Last Update 04 Nov 25

Fair value Decreased 5.02%Apple Hospitality REIT's analyst price target has been adjusted downward from $13.60 to $12.92, as analysts cite moderating discount rates along with slightly improved profit margins and revenue growth projections.

What's in the News

- Apple Hospitality REIT, Inc. updated its 2025 earnings guidance, projecting net income in the range of $162 million to $175 million. This reflects a lower outlook due to economic uncertainty and a potential government shutdown (Company filing).

- Operational adjustments for full-year 2025 include a decrease in Net Income guidance by $5.5 million and a decrease in Comparable Hotels RevPAR Change by 100 basis points. Adjusted Hotel EBITDA Margin is expected to increase by 20 basis points due to strong cost control measures (Company filing).

- From April 1, 2025 to June 30, 2025, the company repurchased 1,432,127 shares for $16.87 million, completing the share buyback of over 16.5 million shares since 2015. This represents 7.28% of shares outstanding (Company filing).

Valuation Changes

- Consensus Analyst Price Target: Decreased from $13.60 to $12.92, reflecting a modest downward adjustment.

- Discount Rate: Lowered from 8.65% to 7.94%, indicating a slightly more favorable market environment.

- Revenue Growth: Upgraded from 1.71% to 1.92%. This shows a slight improvement in projected top-line performance.

- Net Profit Margin: Increased from 11.97% to 12.12%. This suggests a marginal gain in anticipated profitability.

- Future P/E Ratio: Reduced from 22.18x to 20.16x. This points to lower expected valuation multiples.

Key Takeaways

- Reliance on business travel recovery and exposure to select-market risks could constrain occupancy, revenue growth, and operating margins amid shifting work patterns and regional slowdowns.

- Elevated refinancing costs, new lodging competitors, and lagging sustainability efforts threaten net income, daily rate growth, and long-term competitiveness.

- Opportunistic acquisitions, low supply in key markets, and effective capital recycling position the company for resilient revenue and margin growth despite industry volatility.

Catalysts

About Apple Hospitality REIT- Apple Hospitality REIT, Inc. (NYSE: APLE) is a publicly traded real estate investment trust (“REIT”) that owns one of the largest and most diverse portfolios of upscale, rooms-focused hotels in the United States.

- Investors may be overestimating the resilience of business travel demand in light of the persistent shift toward remote and hybrid work, which reduces the need for corporate travel and longer stays-negatively impacting occupancy, RevPAR, and ultimately revenue growth.

- The heavy concentration of assets in specific upscale, select-service segments and in suburban/secondary U.S. markets increases exposure to region-specific economic slowdowns and intense competition, which could compress net operating income and margins if local demand fails to rebound as expected.

- With ongoing market volatility and higher-for-longer interest rate environments, refinancing and capital expenditure costs are likely to remain elevated, increasing net interest expense and pressuring earnings, especially as the company navigates upcoming debt maturities and significant planned renovations.

- The continued rise of alternative lodging options such as Airbnb and Vrbo is intensifying competitive pressures, potentially eroding occupancy rates and limiting average daily rate (ADR) growth for traditional hotel REITs like Apple Hospitality, which may weigh on future revenue and net margins.

- Consumer preferences are increasingly shifting toward more sustainable and eco-friendly accommodations; if Apple Hospitality underinvests or lags in sustainability upgrades, occupancy and revenue growth may underperform expectations as environmentally conscious travelers choose alternative lodging options.

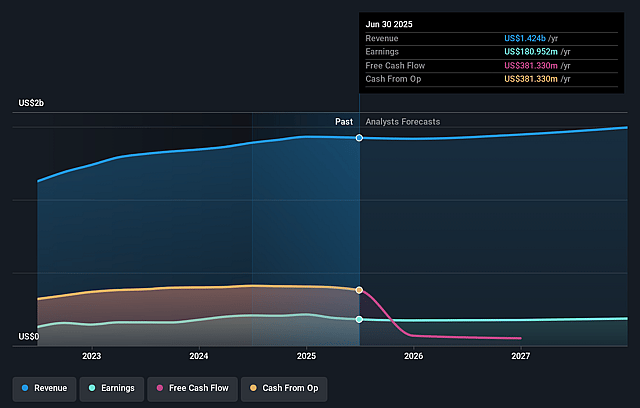

Apple Hospitality REIT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Apple Hospitality REIT's revenue will grow by 1.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.7% today to 12.0% in 3 years time.

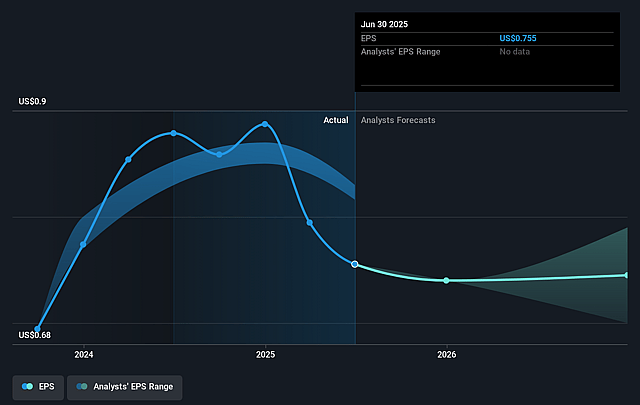

- Analysts expect earnings to reach $179.3 million (and earnings per share of $0.73) by about September 2028, down from $181.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.2x on those 2028 earnings, up from 16.5x today. This future PE is lower than the current PE for the US Hotel and Resort REITs industry at 29.5x.

- Analysts expect the number of shares outstanding to decline by 1.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.65%, as per the Simply Wall St company report.

Apple Hospitality REIT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's demonstrated ability to opportunistically acquire and cluster assets (such as the recent Tampa acquisition at a favorable cap rate and price below replacement cost), paired with strong execution on synergies and market positioning, suggests potential for enhanced long-term portfolio earnings and asset value growth, contradicting expectations of sustained earnings decline.

- Historically low new hotel supply in the company's core markets (with nearly 60% of properties facing no like-kind competition within a 5-mile radius) reduces downside risks and enhances prospects for occupancy and ADR improvement as travel demand normalizes, supporting future revenue and margin resilience.

- Apple Hospitality REIT's recurring share repurchase strategy, funded by value-maximizing asset sales at blended cap rates substantially below implied share value, indicates management's ability to exploit public-private arbitrage, thereby driving per-share earnings/FFO growth and offsetting cyclical downturns.

- The company's diversified, rooms-focused portfolio has repeatedly outperformed the broader industry during economic uncertainties, with a proven track record of rapid tactical reallocation across group, leisure, and business travel segments-pointing to enduring top-line and EBITDA margin stability in variable environments.

- Management's consistent and effective capital recycling through renovations and asset repositioning not only upgrades portfolio quality but also attracts higher-yielding demand segments (as evidenced by persistent group ADR growth and rising ancillary revenues), augmenting long-term NOI and FFO per share beyond near-term headwinds.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.6 for Apple Hospitality REIT based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $179.3 million, and it would be trading on a PE ratio of 22.2x, assuming you use a discount rate of 8.7%.

- Given the current share price of $12.62, the analyst price target of $13.6 is 7.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.