Last Update 27 Nov 25

Fair value Increased 0.22%ADSK: Future Operating Margin Expansion Will Drive Shares Higher This Cycle

Autodesk's average analyst price target has increased modestly to approximately $373. This reflects analyst optimism around improving revenue growth, expanded profit margins, and consistent execution in recent quarters.

Analyst Commentary

Analyst sentiment toward Autodesk has largely been influenced by the company’s ability to deliver consistent results, drive margin expansion, and set ambitious long-term targets. While several analysts have boosted their price targets and outlooks, perspectives remain mixed regarding macroeconomic factors and the sustainability of growth rates.

Bullish Takeaways- Bullish analysts highlight Autodesk’s steady revenue growth and continued strength across key financial metrics, supporting confidence in the company’s long-term trajectory.

- Raised outlooks reflect improved operating margin targets, with management aiming for significant expansion by fiscal 2029. This has been received positively by the market.

- Discussion of new revenue models and increased productivity has led to upward revisions in both earnings estimates and cash flow projections.

- Positive guidance updates, particularly around billings and double-digit core revenue growth, have contributed to higher price targets and a generally optimistic assessment of valuation upside.

- Bearish analysts remain cautious about macroeconomic uncertainty, which continues to temper enthusiasm around the long-term growth outlook.

- Despite positive financial reports, some analysts maintain a neutral stance, citing potential headwinds from conservative management guidance for the second half of the fiscal year.

- There are notes of caution regarding the sustainability of recent momentum, with some expecting early projections for fiscal 2027 revenue growth to prove conservative.

What's in the News

- Autodesk raised its full-year earnings guidance for the fiscal year ending January 31, 2026. The company expects revenue between $7,150 million and $7,165 million, with GAAP EPS projected at $5.16 to $5.33. (Corporate Guidance)

- The company provided Q4 guidance for the period ending January 31, 2026, forecasting revenue of $1,901 million to $1,917 million and GAAP EPS of $1.40 to $1.57. (Corporate Guidance)

- A partnership between L&T Technology Services and Autodesk was announced. This collaboration aims to drive AI-led digital transformation in manufacturing by integrating Autodesk's solutions into LTTS's Center of Excellence in Vadodara, which will serve as a regional hub for digital plant innovation. (Client Announcements)

- Autodesk launched its first-ever Team USA campaign, celebrating its role as Official Design and Make Platform for the LA28 Olympic and Paralympic Games and Team USA. The campaign highlights athletes who embody innovation both on and off the podium. (Product-Related Announcements)

- Aurigo Software and Autodesk launched a fully integrated solution linking Aurigo’s capital planning with Autodesk Construction Cloud. This integration is designed to help facility owners manage capital programs more efficiently through advanced planning and predictive analytics. (Client Announcements)

Valuation Changes

- Fair Value Estimate has risen slightly from $363.71 to $364.52, reflecting marginally higher intrinsic valuation.

- Discount Rate has increased from 8.39% to 8.51%, indicating a modestly higher required rate of return.

- Revenue Growth projection has climbed from 12.06% to 12.70%, which points to improved growth expectations.

- Net Profit Margin is up from 20.96% to 22.59%, which signals anticipated expansion in profitability.

- Future P/E Ratio has fallen significantly from 49.22x to 43.29x, which suggests a more attractive forward valuation relative to earnings.

Key Takeaways

- Expanding cloud and AI-driven solutions, plus SaaS models, are enhancing recurring revenue, margin stability, and differentiation in core AEC markets.

- Strategic acquisitions and focus on sustainability are growing Autodesk's product ecosystem, customer value, and positioning as a key enabler of digital transformation.

- Rising competition from open-source and alternative platforms, evolving customer preferences, and regulatory challenges threaten Autodesk's pricing power, market share, and long-term profitability.

Catalysts

About Autodesk- Provides 3D design, engineering, and entertainment technology solutions worldwide.

- Strength in Autodesk's core AEC (Architecture, Engineering, Construction) markets is driven by sustained investment in infrastructure, data centers, and industrial buildings, underpinned by increased global urbanization and infrastructure buildout, which is likely to fuel ongoing growth in Autodesk's addressable market and support robust revenue expansion.

- Accelerating adoption of cloud-based platforms-such as Autodesk Construction Cloud and Fusion 360-and ongoing rollout of subscription and SaaS models are increasing recurring revenue, improving revenue visibility, and enhancing net margin stability due to higher operating leverage and sales efficiency improvements.

