Last Update 31 Oct 25

Fair value Increased 5.94%Narrative Update: NPK International

Analysts have raised their price target for NPK International from $12.63 to $13.38, citing continued growth momentum, margin improvement, and robust market trends as key drivers behind the upward revision.

Analyst Commentary

Recent commentary from street research highlights a consistently optimistic stance on NPK International's outlook, supported by firm price target increases and an endorsement of the company’s growth trajectory. Analysts point to a number of drivers that support their revised assessments, as well as items to keep under consideration.

Bullish Takeaways

- Bullish analysts expect NPK International to maintain robust growth through 2025 and into 2026. They cite expansion in worksite access solutions and favorable market conditions as pivotal factors.

- There is confidence in the company’s ability to gain market share from traditional wooden mats. This indicates successful product differentiation and execution in key verticals.

- Positive end market tailwinds are anticipated to sustain momentum. Geographic expansion may serve as a catalyst for further earnings growth and margin improvement.

- Following recent earnings reports, price targets have been incrementally raised. These changes reflect analysts’ conviction in the firm’s ongoing operational success and upward earnings potential.

Bearish Takeaways

- Some analysts remain cautious about the degree of market share capture. They note that long-term gains depend on consistent execution and competitive response.

- Risks persist around how effectively management can translate geographic expansion into profitable growth, without encountering operational or integration challenges.

- While end market trends are favorable, unexpected shifts in demand or regulatory changes could impact the pace of growth anticipated in price targets.

What's in the News

- From July 1, 2025 to September 30, 2025, NPK International repurchased 400,000 shares, representing 0.47 percent for $3.4 million. This completed a total of 3,037,206 shares repurchased under the buyback announced in February 2024 (Key Developments).

- The company raised its full-year 2025 earnings guidance and now expects revenues between $268 million and $272 million (Key Developments).

- In the previous quarter, the company also raised its 2025 earnings guidance, projecting revenues in the $250 million to $260 million range based on strong first half results (Key Developments).

- Between April 1, 2025 and June 30, 2025, NPK International repurchased 817,606 shares, representing 0.96 percent for $6.13 million under its ongoing buyback program (Key Developments).

Valuation Changes

- Fair Value Estimate has risen slightly from $12.63 to $13.38. This reflects increased optimism in NPK International’s valuation.

- Discount Rate has decreased from 7.91 percent to 7.83 percent. This indicates a marginal reduction in perceived risk.

- Revenue Growth Assumption has fallen from 12.0 percent to 9.5 percent. This suggests expectations for a slower pace of top-line expansion.

- Net Profit Margin has increased significantly from 13.0 percent to 17.2 percent. This points to improved profitability forecasts.

- Future Price-to-Earnings (P/E) Ratio estimate has declined from 28.9x to 22.3x. This signals expectations for lower future valuation multiples.

Key Takeaways

- Expanding infrastructure spending and longer rental contracts are driving sustained revenue growth, improved asset utilization, and enhanced earnings consistency.

- Innovation in high-margin products and a strong balance sheet enable ongoing investment, market share gains, and improved shareholder returns.

- Dependence on large infrastructure projects, unpredictable product sales, slow market diversification, and rising cost pressures create significant risks to NPK International's revenue and profitability stability.

Catalysts

About NPK International- A temporary worksite access solutions company, manufactures, sells, and rents recyclable composite matting products.

- NPK International is benefiting from robust, sustained demand for utility transmission and pipeline infrastructure, supported by increasing global investment in critical infrastructure modernization and energy transition projects; with the company reasonably early in this wave of spending and utilities reaffirming or upping their CapEx commitments, there is a visible multi-year revenue growth runway from these long-term infrastructure trends.

- The ongoing shift by utility and infrastructure customers toward longer-duration rental contracts is increasing asset utilization rates (currently trending at the high end of historical ranges), providing greater revenue visibility and operational leverage-which should support improved earnings consistency and operating margins.

- Continued expansion of NPK International's rental fleet and geographic footprint-especially in high-growth regions such as the Midwest, Gulf Coast, and markets tied to infrastructure spending-positions the company to capture more share from secular increases in food, energy, and infrastructure demand, driving sustainable top-line and EBITDA growth over the long term.

