Last Update 16 Nov 25

Fair value Increased 1.07%CME: Revenue Resilience And New Ventures Will Balance Volatility Risks Ahead

The average analyst price target for CME Group was raised by approximately $3 to $285, as analysts point to the firm's resilient revenue streams and strong market position amid continued macroeconomic uncertainty.

Analyst Commentary

Recent analyst activity reflects a mix of optimism and caution regarding CME Group's performance and outlook, particularly as the firm navigates shifting macroeconomic and market conditions. Analysts' assessments center on the company's recurring revenue model, its strong industry positioning, and the challenges posed by fluctuating trading volumes and volatility.

Bullish Takeaways- Bullish analysts emphasize CME Group's stable revenue stream, derived primarily from clearing and transaction fees. This provides resilience even during periods of macroeconomic uncertainty.

- The firm's "strong moat" in futures and options is seen as positioning it favorably relative to competitors, enabling it to defend market share and sustain long-term growth.

- Recent upward adjustments to price targets suggest confidence in CME Group's ability to deliver solid financial performance. Exchange volume trends are described as positive for certain asset classes.

- New ventures and partnerships in adjacent areas, such as prediction markets, are viewed as positive catalysts that can support CME Group's strategic growth initiatives.

- Bearish analysts caution that periods of lower volatility can lead to subdued trading volumes, which may dampen near-term revenue growth and earnings momentum.

- Some continue to lower price targets, reflecting concerns about the sustainability of current earnings projections amid softer demand in certain segments, such as energy trading.

- EPS estimates are being trimmed to account for the ongoing impact of de-risking and lower market activity, especially in quarters marked by reduced volatility.

- Overall, there is an expectation that while CME Group's business model remains strong, future results may be tempered by shifts in macroeconomic conditions that impact market participation.

What's in the News

- CME Group intends to launch financial contracts tied to sports games and economic indicators by the end of the year. The company is entering competition with Kalshi and Polymarket, and is planning a new futures commission merchant partnership with FanDuel (Bloomberg).

- UBS lowered its price target for CME Group to $285 from $305 and maintained a Neutral rating. The firm cited Q3 estimates trending lower, despite raising overall estimates (UBS via periodical).

- Flutter Entertainment announced a partnership with CME Group to enter the prediction market. Analysts noted this as an alternative to setting up a designated contract market and speculated that DraftKings may follow a similar path (Jefferies via periodical).

Valuation Changes

- Consensus Analyst Price Target has risen slightly, increasing from $282.11 to $285.12.

- Discount Rate edged up from 8.13% to 8.18%.

- Revenue Growth expectations increased modestly, moving from 4.41% to 4.52%.

- Net Profit Margin fell notably, dropping from 58.49% to 54.80%.

- Future P/E ratio increased from 29.98x to 32.61x, which reflects higher valuation expectations.

Key Takeaways

- Strong global demand for risk management, retail engagement, and international expansion drives volume and revenue growth, diversifying CME's client base.

- Innovation in products, technology, and partnerships enhances efficiency and margins, positioning CME for sustainable long-term earnings growth.

- Competitive threats from DeFi, regulatory shifts, and low volatility could erode CME Group's market share, trading volumes, and profit margins over time.

Catalysts

About CME Group- Operates contract markets for the trading of futures and options on futures contracts worldwide.

- Heightened global macroeconomic uncertainty, record sovereign debt issuance, persistent geopolitical tensions, and ongoing trade disputes are fueling sustained demand for risk management and hedging solutions, evidenced by record contract volumes and open interest; this trend is likely to support continued revenue and fee growth.

- Robust international expansion-with record-breaking double-digit ADV growth across EMEA and APAC and rising participation from both institutional and retail clients globally-broadens CME's addressable market and underpins future volume and revenue growth.

- The rapid acceleration of retail engagement, highlighted by a 56% increase in new retail traders and five consecutive quarters of double-digit retail client acquisition growth, diversifies CME's client base and supports both volume and transaction-based revenue growth.

