Last Update 11 Dec 25

Fair value Increased 4.16%TER: AI Test Demand And Robotics Expansion Will Drive Measured Upside Through 2027

Analysts have lifted their fair value estimate for Teradyne from $184.69 to $192.38, citing stronger multiyear AI testing demand, improving revenue growth and margins, and higher expected future earnings power reflected in a richer forward P E multiple.

Analyst Commentary

Recent Street research updates point to a sharp improvement in sentiment around Teradyne, with multiple firms raising price targets and, in some cases, upgrading ratings as AI driven test demand and Industrial Automation momentum become more visible through 2026 and beyond.

Bullish Takeaways

- Bullish analysts highlight Teradyne's growing role in AI compute and high bandwidth memory testing, arguing that increasing complexity and capacity needs support structurally higher revenue growth and a premium valuation multiple.

- Several models have been revised to reflect multi year acceleration in demand from leading foundries and OSAT partners, with higher out year EPS estimates underpinning price targets that now cluster around the high $100s to low $200s.

- The ramp in GPU wafer sort and SoC testing is seen as a key catalyst, with checks suggesting share gains at top tier manufacturers that could provide upside to consensus through 2026.

- Improving trends in Industrial Automation, including robotics deployments in large e commerce and warehouse environments, are viewed as a complementary growth driver that diversifies the earnings base and supports a richer forward P E.

Bearish Takeaways

- Bearish analysts caution that expectations for wafer fab equipment spending in 2026 may already be elevated, leaving less room for upside if AI driven investment normalizes or is delayed.

- Some remain hesitant to fully embed aggressive sales and EPS revisions, instead expanding valuation multiples on anticipated AI test demand, which increases sensitivity to execution risk and any slowdown in order momentum.

- There are lingering concerns that near term optimism from industry checks could prove overstated if memory and smartphone recoveries proceed more gradually than current forecasts assume.

- Despite higher price targets, a subset of more cautious views suggests that the current share price already discounts a substantial portion of the multi year AI and automation growth story, limiting risk reward asymmetry.

What's in the News

- Teradyne Robotics will open a new U.S. Operations Hub in Wixom, Michigan in 2026, expanding cobot manufacturing, adding potential AMR production, and creating over 200 jobs to support rising North American automation demand (Business Expansions).

- The company completed the repurchase of 10,780,000 shares, or 6.81% of shares outstanding, for $1.12 billion under its January 26, 2023 buyback program, including $246 million spent in the latest tranche (Buyback Tranche Update).

- Teradyne issued fourth quarter 2025 guidance, forecasting revenue of $920 million to $1.0 billion and GAAP diluted EPS of $1.12 to $1.39 (Corporate Guidance).

- Michelle Turner was appointed Chief Financial Officer effective November 3, 2025, succeeding long serving CFO Sanjay Mehta, who will remain as an executive advisor before retiring in 2026 (Executive Changes).

- Teradyne launched several new test platforms, including the ETS-800 D20 for power semiconductors, the Titan HP system level test platform for AI and cloud devices, and the UltraPHY 224G solution for next generation high speed PHY testing in data center and silicon photonics markets (Product Related Announcements).

Valuation Changes

- The Fair Value Estimate has risen slightly from $184.69 to $192.38 per share, reflecting modestly higher long term earnings expectations.

- The Discount Rate has edged down marginally from 10.45% to 10.43%, implying a slightly lower assumed cost of capital.

- Revenue Growth has increased slightly in the model from 16.94% to 17.01%, indicating a small uplift in projected top line expansion.

- The Net Profit Margin has improved marginally from 24.07% to 24.12%, signaling a modest enhancement in long term profitability assumptions.

- The future P E multiple has risen slightly from 32.10x to 33.29x, suggesting a higher expected valuation level on forward earnings.

Key Takeaways

- Strategic focus on AI, robotics, and semiconductor automation aims to drive significant future revenue and net margin improvement.

- Quantifi Photonics acquisition and share buyback plan reflect confidence in earnings growth and market position strengthening.

- Geopolitical and economic factors including tariffs are causing uncertainty, potentially impacting Teradyne's revenue, margins, and financial performance across multiple segments.

Catalysts

About Teradyne- Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

- Teradyne expects significant future growth potential from AI accelerators, robotics, and semiconductor automation, which are being driven by long-term industry themes such as AI, verticalization, and electrification. These areas are likely to boost future revenue.

- The acquisition of Quantifi Photonics is anticipated to strengthen Teradyne’s position in silicon photonics testing, potentially enhancing revenue growth in semiconductor testing markets.

- Teradyne’s strategic initiatives in robotics and its recent structural reorganization aim to lower the operating breakeven, thus potentially improving net margins in the future as market conditions improve.

- The significant share buyback plan, up to $1 billion through the end of 2026, indicates confidence in future earnings and free cash flow generation, which could drive EPS growth.

- New opportunities in production board test for AI compute and new mobile testing enhancements demonstrate potential for diversification and revenue growth, particularly as demand recovers for more advanced and complex technologies.

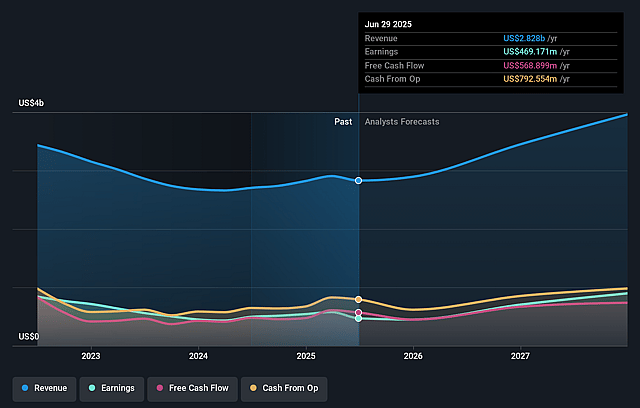

Teradyne Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Teradyne's revenue will grow by 13.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.6% today to 23.2% in 3 years time.

- Analysts expect earnings to reach $952.0 million (and earnings per share of $6.28) by about September 2028, up from $469.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.1 billion in earnings, and the most bearish expecting $684.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.0x on those 2028 earnings, down from 39.0x today. This future PE is lower than the current PE for the US Semiconductor industry at 33.5x.

- Analysts expect the number of shares outstanding to decline by 2.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.98%, as per the Simply Wall St company report.

Teradyne Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tariffs and trade policies are creating uncertainty among Teradyne's customers in the mobile, automotive, and industrial segments, potentially reducing demand and impacting future revenue projections.

- Limited visibility beyond the second quarter due to geopolitical factors might lead to unpredictability in earnings and revenue forecasts.

- Robotics revenue has declined both sequentially and year-over-year, with challenging macro conditions being a persistent headwind, potentially affecting net margins and operational outcomes.

- Fluctuating product mix and volume could lead to variations in gross margins, especially concerning future semiconductor test needs and possible shifts in demand for HBM test capacity.

- The continuity of economic factors such as tariffs and trade policy might impact not only end market demand but also cost structures, thereby affecting net profit margins and overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $116.062 for Teradyne based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $133.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.1 billion, earnings will come to $952.0 million, and it would be trading on a PE ratio of 24.0x, assuming you use a discount rate of 10.0%.

- Given the current share price of $115.07, the analyst price target of $116.06 is 0.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Teradyne?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.