Last Update 04 Dec 25

Fair value Increased 1.93%IP: Earnings Will Strengthen As $1.5B Portfolio Sale And Closures Progress

Analysts nudged our fair value estimate for International Paper higher by about $1 to approximately $48 as they balance emerging evidence of profit and margin improvement from strategic portfolio actions against lingering skepticism over the pace and durability of demand and pricing recovery.

Analyst Commentary

Bullish analysts view International Paper as moving closer to a strategic inflection point, with portfolio simplification and cost actions beginning to support a more durable improvement in earnings power. Bearish analysts, however, continue to question whether current valuation fully reflects lingering demand and pricing risks, particularly in containerboard.

Bullish Takeaways

- The planned $1.5 billion divestiture of the underperforming Global Cellulose Fiber operations is seen as a concrete step toward sharpening the portfolio focus and improving consolidated return on capital.

- Supportive analysts argue that the current share price no longer embeds excessive optimism around the new leadership transition. They view the setup as a more attractive risk reward as execution on strategic initiatives progresses.

- Despite modestly lower or unchanged price targets, the constructive camp believes that margin expansion from portfolio pruning and operational efficiencies can underpin midcycle earnings above what is implied in more cautious forecasts.

- Some positive views hinge on the belief that the company is nearing a pivot point in its strategic rethink, where incremental actions could translate more directly into visible profit and cash flow improvement.

Bearish Takeaways

- Bearish analysts contend that the shares still discount a faster and smoother recovery in demand and pricing than underlying fundamentals justify. They see room for valuation downside if macro or industry conditions disappoint.

- Containerboard demand remains described as sluggish, with capacity reductions mainly preventing further price erosion rather than signaling a robust upcycle. This tempers expectations for near term revenue growth.

- More cautious views highlight that the investment case is increasingly dependent on execution of longer dated strategic actions, including initiatives in Europe, which are seen as more complex and harder to deliver on schedule.

- Even where price targets are nudged higher, bearish analysts stress that the upside is capped by near term earnings pressure and the possibility that the next meaningful price increase in the sector may not materialize until 2026.

What's in the News

- Announced the closure of packaging facilities in Compton, California and Louisville, Kentucky by January 2026, affecting 218 employees, as part of a footprint streamlining effort to support its sustainable packaging transformation (Key Developments).

- Revised 2025 earnings guidance, now expecting approximately $24 billion in net sales for the full year (Key Developments).

- Reported completion of a share repurchase program totaling 14,260,530 shares, or 4.02% of shares outstanding, for $537.01 million under the buyback authorized in October 2021 (Key Developments).

- Amended its Supply and Offtake Agreement with Sylvamo North America for the Riverdale Mill, extending supply through April 30, 2026, with a wind down in May and clarifying Sylvamo’s $1 purchase and staged removal of sheeting assets from the mill (Key Developments).

Valuation Changes

- Fair Value Estimate has risen slightly, moving from about $47.16 to approximately $48.07 per share, reflecting modestly improved long term earnings expectations.

- Discount Rate has fallen marginally, edging down from roughly 7.52 percent to about 7.50 percent, indicating a slightly lower implied risk profile in the valuation model.

- Revenue Growth has increased slightly, with the long term annual growth assumption moving from around 2.28 percent to about 2.34 percent.

- Net Profit Margin has risen modestly, with the long run margin assumption increasing from roughly 6.78 percent to about 7.08 percent, signaling a more constructive view on profitability.

- Future P/E has declined slightly, easing from about 17.70x to roughly 17.23x, suggesting a marginally more conservative multiple applied to forward earnings.

Key Takeaways

- Rising sustainability trends and e-commerce growth are strengthening demand for fiber-based packaging, supporting both revenue growth and pricing power.

- Operational improvements, strategic divestitures, and emerging market expansion are boosting margins, competitiveness, and overall earnings quality.

- Ongoing operational, market, and integration challenges threaten margin improvement, revenue growth, and achievement of long-term financial targets amid industry and macroeconomic headwinds.

