Last Update 01 Nov 25

Fair value Increased 3.89%Analysts have increased their price target for Royal Gold from approximately $239 to $248 per share, citing recent acquisitions, strong commodity markets, and expectations for higher revenue growth as the main drivers for the upward revision.

Analyst Commentary

Bullish analysts have highlighted several factors driving upward revisions to Royal Gold's price target and outlook. Their commentary reflects confidence in the company's growth trajectory and its ability to capitalize on favorable market dynamics.

Bullish Takeaways- Recent strategic acquisitions, including the completion of deals with Sandstorm Gold and Horizon Copper, are expected to enhance growth, diversification, and the longevity of Royal Gold's portfolio.

- Rising precious metals prices, supported by ongoing global trade and geopolitical uncertainty, are poised to benefit Royal Gold's revenue and valuation.

- Medium-term earnings per share are projected to improve, as recent deals are considered accretive to net asset value and earnings potential.

- Continued momentum in capital returns and corporate mergers and acquisitions may provide additional opportunities for valuation expansion and execution on long-term growth strategies.

- Analysts note that recent upward revisions in price targets may already reflect much of the anticipated growth. This could limit near-term upside if execution does not meet expectations.

- Accretive acquisitions carry integration risks, and the actual impact on financial results will depend on effective management and realization of projected synergies.

- Future performance remains sensitive to fluctuations in precious metals pricing and ongoing volatility in commodity markets. These factors can impact revenue consistency.

What's in the News

- The White House announced it will clarify that gold bar imports are not subject to recently announced tariffs. This addresses trader concerns about potential duties on the sector (Bloomberg).

- Royal Gold has scheduled a special shareholders meeting for October 9, 2025, to discuss and vote on the approval of share issuance and the potential adjournment or postponement of the meeting.

Valuation Changes

- Fair Value Estimate has increased from $238.63 to $247.91, reflecting a moderate upward adjustment.

- Discount Rate has risen slightly from 7.46% to 7.51%, indicating a minor increase in risk assessment.

- Revenue Growth projections have improved significantly, rising from 25.93% to 38.52%.

- Net Profit Margin has declined slightly from 60.77% to 58.87%.

- Future P/E ratio has decreased from 20.34x to 16.41x, suggesting expectations of stronger earnings relative to price.

Key Takeaways

- Strategic acquisitions and project investments diversify assets, reduce risk, and enhance exposure to gold and copper, supporting stable, long-term growth and margins.

- Increased scale and diversification attract broader investors, reinforce robust cash flows, and underpin consistent dividend growth and valuation strength.

- Heavy reliance on gold, operational setbacks at key mines, rising debt from acquisitions, premium deal competition, and geopolitical risks threaten profitability and revenue stability.

Catalysts

About Royal Gold- Acquires and manages precious metal streams, royalties, and related interests.

- The strategic acquisitions of Sandstorm Gold and Horizon Copper will significantly diversify Royal Gold's asset base, reducing single-asset risk and increasing exposure to long-term growth projects, which should drive more stable and growing revenue streams and improve net margins.

- Recent investments in projects like the Kansanshi gold stream (with a multi-decade production profile) and the Warintza copper-gold-moly project (large-scale development potential in the early 2030s) position Royal Gold to benefit from increasing demand for gold (as a hedge against inflation and geopolitical risk) and copper (driven by electrification and renewable energy adoption), supporting higher long-term revenue and earnings growth.

- The combination with Sandstorm and Horizon portfolios will make Royal Gold more attractive to passive and generalist investors due to greater scale and diversification; this could drive a larger investor base and valuation re-rating, positively impacting share price and EPS growth.

- Continued consistent reinvestment of robust free cash flows into new royalty and stream acquisitions, along with sector-leading geographic and asset diversification, supports stable or growing net margins and underpins the ability to raise dividends over time.

