Last Update08 Oct 25Fair value Increased 2.15%

Analysts have raised their fair value estimate for Equity Bancshares from $48.75 to $49.80. They cite improved profitability metrics, successful acquisition integration, and anticipated stable loan growth as key drivers behind the upward revision.

Analyst Commentary

Recent Street research reflects a mix of optimism and caution surrounding Equity Bancshares’ prospects, as analysts weigh both recent accomplishments and areas that require ongoing scrutiny. Below, we summarize the key bullish and bearish takeaways from the latest analyst actions and commentary.

Bullish Takeaways- Bullish analysts highlight the company’s successful execution of recent acquisitions and effective integration strategies, which are expected to drive further profitability improvements.

- Restructuring of the securities portfolio is projected to help propel profitability metrics into top quartile levels and support a positive valuation outlook.

- Organic loan growth is expected to remain steady, with expansion into larger Midwest markets contributing to mid-single-digit growth and helping to sustain a strong core net interest margin even in a potentially lower interest rate environment.

- Disciplined management, particularly with regard to deal pricing and capital deployment, is anticipated to minimize valuation overhangs and position the company well for future compelling transactions.

- Some analysts maintain a neutral stance, noting that announced acquisitions and related transactions, while net positive for earnings per share, could have a dilutive impact on tangible book value.

- Although recent quarters saw net interest margin strength, lower-than-expected revenue and credit trends, especially in the restaurant sector, suggest areas that warrant continued monitoring.

- There is modest concern around credit quality, with analysts emphasizing the need to monitor for emerging losses if economic conditions in key loan segments deteriorate.

- While additional deals are viewed positively by some, there is a measured outlook on valuation upside until the impact of further acquisitions and integration becomes clearer.

What's in the News

- Keefe Bruyette raised Equity Bancshares' price target to $45 from $44 and maintained a Market Perform rating (Periodical).

- The Board of Directors declared a quarterly cash dividend of $0.18 per share, payable on October 15, 2025 to shareholders of record as of September 30, 2025 (Key Development).

- Equity Bancshares announced a share repurchase program that authorizes the repurchase of up to 1,000,000 shares of common stock through September 30, 2026 (Key Development).

- During the second quarter of 2025, the company realized net charge-offs totaling $573,000 (Key Development).

Valuation Changes

- Fair Value Estimate has risen slightly, increasing from $48.75 to $49.80 per share.

- Discount Rate is nearly unchanged, moving marginally higher from 7.04% to 7.05%.

- Revenue Growth projection has declined modestly, falling from 22.97% to 22.84%.

- Net Profit Margin forecast has improved slightly, rising from 34.65% to 34.92%.

- Future P/E ratio has edged up from 9.38x to 9.54x. This reflects a minor increase in valuation expectations.

Key Takeaways

- Expansion into high-growth mid-sized markets and strategic M&A enhance geographic reach, scale, and long-term revenue opportunities.

- Investment in digital banking and diversified services improves income mix, operational efficiency, and supports stable earnings growth with strong risk management.

- Rising digital competition, demographic shifts, sector concentration, and regulatory costs threaten long-term growth, profitability, and customer retention for the bank.

Catalysts

About Equity Bancshares- Operates as the bank holding company for Equity Bank that provides a range of banking, mortgage banking, and financial services to individual and corporate customers.

- The company's recent merger with NBC Bank expands its geographic reach into Oklahoma City-one of the Midwest's fastest-growing metro areas-positioning Equity Bancshares to benefit from rising demand for community-focused banking solutions in mid-sized markets; this is likely to drive above-average loan growth and revenue expansion over the long term.

- Accelerated adoption of digital banking tools and improved treasury, debit/credit, mortgage, trust, and wealth management offerings have resulted in increased non-interest income, while ongoing investments in digital platforms are expected to lower operational costs and improve net margins.

- The strong pipeline of commercial and C&I loan originations, alongside continued small business growth in regional economies, supports future commercial lending volume and fee income, which should stabilize and grow both revenue and earnings.

