Last Update 02 Dec 25

KNOP: Takeover Bid And Downgrade Will Influence Future Performance

KNOT Offshore Partners’ analyst price target has been reduced from $15.00 to $10.00, as analysts cite the recent takeover proposal as a key factor in adjusting expectations.

Analyst Commentary

Following the recent developments surrounding the takeover proposal for KNOT Offshore Partners, analysts have provided a range of perspectives reflecting both optimism and caution about the company's future outlook and valuation.

Bullish Takeaways

- Bullish analysts highlight that the takeover interest may signal underlying value in KNOT Offshore Partners' assets, which could support the revised valuation.

- Some analysts see ongoing contract stability in the company's fleet. This stability can offer predictable cash flows despite recent market uncertainties.

- The partnership's strong operational execution has been recognized, and efficient vessel management remains a positive factor for long-term growth.

- Analysts note that the lowered price target still leaves room for upside if the company successfully navigates the takeover process and delivers on strategic initiatives.

Bearish Takeaways

- Bearish analysts express concern that the uncertainty from the takeover proposal could affect KNOT Offshore Partners' market performance in the near term.

- There are reservations about growth prospects, as the proposal may indicate limited opportunities for organic expansion or reinvestment.

- Analysts are cautious that the revised price target reflects increased risk and reduced investor confidence in future earnings momentum.

- Possible changes in management or strategic direction stemming from the bid are viewed as potential sources of execution risk.

What's in the News

- Knutsen NYK Offshore Tankers AS submitted an unsolicited non-binding proposal to acquire an additional 70.80% stake in KNOT Offshore Partners LP for approximately $240 million, offering $10 per share in cash.

- If the proposed transaction is completed, Knutsen NYK Offshore Tankers AS and its affiliates would own 100% of KNOT Offshore Partners LP.

- The completion of the proposed acquisition is contingent upon approval by KNOT Offshore Partners' shareholders. (Key Developments)

Valuation Changes

- Fair Value Estimate has decreased from $10.67 to $10.67, indicating minimal change following the recent developments.

- Discount Rate has declined slightly from 10.74% to 10.68%, which reflects a marginally lower perceived risk.

- Revenue Growth projection remains steady at approximately 2.18%.

- Net Profit Margin has shown virtually no change, holding at 15.24%.

- Future P/E ratio has decreased slightly from 9.12x to 9.11x, suggesting a modestly lower earnings multiple expected by analysts.

Key Takeaways

- Robust demand for offshore oil transport and limited alternative infrastructure ensure stable revenue and high vessel utilization for KNOT's modern shuttle tanker fleet.

- Long-term, fixed-rate contracts and a tightening shuttle tanker market support strong earnings visibility, margin improvement, and sustained distribution potential.

- Rising refinancing costs, leverage, and customer concentration heighten earnings volatility and limit flexibility, while industry decarbonization trends threaten long-term demand and cash flow growth.

Catalysts

About KNOT Offshore Partners- Acquires, owns, and operates shuttle tankers under long-term charters in the North Sea and Brazil.

- Anticipated growth in deepwater offshore oil production, particularly in Brazil (with numerous new FPSOs coming online), is expected to drive sustained demand for shuttle tanker services, supporting higher vessel utilization rates and increasing future contracted revenues for KNOT.

- Persistent infrastructure constraints and lack of scalable alternatives to marine transportation for moving offshore oil, especially in production-heavy regions, suggest long-term, reliable demand for KNOT's specialized shuttle tanker fleet, which underpins revenue stability and supports contract renewals at potentially higher day-rates.

- KNOT's strong pipeline of long-term, fixed-rate charter contracts-with $854 million in backlog and growing charter coverage-provides earnings visibility, reduces revenue volatility, and enhances the capacity to sustain and potentially increase distributions over time.

- Ongoing fleet modernization via drop-downs and accretive asset acquisitions from Knutsen NYK (the sponsor) allows KNOT to maintain a younger, more efficient fleet, potentially leading to higher net margins and improved operational efficiency as older vessels are swapped for newer ones on favorable terms.

