect the number of shares outstanding to grow by 0.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.65%, as per the Simply Wall St company report.

Construction Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Construction Partners' heavy reliance on public infrastructure funding exposes it to the risk of government budget changes, political shifts, or fiscal tightening, which could result in significant revenue volatility and contraction in future earnings if public spending slows.

- The company's geographic concentration in the Southeast and Sunbelt states increases sensitivity to region-specific economic downturns, policy changes, and weather events (such as the weather-related delays highlighted this quarter), which could negatively impact both revenues and margins over the long term.

- Long-term labor force pressures, including an aging workforce and industry-wide talent shortages, could create higher recruitment, retention, and compensation costs, potentially compressing net margins and limiting the company's ability to execute on its backlog.

- Sustained increases in raw material (bitumen, aggregates) and energy costs, or heightened competition that limits pricing power-combined with the company's relatively low differentiation in a fragmented market-may put downward pressure on gross margins and net earnings.

- Rising expectations and regulatory demands for sustainable construction and greener paving solutions could necessitate higher capital expenditures and operational changes; failure to keep pace may result in lost contracts or market share, diminishing future revenue growth and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $120.167 for Construction Partners based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.1 billion, earnings will come to $286.4 million, and it would be trading on a PE ratio of 30.1x, assuming you use a discount rate of 8.7%.

- Given the current share price of $120.81, the analyst price target of $120.17 is 0.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.