Last Update17 Oct 25Fair value Decreased 1.52%

Coterra Energy's consensus analyst price target has edged slightly lower by $0.50 to $32.29. Analysts cite ongoing pressure from weaker natural gas prices and modestly lowered sector expectations, despite resilient operational performance and positive long-term demand trends for U.S. gas.

Analyst Commentary

Bullish Takeaways- Bullish analysts highlight potential structural changes in the U.S. gas market that could lift price floors and reduce sector risk over the next decade. This supports long-term growth prospects for natural gas equities.

- Coterra's operational execution remains resilient. Recent production has surpassed expectations, and updated guidance indicates higher capital expenditures and increased output for 2025.

- Cost efficiencies and ongoing debt reduction have contributed to a strong balance sheet. This supports a low reinvestment rate relative to peers and maintains attractive valuation metrics.

- Growing demand from LNG exports and rising power needs from datacenters are positioned to provide fundamental support to U.S. gas demand and, in turn, to Coterra's future earnings growth.

- Bearish analysts are concerned that persistent oversupply conditions in natural gas may keep Henry Hub prices subdued well into 2026. This could weigh on cash flow and sector sentiment.

- Recent downward revisions to price targets reflect cautious outlooks on gas and NGL realizations. Expectations for Q3 cash flow are projected to fall below the market consensus.

- Updated forecasts, while sometimes still above consensus, have been characterized as "disappointing" relative to earlier margin indicators. This has led to more conservative valuation assumptions.

- The sector continues to face supply and demand imbalances. Improvement in fundamentals may be delayed until supply growth is meaningfully constrained.

What's in the News

- Wells Fargo initiated coverage on Coterra Energy with an Overweight rating and a $33 price target. The firm cited the potential for structural changes in U.S. gas markets to lift price floors and reduce risk. Growing demand from LNG exports and datacenters is expected to benefit gas equities (Wells Fargo).

- Coterra Energy has completed the repurchase of 35.58 million shares, totaling $911.19 million since the buyback program was announced in February 2023 (Company filing).

- The company has revised its 2025 production guidance upward, with a new midpoint of 768 MBoepd for total equivalent production and 2,913 MMcfpd for gas. Both figures are above earlier projections (Company guidance).

- For the quarter ended June 30, 2025, Coterra reported strong year-over-year growth in production across natural gas, oil, and NGLs (Company results).

Valuation Changes

- Consensus Analyst Price Target: Slightly decreased from $32.79 to $32.29, reflecting a $0.50 reduction.

- Discount Rate: Increased slightly from 7.03% to 7.04%, indicating a marginal increase in perceived risks or return expectations.

- Revenue Growth: Increased marginally from 14.50% to 14.51%, signaling a modest improvement in growth projections.

- Net Profit Margin: Increased significantly from 19.31% to 23.06%, suggesting a stronger profitability outlook.

- Future P/E: Declined from 18.87x to 15.56x, indicating the stock is viewed as more attractively valued relative to future earnings.

Key Takeaways

- Expanding production, technological advances, and a diversified commodity mix position the company for stable cash flow, durable growth, and reduced earnings volatility.

- Efficient capital allocation, inventory depth, and a focus on shareholder returns support long-term financial sustainability and create value for investors.

- Persistently low gas prices, operational risks, regulatory pressures, and inventory decline threaten Coterra's margins and growth, despite efforts to expand production and diversify sales.

Catalysts

About Coterra Energy- An independent oil and gas company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States.

- Coterra's strategic focus on consistently expanding both oil and gas production across the Permian, Marcellus, and Anadarko enables the company to capture rising global energy demand-especially with supportive trends like LNG export growth and US power generation relying on natural gas-positioning revenue for durable growth.

- The deployment of advanced drilling and completion technologies, including successful wellbore redesigns, simul-frac fleets, and longer laterals, has reduced per-foot costs (notably a 12% YoY cost drop in the Permian) and improved capital efficiency, creating sustainable improvements in net margins and free cash flow.

- The company's diversified commodity mix and focus on differentiated, higher-value marketing strategies (such as long-term gas sales to power plants and select LNG contracts) help stabilize cash flow and realized prices, mitigating earnings volatility and expanding gross margins through commodity cycles.

- Coterra's substantial Tier 1 inventory and ongoing delineation of new zones across its asset base mean the company can continue to allocate capital efficiently at low reinvestment rates, supporting long-term production sustainability and above-average returns on invested capital, which underpin positive outlooks for earnings and free cash flow.

- Prudent capital allocation, as seen by prioritizing rapid deleveraging followed by anticipated increases in share buybacks and dividends, enhances the EPS growth profile and shareholder value creation, particularly as the balance sheet strengthens and more free cash flow is directed to shareholder returns.

Coterra Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Coterra Energy's revenue will grow by 15.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 25.3% today to 19.5% in 3 years time.

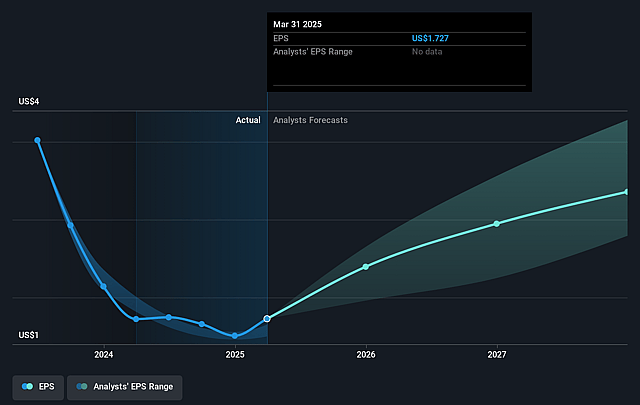

- Analysts expect earnings to reach $1.9 billion (and earnings per share of $2.64) by about September 2028, up from $1.6 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $3.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.6x on those 2028 earnings, up from 11.5x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to grow by 3.6% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.19%, as per the Simply Wall St company report.

Coterra Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's expanded activity in the Marcellus and increasing natural gas production guidance comes amid ongoing weakness and volatility in natural gas prices, and there is risk of oversupply in the U.S. market; if structural low prices persist, this could compress long-term revenues and net margins.

- Despite recent successes in remediation, mechanical and pressure issues in Culberson (Windham Harkey wells) have not fully resolved, and original predrill oil volumes may not be achieved, suggesting operational risks and potential underperformance in future output and cash flow durability.

- Management's expectation that federal lease sales in New Mexico will meaningfully add to the asset base hinges on winning competitive bids in an environment of rising acreage prices and new regulations, which could inflate acquisition and compliance costs, impacting future capital efficiency and earnings.

- Growing focus on differentiated power and LNG sales is positive, but Coterra repeatedly emphasizes unwillingness to commit to long-term in-basin pricing or infrastructure expansion without price premiums; this may limit market access and flexibility as demand growth increasingly comes from outside core basins, risking lost revenue opportunities if the global energy transition accelerates.

- Plans for steady production growth and robust free cash flow are premised on "stable operational cadence" and high-quality inventory, yet management acknowledges that a future decline in Tier 1 inventory will increase cost structures; if Coterra cannot replace reserves fast enough or if key wells underperform, this would raise costs and depress margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $33.4 for Coterra Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $27.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $9.6 billion, earnings will come to $1.9 billion, and it would be trading on a PE ratio of 18.6x, assuming you use a discount rate of 7.2%.

- Given the current share price of $23.85, the analyst price target of $33.4 is 28.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.