Catalysts

About International Paper- Produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa.

- International Paper is benefiting from a long-term shift away from plastic and toward fiber-based, recyclable packaging, as rising sustainability and circular economy priorities among consumers and regulators are boosting demand for its core product lines. This is expected to drive higher revenue and potentially support premium pricing.

- The acceleration of global e-commerce continues to support steady and growing demand for corrugated packaging, giving International Paper a long-term volume growth tailwind and improving top line stability, even amid economic volatility.

- The company's substantial capital investments in automation, advanced manufacturing, and mill reliability-funded by targeted asset divestitures and plant closures-are expected to reduce operating costs and materially expand net margins over the next several years.

- Strategic focus on commercial excellence-including the 80/20 model and improved customer service-is resulting in market share gains in North America and Europe, which should help close the revenue gap with industry peers and lift future earnings.

- Portfolio optimization, including exiting noncore and lower-margin businesses and expanding more heavily into emerging markets with rising packaging consumption, is projected to enhance International Paper's revenue quality and drive higher returns on invested capital over time.

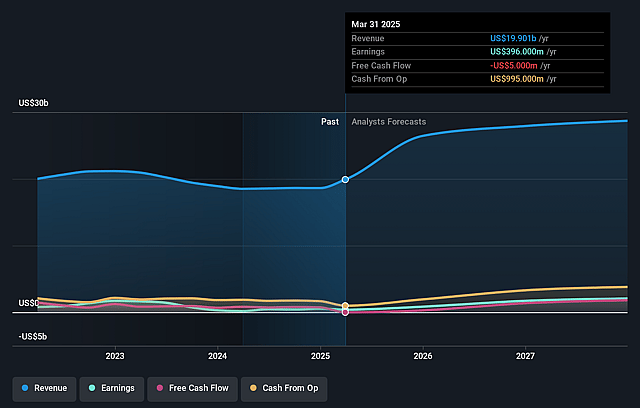

International Paper Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming International Paper's revenue will grow by 8.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.1% today to 7.1% in 3 years time.

- Analysts expect earnings to reach $2.0 billion (and earnings per share of $3.71) by about September 2028, up from $-27.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.3 billion in earnings, and the most bearish expecting $1.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.7x on those 2028 earnings, up from -916.7x today. This future PE is lower than the current PE for the US Packaging industry at 22.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.2%, as per the Simply Wall St company report.

International Paper Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Chronic mill reliability issues stemming from years of underinvestment continue to impact operational efficiency and have left $150 million in profit on the table year-to-date, with no guarantee of rapid resolution; this threatens both net margins and future earnings.

- Macroeconomic uncertainty and persistent market softness in both North America and especially EMEA, including ongoing tariff negotiations and geopolitical tensions, are suppressing overall industry demand and could limit revenue growth and earnings stability.

- European market remains structurally oversupplied and subject to pricing volatility, with management acknowledging risks that recent price increases may not be sustainable-potentially undermining revenue and EMEA segment EBITDA through 2026 and beyond.

- The company is in the early stages of executing complex asset optimization, cost-outs, and plant closures (especially in EMEA), which pose risk of execution delays and integration challenges; these may elevate restructuring costs and limit the intended improvements to margins and ROIC in the medium term.

- Reliance on cost-out actions and commercial transformation to achieve ambitious $6 billion EBITDA and $1.1 billion commercial excellence targets by 2027, while still carrying significant maintenance obligations, integration risk from the DS Smith acquisition, and pressure from secularly slow growth in key end-markets, increases the probability of missing long-term earnings and free cash flow objectives.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $54.325 for International Paper based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $63.0, and the most bearish reporting a price target of just $42.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $28.1 billion, earnings will come to $2.0 billion, and it would be trading on a PE ratio of 21.7x, assuming you use a discount rate of 7.2%.

- Given the current share price of $46.88, the analyst price target of $54.32 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.