Last Update03 Oct 25Fair value Decreased 1.07%

Costco’s analyst price target has been revised downward to $1,061 from $1,072. Analysts cite mixed quarterly results, persistent strength in sales and margin improvements, but continued caution given the stock’s elevated valuation multiples.

Analyst Commentary

Analyst sentiment toward Costco Wholesale remains divided after the latest quarterly results, as multiple firms updated their ratings and price targets. The following summarizes the most recent bullish and bearish takeaways from Street research.

Bullish Takeaways- Bullish analysts point to Costco’s consistent core comparable sales growth and strong traffic trends, even as the broader retail landscape remains challenging.

- Margin improvements and effective navigation of rising input costs highlight the company’s execution strengths. This supports its reputation as a defensive growth holding.

- The company’s scale, supply chain capabilities, and ongoing gains in market share are expected to reinforce its competitive position and support long-term growth.

- Renewal rates remain high and customer loyalty among higher-income demographics continues to drive stability in revenues and earnings.

- Bearish analysts remain cautious due to the stock’s elevated valuation multiples, which are considered high compared to many leading technology firms and leave little room for error.

- Recent quarters have shown some slowing in growth metrics, with certain margin figures modestly below consensus and U.S. same-store sales showing deceleration from peak growth rates.

- Some suggest the company’s premium valuation already reflects the quality of its offering, making the case that prospective returns may be limited unless further upside surprises are delivered.

- There is hesitation to recommend new positions because of the challenge in justifying a high multiple amid only incremental growth in core financial metrics.

What's in the News

- Costco has removed the Xbox section from its U.S. and U.K. websites. Nintendo and PlayStation products are still available online (TheGamer).

- Krispy Kreme is actively pursuing expansion into more big-box retailers, including Costco. The company aims to boost its national presence and meet rising consumer demand for wider doughnut availability (New York Times).

- Roth Capital maintains a Neutral rating on Costco. The firm notes that while sales results outpace peers, valuation remains high and U.S. same-store sales growth has slowed from 8% to 5.5% (Roth Capital).

Valuation Changes

- Consensus Analyst Price Target: Decreased modestly from $1,072.67 to $1,061.20, reflecting slight downward adjustments in fair value estimates.

- Discount Rate: Increased minimally from 6.78% to 6.79%, indicating a marginal rise in the required return on equity.

- Revenue Growth: The projected rate has moved higher, from 6.98% to 7.43%, suggesting slightly improved sales outlooks.

- Net Profit Margin: Increased from 3.17% to 3.22%, reflecting expectations for incremental improvements in profitability.

- Future P/E Ratio: Decreased from 55.62x to 52.11x, indicating a moderation in expected future valuation multiples.

Key Takeaways

- Expansion of warehouse locations and gas station hours aims to increase membership, store traffic, and revenue growth.

- E-commerce growth and international market investments could boost overall earnings and diversify sales.

- Rising costs from labor, tariffs, and supply chains, along with foreign exchange fluctuations, could pressure Costco's margins and market competitiveness.

Catalysts

About Costco Wholesale- Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

- Costco plans to continue expanding its warehouse locations, with 28 new openings planned for fiscal year 2025. This expansion is likely to increase membership and sales volume, driving revenue growth.

- Costco's extension of gas station hours is designed to enhance member convenience, which could lead to higher gasoline sales and increased store traffic, positively impacting revenue.

- The updated employee agreement with higher wages may initially increase SG&A expenses, but Costco's focus on labor productivity and cost discipline could help maintain net margins over time.

- E-commerce and digital channels show significant growth, with e-commerce comp sales up 22.2% adjusted for FX, suggesting a strong potential to boost revenue and earnings from online sales.

- Continued investment in international markets with new warehouse openings and the introduction of Executive Memberships in additional countries could further diversify and increase international sales, enhancing overall earnings potential.

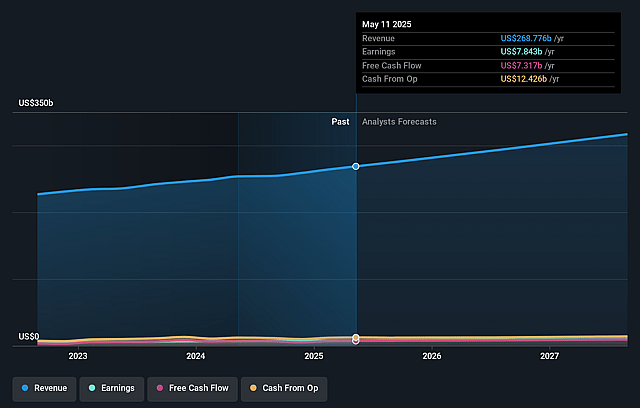

Costco Wholesale Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Costco Wholesale's revenue will grow by 7.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.9% today to 3.2% in 3 years time.

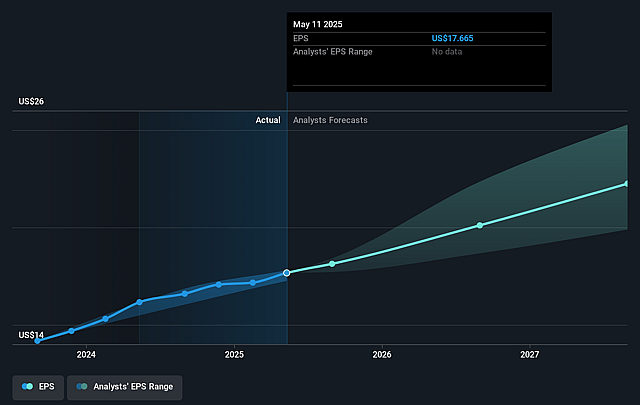

- Analysts expect earnings to reach $10.4 billion (and earnings per share of $23.52) by about September 2028, up from $7.8 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $8.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 55.6x on those 2028 earnings, up from 55.4x today. This future PE is greater than the current PE for the US Consumer Retailing industry at 21.7x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Costco Wholesale Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Foreign exchange fluctuations have negatively impacted Costco's international sales and profits, introducing uncertainty into net income and earnings.

- Increased labor costs due to the updated employee agreement could pressure margins, as Costco plans to improve wages significantly over the next few years.

- Tariff unpredictability and potential trade tensions, especially with a significant portion of sales being imports, could impact future costs and profit margins adversely.

- Supply chain cost increases, as Costco invests in maintaining higher inventory levels amidst global delays, could exert pressure on core operating margins.

- Rising competition from other retailers might impact market share and revenues, especially if they struggle to maintain price leadership amidst inflationary pressures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $1072.667 for Costco Wholesale based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $1225.0, and the most bearish reporting a price target of just $620.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $329.0 billion, earnings will come to $10.4 billion, and it would be trading on a PE ratio of 55.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of $979.25, the analyst price target of $1072.67 is 8.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.