Last Update19 Sep 25Fair value Decreased 1.65%

General Mills’ consensus price target was revised downward to $53.89 amid disappointing guidance and weak volume trends, as analysts factor in near-term EPS pressure from increased reinvestment and ongoing competitive headwinds, though some maintain a constructive longer-term outlook.

Analyst Commentary

- Guidance for FY26 and initial Q4 results have generally come in below street expectations, leading to EPS resets and lower price targets from several analysts.

- Weak volume trends, sluggish center store category growth, and market share pressures continue to weigh on outlook, though sequential improvements in volume share are being noted.

- Management’s heavier-than-anticipated reinvestment is viewed as a near-term drag on EPS, but is considered necessary for long-term improvement in volume and organic sales growth.

- Valuation concerns persist relative to peers given muted growth prospects, though bullish analysts view trimmed guidance as increasingly achievable and believe the company is building in sufficient cushion for delivery.

- Some analysts remain constructive based on solid brand portfolio and pricing power, and see investor sentiment as overly negative with potential for upside if execution around investment and pricing materializes.

What's in the News

- General Mills will host its 2025 Investor Day.

- The company completed the repurchase of 71.8 million shares (12.61% of shares outstanding) for $4.93 billion under its ongoing buyback program.

- FY2026 earnings guidance was reaffirmed, with expected organic net sales growth between -1% and +1%; inorganic factors (divestitures, FX, acquisitions, 53rd week) expected to reduce full-year net sales growth by ~4%.

- Announced $54 million investment to expand the James Ford Bell Technical Center, increasing pilot plant space by over 20% to accelerate R&D and innovation.

- Introduced multiple product launches and partnerships including Wheaties featuring Jalen Hurts, Wicked-inspired Pillsbury and Betty Crocker baking products, Progresso Pitmaster BBQ soups, pet nutrition expansion with Edgard & Cooper at PetSmart, and continued Cereal Training Camp promotions with NFL players.

Valuation Changes

Summary of Valuation Changes for General Mills

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from $54.80 to $53.89.

- The Consensus Revenue Growth forecasts for General Mills has significantly risen from -0.8% per annum to -0.3% per annum.

- The Future P/E for General Mills has fallen from 15.85x to 15.03x.

Key Takeaways

- General Mills’ increased investment and reinvestment strategy may delay improvements in net margins and earnings in the short term.

- Challenges like the potential Yoplait closure and changing consumer behavior could suppress revenue growth and impact future earnings projections.

- General Mills' focus on strategic reinvestment, targeted marketing, and innovation aims to enhance competitiveness and drive future revenue and earnings growth.

Catalysts

About General Mills- Manufactures and markets branded consumer foods worldwide.

- General Mills plans a sizable step-up in investment for fiscal '26, including at least 5% through Holistic Margin Management (HMM) savings and $100 million in additional cost savings. However, reinvestment of these savings into pricing, innovation, in-store activity, and media could delay improvements in net margins and overall earnings in the short term.

- The company faces a challenging consumer environment, with low consumer confidence leading to increased value-seeking behavior. Even as General Mills invests in competitive pricing and marketing to address this, the shift in consumer behavior may suppress revenue growth in the near term.

- General Mills expects a significant headwind from the potential closure of the Yoplait business, equivalent to a 5-point hit on profit. This anticipated drop in profit could affect future earnings projections and contribute to a perception of overvaluation.

- Continued investment will be necessary to make pricing adjustments for snacks and to improve competitiveness across various brands. Such investments may not immediately boost earnings, as achieving the right pricing balance will take time, potentially affecting revenue and net margins.

- General Mills' strategy of fewer, but bigger innovations in fiscal '26 involves focusing on a smaller number of larger innovations. While this may benefit future revenue growth, the time required to develop and execute such innovations means immediate impacts on earnings might be limited.

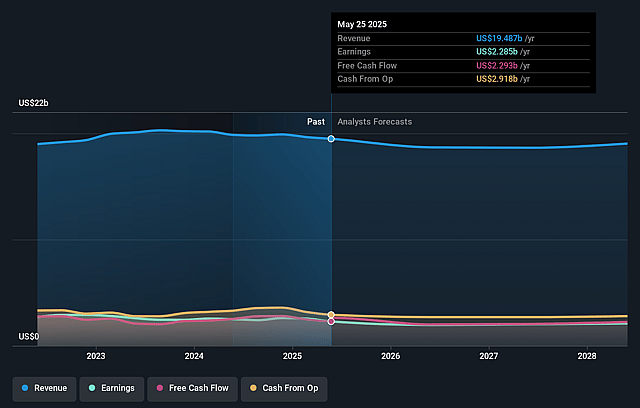

General Mills Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming General Mills's revenue will decrease by 0.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 11.7% today to 11.0% in 3 years time.

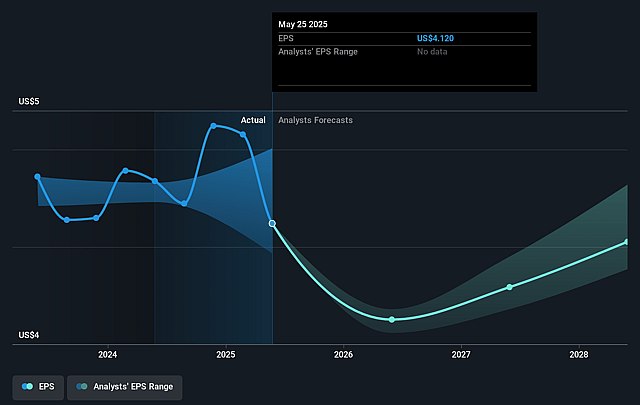

- Analysts expect earnings to reach $2.1 billion (and earnings per share of $4.02) by about September 2028, down from $2.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.8x on those 2028 earnings, up from 11.6x today. This future PE is lower than the current PE for the US Food industry at 19.8x.

- Analysts expect the number of shares outstanding to decline by 2.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

General Mills Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- General Mills plans to reinvest savings from cost efficiencies and the 53rd week of fiscal year into marketing and innovation, potentially improving competitiveness and driving revenue growth.

- The company has identified several billion-dollar brands, like Blue Buffalo and Pillsbury, where refined pricing strategies and enhanced marketing have significantly improved performance, which could contribute positively to their overall earnings.

- Innovation and new product launches are being prioritized, with an emphasis on fewer, but bigger high-impact innovations, which might boost sales and revenue.

- The snack bars and cereal categories are expected to recover, with increased media expenditure and promotional activities in the upcoming quarters, which could enhance volume growth and profit margins.

- Despite current challenges, General Mills believes enhanced marketing on their core products and new innovations will significantly improve their market share and volume competitiveness, potentially leading to stronger revenue and earnings in the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $54.8 for General Mills based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $63.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $19.0 billion, earnings will come to $2.1 billion, and it would be trading on a PE ratio of 15.8x, assuming you use a discount rate of 6.8%.

- Given the current share price of $49.75, the analyst price target of $54.8 is 9.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.