Last Update 05 Dec 25

Fair value Decreased 53%CURV: Cost Cuts And Store Closures Will Drive Leaner Future Model

Analysts have sharply reduced their fair value estimate for Torrid Holdings from approximately $2.95 to about $1.38 per share, citing weaker revenue growth expectations, a lower future P/E multiple, and uncertainty around the timing and impact of store closures and cost-cutting efforts.

Analyst Commentary

Analysts are reassessing Torrid Holdings' outlook in light of the updated fair value estimate, focusing on the balance between near term execution risk and the potential benefits of management's cost reduction initiatives.

Bullish Takeaways

- Bullish analysts view management's willingness to pursue more aggressive cost-cutting as a necessary step to protect margins and support a leaner, more efficient operating model over time.

- They see the planned store closures as a way to rationalize the footprint, closing chronically underperforming locations and potentially improving average store productivity.

- Some believe that rightsizing the store base could allow Torrid to reallocate resources toward higher impact channels, including e commerce and better performing stores, which may support more sustainable revenue per customer.

- There is cautious optimism that, if executed well, these changes could eventually warrant a higher earnings multiple than the market currently assigns, as profitability stabilizes.

Bearish Takeaways

- Bearish analysts emphasize that the downgrade reflects concern that Torrid is still in the early stages of store closures, meaning the full earnings and traffic impact remains uncertain and may pressure near term results.

- They highlight risks around long term revenue retention, questioning whether sales from closed locations can be fully recaptured online or at nearby stores without eroding overall growth.

- Ongoing tariff pressures and a choppy macro backdrop are seen as additional headwinds that could offset cost savings and limit margin expansion, constraining upside to earnings estimates.

- Given these uncertainties, cautious analysts argue that a lower valuation multiple is appropriate until there is clearer evidence that the new operating model can deliver consistent, profitable growth.

What's in the News

- Issued full year fiscal 2025 earnings guidance, projecting net sales between $995 million and $1.002 billion (company guidance).

- Reported that from May 4, 2025 to August 2, 2025, it repurchased 0 shares under its buyback program, while confirming completion of 6,779,633 shares repurchased in total. This represents 6.28% of shares for $55.06 million since the December 8, 2021 authorization (buyback update).

Valuation Changes

- The fair value estimate has fallen significantly, from approximately $2.95 to about $1.38 per share, reflecting a more cautious long term outlook.

- The discount rate has risen slightly, from about 12.32 percent to roughly 12.50 percent, implying a modestly higher required return for investors.

- The revenue growth forecast has weakened, with the expected rate moving from around negative 2.64 percent to approximately negative 4.89 percent.

- The net profit margin outlook has improved meaningfully, increasing from about 2.41 percent to roughly 4.85 percent, suggesting better anticipated profitability.

- The future P/E multiple has declined sharply, dropping from roughly 14.8x to about 3.8x, indicating a materially lower valuation being applied to future earnings.

Key Takeaways

- Expansion of sub-brands and launch of value-focused products are driving market growth, higher margins, and enhanced brand relevance among diverse and price-sensitive consumers.

- Accelerated digital transformation, store closures, and increased marketing investments are strengthening customer engagement and improving profitability through operational efficiency.

- Weak store and sales performance, heightened promotional dependence, increased marketing costs, and external margin pressures threaten profitability and growth if digital and new customer strategies underdeliver.

Catalysts

About Torrid Holdings- Provides apparel, intimates, and accessories for curvy women in North America.

- Ongoing growth of sub-brands, including targeted launches like LoveSick aimed at younger and more diverse demographics, is expected to significantly expand the company's addressable market and drive higher product margins due to higher full-price sell-through and reduced promotion reliance. This is poised to improve both revenue growth and EBITDA margin expansion into 2026 and beyond.

- Strategic shift to a more digitally-driven operating model, with digital transactions approaching 70% of demand and continued investments in omnichannel capabilities, supports stronger customer engagement and conversion while reducing exposure to underperforming physical stores-enhancing both top-line growth and long-term margin profile.

- Cost efficiencies from the closure of up to 180 underproductive brick-and-mortar locations and aggressive resource reallocation (toward digital and marketing efforts) are expected to deliver 150 to 250 basis points of adjusted EBITDA margin expansion and generate substantial free cash flow for debt reduction and share repurchases, improving net income and EPS.