- Industry adoption of advanced, longer-life composite mats (versus traditional timber) for access solutions is accelerating, with NPK's product innovation and strong customer relationships with utilities and fleet operators driving a secular transition to higher-margin, value-added products-enhancing overall net margins.

- Strong and flexible balance sheet with ample liquidity allows continued investment in fleet expansion, operational efficiency, and share repurchases, while also enabling potential strategic acquisitions; this supports both revenue growth and shareholder returns (EPS uplift from buybacks), and underpins the company's undervaluation relative to forward growth prospects.

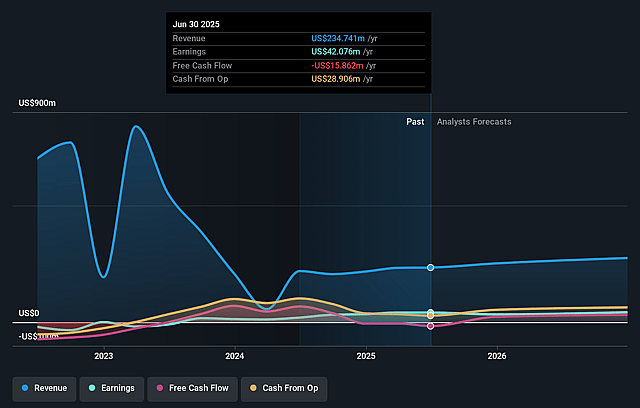

NPK International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NPK International's revenue will grow by 12.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 17.9% today to 13.0% in 3 years time.

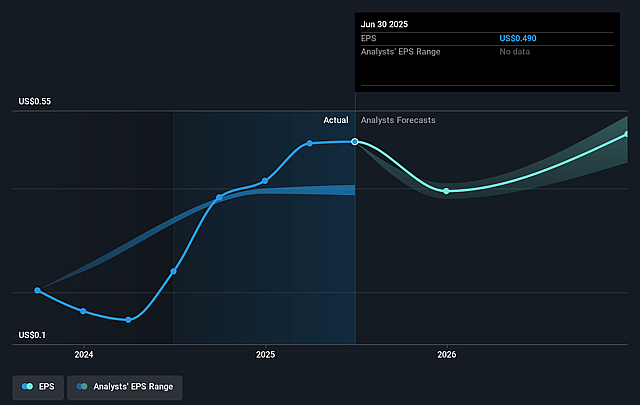

- Analysts expect earnings to reach $42.8 million (and earnings per share of $0.5) by about September 2028, up from $42.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.9x on those 2028 earnings, up from 20.7x today. This future PE is greater than the current PE for the US Trade Distributors industry at 23.3x.

- Analysts expect the number of shares outstanding to decline by 2.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.91%, as per the Simply Wall St company report.

NPK International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- NPK International's significant increase in rental revenues has been driven by a concentrated surge in large-scale infrastructure projects; however, this exposes the company's future revenues to project timing risks and sector cyclicality-potentially leading to revenue volatility if such projects decline or are delayed.

- The company's product sales, while currently robust, are described as more difficult to predict and are down year-over-year from record levels, suggesting a risk of declining or inconsistent revenue streams as industry transitions or customer preferences shift-negatively impacting both revenue stability and net margins.

- While NPK International is expanding geographically, its historical concentration in oil and gas basins and slower expansion into new markets could limit long-term growth and expose the company to competitive pressure and regional market downturns-putting both revenue growth and earnings at risk.

- The elevated SG&A expenses tied to performance-based incentives and rightsizing efforts, along with management's ongoing focus on streamlining overhead, indicate operating cost pressures and execution risk; if not managed effectively, these could compress operating margins and lower overall profitability.

- Increasing reliance on large utility and infrastructure customers, and the heavy investment in rental fleet scale, may create vulnerability if regulatory or policy changes (e.g., delayed utility CapEx, shifting infrastructure priorities, or increased compliance demands) result in reduced project pipelines or higher operational costs-adversely impacting revenue growth, EBITDA, and net earnings over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.625 for NPK International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $329.6 million, earnings will come to $42.8 million, and it would be trading on a PE ratio of 28.9x, assuming you use a discount rate of 7.9%.

- Given the current share price of $10.31, the analyst price target of $12.62 is 18.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.