Last Update 27 Nov 25

Fair value Decreased 0.42%PAYX: Acquisition Synergy Will Boost Solution Suite And Support Margin Resilience

The analyst price target for Paychex has edged down slightly, with the fair value estimate decreasing by $0.57 to $134.14. Analysts cite ongoing macroeconomic concerns and mixed signals from recent earnings results as key factors behind the adjustment.

Analyst Commentary

Recent analyst commentary reflects a balanced view on Paychex, with varying opinions regarding the company’s valuation, growth prospects, and execution in the current macroeconomic climate.

Bullish Takeaways- Bullish analysts see the acquisition of Paycor as expanding Paychex's suite of solutions, providing a stronger competitive position within the human capital management sector.

- The company maintains a premium valuation, supported by an industry-leading margin and free cash flow profile that is viewed as justified given Paychex's market position.

- Ongoing stability in the core operating environment is recognized, even as more optimistic analysts remain optimistic about the long-term impact of recent strategic moves.

- There are expectations that secular trends such as demand for payroll, workforce management, and HR outsourcing could support multiple expansion over the medium term.

- Bearish analysts highlight potential risks from macroeconomic weakness and rising unemployment, which could lead to revenue softness and cyclicality in performance.

- The company’s organic growth, including recurring revenue growth from Paycor, has underperformed expectations, prompting caution on future growth acceleration.

- Some see the current environment, characterized by lower interest rates and uncertain labor markets, as a challenging period for payroll outsourcing stocks, resulting in more conservative ratings and price targets.

- Questions remain about Paychex's ability to meet guidance in the second half of the year, especially as ramping up performance appears difficult amid mixed quarterly results.

What's in the News

- Paychex introduced participant Event Notifications, an AI-powered tool for financial advisors that provides real-time alerts on key retirement plan milestones. This tool is designed to enhance advisor engagement and participant outcomes. The new product is part of several updates to the Paychex Flex Advisor Console and participant portal (Key Developments).

- The company reaffirmed its fiscal year 2026 outlook, raising its earnings expectation while maintaining projected total revenue growth of between 16.5% and 18.5% (Key Developments).

- Paychex completed a share repurchase tranche, buying back 1,100,000 shares for $160.1 million from June to August 2025. The company has bought back 0.54% of shares under its current program since January 2024 (Key Developments).

- Nayya and Paychex announced a strategic partnership to deliver AI-driven, personalized benefits guidance through the Paychex platform. This collaboration aims to enhance employee engagement and benefits utilization (Key Developments).

- Paychex launched a new financial management and accounts payable solution, Bill Pay, Powered by BILL. This solution integrates payroll, HR, and bill payments for SMBs through Paychex Flex, streamlining operations and providing automated payment options (Key Developments).

Valuation Changes

- Fair Value Estimate decreased modestly from $134.71 to $134.14.

- Discount Rate increased slightly from 7.18% to 7.39%.

- Revenue Growth remained essentially unchanged at approximately 8.77%.

- Net Profit Margin held steady, with no meaningful change, at about 31.09%.

- Future Price-to-Earnings Ratio edged up slightly from 25.68x to 25.73x.

Key Takeaways

- The acquisition of Paycor is expected to enhance Paychex's market position through an expanded customer base and improved revenue opportunities.

- Investments in technology and AI focus could boost efficiency, client retention, and revenue growth, strengthening the company’s overall performance.

- Integration challenges with Paycor and rising employee costs threaten margins, while reliance on relief programs underscores revenue vulnerabilities amidst uncertain economic conditions.

Catalysts

About Paychex- Provides integrated human capital management solutions (HCM) for payroll, benefits, human resources (HR), and insurance services for small to medium-sized businesses in the United States, Europe, and India.

- The pending acquisition of Paycor is expected to strengthen Paychex's competitive position by expanding its customer base and offering a more comprehensive HCM portfolio, which could drive revenue growth through cross-selling opportunities.

