Last Update 28 Nov 25

Fair value Decreased 7.75%HUN: Shares Will Face Pressure As Dividend Reduction Risks Rise This Year

Analysts have lowered their price target for Huntsman to $9.62 from $10.42 per share. They cite weaker MDI market performance and continued softness in key end markets as the primary factors behind the revision.

Analyst Commentary

Recent Street research reflects a mix of cautious and optimistic perspectives regarding Huntsman’s prospects. Analysts note developments in end-market performance, regional dynamics, and execution risks as key valuation factors.

Bullish Takeaways- Bullish analysts see continued Overweight ratings based on the potential for improvement despite current headwinds. This indicates some confidence in the company’s longer-term positioning.

- Recent price targets, while lowered, remain above the company’s current trading levels according to some analysts. This suggests that expectations for recovery or operational improvements are factored into outlooks.

- Despite market softness, upward movement in Huntsman’s shares following recent earnings is viewed as a sign that some investors anticipate stabilization or renewed growth if macro conditions improve.

- Bearish analysts point to sustained weakness in MDI markets and soft macroeconomic indicators such as housing and consumer demand. These factors weigh heavily on valuations and near-term forecasts.

- Multiple price target reductions, including significant cuts to below $10, reflect expectations for further downside risk due to execution concerns and end-market dependence.

- Some warn that Huntsman’s dividend could face increased risk of being lowered, adding to investor concerns over income sustainability.

- Ongoing competition from overseas suppliers, particularly in polyurethane chemicals, is believed to pressure market share and limit near-term growth opportunities.

What's in the News

- Huntsman Corporation's Board of Directors has declared a $0.0875 per share cash dividend on its common stock. The dividend is payable on December 31, 2025, to stockholders of record as of December 15, 2025 (Key Developments).

Valuation Changes

- Consensus Analyst Price Target: Decreased from $10.42 to $9.62, reflecting a more cautious near-term outlook.

- Discount Rate: Lowered marginally from 10.13% to 10.06%, indicating a modest reduction in perceived risk.

- Revenue Growth: Revised downward from 3.47% to 2.91%, signaling slightly weaker growth expectations.

- Net Profit Margin: Increased from 1.45% to 2.02%, suggesting improved profitability assumptions despite other headwinds.

- Future P/E: Decreased notably from 25.94x to 17.72x, as lower forward earnings multiples are being applied.

Key Takeaways

- Shift toward specialty chemicals and eco-friendly products is expected to improve margins, strengthen market position, and reduce earnings volatility.

- Efficiency measures and strategic asset closures are aimed at boosting free cash flow and enhancing profitability as markets recover.

- Sustained overcapacity, high European costs, weak end-markets, volatile input prices, and economic uncertainty are driving margin compression and persistent earnings instability.

Catalysts

About Huntsman- Manufactures and sells diversified organic chemical products worldwide.

- Demand for Huntsman's advanced materials and polyurethane-based products is expected to benefit from accelerating global trends in sustainability, energy efficiency, and lightweighting-especially as infrastructure and construction activity resumes, and the EV/clean tech markets expand. This supports potential for higher long-term revenue growth and greater market share.

- The company is actively transforming its portfolio away from lower-margin, commodity chemicals toward specialty chemicals (e.g., adhesives, elastomers, aerospace composites), aiming to further improve EBITDA margins and overall profitability in future cycles.

- Cost optimization, working capital discipline, and strategic asset closures (e.g., the maleic anhydride facility in Europe) are expected to enhance free cash flow generation and support improved net margins and earnings resilience during the next macro upturn.

- Resumption of aerospace build rates and normalization in downstream end markets such as electronics and automotive are positioned to drive earnings recovery as macro conditions improve, providing upside to mid-cycle EBITDA levels.

- Ongoing tightening of environmental regulations and heightened customer demand for sustainable, eco-friendly solutions is likely to reinforce Huntsman's pricing power and reduce cyclicality-positively impacting revenues and supporting long-term margin expansion.

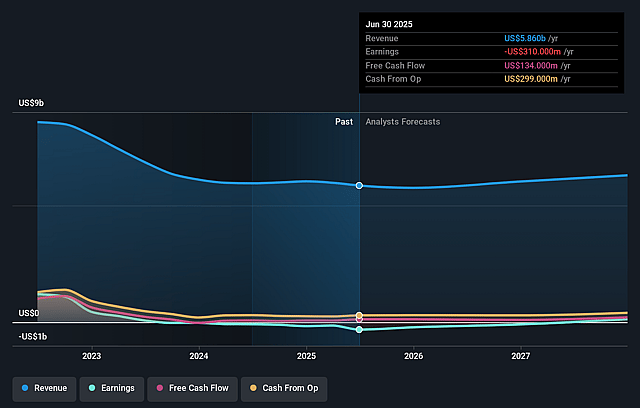

Huntsman Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Huntsman's revenue will grow by 2.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -5.3% today to 0.7% in 3 years time.

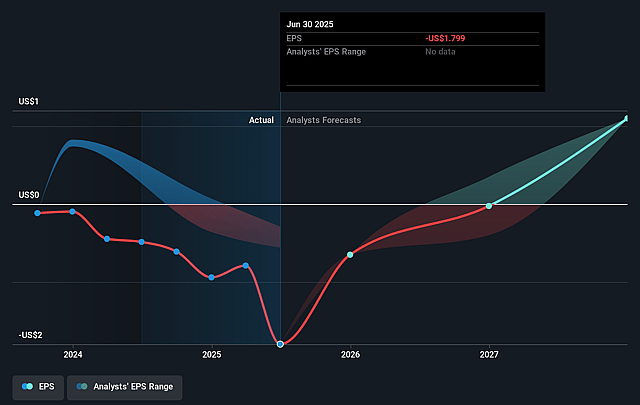

- Analysts expect earnings to reach $43.7 million (and earnings per share of $1.1) by about September 2028, up from $-310.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 60.0x on those 2028 earnings, up from -6.1x today. This future PE is greater than the current PE for the US Chemicals industry at 25.7x.

- Analysts expect the number of shares outstanding to grow by 0.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.84%, as per the Simply Wall St company report.

Huntsman Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged overcapacity in the global MDI/polyurethanes market, particularly from new or existing Chinese and European production, could keep utilization rates depressed (in the 80% range), resulting in persistent pricing pressure and limiting Huntsman's ability to expand revenue and restore net margins to historical levels.

- Intensified competition in Europe, where competitors are pursuing a volume-over-value strategy, is creating the company's highest production costs and lowest product values worldwide, risking further margin compression and sustained EBITDA weakness.

- Weakness in construction and housing end-markets, especially in North America and Europe, compounded by high interest rates and consumer uncertainty, is resulting in low volumes and an anemic sales environment, hampering revenue growth and prolonging earnings stagnation.

- Exposure to high, volatile raw material and energy costs in Europe, as demonstrated by the closure of energy-intensive facilities and persistent viability challenges for Huntsman's Rotterdam operations, puts further downward pressure on operating margins and threatens the profitability of the European footprint.

- Limited visibility on recovery timing, continued trade uncertainty (including tariffs and shifting import patterns), and muted customer confidence across end markets all create prolonged revenue instability and earnings volatility, making it difficult for Huntsman to deliver consistent financial improvements over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.231 for Huntsman based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.4 billion, earnings will come to $43.7 million, and it would be trading on a PE ratio of 60.0x, assuming you use a discount rate of 9.8%.

- Given the current share price of $10.82, the analyst price target of $11.23 is 3.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.