Last Update 14 Jan 26

Fair value Increased 47%BlackGoat has increased profit margin from 20.0% to 28.0%, decreased future PE multiple from 30.0x to 24.0x and decreased shares outstanding growth rate from 0.0% to 0.0%.

Company Overview

Micron Technology (MU) is a global leader in memory and storage solutions, specialising in DRAM, NAND, and NOR flash memory. As the sole U.S.-based manufacturer of these critical components, the company holds a significant strategic position. Its products are essential building blocks for a vast range of modern technologies, from data centers powering the AI revolution to mobile devices and advanced automotive systems.

What makes Micron interesting is its pivotal role in the AI supercycle. The company is perfectly positioned to capitalize on the insatiable demand for High-Bandwidth Memory (HBM), a high-margin product essential for training and deploying AI models. This structural shift has the potential to fundamentally change the company's historical reliance on volatile consumer electronics markets.

Fundamentals

Micron's financial health is a classic reflection of the memory market's cyclical nature. While fiscal year 2023 saw a sharp revenue decline to $15.5 billion due to a severe industry downturn, a powerful recovery is now underway, culminating in a record-breaking fiscal year 2025. For fiscal 2025, Micron's revenue surged nearly 50% year-over-year to $37.4 billion, with gross margins expanding an impressive 17 percentage points to 41% .

The company has a solid balance sheet and is in a period of strong growth. This is driven by an improving supply-demand balance and a decisive upturn in pricing for both DRAM and NAND. The shift towards high-margin AI products is evident in the company's results: the data center segment accounted for 56% of total revenue in fiscal 2025 with a 52% gross margin, and HBM revenue reached an annualized run rate of nearly $8 billion.

Growth Catalysts

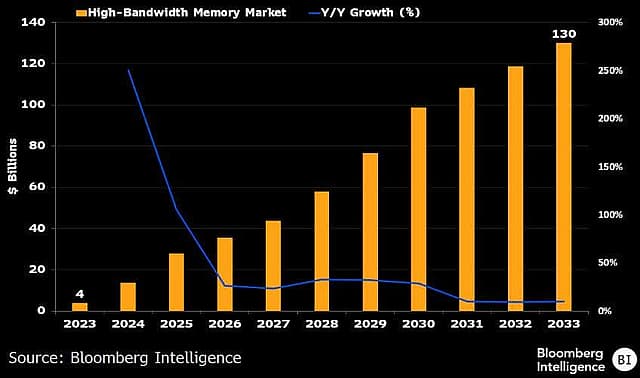

- The AI Supercycle: This is the most powerful catalyst. The demand for next-generation HBM is unprecedented. Micron has successfully passed NVIDIA's quality verification for its HBM3E products, becoming a key supplier for the next-generation "Blackwell" AI accelerator . The company is now shipping high-volume HBM to four major customers across both GPU and ASIC platforms . With its entire 2025 production capacity already sold out, analysts project the HBM market will grow from roughly $30 billion in 2025 to a staggering $100 billion by 2030, representing a massive runway for growth.

- Competitive Positioning: Outpacing Samsung and SK Hynix: Micron's HBM market share has surged to 21% in Q2 2025 (up from 4% in 2024), challenging SK Hynix's 62% dominance. Samsung, once a leader, has seen its share drop to 17% due to yield issues and export restrictions. Micron's advantages include:

- Technological Leadership: Micron's 12-high HBM3E stacks and early HBM4 sampling outpace SK Hynix's 12-high HBM3E and Samsung's HBM3E.

- Customer Relationships: Micron's HBM is embedded in NVIDIA's B200 and AMD's MI350X, securing long-term demand from AI's top accelerators.

- Yield Improvements: Micron's EUV lithography in DRAM production has boosted bit density by 30% and reduced power consumption by 20%, a differentiator in energy-conscious AI workloads.

- Favorable Market Dynamics: The memory industry is in a strong cyclical upturn. Production cuts and increasing demand, amplified by the AI boom, are driving up prices for both DRAM and NAND. This dual-tailwind of a cyclical recovery and a structural AI shift creates a highly favorable environment.