- Investments in automation and technology are boosting efficiency, resulting in an increased operating margin, with further potential margin improvements anticipated from cost synergies over $80 million from the Paycor acquisition.

- Paychex's focus on AI-driven solutions, like the new Gen AI-powered HR Copilot tool, is likely to enhance client engagement and operational efficiency, which could positively impact earnings and net margins.

- The improved client retention rates and decreased client losses signal a strong value proposition, supporting stable revenue streams and potential revenue growth as the company retains more high-value clients.

- The strategic focus on expanding sales coverage and investment in product development post-Paycor acquisition is expected to drive future revenue growth and enhance overall company performance.

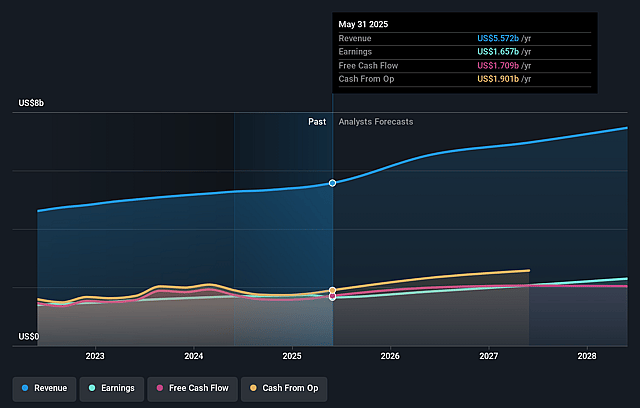

Paychex Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Paychex's revenue will grow by 10.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 29.7% today to 30.8% in 3 years time.

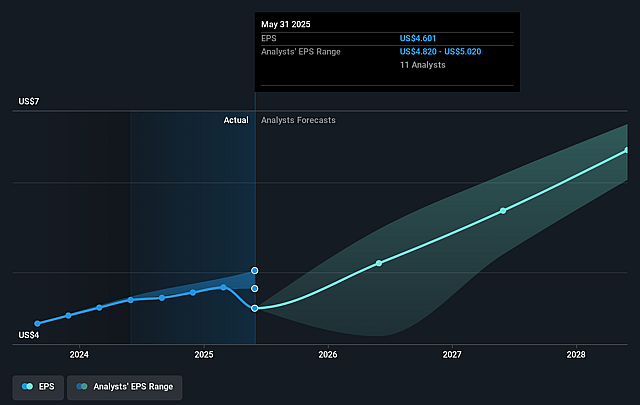

- Analysts expect earnings to reach $2.3 billion (and earnings per share of $6.36) by about September 2028, up from $1.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.3x on those 2028 earnings, down from 29.2x today. This future PE is greater than the current PE for the US Professional Services industry at 26.3x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.18%, as per the Simply Wall St company report.

Paychex Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acquisition of Paycor, while expected to bring synergies, involves risks such as integration challenges and potential execution missteps, which could impact net margins and earnings.

- The expiration of the Employee Retention Tax Credit (ERTC) program is no longer a headwind, but past reliance on such programs highlights potential vulnerabilities in revenue growth without similar government relief programs.

- Market conditions including elevated employee costs and clients opting for lower-cost health plans, particularly in Florida, create revenue headwinds and may not pass through to earnings, affecting net margins.

- Changes in client behavior, such as increased shopping for health coverage due to inflation and smaller deal sizes, could affect future revenue and client retention rates.

- The ongoing macroeconomic uncertainty, including moderate U.S. job growth and small business confidence, could impact checks per client, leading to potential stagnation in revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $146.583 for Paychex based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $160.0, and the most bearish reporting a price target of just $122.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.5 billion, earnings will come to $2.3 billion, and it would be trading on a PE ratio of 28.3x, assuming you use a discount rate of 7.2%.

- Given the current share price of $134.41, the analyst price target of $146.58 is 8.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.