- New product innovations (e.g., Micro contracts, expansion into crypto, FX Spot+), ongoing tech-driven operating efficiencies (cloud migration and tokenization initiatives), and strengthening of strategic partnerships (such as the long-term NASDAQ index license extension and Google Cloud collaboration) are enhancing operating leverage and EBITDA/net margin performance.

- The ongoing global shift toward electronic trading, greater regulatory demands for transparency and standardized clearing, and a proven ability to grow non-transactional revenue (e.g., record market data revenue) position CME to capture a larger share of trading activity and support durable long-term earnings growth.

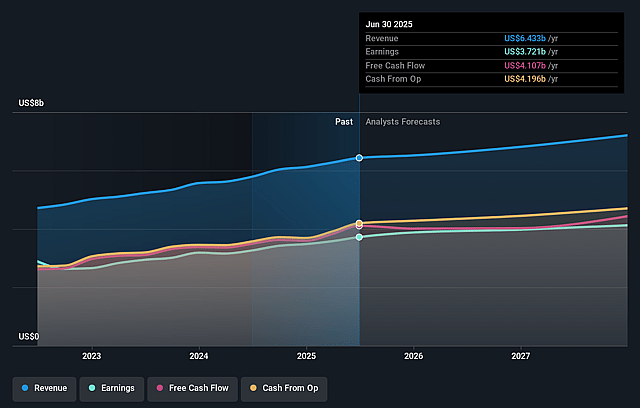

CME Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CME Group's revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 57.9% today to 58.5% in 3 years time.

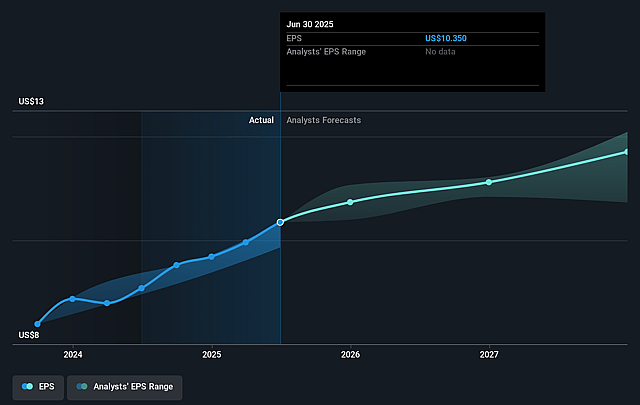

- Analysts expect earnings to reach $4.3 billion (and earnings per share of $12.05) by about September 2028, up from $3.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.0x on those 2028 earnings, up from 25.3x today. This future PE is greater than the current PE for the US Capital Markets industry at 26.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.13%, as per the Simply Wall St company report.

CME Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged periods of geopolitical stability and reduced headline risk could curb market volatility, lowering overall demand for risk-hedging and derivatives trading, which may lead to declining trading volumes and negatively impact CME Group's revenue and earnings growth.

- The accelerating adoption of decentralized finance (DeFi) and tokenization technologies poses a long-term competitive threat, as new market structures could enable trading and settlement of derivatives outside of centralized venues like CME, potentially reducing future market share and fee revenues.

- CME's continued heavy reliance on trading activity in interest rate and equity futures exposes the company to periods of subdued volatility or volume in those sectors, which could result in revenue stagnation or contraction and put pressure on net margins.

- Regulatory changes-such as potential increased oversight of retail derivatives trading, limitations on certain products (e.g., perpetuals in the U.S.), or global moves to further tighten derivatives market participation-may dampen speculative activity and reduce overall transaction fees and open interest.

- Intensifying industry competition from alternative electronic trading venues, lower-fee platforms, and the proliferation of OTC derivatives and algorithmic solutions could create sustained pricing pressure, eroding net margins and constraining CME's long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $282.111 for CME Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $313.0, and the most bearish reporting a price target of just $212.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.3 billion, earnings will come to $4.3 billion, and it would be trading on a PE ratio of 30.0x, assuming you use a discount rate of 8.1%.

- Given the current share price of $261.53, the analyst price target of $282.11 is 7.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.