Last Update18 Oct 25Fair value Increased 1.30%

Analysts have nudged their fair value estimate for Vita Coco Company slightly higher, from $42.78 to $43.33. This reflects continued resilience and strong category growth, despite near-term concerns about tariffs and valuation.

Analyst Commentary

Recent Street research highlights a mix of optimism and caution regarding Vita Coco Company's prospects, focusing on their earnings outlook, category leadership, and market dynamics.

Bullish Takeaways- Bullish analysts have raised price targets, reflecting confidence in Vita Coco's continued sales momentum and resilient demand within a fast-growing beverage category.

- Vita Coco's market leadership and consistent share gains are considered positive contributors to its premium valuation multiple.

- Some suggest that the recent selloff, perceived as being driven by tariff concerns, may be overdone. They believe that Vita Coco has the flexibility to offset these pressures through sourcing strategies and pricing power.

- Falling sea freight costs are viewed as a near-term tailwind, potentially supporting margins and profitability.

- Bearish analysts forecast that tariff pressures may weigh on future gross margins and adjusted EBITDA, prompting more conservative financial projections for 2026.

- There are concerns regarding Vita Coco's high valuation, with the stock currently trading at one of the richest multiples within consumer staples.

- Some caution surrounds the company's forward setup, especially as high investor sentiment could make shares vulnerable if growth expectations are not met.

What's in the News

- Vita Coco launches limited-edition Halloween mystery kits featuring costumes for Labubu dolls, paired with Strawberries & Creme and Orange & Creme Vita Coco Treats. These kits will be available for loyalty members starting October 1 (Key Developments).

- The company introduces "Major League Hydration by Vita Coco," an athlete-endorsed campaign that highlights coconut water as a preferred fitness beverage among elite athletes from football, golf, tennis, soccer, and pickleball (Key Developments).

- From April to July 2025, Vita Coco completed the repurchase of 867,947 shares totaling $22.86 million as part of its ongoing share buyback program (Key Developments).

- The company raised its full-year 2025 financial guidance and now expects net sales between $565 million and $580 million, driven by strong Vita Coco Coconut Water growth, new product rollouts, and price increases. This outlook is partially offset by higher transportation costs and tariffs (Key Developments).

Valuation Changes

- The Fair Value Estimate has risen slightly, moving from $42.78 to $43.33 per share.

- The Discount Rate remains unchanged at 6.78%.

- The Revenue Growth Forecast is stable at approximately 10.6% annually.

- The Net Profit Margin remains essentially flat, holding at around 13.35%.

- The Future P/E Ratio has increased modestly, rising from 29.36x to 29.74x.

Key Takeaways

- Expanding product offerings and international market investments are driving diversified revenue growth and increased market share.

- Focus on sustainability and supply chain improvements is enhancing brand loyalty, pricing power, and long-term margin stability.

- Elevated costs from tariffs, freight volatility, and SG&A spending threaten margins, while category overexposure and private label weakness increase risks to sustained revenue growth.

Catalysts

About Vita Coco Company- Develops, markets, and distributes coconut water products under the Vita Coco brand name in the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific.

- Continued strong growth in coconut water household penetration and per-household consumption in both the U.S. and key international markets (U.K., Germany), coupled with low current category penetration compared to traditional juices, indicates a long runway for volume and revenue growth as health-conscious consumers seek natural and "better-for-you" alternatives.

- Ongoing expansion into new product adjacencies (such as Vita Coco Treats and coconut milk-based beverages) is creating new consumption occasions and diversifying revenue streams, supporting topline growth and potentially enhancing gross margins with premium offerings.

- Heightened investment in international markets (notably Europe) is resulting in accelerating sales growth and market share gains, with management expecting international revenues to ultimately rival the Americas business, thus significantly impacting consolidated revenues and earnings power.

- Enhanced brand positioning around sustainability and ethical sourcing aligns with rising consumer and retailer environmental expectations, which could drive pricing power, margin expansion, and increased brand loyalty over time.