- The slow pace of new shuttle tanker deliveries, combined with rising regulatory standards on emissions, points to a tightening market supply, which is likely to support elevated charter rates and fleet values-positively impacting KNOT's topline growth and net profitability over the long term.

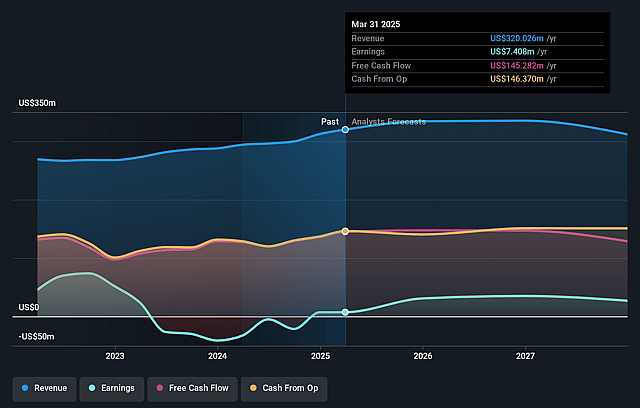

KNOT Offshore Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming KNOT Offshore Partners's revenue will grow by 1.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.3% today to 13.8% in 3 years time.

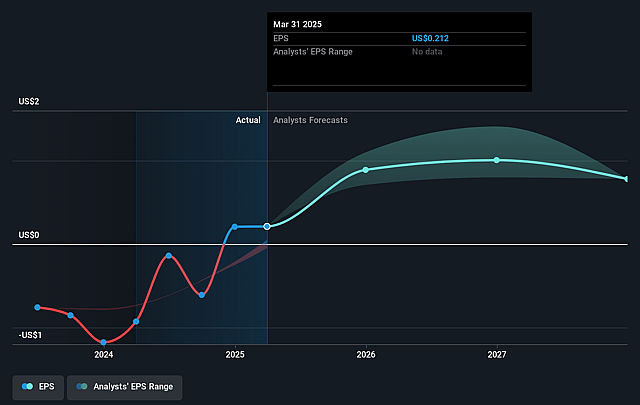

- Analysts expect earnings to reach $45.6 million (and earnings per share of $0.84) by about September 2028, up from $7.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.9x on those 2028 earnings, down from 38.5x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.15%, as per the Simply Wall St company report.

KNOT Offshore Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's significant upcoming debt maturities and balloon payments in 2025 and 2026 pose refinancing risk, particularly as existing low-rate interest rate hedges are rolling off and new swaps will likely be at higher market rates, potentially raising interest expense and eroding net margins and earnings.

- Persistent focus on fleet expansion via drop-downs rather than share buybacks may result in lower return on invested capital, especially if new vessel acquisitions generate a lower internal rate of return than the company's current equity valuation would justify, which could dilute earnings per share and limit capital returns to shareholders.

- Customer concentration risk remains elevated, as several vessels have long-term charters with a small pool of oil majors; if contracts are not renewed or options are not exercised, revenue backlog and fixed charter coverage would decrease, increasing earnings volatility and revenue risk.

- The current strategy increases leverage and future amortization commitments, which, alongside subdued distribution payouts, limits financial flexibility for reinvestment or weathering industry downturns, raising the risk of dividend cuts or missed growth opportunities if market conditions weaken.

- Long-term industry and secular shifts toward decarbonization, stricter emissions regulations, and global energy transition could gradually reduce demand for offshore oil transport and shuttle tankers, threatening vessel utilization, reducing day rates, and pressuring long-term revenue and cash flow growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.967 for KNOT Offshore Partners based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $8.9.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $330.7 million, earnings will come to $45.6 million, and it would be trading on a PE ratio of 12.9x, assuming you use a discount rate of 13.2%.

- Given the current share price of $8.17, the analyst price target of $11.97 is 31.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.