- Strategic consolidation through disciplined M&A (with a pipeline of acquisition targets in the $250 million–$1.5 billion range) provides opportunities for scale, cost synergies, and improved operating leverage, supporting sustained net margin and EPS growth.

- Capital flexibility from recent capital raises and a robust TCE ratio (10%+) allows the company to maintain conservative credit standards and proactively manage credit risk, supporting stable earnings and potential for higher book value compounding.

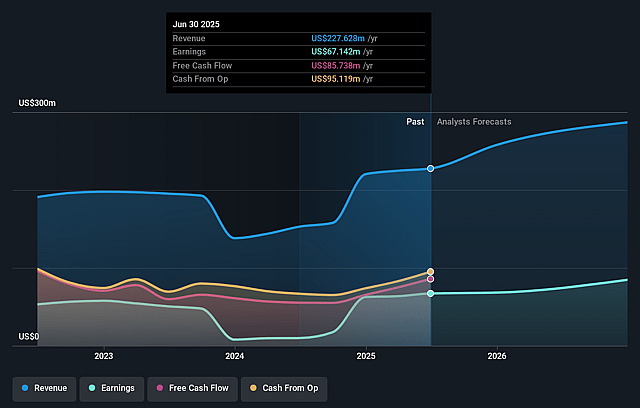

Equity Bancshares Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Equity Bancshares's revenue will grow by 23.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 29.5% today to 34.6% in 3 years time.

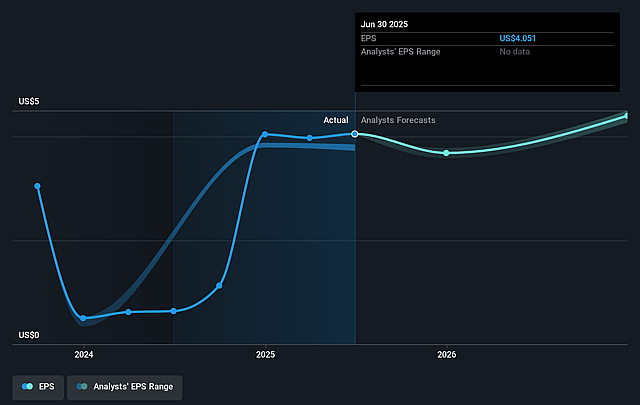

- Analysts expect earnings to reach $146.6 million (and earnings per share of $5.31) by about September 2028, up from $67.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.4x on those 2028 earnings, down from 12.0x today. This future PE is lower than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.04%, as per the Simply Wall St company report.

Equity Bancshares Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerated shift to digital banking and increased consumer preference for seamless, technology-driven banking services may favor larger national banks and fintechs, potentially leading to customer attrition and stagnating revenue growth for Equity Bancshares if it cannot keep pace with innovation.

- Ongoing demographic trends, such as rural depopulation and the aging of populations in Midwest and South Central U.S. markets, could gradually erode the bank's core customer base, posing long-term risks to both deposit and loan growth (revenue impact).

- High reliance on commercial real estate (CRE) and sector-specific exposures (e.g., the cited QSR relationship and agriculture lending) increases vulnerability to sector downturns, which could result in elevated credit losses and higher non-performing assets, negatively affecting net earnings and asset quality.

- Industry-wide consolidation and M&A activity may favor banks that can achieve rapid scale and digital efficiencies; as a smaller regional player, Equity Bancshares could face rising operational costs and lose market share if unable to compete on technology and pricing, putting downward pressure on net margins.

- Prolonged cost pressures from tightening regulatory and compliance requirements could disproportionately impact smaller community banks like Equity Bancshares, driving up operational expenses and squeezing net margins and profitability over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $48.75 for Equity Bancshares based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $54.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $423.2 million, earnings will come to $146.6 million, and it would be trading on a PE ratio of 9.4x, assuming you use a discount rate of 7.0%.

- Given the current share price of $41.83, the analyst price target of $48.75 is 14.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.