- Operational improvements in supply chain flexibility and scale-including expanded sourcing regions, negotiated cost mitigations, and the potential for ocean freight rate normalization-are expected to help manage input cost volatility, supporting longer-term gross and net margin improvement.

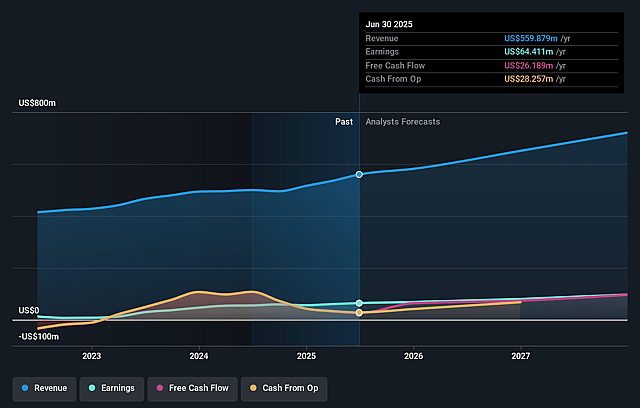

Vita Coco Company Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vita Coco Company's revenue will grow by 10.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.5% today to 13.6% in 3 years time.

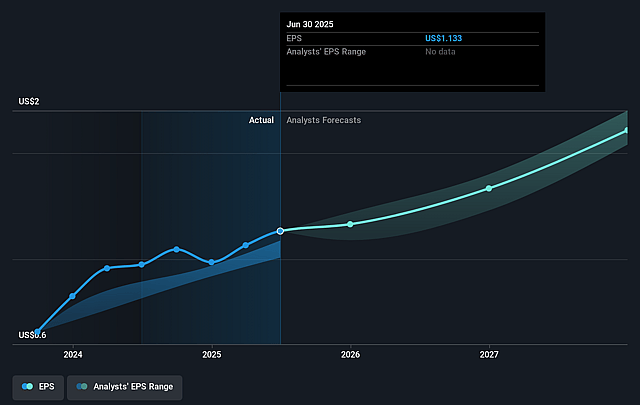

- Analysts expect earnings to reach $103.0 million (and earnings per share of $1.72) by about September 2028, up from $64.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.0x on those 2028 earnings, down from 34.0x today. This future PE is greater than the current PE for the US Beverage industry at 24.4x.

- Analysts expect the number of shares outstanding to grow by 0.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Vita Coco Company Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing tariff uncertainty and the possibility of increased U.S. tariffs on coconut imports (potentially rising from the 10% baseline to 19%-20% or higher) could significantly raise Vita Coco's cost of goods sold, creating gross margin pressure and potentially impacting net earnings, especially due to the company's reliance on coconuts sourced mainly from Southeast Asia and Brazil.

- Elevated and volatile ocean freight rates have negatively impacted gross margins (down 450 basis points year-over-year), and continued unpredictability in global shipping costs may compress margins further or introduce earnings volatility until freight costs normalize.

- Weakness or volatility in the private label segment-including recent losses of some private label business and uncertain timing/size of potential wins in 2026-creates risk of slower revenue growth or declining segment revenue, especially as branded growth may not fully offset private label declines in the near term.

- Increased SG&A expenses driven by ongoing international expansion, marketing investments, and higher people and incentive costs can offset top-line growth and pressure net margins if sales growth does not continue at an aggressive pace or if new innovations (like Treats) underperform expectations.

- Overexposure to a single category (coconut water/coconut-based beverages) poses risk if consumer preferences shift due to concerns over water use, sugar/calorie content, or single-use packaging, potentially limiting future revenue growth and leaving Vita Coco vulnerable to new competitive entrants or changes in long-term health and wellness trends.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $41.556 for Vita Coco Company based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $45.0, and the most bearish reporting a price target of just $36.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $755.8 million, earnings will come to $103.0 million, and it would be trading on a PE ratio of 28.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of $38.59, the analyst price target of $41.56 is 7.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.