- Royal Gold's business model, with no direct operational exposure and a debt-free balance sheet (pre-acquisitions), enables strong cash flow resilience even through inflationary or cost pressures facing miners, supporting reliable earnings and dividend growth.

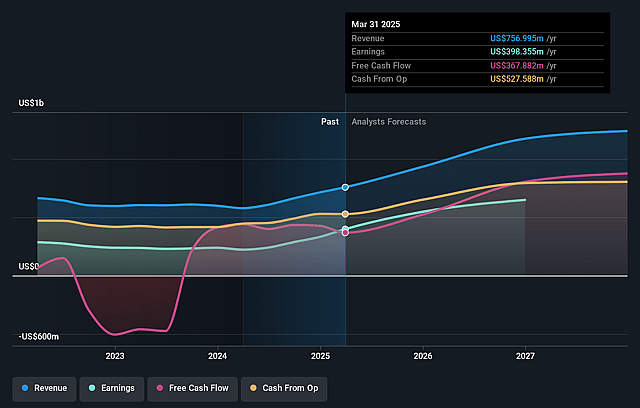

Royal Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Royal Gold's revenue will grow by 21.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 56.8% today to 62.0% in 3 years time.

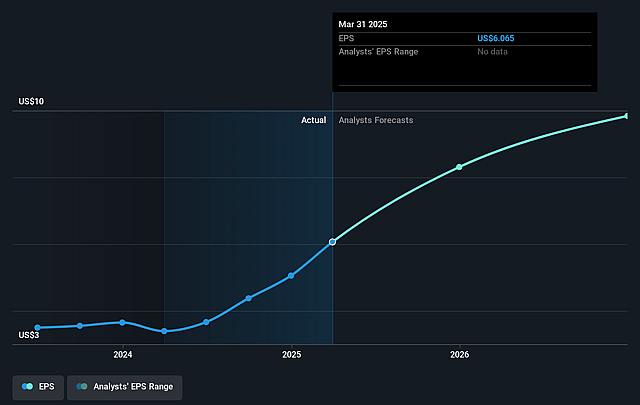

- Analysts expect earnings to reach $877.9 million (and earnings per share of $13.33) by about September 2028, up from $449.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.7x on those 2028 earnings, down from 27.1x today. This future PE is lower than the current PE for the US Metals and Mining industry at 22.5x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.37%, as per the Simply Wall St company report.

Royal Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Royal Gold's revenue and margin growth is heavily reliant on gold, which represented 78% of total revenue this quarter; a long-term decline in global investment demand for gold or lower gold prices-potentially driven by a shift toward digital assets or global decarbonization reducing gold's appeal as a hedge-could significantly impair both topline and earnings.

- Multiple key assets, including Mount Milligan, Andacollo, and Xavantina, are experiencing production underperformance or reductions in guidance, and while management cites portfolio diversification, persistent operational or regulatory setbacks at a handful of large mines could materially reduce royalty revenue and earnings consistency.

- The planned Sandstorm Gold and Horizon Copper acquisitions will require the use of Royal Gold's revolving credit facility, increasing leverage to at least $1.2 billion; if integration benefits are delayed or anticipated cost and revenue synergies do not materialize, higher interest costs and debt could negatively impact net margins and constrain future dividend growth.

- Intensifying competition for high-quality royalty and streaming deals, as evidenced by recent portfolio actions, may force Royal Gold to pay premium pricing for new transactions, compressing future deal returns and threatening long-term profitability.

- Expanding exposure to African jurisdictions, such as Zambia and Botswana, adds heightened geopolitical and regulatory risk; increased political volatility or policy changes could disrupt local mine operations, reduce or delay royalty streams, and ultimately impact revenue predictability and bottom-line results.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $211.429 for Royal Gold based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $237.0, and the most bearish reporting a price target of just $182.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $877.9 million, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 7.4%.

- Given the current share price of $185.01, the analyst price target of $211.43 is 12.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.