Last Update 01 Nov 25

Fair value Decreased 1.02%The consensus analyst price target for Upstart Holdings has been slightly decreased by less than $1 as analysts weigh accelerating delinquencies in older loan vintages against a recent quarterly beat and raised guidance.

Analyst Commentary

Recent Street research presents a mixed outlook for Upstart Holdings, reflecting both optimism and caution among analysts as they assess the company's latest financial results and developing loan trends.

Bullish Takeaways

- Bullish analysts are encouraged by Upstart's latest quarterly beat and the upward revision to company guidance. Many view these as indicators of solid execution and momentum.

- Upgrades in price targets suggest renewed confidence in future growth potential. The firm continues to report resilient earnings despite short-term market volatility.

- Analysts point to the company's ability to deliver above-consensus results in a challenging macro environment, highlighting operational flexibility and adaptability.

- The long-term view remains constructive, with supportive commentary around Upstart's potential to outperform as lending conditions normalize.

Bearish Takeaways

- Some analysts remain guarded due to accelerating delinquencies in Upstart's older loan vintages, raising concerns about credit quality and future earnings stability.

- There is skepticism about whether the company's underwriting model is sufficiently robust. Comparisons are drawn to rising delinquency trends across similar asset classes such as auto lending.

- Cautious analysts highlight that consensus transaction volume estimates may be too optimistic, given the ongoing deterioration in legacy portfolios.

- Despite positive earnings surprises, conservative ratings reflect uncertainty around the sustainability of near-term growth and the reliability of the current credit environment.

What's in the News

- Corporate America Family Credit Union partnered with Upstart to offer personal loans, HELOCs, and auto refinance loans. Lending as a network partner will begin in September 2025, with plans to expand product offerings this year. (Client Announcements)

- Cornerstone Community Financial Credit Union announced its partnership with Upstart to provide smarter, more inclusive personal loan options. The credit union will join the Upstart Referral Network in April 2025. (Client Announcements)

- ABNB Federal Credit Union began offering personal loans through Upstart's Referral Network as of May 2025, streamlining the membership and loan process online. (Client Announcements)

- Peak Credit Union expanded its partnership with Upstart. It initially joined the Referral Network in November 2022 to offer more consumers access to personal loans. (Client Announcements)

- Upstart Holdings provided new earnings guidance for Q3 and the full year 2025, forecasting $280 million in quarterly revenue and $1.055 billion in annual revenue. The company expects GAAP Net Income of $35 million for the year. (Corporate Guidance New/Confirmed)

Valuation Changes

- Fair Value Estimate has declined slightly from $75.46 to $74.69.

- Discount Rate has risen modestly, increasing from 8.58% to 8.75%.

- Revenue Growth projection remains nearly unchanged at around 27.01%.

- Net Profit Margin is essentially flat, staying at approximately 18.74%.

- Future P/E Ratio has dropped marginally from 31.85x to 31.67x.

Key Takeaways

- Improvements in underwriting, automation, and personalization enhance loan approval rates, lower costs, and reduce default risks, positively impacting revenue and net margins.

- Strategic HELOC growth, backed by strong banking relationships, alongside expanded borrower base, sets stage for future revenue growth and earnings support.

- High default rates and macroeconomic volatility threaten revenue stability, while maintaining model accuracy and managing profitability amid these conditions are critical challenges.

Catalysts

About Upstart Holdings- Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

- The implementation of Model 19, featuring the Payment Transition Model (PTM), has improved underwriting accuracy, which is likely to enhance loan approval rates and reduce default risks, positively impacting revenue and net margins.

- Upstart's HELOC product growth, driven by conversion improvements, cross-selling, and state expansion, positions it well for future revenue growth and margins with the potential to leverage its strong relationships with banks and credit unions for cost-effective funding.

- Improvements in small dollar relief loans, such as reduced origination costs, have expanded Upstart's borrower base and are expected to contribute to revenue growth, while the integration of small dollar repayment data will enhance the accuracy of underwriting models.

- Increased automation and personalization in servicing operations have reduced costs and improved borrower outcomes, which will likely improve net margins through operational efficiencies and lower default rates.

- Enhanced lending partner confidence, due to strong platform performance and capital market engagements, strengthens funding capabilities and sets the stage for increased origination volume, supporting earnings growth in the medium term.

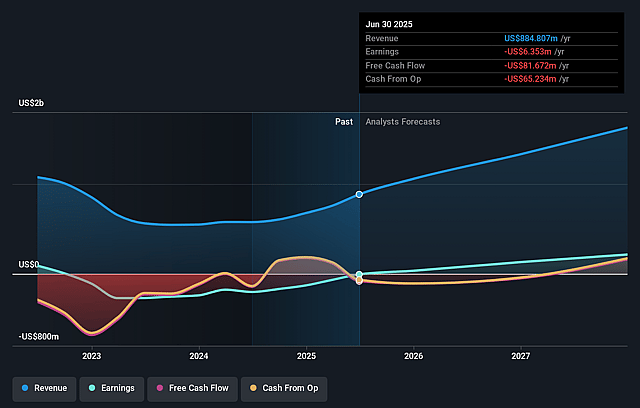

Upstart Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Upstart Holdings's revenue will grow by 27.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.7% today to 18.5% in 3 years time.

- Analysts expect earnings to reach $337.2 million (and earnings per share of $1.54) by about September 2028, up from $-6.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.1x on those 2028 earnings, up from -976.3x today. This future PE is greater than the current PE for the US Consumer Finance industry at 10.6x.

- Analysts expect the number of shares outstanding to grow by 5.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.32%, as per the Simply Wall St company report.

Upstart Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has faced periods of underperformance due to high default rates during macroeconomic volatility, potentially impacting future revenue and profit stability.

- There are concerns about maintaining consistent model accuracy, which is crucial for managing risk and ensuring profitability, due to potential gaps between predicted and actual default rates.

- The company's profitability is sensitive to macroeconomic changes, such as interest rate movements and macro indices (e.g., the Upstart Macro Index), which could affect earnings and net margins if conditions worsen.

- Although the company plans to reduce loans on its balance sheet, potential funding constraints could delay these efforts, affecting liquidity and net income.

- Investments in new product categories and marketing could pressure operating margins and net income if not managed properly against growth expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $80.846 for Upstart Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $337.2 million, and it would be trading on a PE ratio of 34.1x, assuming you use a discount rate of 8.3%.

- Given the current share price of $64.46, the analyst price target of $80.85 is 20.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.