- Continued innovation and integration of AI-driven tools (e.g., generative design, AutoConstrain) and industry-specific foundation models are boosting customer productivity and differentiating Autodesk's offerings, supporting premium pricing and driving margin expansion and long-term earnings growth.

- Focused strategic tuck-in acquisitions and strong cross-sell activity are expanding Autodesk's product ecosystem, allowing deeper integration and higher customer lifetime value, raising the potential for long-term revenue acceleration and resilient net margin improvement.

- Rising importance of sustainability and regulatory-driven climate action, together with increased demand for digitally-enabled energy efficiency solutions, are positioning Autodesk as an essential technology provider for customers' sustainable transformation efforts, driving higher-value software adoption and supporting both topline growth and higher-margin service offerings.

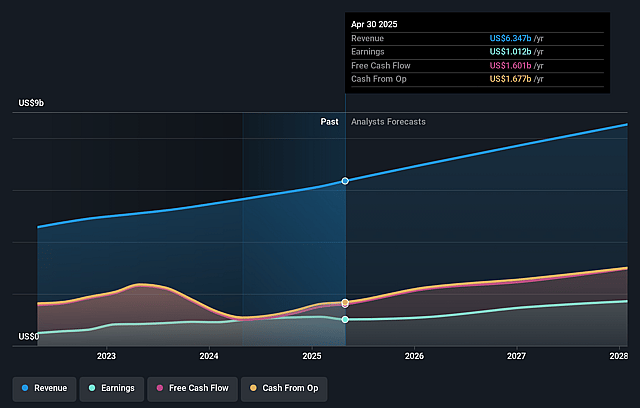

Autodesk Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Autodesk's revenue will grow by 12.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.8% today to 21.0% in 3 years time.

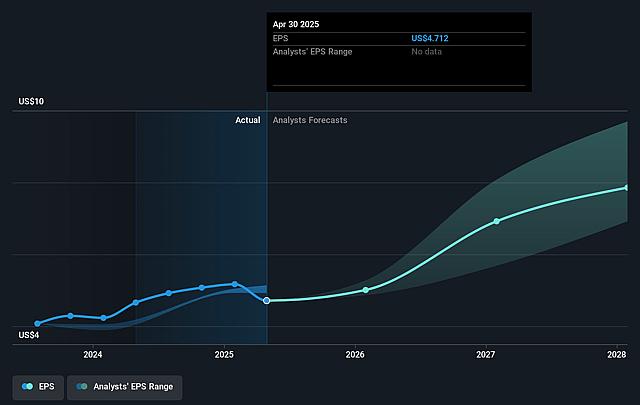

- Analysts expect earnings to reach $2.0 billion (and earnings per share of $9.29) by about September 2028, up from $1.0 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $1.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 48.4x on those 2028 earnings, down from 66.3x today. This future PE is greater than the current PE for the US Software industry at 36.2x.

- Analysts expect the number of shares outstanding to decline by 0.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.51%, as per the Simply Wall St company report.

Autodesk Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing adoption of open-source and lower-cost software solutions globally could erode Autodesk's pricing power, as evidenced by customer examples switching from competitive solutions, potentially leading to price compression and pressure on long-term revenue growth.

- Ongoing customer adaptation to the new transaction model and frequent migrations may cause friction, slowing net new customer acquisition and risking higher churn rates, which can negatively affect recurring revenue streams and overall earnings.

- Rapid advances in AI and generative design-areas in which Autodesk is investing but where emerging competitors and start-ups are active-could enable new entrants to leapfrog Autodesk's technology if Autodesk's own innovation pace slows, threatening its competitive moat and long-term margins.

- Heightened data privacy and global regulatory requirements, as Autodesk continues its transition to cloud-based and AI-enabled solutions, may increase compliance costs and operational complexity, creating headwinds for operating margins over time.

- Accelerated adoption of alternative, agile, or in-house software platforms-particularly as the construction industry explores modular and industrialized construction methods-may bypass legacy Autodesk solutions, constraining Autodesk's total addressable market in its traditional AEC business and impacting future revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $358.964 for Autodesk based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $430.0, and the most bearish reporting a price target of just $270.97.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $9.3 billion, earnings will come to $2.0 billion, and it would be trading on a PE ratio of 48.4x, assuming you use a discount rate of 8.5%.

- Given the current share price of $325.19, the analyst price target of $358.96 is 9.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.