- Increased investment in brand-building, digital marketing, and influencer partnerships is positioned to accelerate customer file growth, boost brand awareness, and reactivate lapsed and new customers-capitalizing on consumer trends favoring inclusivity, body positivity, and expanded fashion options, supporting sustained revenue growth.

- Launch of an opening price point (OPP) assortment for 2026, comprising around 25% of apparel sales, broadens product accessibility and value for price-sensitive shoppers, allowing Torrid to defend and grow market share against both ultra-fast fashion competitors and the rising demand for value, ultimately supporting revenue stability and volume-driven earnings growth.

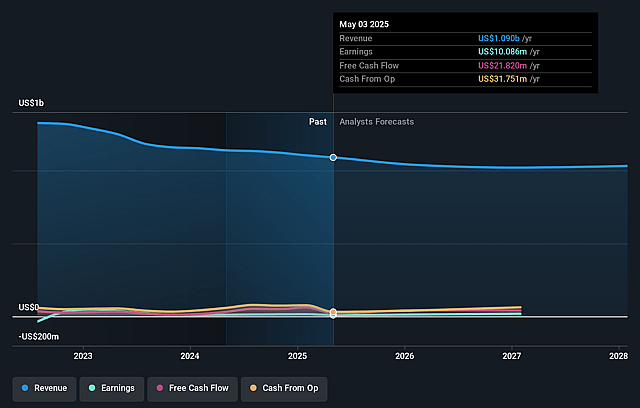

Torrid Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Torrid Holdings's revenue will decrease by 2.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.3% today to 2.4% in 3 years time.

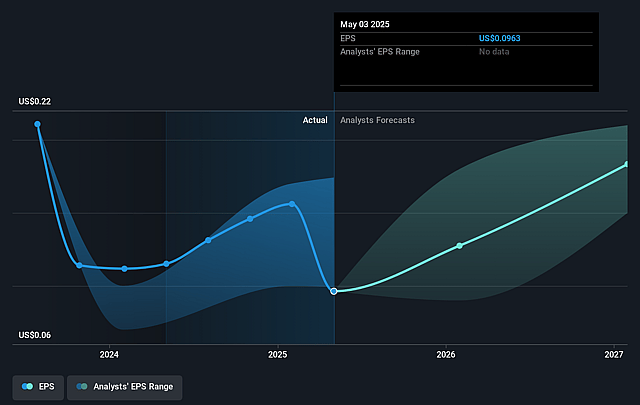

- Analysts expect earnings to reach $23.7 million (and earnings per share of $0.23) by about September 2028, up from $3.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, down from 56.6x today. This future PE is lower than the current PE for the US Specialty Retail industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 5.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Torrid Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained comparable sales declines (down 6.9% year-over-year) and ongoing "choppiness" in consumer demand signal potential for enduring revenue and earnings headwinds, especially as macro pressures constrain discretionary spending within Torrid's core customer base.

- Structural dependence on promotional activity to drive conversion and respond to increased value orientation among customers threatens gross margins and long-term pricing power, risking continued net margin compression as promotions become entrenched and undermine brand premiumization efforts.

- The acceleration of store closures (up to 180 underperforming locations in FY25) exposes the company to possible risks in physical-to-digital customer migration and customer attrition, especially as 40% of demand was still through physical stores recently, potentially limiting revenue growth and contributing to customer file stagnation if digital retention initiatives underperform.

- Heavy reliance on incremental marketing spend-including a notable increase above original budget-to drive top-of-funnel customer acquisition and awareness may inflate SG&A over the medium term, with uncertain payback and potential earnings dilution if new customer growth or sub-brand expansion does not offset lost store sales and higher marketing costs.

- Margin headwinds from external factors such as rising tariffs ($15M in fiscal 2025), supply chain cost pressures, and continued increases in input costs could further erode profitability, especially as Torrid's ability to take additional price increases is constrained by already high price sensitivity and customer pushback, threatening both short-term earnings and longer-term net margin recovery.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.95 for Torrid Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $1.75.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $985.6 million, earnings will come to $23.7 million, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 12.3%.

- Given the current share price of $1.9, the analyst price target of $2.95 is 35.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.