- Government Support: As a key U.S. technology company, Micron is a major beneficiary of the CHIPS and Science Act. It has been awarded $6.1 billion in federal grants to support its plans to invest $50 billion in new U.S. manufacturing facilities. This de-risks capital-intensive expansion and provides a long-term competitive advantage.

Risks

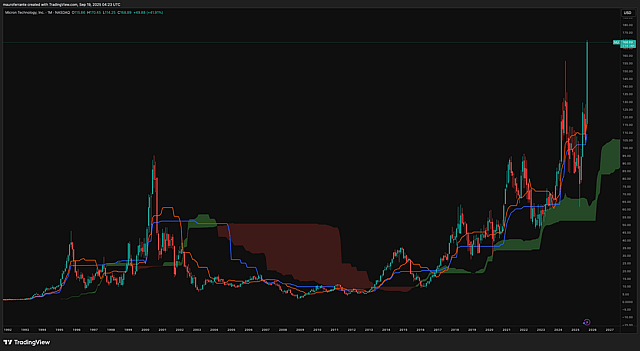

- Inherent Industry Cyclicality: Despite the current supercycle, the risk of oversupply and a subsequent price collapse remains a persistent threat. The industry has a long history of boom-and-bust cycles that have led to steep revenue declines and losses.

- Intense Competition: Micron operates in a tight oligopoly with two larger, well-capitalized rivals: Samsung and SK Hynix. While Micron is making rapid strides, the competition remains fierce. In the second quarter of 2025, its HBM market share surged to 21%, a significant jump from just 4% in 2024. However, it still trails market leader SK Hynix, which holds a dominant 62% share, while Samsung's share has fallen to 17% amid yield issues and export restrictions. Micron has stated its ambition to capture a market share in the 23-24% range by the end of 2025, but the battle for this lucrative market could lead to price wars and margin erosion.

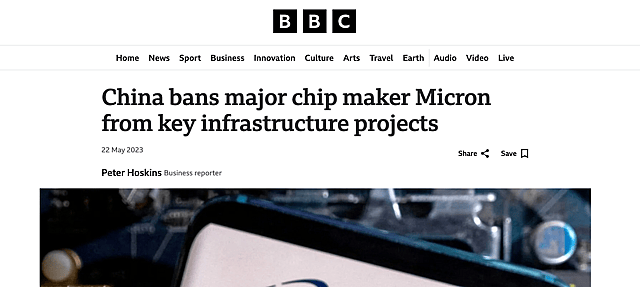

- Geopolitical Headwinds: As a U.S.-based company, Micron is at the epicenter of U.S.-China technological tensions. The most direct risk is a potential repeat of China's May 2023 action, which banned Micron products from critical infrastructure projects, impacting the company's revenue in the key market.

Valuation

In conclusion, Micron Technology stands at a fascinating crossroads where the promise of a powerful, AI-driven supercycle meets the persistent risks of a volatile industry. The core investment thesis is a bet that the structural, long-term demand for high-performance memory, particularly HBM, will be strong enough to fundamentally change the company's profitability and mitigate the historical boom-and-bust cycles. While the current environment of rising prices and immense AI demand is highly favorable, investors must weigh this against the significant challenges, including fierce competition from rivals like Samsung and SK Hynix, and the unpredictable nature of geopolitical tensions. Ultimately, Micron is a compelling, high-beta opportunity for investors who believe in the enduring power of AI and are prepared to navigate the significant volatility inherent in the semiconductor memory sector.

Fair Value Assumptions

- Revenue growth: ~14% per year

- Net profit margin: ~20% within 5 years

- Forward P/E (5 years out): ~30x

Based on these assumptions, I estimate a fair value of around $200 per share, compared to the current market price of ~$160. My own average entry price is $110, which provides a meaningful margin of safety. That said, given the current momentum and market enthusiasm around AI, the stock could well overshoot this fair value target in the short term, though such levels may be difficult to sustain over the long run.

Have other thoughts on Micron Technology?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

BlackGoat is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. BlackGoat has a position in NasdaqGS:MU.. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.