Last Update 19 Nov 25

IP: Profitability Will Advance As $1.5B Asset Sale Nears Completion

International Paper's analyst price targets have seen both upgrades and reductions recently, with changes ranging roughly from a $1 increase to a $5 decrease. Analysts cite improving profitability initiatives alongside mixed expectations for future growth and operational execution.

Analyst Commentary

Recent analyst commentary on International Paper highlights both optimism about the company's current transformation and reservations regarding its future growth trajectory and execution challenges.

Bullish Takeaways- Bullish analysts note that International Paper is executing significant strategic changes, such as divesting underperforming assets. These changes are expected to improve profitability and enhance margins over time.

- There is a consensus among optimistic analysts that the new leadership is fostering a more realistic approach to growth, aligning valuation more closely with achievable operational improvements.

- Some revised price targets reflect optimism around the company reaching a pivotal point for strategic realignment. This supports the case for future earnings growth.

- Bearish analysts highlight concerns that current share prices continue to reflect excessive optimism. Downside risk remains if execution does not meet expectations.

- Several commentaries point to ongoing demand headwinds in key markets, with producers responding by cutting capacity rather than achieving volume growth.

- There is skepticism regarding the company's ability to successfully implement planned strategic actions, particularly in its European operations. This raises doubts about the timeline and reliability of projected improvements.

- Some downward price target revisions reflect caution about reliance on factors beyond management's direct control, such as future price increases and challenging external markets.

What's in the News

- International Paper will close its packaging facilities in Compton, California, and Louisville, Kentucky, by January 2026. This decision will affect a combined 218 employees. The company aims to minimize employee impact through attrition, retirements, and assistance programs. (Key Developments)

- The company completed its repurchase of 14,260,530 shares, representing 4.02% of shares outstanding and totaling $537.01 million under the buyback announced in 2021. (Key Developments)

- International Paper revised its earnings guidance for 2025, expecting $24 billion in net sales. (Key Developments)

- A new agreement with Sylvamo North America, LLC clarifies and amends the long-term supply arrangement at the Riverdale Mill. Winding down operations and transfer of certain assets are scheduled through mid-2026. (Key Developments)

- Plans are underway to convert the No. 16 paper machine at the Riverdale mill in Alabama to containerboard production by Q3 2026. This is part of a shift toward sustainable packaging solutions. (Key Developments)

Valuation Changes

- Fair Value remained unchanged at $47.16 according to updated analyses.

- Discount Rate rose slightly from 7.34% to 7.52%, reflecting a modest increase in required returns.

- Revenue Growth expectations declined, moving from 2.44% to 2.28% annually.

- Net Profit Margin estimates increased slightly from 6.75% to 6.78%.

- Future P/E Ratio decreased notably, dropping from 21.31x to 17.70x. This may indicate lowered growth expectations or changes in market sentiment.

Key Takeaways

- Rising sustainability trends and e-commerce growth are strengthening demand for fiber-based packaging, supporting both revenue growth and pricing power.

- Operational improvements, strategic divestitures, and emerging market expansion are boosting margins, competitiveness, and overall earnings quality.

- Ongoing operational, market, and integration challenges threaten margin improvement, revenue growth, and achievement of long-term financial targets amid industry and macroeconomic headwinds.

Catalysts

About International Paper- Produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa.

- International Paper is benefiting from a long-term shift away from plastic and toward fiber-based, recyclable packaging, as rising sustainability and circular economy priorities among consumers and regulators are boosting demand for its core product lines. This is expected to drive higher revenue and potentially support premium pricing.

- The acceleration of global e-commerce continues to support steady and growing demand for corrugated packaging, giving International Paper a long-term volume growth tailwind and improving top line stability, even amid economic volatility.

- The company's substantial capital investments in automation, advanced manufacturing, and mill reliability-funded by targeted asset divestitures and plant closures-are expected to reduce operating costs and materially expand net margins over the next several years.

- Strategic focus on commercial excellence-including the 80/20 model and improved customer service-is resulting in market share gains in North America and Europe, which should help close the revenue gap with industry peers and lift future earnings.

- Portfolio optimization, including exiting noncore and lower-margin businesses and expanding more heavily into emerging markets with rising packaging consumption, is projected to enhance International Paper's revenue quality and drive higher returns on invested capital over time.

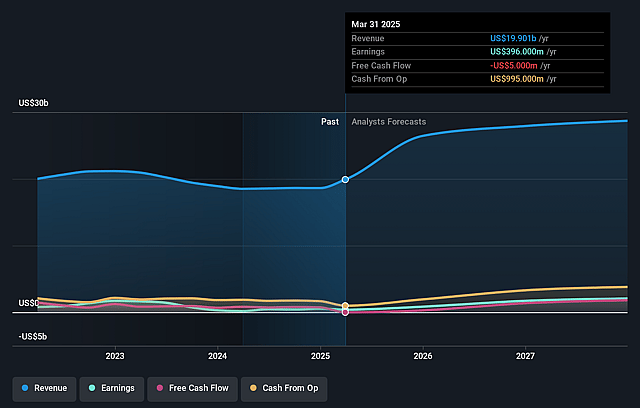

International Paper Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming International Paper's revenue will grow by 8.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.1% today to 7.1% in 3 years time.

- Analysts expect earnings to reach $2.0 billion (and earnings per share of $3.71) by about September 2028, up from $-27.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.3 billion in earnings, and the most bearish expecting $1.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.7x on those 2028 earnings, up from -916.7x today. This future PE is lower than the current PE for the US Packaging industry at 22.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.2%, as per the Simply Wall St company report.

International Paper Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Chronic mill reliability issues stemming from years of underinvestment continue to impact operational efficiency and have left $150 million in profit on the table year-to-date, with no guarantee of rapid resolution; this threatens both net margins and future earnings.

- Macroeconomic uncertainty and persistent market softness in both North America and especially EMEA, including ongoing tariff negotiations and geopolitical tensions, are suppressing overall industry demand and could limit revenue growth and earnings stability.

- European market remains structurally oversupplied and subject to pricing volatility, with management acknowledging risks that recent price increases may not be sustainable-potentially undermining revenue and EMEA segment EBITDA through 2026 and beyond.

- The company is in the early stages of executing complex asset optimization, cost-outs, and plant closures (especially in EMEA), which pose risk of execution delays and integration challenges; these may elevate restructuring costs and limit the intended improvements to margins and ROIC in the medium term.

- Reliance on cost-out actions and commercial transformation to achieve ambitious $6 billion EBITDA and $1.1 billion commercial excellence targets by 2027, while still carrying significant maintenance obligations, integration risk from the DS Smith acquisition, and pressure from secularly slow growth in key end-markets, increases the probability of missing long-term earnings and free cash flow objectives.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $54.325 for International Paper based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $63.0, and the most bearish reporting a price target of just $42.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $28.1 billion, earnings will come to $2.0 billion, and it would be trading on a PE ratio of 21.7x, assuming you use a discount rate of 7.2%.

- Given the current share price of $46.88, the analyst price target of $54.32 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.