Last Update 03 Nov 25

Fair value Increased 2.93%Valero Energy's analyst price target has risen from $175.63 to $180.78. This increase reflects analysts' optimism following a strong earnings report and continued favorable outlooks for refining margins and capital returns.

Analyst Commentary

Recent research commentary on Valero Energy reflects a positive shift in sentiment among major analysts, with several prominent firms boosting their price targets and maintaining favorable outlooks following the company's latest quarterly results. These perspectives highlight both supportive drivers for the stock and potential risks to monitor going forward.

Bullish Takeaways

- Bullish analysts have raised price targets following strong quarterly earnings, with several now valuing the company well above previous estimates.

- Return of capital initiatives are seen as a key driver of relative performance, positioning Valero as a sector standout, particularly in dividend growth, even across varying commodity scenarios.

- Expectations for refining margins remain constructive, with the global refined products market still tight and distillate supplies entering winter at lower-than-average levels. This could potentially support continued margin strength.

- Valero is viewed as well positioned to benefit from ongoing structural upcycles in the refining sector, with solid execution supporting a favorable earnings outlook into 2026.

Bearish Takeaways

- Analysts note ongoing debates around supply and demand, which could result in near-term volatility in refining margins and stock valuations.

- Forward demand indicators are described as soft, raising questions about the sustainability of above-trend earnings in future quarters.

- Certain projections for upcoming quarters suggest earnings may come in slightly below consensus, signaling the possibility of performance normalization after outsized beats.

What's in the News

- Wells Fargo initiated coverage of Valero Energy with an Overweight rating and set a $216 price target. The bank cited industry-wide caution as an opportunity and highlighted Valero as a dividend growth leader (Periodical).

- Valero's Board of Directors appointed Homer Bhullar as Chief Financial Officer, effective January 1, 2026. He will succeed Jason Fraser, who will retire at year-end (Key Development).

- Between July and September 2025, Valero repurchased over 5.6 million shares for $920.61 million and completed its 2023 buyback program, totaling nearly 9.52 percent of shares outstanding (Key Development).

Valuation Changes

- Consensus Analyst Price Target: Increased from $175.63 to $180.78, indicating a modest upward adjustment in valuation.

- Discount Rate: Marginally decreased from 6.97% to 6.97%, reflecting slightly lower perceived risk.

- Revenue Growth: Declined moderately from -0.28% to -0.29% year-over-year, which signals a slightly more negative growth outlook.

- Net Profit Margin: Improved from 3.07% to 3.32%, showing stronger profitability expectations.

- Future P/E: Dropped from 17.60x to 15.69x, suggesting shares are now expected to be valued at a lower multiple of future earnings.

Key Takeaways

- Strategic investments and a strong balance sheet may boost future earnings through growth and higher-value product yields.

- Shareholder returns could improve from increased dividends and buybacks, while renewable diesel segment earnings benefit from market factors.

- Asset impairments, renewable segment struggles, operational cost pressures, and regulatory uncertainties threaten Valero's financial stability and profitability.

Catalysts

About Valero Energy- Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

- The SEC unit optimization project at St. Charles, expected to start up in 2026, is projected to increase the yield of high-value products, potentially boosting future revenues and earnings.

- Anticipated tight product supply and demand balances, with low product inventories, are expected to support refining fundamentals during the driving season, possibly enhancing refining margins and revenues.

- A strong balance sheet and $5.3 billion of available liquidity provide Valero with operational and financial flexibility to invest in growth and optimization projects, potentially improving future earnings.

- The potential for higher D4 RIN prices and an increase in the RIN obligation could positively impact the renewable diesel segment's earnings by improving margins.

- Continued commitment to capital discipline and shareholder returns, such as the 6% increase in the quarterly cash dividend, could support per-share earnings growth through ongoing share buybacks.

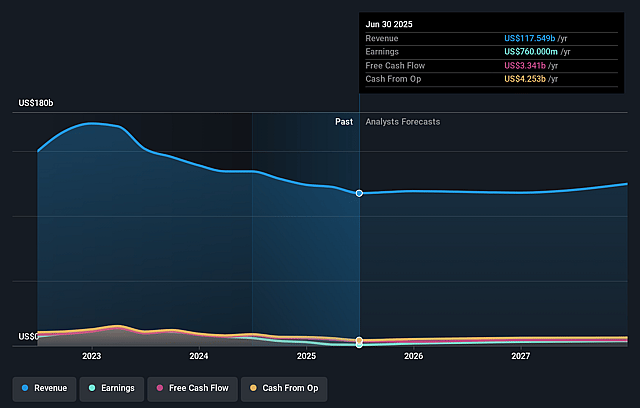

Valero Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Valero Energy's revenue will decrease by 0.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.6% today to 3.3% in 3 years time.

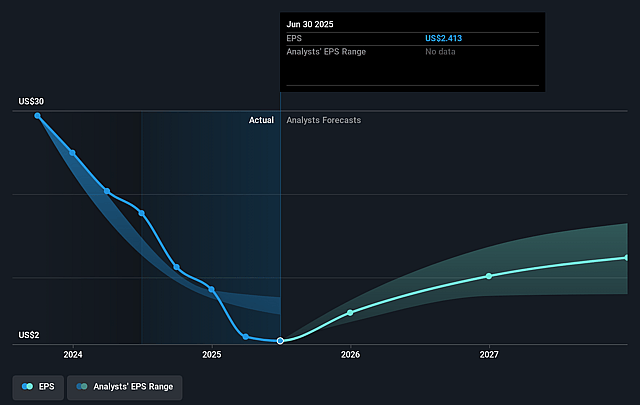

- Analysts expect earnings to reach $3.8 billion (and earnings per share of $13.76) by about September 2028, up from $760.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $4.9 billion in earnings, and the most bearish expecting $2.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, down from 66.1x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to decline by 1.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.14%, as per the Simply Wall St company report.

Valero Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A significant net loss attributed to asset impairments, particularly related to West Coast operations, could negatively impact future earnings and financial health.

- The renewable diesel segment struggled with high operating losses, reflecting challenges in maintaining profitability amidst shifting regulatory and market dynamics, thereby affecting net margins.

- With the intent to close the Benicia refinery due to stringent regulations, there could be substantial costs related to plant closure, negatively affecting cash flow and future earnings.

- Uncertainty around policy changes, such as potential increases to RIN obligations and California LCFS adjustments, introduces risk to revenue stability in the renewable segment.

- High operational cost pressures, particularly from maintenance and potential fluctuations in natural gas prices, may constrain margin improvements, thus impacting overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $158.333 for Valero Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $181.0, and the most bearish reporting a price target of just $133.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $116.8 billion, earnings will come to $3.8 billion, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 7.1%.

- Given the current share price of $161.83, the analyst price target of $158.33 is 2.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.